You’ve got to haggle for best home loan deals

Mortgage holders in Australia are being far too complacent when it comes to approaching their lender for a cheaper home loan, new research by comparison website Finder.com.au shows.

The national survey of 2033 participants found 65 per cent of Australian home loan customers have never asked for a better interest rate – but for those who did, it has certainly paid off.

Finder.com.au money expert Bessie Hassan says a staggering four out of five mortgage owners (82 per cent) received a better deal upon requesting one.

“Something as simple as asking for a cheaper rate is delivering thousands of dollars in savings for Australian home loan customers”, she says, adding that it’s crucial to take steps to get the best home loan deal.

“Haggling doesn’t come naturally to a lot of people but when there are big dollars at stake, it’s worth stepping out of your comfort zone and asking your lender to do better,” she says.

“Mortgage repayments are the single biggest monthly expense for most households and those saved dollars are much better off in your back pocket.

“Although we’re in a historically low rate market, it’s vital that mortgage holders regularly review their loans and approach their bank, using loyalty, loan size or market competitiveness as leverage.”

Small reductions in home loan rates can result in thousands of dollars saved. Based on the current average national home loan size of $360,100, a 0.10 per cent reduction from the average standard variable rate of 4.93 per cent to 4.83 per cent could save you approximately $262 per year or $7870.79 over 30 years.

“A 0.25 per cent discount off the standard variable rate to 4.68 per cent could pocket you $653 per year, or $19,594.87 over the life of your loan,” Hassan says.

“Simply put, the savings are extensive.”

The survey found 18 per cent of borrowers had switched to a new lender for a cheaper mortgage rate or more suitable loan.

“As well asking your lender for a discount, factor in their overall offering, including fees, features, flexibility and customer service.

“Frankly, if you’re not impressed with what your lender is offering you, weigh up your options and consider making the switch for a better deal,” Hassan advises.

“While borrowers can negotiate discounts on both fixed and variable loans, keep in mind that once a fixed rate has been secured this rate applies for the entirety of the fixed term. If you choose to exit the loan during this period, a hefty break fee will usually apply,” she says.

The generations

Generation Y were least complacent – with 44 per cent approaching their bank for a cheaper rate (and 68 per cent were successful).

Only eight per cent of baby boomers were knocked back when they asked for a better rate.

The sexes

While more men (38 per cent) apply for an interest rate cut with their banks than women (33 per cent), women are more successful at getting a cheaper rate.

Fifty-one per cent of women had not negotiated a lower interest rate on their home loan compared to 41 per cent of men.

State by state

More than one in 10 Queenslanders who asked for a discount were successful in getting one, while Tasmanians had the highest success rate at 95 per cent.

South Australians are the most likely to have applied for a discount or switched lenders (57 per cent).

NSW residents were the least successful at getting a discount, with only 73 per cent succeeding.

ACT borrowers were most complacent, with 58 per cent not bothering to negotiate.

TOP TIPS

Identify your rate. Review your home loan statement to check your existing interest rate. Once you’ve got this, determine whether or not your rate is competitive by comparing other home loans available on the market. You should also visit your lender’s website to see what they’re offering new customers – it will most likely be lower than the rate they’re offering you, so you can use this as leverage during your negotiations.

Build a case. To show why you deserve a better home loan rate, you need to retrieve your account information. How long have you been a customer with the bank? Have you made your repayments on time? Do you have any other products with the bank? Lenders are more inclined to give you a rate discount if you can prove your good track record.

Shop around. Do some online research and contact other lenders to see what they can offer you. When comparing home loans, make sure you look at the comparison rate as well as loan fees such as the establishment fee and any ongoing fees.

Approach your lender. Once you’ve done your background research, contact your lender and negotiate a better deal. Explain why you deserve a better rate and notify them that you’ve found more competitive deals on the market. If the lender agrees to issue a rate discount, the new rate should come into effect immediately so you could be reaping savings on your next monthly repayment.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/1p8N2KU1SCU/

An attempt by Property Media Group Pty Ltd (PMG) – a group representing individual real estate agents offices from all over Australia – to challenge the market control of Domain and Realestate.com.au looks set to fall over.

The Australian Competition and Consumer Commission (ACCC) has issued a draft determination proposing to deny authorisation to PMG, which is seeking to collectively bargain and boycott suppliers of online and print real estate advertising, including the two main players.

PMG made the application for authorisation on behalf of itself and 170 real estate agents ranging from individual agents to representatives of large franchise groups.

A collective boycott involves two or more competitors agreeing not to acquire goods or services from a target supplier. In this case, PMG has indicated that a boycott may include agents agreeing not to acquire premium property listings, or participating agents in a region agreeing not to enter into contracts with a real estate platform.

However, PMG would have broad discretion to select what kind of boycott activities for real estate agents to engage in, including the possibility of a national boycott of a real estate advertising platform by all of the participating real estate agents.

“While the ACCC considers that collective bargaining and boycott action can be in the public interest in certain circumstances, we are not satisfied that the conduct proposed by PMG would result in significant public benefits,” ACCC commissioner Roger Featherston says.

“The ACCC is particularly concerned by the potential size and scope of collective bargaining groups and boycott activities, combined with uncertainty about how PMG will ultimately conduct negotiations and implement any boycotts.”

PMG has sought authorisation for the conduct because it sees realestate.com.au and Domain.com.au as having significant market power, charging excessive prices and essentially forcing real estate agents on to premium contracts.

However the ACCC considers that while the two websites have some market power, there is evidence of competition, both between each other and from other small and mid-tier players.

The ACCC also received information showing that real estate agents can and do enter into a diversity of contracts and listing types, including within the same region.

Realestate.com.au is part of REA, 61.6 per cent of which is owned by News Corp, while Domain is owned by Fairfax.

It’s not the first time a group of agents has united to try and wield some of the power away from the market leaders. In 2014, Real Estate Digital Marketing Services was formed as a response to price hikes in real estate advertising.

The ACCC is now seeking submissions from Property Media Group and interested parties in relation to its draft determination, before making a final decision, expected in October 2016.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/6FgKZCyKThw/

Landlords urged to offer taster to potential tenants

As covered in the September issue of API magazine, Airbnb is the next big thing to hit property investing, and now the short-stay accommodation site has teamed up with Rent.com.au to encourage landlords to offer renters the chance to “try before they buy” and test-drive a new neighbourhood before signing the rental lease.

Schools, cafes, shops, sporting facilities, public transport, entertainment and the arts, will all go under the microscope, as renters “check in” to new suburbs in the search for their next home.

Under the agreement, more than 7 million renters can now book apartments, houses, private and shared rooms and unique accommodation options via a click-through from the Rent.com.au website.

“We love the idea of people ‘test-driving’ their new community,” Rent.com.au CEO Greg Bader says.

“We can all look at the photos and descriptions on our website, and that gives us a good idea of the property we’re moving into, but it doesn’t really paint the full picture of a new community.

“Whether for a weekend or a week, holiday or work, move in and get a feel if a place is right for you.

“Explore, experiment, suss out the clubs and pubs, check the commute to work, time the school run, or just chill at a local cafe.”

Airbnb, Bader adds, is a great way for people to get a real taste of their new location and offers “instant community connection”.

“Entering into a new lease is a big deal in terms of commitment, so why not take the time to really make sure an area is for you,” he asks.

“One of Airbnb’s key strengths is the fact that the majority of its short-stay accommodation options aren’t in the same areas as hotels, but in the same suburbs or buildings where renters are searching.”

With affordability issues around our capital cities, renting is something more and more people are signing up for, and the rise of the “rentvestor” has seen many investors opt to buy where they can afford and rent where they want to enjoy the lifestyle.

It’s only logical, Bader says, that they “try before they buy” and ask themselves, “can I really see myself living here?” before signing a lease.

“We also see benefits for private landlords in securing long-term tenants or extra income,” Bader says.

“Rental cycles vary for different landlords, so if there’s a student focus, for example, there’s real probability of vacancies over the Christmas period… why not list on Airbnb to cover those periods?

“Obviously, people can go directly to the Airbnb site at any time, but we’re just simplifying the process with direct access from our site.

“It’s a game-changing approach to renting and helps to give renters the best possible choice and range of services imaginable.”

Rent.com.au data shows that 50 per cent of all renters look to spend around $300 per week on a rental (or a minimum of $15,000 per year).

With a one-night stay via Airbnb available from less than $100 per night, this partnership could see tenants making more informed decisions when choosing their next rental home.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Z03plWLT10Y/

Business confidence slumps in Qld

Business confidence in the Queensland economy and building industry has slumped, with nearly 30 per cent of respondents in a recent Master Builders survey pessimistic for the future.

The Master Builders Survey of Industry Conditions for the April-June quarter 2016 shows this negativity is in line with recent building approvals, which are holding steady but expected to decline – particularly multi-units in greater Brisbane.

Master Builders deputy CEO Paul Bidwell says for the most part, however, respondents think the economic outlook for the state’s building industry will remain stable.

“Even though many respondents expect things to remain stable, the fact that a significant number are pessimistic going forward indicates that there are signs of a slowdown,” he says.

Regional summary

There was a general improvement seen regionally, with most regions recovering the losses made in the previous quarter.

The improvement was evident most in Mackay, Whitsunday and north Queensland. Central Queensland, which has also struggled with the downturn in the resource sector, maintained the gains of previous quarters but didn’t add to them.

Toowoomba, southwest Queensland and Wide Bay Burnett enjoyed a strong quarter, and although far north Queensland fell back somewhat, it still remains a regional standout.

Brisbane and the Gold and Sunshine coasts

Business confidence in the building and construction industry dropped in greater Brisbane. Turnover and profitability fared better, recovering some of the loss of the previous quarter. The report shows it’s anticipated that both indicators will be back in negative territory by September.

Business confidence in the building and construction industry in the Sunshine Coast fell away but remained at a high level during the June quarter, while the Gold Coast (pictured) continues as the state’s standout performer and there are no signs of this changing, for now.

Hot topic: renovations

The most popular renovations are bathrooms and decks, followed by kitchens.

The survey found 25 per cent of people renovate their bathroom, followed by 23 per cent who add on a deck or patio, and almost 10 per cent prefer a kitchen.

When it comes to changing customer profiles, respondents saw a drop in demand from first-time buyers and investors.

When asked about other trends, the most common theme was money or rather the lack of it. Some of the responses included: “People haven’t the disposable money”

“People are more focused on price than quality”

“They say they care about quality but at the end of the day they don’t want to pay for it”.

The role of interior design is growing in importance, with clients employing stone-look features, using a lot of timber and often seeking an industrial look.

Multi-layering eclectic design also has a place, as well as solid timber, exposed feature posts, beams and butt joint feature glazing.

Interestingly, the “media room is dead”, while provision for an electric car is now being requested.

To see the report in full, visit: www.masterbuilders.asn.au/publications-and-resources/reports-and-statistics/survey-of-industry-conditions

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/SQ-3R8uuzQw/

Coastal areas still popular retirement choice

Data released yesterday by the Australian Bureau of Statistics (ABS) offers an interesting insight into Australia’s ever-increasing aged population, and also the locations in which they like to spend their twilight years.

Australia’s aged population has increased by almost 20 per cent since 2010, according to the figures.

There were 2.2 million people aged 65 and over living in Australia’s capital cities in 2015 (up from 1.8 million in 2010).

Additionally, 1.4 million live in areas outside our capitals (up from 1.2 million in 2010).

Hobart has the oldest population of any Australian capital city, with its median age – the age at which half the population is older and half is younger – sitting at 39.8 years at June 2015, compared to 37.4 years for the whole country.

Adelaide was the next oldest capital (38.8 years) followed by Sydney (36.1) and Melbourne (36.0).

Darwin was the youngest capital city (33.3).

The residents of Tea Gardens – Hawks Nest, near Port Stephens on the New South Wales coast, were officially Australia’s oldest, with a median age of 61.0 years in 2015.

People living in Tuncurry, on the NSW mid-north coast, were the next oldest (59.7 years), followed by residents of Bribie Island in Queensland (59.3), Paynesville in Victoria’s Gippsland region (59.0) and Victor Harbor on South Australia’s Fleurieu Peninsula (58.1).

“The older populations in these areas reflect a preference among many Australians to retire to coastal and rural parts of the country,” ABS director of demography Beidar Cho says.

People aged 65 years and over contributed to more than 60 per cent of population growth in areas outside capital cities between 2010 and 2015.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/aU_99c3iwI4/

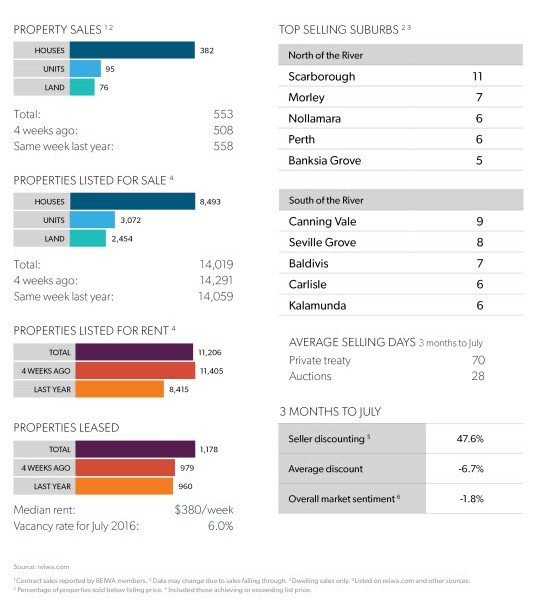

Pockets of positivity in Perth’s rental market

The number of leased properties in Perth’s overall market for houses and units declined 5.2 per cent in the June 2016 quarter, according to recent figures.

However, Real Estate Institute of Western Australia president Hayden Groves comments that it was pleasing there were areas across the metro region that were bucking the trend and doing well in challenging conditions.

“There was a notable lift in activity in the northeast sub-region, and we also saw signs of strength in the southwest sub-region with activity lifting 0.2 per cent,” Groves says.

Perth’s northeast sub-region was the standout performer in the Perth rental market in the June quarter, recording a 4.7 per cent increase in leasing activity.

The central sub-region had the biggest decline in activity in the three months to June, dropping 8.5 per cent.

At a suburb level, the top performers for increase in leasing activity in each of the sub-regions were:

*For suburbs with more than 30 leased properties

Rent prices

Perth’s overall median rent (houses and units) dropped $15 to $380 per week.

“As with leasing activity, the northeast and southeast sub-region’s median rent price held steady over the quarter with no change,” Groves says.

Despite the rental market becoming more affordable overall for Perth tenants, there were still some suburbs throughout the metropolitan area that were benefiting investors.

“For example, 30 per cent of the 124 suburbs in the central sub-region experienced either an increase in their median rent prices or had stable rents,” Groves says.

Perth market snapshot

Source: REIWA

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/RvklPgMTAgE/

Emma Power, Western Sydney University

Pet owners grapple with rental insecurity, new research shows. Despite the popularity of pet ownership across countries such as Australia (where 63% of households include a pet), the United States (62%) and United Kingdom (46%), rental policy rarely recognises pets as important members of households. Instead, landlords and property agents typically restrict the right to keep pets.

Reports from animal welfare organisations suggest these policies make it difficult for pet owners to find rental housing. There is also evidence of connections between rental insecurity and poor animal welfare outcomes.

Research shows that insecure housing, including difficulties finding pet-friendly rental properties, is a key factor driving people to relinquish their pets.

The ‘no pets’ clause

My research shows that pet ownership can trigger feelings of housing insecurity for renter households. The research involved an open survey with 679 households that had rented with pets in Sydney, as well as 28 in-depth interviews.

The majority of survey respondents rated finding pet-friendly housing in their suburb as difficult. They perceived that it became more difficult to find rental properties after they acquired their pet.

About half of those who always declared their pets when they applied for properties had been given pet ownership as the reason their application was rejected. These figures are likely to represent only a small proportion of those who have been rejected for pet ownership as reasons for rejection are rarely provided.

The competitive nature of Sydney’s rental market, which gives real estate agents a larger pool of tenants to choose from, was believed to have increased the challenge. A small number of households had even been offered rental housing if they got rid of their pet. These experiences led to a sense of rental insecurity and feelings of stress when participants wanted or needed to move house.

Compromising on quality, cost and location

In the in-depth interviews, households were asked how they found their current rental property. They explained how long lists of available rental properties would disappear when the “pet-friendly” filter was activated on popular property search websites.

There was also a widespread perception that advertised pet-friendly housing was of a lower quality than housing that did not allow pets. Many described making compromises on property quality and cleanliness. Some purposefully chose less desirable properties to increase their chance of success.

For example, one participant stated:

I think they call them ‘pet friendly’ because they don’t really care what happens to them. They’re probably going to pull them down eventually.

Another explained:

It was quite heartbreaking when you looked at the properties, because they were pretty much all rundown and disgusting. Really sort of dark and dingy, bathrooms that you would see were, I suppose, just not up to scratch. Or houses that seriously probably haven’t had a lick of paint or anything done to them in 20, 30 years.

Households also made compromises on property location and cost. These choices led to feelings of housing stress. For some it meant living in housing they considered sub-standard, including properties that were unclean or located in undesirable or unsafe areas. A number accepted longer work commutes or greater financial stress to secure a property.

As one interview participant put it when explaining why they stayed in a neighbourhood they didn’t like:

My car is on the street and it’s been broken into several times and there are a few personal safety issues but they let me have the cat, so …

Some renters don’t declare their pet, then live with the stress of what might happen if they are discovered. FenrisWolf from shutterstock.com

The vast majority of pet owners declared some or all of their pets when applying to rent a property. Those who had previously been rejected for a property because they had a pet were less likely to declare their pets. Why take this risk?

In-depth interviews suggest that renter households were extremely concerned about housing security: they valued their rental property and wanted to live in it as long as they could.

However, some felt that they could secure a property only if they didn’t declare their pets. Despite finding it extremely stressful to live in a rental property without permission to kept their pets, these households risked eviction so they could find somewhere to live with their pets.

Are landlords’ fears justified?

Tenant experiences in the research suggest that landlords are concerned about the risks to their properties that pets might bring.

Sometimes these concerns are based on real experience. However, there is some evidence to suggest that landlord fears are just that.

In one US study, for instance, 63% of landlords who were concerned about pets in their properties didn’t have any firsthand experience of the problems they identified. Further, when damage did occur it was “far less than the average rent or the average pet deposit”.

Landlords can request a ‘pet CV’, or owners may themselves improve their chances by providing an independent ‘character reference’. Javier Brosch from shutterstock.com

Indeed, somewhat counter-intuitively, having a pet-permitting lease may provide more protection for landlords than simply restricting pets. Pet-friendly leases do not mean all pets are automatically allowed. Landlords can ask for a “pet CV” as well as references for the pet, such as from a local vet, neighbours or former landlord. This is a way of ensuring the pet applicant is appropriate to the property.

Some jurisdictions in Australia allow for special provisions such as for carpets to be steam-cleaned if an animal such as a cat or dog lives at the property. In others, such as in the US and some states in Australia, an additional pet bond can be charged to cover any potential damage.

A pet-friendly lease may even bring benefits. US research suggests that households with pets stayed in rental properties longer than those that did not have pets. This brings longer-term, more secure rent to property owners. These factors are worth weighing up when landlords are making property management decisions.

![]()

Emma Power, Senior Research Fellow, Geography and Urban Studies, Western Sydney University

This article was originally published on The Conversation. Read the original article.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/CFOEiAOhysM/

The Australian government is using warnings from rating agencies like Standard Poor’s Global Ratings (SP), which placed Australia on a negative watch during the election, to make the case for passing budget measures. In reality, SP (and the other two agencies in the credit rating industry) has no moral or technical authority to make such a warning.

SP warned that Canberra needed to take “forceful” fiscal action to address “material” budget deficits, which is unlikely in the near future, or face losing its AAA rating.

However, rating agencies shouldn’t be entrusted with this sort of power. As a matter of fact, it is not clear at all why the rating agencies, SP included, are still in business. These agencies were instrumental in bringing about the global financial crisis, but have survived because of the lack of political will and because the ratings are required by law as a regulatory requirement.

The reputation of the credit rating agencies has been tarnished not only by the global financial crisis but, before that, by the Enron scandal, the Asian financial crisis and the financial collapse of New York City in the mid-1970s. The agencies’ track record shows failure to detect frequent near-defaults, defaults and financial disasters, as well as failure to downgrade troubled firms until just before (or even after) the declaration of bankruptcy. In fact, the credit rating agencies follow the market, so the market alerts the agencies of trouble, and not vice versa.

During the global financial crisis, hundreds of billions of dollars’ worth of triple-A-rated mortgage-backed securities were abruptly downgraded from triple-A to “junk” (the lowest possible rating) within two years of the issue of the original rating. About 73% (over $800 billion worth)

of all mortgage-backed securities that one credit rating agency (Moody’s) had rated triple-A in 2006 were downgraded to junk status two years later. In the US, the Financial Crisis Inquiry Commission puts a big chunk of the blame for the global financial crisis on the agencies, while European Union officials blame agencies for contributing to the advent of the European sovereign debt crisis.

The failure of the rating agencies can be attributed to negligence and incompetence. Starting with negligence, there is every indication that the credit rating agencies did not check the soundness of their ratings because customers were willing or forced to buy it. Negligence means that the rating agencies were in a position to make sound judgement but did not make the effort to do a thorough job. Given the bullishness prevailing in the run-up to the crisis, the agencies chose instead to receive big pay for a lousy job.

The agencies did not have the expertise to do the job the agencies were entrusted to do, particularly when it came to the evaluation of risk embedded in structured products. In his testimony to the Financial Crisis Inquiry Commission, Gary Witt (formerly of Moody’s CDO unit) said that Moody’s didn’t have a good model on which to estimate correlations between mortgage-backed securities, so they “made them up”.

Credit rating agencies promoted inferior products knowing the quality of these products. The credit rating agencies knew that the risk was great or that the securities were not really AAA, yet they passed them as AAA.

While the credit rating agencies may be perceived as “willing victims” of investment bankers and the issuers of securities, there is also evidence to suggest that the transparency, quality and integrity of the agencies’ other practices and processes were substantially lowered. This was in order to support the extraordinary growth of the agencies’ structured finance operations. In effect, the agencies deliberately overlooked the possibility that rating may have been unwarrantedly high.

For all of these reasons the rating agencies must not be taken seriously. The agencies are more stringent in rating countries than in rating private-sector firms, because they do not receive fees for rating countries, which is the “public relations” part of business. Credit rating agencies have every right to compete on a level playing field, but these agencies shouldn’t have oligopolistic power and should be forced to operate under the investor-pays model to avoid conflict of interest.

![]()

Imad Moosa, Professor, Finance, RMIT University

This article was originally published on The Conversation. Read the original article.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/MJGuudn1qKE/

June jump for new home lending

Latest Australian Bureau of Statistics (ABS) figures on housing finance show new home lending increased during the month of June.

The number of loans to owner-occupiers for dwelling construction rose by 2.1 per cent in seasonally adjusted terms while loans for the purchase of new homes saw growth of 2.7 per cent.

Overall, new home lending volumes increased by 2.3 per cent during the month, which is 6.3 per cent higher than the same month last year.

The Housing Industry Association’s senior economist Shane Garrett says June’s housing finance results are the first month’s data to fully capture the effect of cheaper mortgage costs from the Reserve Bank’s interest rate cut at the beginning of May.

“Encouragingly, prospective homebuyers seem to have taken advantage of the lower interest rate environment as evidenced by today’s positive results for new home lending,” he says.

“June was also dominated by the close federal election campaign, which was the source of some uncertainty across the economy.

“Today’s data indicate that the benefits of lower interest rates trumped any reluctance by buyers to enter the market during the tight election race. It’s therefore likely that last week’s interest rate cut will help bolster activity on the new home building side.”

Compared with a year earlier, the number of loans to owner-occupiers constructing or purchasing new homes increased in a number of states over the year to June.

The strongest growth was in Victoria (+19.1 per cent), followed by New South Wales (+10.8 per cent). There was a measured increase in Queensland (+4.3 per cent). Over the same period, there were reductions in Western Australian (-20.7 per cent) and the Northern Territory (-17.7 per cent) while Tasmania recorded a more modest fall (-3.5 per cent).

New home lending to owner-occupiers in South Australia and the ACT during June was comparable with the level a year ago.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/lMYzAqfN3qI/

Warning not to rely 100% on technology

The wealth of new technology now available for investors and homebuyers is making it easier to assess property but the Real Estate Buyers Agents Association of Australia (REBAA) says it’s risky business to invest based on technology alone.

REBAA president Rich Harvey warned buyers not to fall into the trap of relying on technology and free online tools exclusively in their purchasing decisions.

His comments come in the wake of the launch of a new property app by US start-up, Compass, last week, which gives real-time national data to homebuyers and renters.

“There is a plethora of free information available on the internet and via mobile apps but the serious danger we see for buyers and investors is how this information is interpreted and acted upon,” Harvey says.

“Take the investor who sees a report promising high capital growth and yield based on two years figures, then buys a property but has major regrets two years later when developers flood the market or the mining boom subsides.

“While an app can punch out a price estimate in five seconds, it can takes years of training and experience to understand property values accurately.

Many free valuation tools and technology apps are highly flawed and fail to take in renovation works and aspect.

“Engaging a buyers’ agent adds yet another layer of protection by analysing the data, negotiating for the purchaser and protects them from making an emotional decision rather than an informed one.”

According to Harvey, many free valuation tools and technology apps are highly flawed and fail to take in renovation works and aspect.

“There is no dispute that technology has enabled faster delivery of information across a multitude of devices and in a more efficient timeframe,” he says.

“But it’s alarming to think that people are basing the biggest financial investment decision they’re likely to make in a lifetime on some free online tools.

“These apps generally don’t provide any financial advice but simply offer a ‘one-size-fits-all’ database of information and documents on which the naïve investor needs to make a decision.

“It might seem like you’re saving money in the house hunt by relying on property apps and free online reports, however it could be far more costly in the long run if you buy an unsuitable property.”

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/t13ZZd-1PN8/