Further 16 forced sales of properties illegally held

“The divestments of these 16 properties, which have a combined purchase price of over $14 million, are further evidence of the Turnbull government’s commitment to enforcing our rules so that foreign nationals illegally holding Australian property are identified and their illegal holdings relinquished,” Morrison says.

“Foreign investment provides significant benefits for Australia but we must also ensure that such investment benefits all Australians, is in line with our rules and is not contrary to our national interest.”

The 16 properties were in Victoria, New South Wales, Queensland and Western Australia, with prices ranging from approximately $200,000 to $2 million. The individuals involved come from a range of countries including the United Kingdom, Malaysia, China and Canada.

“The foreign investors either purchased established residential property without Foreign Investment Review Board approval, or had approval but their circumstances changed meaning they were breaking the rules,” Morrison explains.

“Since taking office in 2013, the Coalition government has forced foreign nationals to divest a total of 46 properties. Under the previous Labor government, no foreign nationals were forced to divest illegally-held Australian property.

“These divestments are a reminder that the Coalition government’s increased compliance measures, which include transferring responsibility for residential real estate enforcement to the Australian Taxation Office (ATO), are working to ensure our foreign investment rules are being enforced.”

Since the transfer of responsibility to the ATO for compliance in May 2015, more than 2200 matters have been referred for investigation. Through information provided by the public, together with the ATO’s own enquiries, approximately 400 cases remain under active investigation.

“Since a new penalty regime was introduced from 1 December last year, 179 penalty notices have been issued, totaling over $900,000,” Morrison adds.

“Penalty notices have been issued to people who have failed to obtain FIRB approval before buying property as well as for breaching a condition of previously approved applications.

“Illegal real estate purchases by foreign citizens attract criminal penalties of up to $135,000 or three years’ imprisonment, or both for individuals; and up to $675,000 for companies. The new rules also allow capital gains made on illegal investments to be forfeited.”

Along with the divestments, a number of people came forward during the reduced penalty period who weren’t in breach and some who voluntarily sold their properties while the ATO was examining their case.

“While Australia welcomes foreign investment, foreign investors must comply with our laws,” Morrison says.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/sRKyetfjzs0/

Jail and ban for property development scammer

The Australian Securities and Investments Commission (ASIC) has permanently banned Steven Hill from engaging in credit activities and providing financial services.

An ASIC investigation found that between January 2006 and February 2007, Hill, through Hill Stephens Associates Pty Ltd and International Finance Consortium (Aust) Pty Ltd, induced various investors to pay approximately $618,000 to acquire interests in a “house and land” property development located in Queensland.

Hill was found guilty of fraudulently misappropriating $281,000 of the invested funds, which were directed to company bank accounts to make payments to Hill and other third parties.

On April 18, 2016, Hill was sentenced to two years and nine months’ jail for fraudulent misappropriation.

Following the sentencing, ASIC determined that Hill should be permanently banned as he was convicted of offences involving dishonest and fraudulent conduct.

ASIC commissioner Peter Kell says Hill’s misconduct was very serious.

“ASIC will ban people from the finance industry who act dishonestly and place personal interests ahead of those they service. Mr Hill’s actions exposed vulnerable members of the community to financial loss and hardship.”

The original ASIC investigations revealed that between January 2006 and February 2007, Hill met with various investors based in New South Wales. Describing himself as a “financier/consultant”, through his company Hill told investors he would be able to provide them with investment opportunities to build their wealth towards retirement.

He advised investors their funds would be used as “seed capital” in a number of Queensland-based property developments he was facilitating.

Hill advised investors they would receive returns of between 10 and 30 per cent per annum, however, unbeknownst to the investors, the funds paid weren’t invested in the developments as originally advised.

In June 2013 Hill was charged with eight counts of fraudulent misappropriation and in March 2015 he was ordered to stand trial on seven counts of fraudulent misappropriation.

In March this year, Hill was convicted on six counts of fraudulent misappropriation by a Sydney District Court jury after a four-week trial.

He was found not guilty of one charge of fraudulently misappropriating $150,000.

Hill has the right to appeal to the Administrative Appeals Tribunal for review of ASIC’s decisions.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/UM8li9hHDKQ/

Property investor confidence remains strong

Despite talk of property price bubbles, tightening investor lending policies and ongoing debate about the future of negative gearing, Australian property investors remain optimistic about the long-term merits of residential real estate according to a new survey.

The second annual Property Investment Professionals of Australia (PIPA) Property Investor Sentiment Survey gathered insights from more than 1000 property investors.

PIPA chair Ben Kingsley says the survey results confirm that property investors remain focused on the long-term benefits of property investment.

“Similar to last year, most property investors are looking past short-term challenges, remaining focused on the long-term wealth benefits that are available from residential real estate, including the potential for capital growth and rental income,” he says.

“Importantly, most investors are not speculating on quick gains in a low interest rate environment.

“The survey also affirms that a lot of the discussion about negative gearing misses the mark. Most investors understand that negative gearing is only a short-term cash flow position, not a property investment strategy. And only a very small minority are attracted to real estate for these tax concessions.”

While 32 per cent of investors say that recent changes to lenders’ investment policies have affected their ability to secure finance, 58 per cent are nonetheless looking to buy a property in the next six to 12 months.

According to the survey, 72 per cent of investors aren’t worried about the potential removal of negative gearing and only 2 per cent think that the currently available negative gearing concessions are the key attraction of real estate investment.

The survey shows that almost half (47 per cent) of property investors are positively geared and a majority (63 per cent) of investors who are currently negatively geared expect they will become positively geared within five years.

Brisbane remains a preferred destination

The number of investors who believe Brisbane offers the best investment prospects has fallen slightly – from 58 per cent to 50 per cent over the last year – but the city remains far ahead of any other capital cities (Melbourne 20 per cent, Sydney 11 per cent, Adelaide 9 per cent and Perth 4 per cent).

“The two key reasons that Brisbane still attracts investors, in spite of concerns around oversupply, are affordability and the potential for attractive yields. Brisbane is investing in infrastructure to make the city more liveable and investors are clued on to this,” Kingsley says.

Brokers highly valued by investors

Mortgage brokers remain by far the most important source of finance for property investors, with 65 per cent of investors (66 per cent in 2015) securing their last investment loan through a broker. Some 71 per cent plan on securing their next investment loan through a broker.

“In the complex borrowing environment we are now facing, brokers continue to play a key role as providers of finance to investors. They tend to better understand the investment lending landscape and offer great choice to investors,” Kingsley says.

The survey also shows that a vast majority (80 per cent) of investors would choose or refinance to a lender offering the option of an interest-only repayment period, as opposed to a lender who did not offer such a period.

Sixty-six per cent of investors would choose or refinance to a lender if it offered the same interest rates for investors as owner-occupiers.

More regulation and improved standards needed

Although investors are becoming more sophisticated, with 31 per cent having a set strategy for investing, they overwhelmingly (87 per cent) consider that more investment education about the risks and potential benefits of investing in property is needed.

Even higher numbers (89 per cent) believe the property investment industry should be regulated and licensed in the same way as many other professions.

“Unlike financial planning and mortgage broking, the provision of property investment advice still remains unregulated,” Kingsley says.

“PIPA is committed to raising the professional standards of this industry and will continue to lobby the government to regulate property investment advice and educate investors to help them make informed investment decisions.”

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/CQkvkPqgD9c/

Proof if it were needed that everyone should check the credentials of the building practitioners they employ, as the Victorian Building Authority (VBA) successfully prosecutes well-known home builder Mentor Gormani, director of Gormani Homes Pty Ltd.

The director of the now deregistered building company was prosecuted by the VBA in the Dandenong Magistrates Court and fined $20,000 for claiming to be a qualified builder when he wasn’t.

Gormani built homes as far away as Tarneit in the west and Cranbourne in the southeast of Melbourne, holding himself out to be a qualified builder when he wasn’t.

Gormani Homes then entered into a number of contracts for building projects at several sites around Melbourne using the registration numbers of other registered building practitioners to falsely obtain insurance.

When his company went into liquidation and a number of its clients made insurance claims for unfinished work, they were refused on the basis that the insurance was taken out in a different builder’s name to the builder named in the relevant contracts.

Gormani portrayed himself as qualified to practise as a building practitioner, telling consumers he was a quality builder while never actually having been registered as one.

Following an investigation by the VBA, Gormani was charged with several offences including holding out as being qualified to practise as a building practitioner, holding out as being covered by the relevant insurance, carrying out building work without a building permit and making a false statement.

He pleaded guilty to nine charges and was ordered to pay fines and costs of $30,900.

VBA CEO Prue Digby says this was a positive result that will send a clear message to others who might seek to undermine Victoria’s building regulatory system.

“The rules and regulations requiring building practitioners to be registered and to operate with the appropriate insurance exist to safeguard Victorians who build and renovate.

“Those who seek to operate outside these rules and regulations undermine the building industry and erode consumer confidence in honest, registered building practitioners who take pride in their work and deliver an excellent product for Victorians.”

You can check whether your builder is registered through the “Find a Practitioner” link on the VBA website.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/jkCW8VKvHzA/

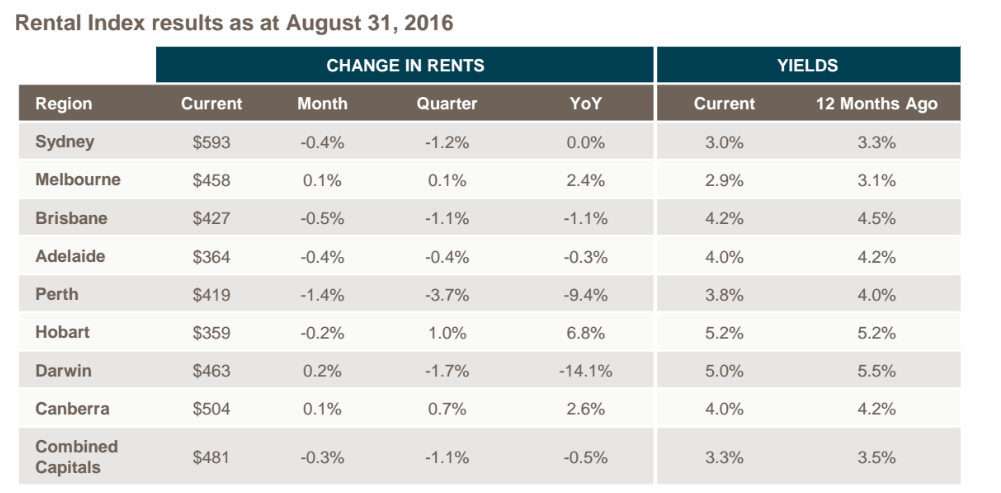

Rents dropping in most Australian cities

With the exception of Melbourne, Darwin and Canberra, rental rates across Australia’s combined capital cities continued to drop in August according to the latest CoreLogic Rent Review.

Interestingly, the August results mirrored the results for July, with both months now sharing a -0.3 per cent drop.

According to research analyst Cameron Kusher, weaker rental market conditions are expected to continue over the coming months as overall housing supply grows. Combined capital city median weekly rents are sitting at $481 per week, the lowest rate since November 2014.

“As long as wages growth continues to stagnate, coupled with historically high levels of new dwelling construction and slowing population growth, landlords won’t have much scope to increase rents,” Kusher says. “On the flipside, renters are now in a much better position to negotiate.”

Changing rental market conditions may also spur on repercussions for older stock, particularly units. With new unit supply being built, much of which is located in inner city locations, Kusher believes there’s the potential for a flight of tenant demand towards higher quality tenancy options in newer buildings.

“It may be more difficult for owners of older units with fewer amenities to compete with better located and facilitated new unit stock, particularly if there is little pricing differential,” he says.

Rental index results as at August 31, 2016

Over the past 12 months, rental rates have increased in Melbourne, Hobart and Canberra. Rental rates are unchanged over the year in Sydney and have fallen in Brisbane, Adelaide, Perth and Darwin.

Melbourne, Hobart and Canberra have each recorded stronger rental growth over the past year compared to the previous year.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/vuxi4z7aUvI/

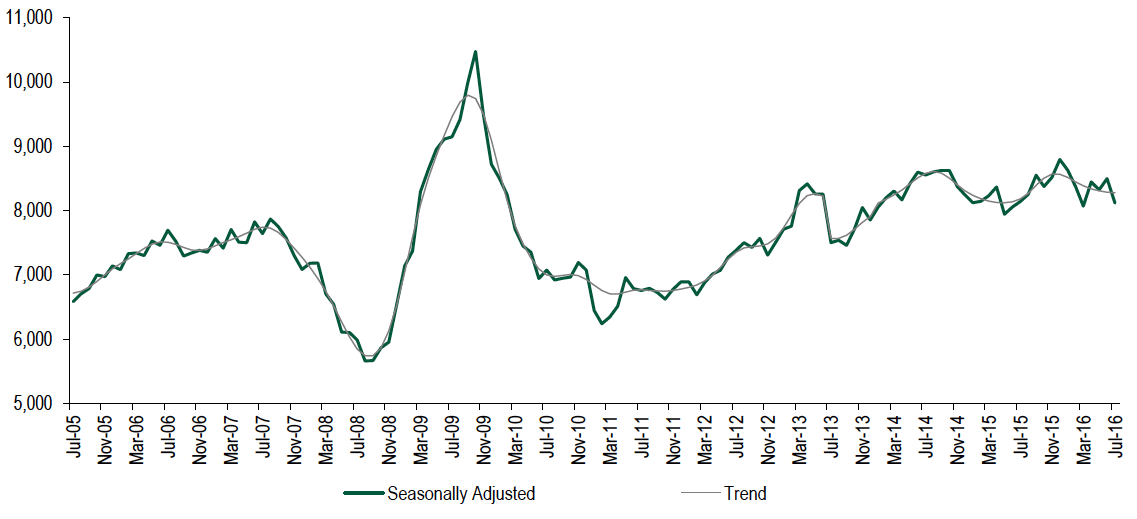

The latest figures released by the Australian Bureau of Statistics on housing finance highlight a sharper than expected fall in July 2016, though the Housing Industry Association (HIA) says it’s not as bad as it looks.

“In contrast to the GDP result earlier in the week where the focus quickly turned to the dim spots below a glowing surface, let’s consider the bright spots underneath a below-expectations result for housing finance,” HIA chief economist Harley Dale says.

While the number of loans for owner-occupiers fell across the board in July 2016, the lending profile over the three months to July “signals no cause for alarm” he adds.

Lending for the purchase of new dwellings increased over the ‘quarter’ (+2.2 per cent), while the number of loans to owner-occupiers for new dwelling construction eased very moderately (-1.0 per cent).

The number of loans for established dwellings (net of refinancing) fell by 2.0 per cent over the July quarter.

“This is hardly ‘shock, horror’ stuff, but these latest finance figures do reinforce that the overall market has peaked,” Dale says.

“On the investment front it’s not surprising that the value of lending for investment in existing property continues to decline – down 19 per cent from its peak. Lending for new property is up 22 per cent,” he notes.

“It is rather ironic that without the policy uncertainty generated by proposed changes to superannuation and persistent headlines regarding negative gearing amendments, lending for existing investment properties would be lower and the counterpart new home building component would be even healthier. That’s exactly what policy makers are after, yet their own actions are delaying that outcome and hampering housing affordability.”

According to Mortgage Choice’s latest national home loan approval data, fixed-rate home loans accounted for 20.32 per cent of all loans written throughout the month of August, which is up slightly from 20.24 per cent the month before.

“Today’s slight lift in fixed-rate demand is largely unsurprising,” CEO John Flavell says.

“In August, the Reserve Bank of Australia [RBA] cut the cash rate… but while the official cash rate was cut by 25 basis points, Australia’s lenders failed to pass on the rate cut in full, with some cutting their residential home loan rates by just 12 basis points.

“Given the RBA held the cash rate at 1.5 per cent in September, we might start to see more interest in fixed-rate home loans as people start to question if now is a good time to lock in a rate.

“If the Reserve Bank does cut the cash rate again, it’s clear that Australia’s lenders are unlikely to pass on the full rate reduction.”

Across the country, fixed-rate demand was highest in Western Australia, with this type of product accounting for 25.78 per cent of all home loans written throughout the month of August.

Queensland and New South Wales were not far behind, with fixed rates accounting for 24.72 per cent and 22.91 per cent respectively of all loans written.

Demand for fixed-rate home loans was lowest in Victoria, where it accounted for just 9.06 per cent of all loans written.

Overall, variable rates were the most popular product among borrowers, with ongoing discount rates accounting for 45.14 per cent of all loans written.

Lending for construction and purchase of new dwellings – Australia

Source: ABS Housing Finance; HIA

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Vpt797GN2W0/

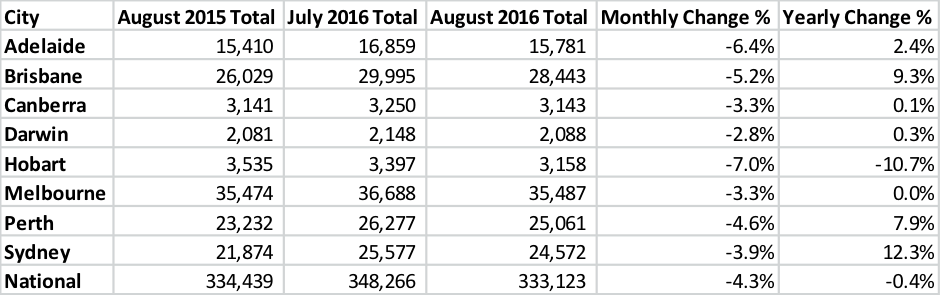

Property sale listings decreased in all capital cities during the month of August according to figures from investment research house SQM Research.

The fall came as a result of decreasing stock, with August recording just 333,123 listings, a fall of 4.3 percentage points.

Year on year results indicate that national sales listings are down 0.4 per cent compared to August last year.

Hobart recorded the largest decrease for August, with property listings falling 7.0 per cent.

Adelaide followed with a monthly change of 6.4 per cent, based on 15,781 listings. Year-on-year Hobart property listings are down 10.7 per cent.

In contrast, Sydney property listings are up 12.3 per cent.

Falls in listings for August aren’t unusual in the lead-up to the spring selling season. SQM Research expects a bounce back to a rise in listings when it reports on September’s findings.

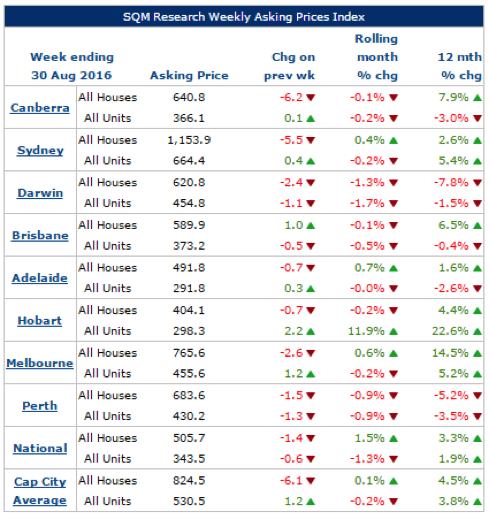

Median asking prices

Source: www.sqmresearch.com.au

Capital city asking prices were largely flat during August, with a minor 0.1 per cent rise for houses and a 0.2 per cent decline for units, signifying that vendors largely aren’t readjusting their asking prices and there’s minimal upward pressure on prices in the current housing market.

Year-on-year results reveal Melbourne median asking prices have risen 14.5 per cent for houses and 5.2 per cent for units, while Hobart has also recorded yearly changes, with median asking prices for units climbing 22.6 percentage points.

Meanwhile, median asking prices for houses in both Darwin and Perth continue to fall, with the median asking price for a house in Darwin sitting at $620,800; 7.8 per cent lower than this time last year.

SQM Research managing director Louis Christopher says: “Our latest indicators on listings and asking prices suggest the national housing market is not displaying any major uplift in activity at this point in time.

“It seems to be a very mixed housing market overall, with the stronger markets being Melbourne and Hobart and the weaker markets being Perth and Darwin.”

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Ai1bicYJJzg/

Wilton and Macarthur set to become growth areas

The Urban Development Institute of Australia (UDIA) NSW has commended the state’s Minister for Planning, Rob Stokes, after he announced plans for a new growth community at Wilton New Town in Western Sydney as well as new land release areas in Menangle Park and Mount Gilead.

UDIA NSW chief Stephen Albin says Western Sydney is experiencing unprecedented growth, and is expected to grow to be the size of Adelaide within a few decades.

“Growth areas such as Wilton and Macarthur will provide critical housing and infrastructure to create more liveable, affordable and connected cities,” he says.

“This land release can only be good for housing affordability and enable new communities to grow in Western Sydney.”

Albin goes on to explain that Western Sydney is growing exponentially, and new land release is “essential” for housing supply in what’s going to be “a bustling employment hub”.

The Wilton New Town will have its own town centre and room for around 16,000 homes over the next 30 years, while the Greater Macarthur Priority Growth Area, also incorporating new land release areas of Menangle Park and Mount Gilead, will accommodate 35,000 new homes.

Watch this space for the release of detailed plans for these new towns for community and industry consultation.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/2luQZnN6F7E/

Comparison rate ignorance holding borrowers back

There are concerns that low levels of financial literacy could be costing unsuspecting homebuyers, particularly when it comes to spotting hidden fees and charges on their home loan.

A national mortgage survey, commissioned by member-owned financial services provider CUA, has revealed that the vast majority of homebuyers and those looking to refinance their home loan could be missing out on the best value because they don’t know how to compare the true cost of different loans.

CUA’s Andy Rigg says it’s a concern that fewer than one in three Australians (29 per cent) understand what is meant by a home loan “comparison rate”.

Lenders are required to disclose the comparison rate so homeowners can compare lenders on an even playing field by seeing what the actual cost of their loan will be, including fees, rather than just the annual percentage rate.

“Property buyers need to be careful that what looks like a very low rate doesn’t actually have lots of nasty hidden fees and charges,” Rigg says.

“Comparison rates are useful in helping property owners choose the most suitable rate for existing and new homeowners by looking behind the headline interest rate to also factor in fees and charges.”

More than 1000 Australians aged from 25 to 49 were surveyed during July, with half of the respondents currently holding a mortgage.

Results revealed that 43 per cent of people misunderstood what was meant by a comparison rate and a further 28 per cent admitted they didn’t know what was meant by a comparison rate.

The findings come at a time when more Aussie homeowners are considering switching their mortgage to lock in some of the lowest interest rates on record.

Forty-seven per cent of mortgage holders surveyed were planning to switch to a fixed rate at some stage in the future, up from just 37 per cent at the start of the year.

Of those planning to fix, around one in three said they were planning to do so in the next six months.

“The current low-interest rate environment is clearly encouraging some homeowners to consider locking in these lower mortgage repayments for the next few years. This could be because they’re chasing greater certainty, want to pay their loan off more quickly or may be hoping to divert extra savings to other investments,” Rigg says.

“However, it’s also clear that many homeowners are still watching and waiting to see if rates fall to even lower levels, before deciding whether to switch from a variable to fixed-rate loan.”

Despite the historically low interest rates, the survey also found the majority of Australians without a mortgage don’t expect to ever be able to own their own home and fear they’ll be permanently locked out of the housing market if prices keep rising.

The survey showed 33 per cent of non-mortgage holders did not think they could ever afford to buy a property, while a further 39 per cent of respondents feared they’d be priced out of the market unless property prices stay the same or decrease.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/ewYHzD5Bopg/

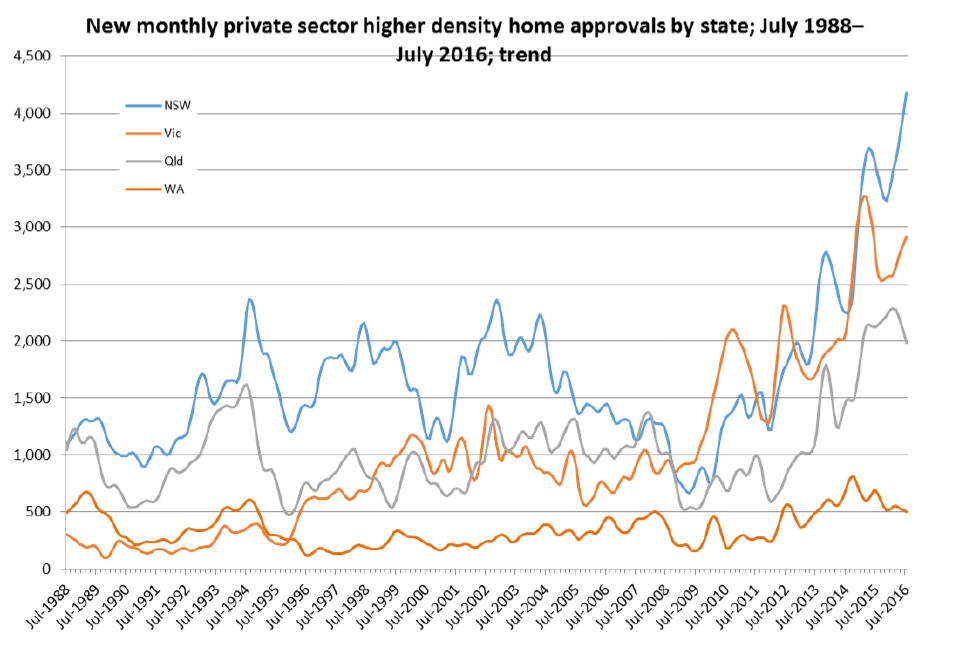

Dwelling approvals in Australia rose 0.2 per cent in July (in trend terms) and have now risen for eight months, according to data from the Australian Bureau of Statistics (ABS).

Approvals rose 2.4 per cent to 6545 in New South Wales, and 0.5 per cent in Victoria, but decreased in Tasmania (3.7 per cent), Northern Territory (3.2 per cent), Australian Capital Territory (2.6 per cent), Queensland (1.8 per cent), South Australia (1.8 per cent) and Western Australia (1.8 per cent).

In seasonally adjusted terms, total dwelling approvals increased 11.3 per cent, driven by a rise in total other residential dwelling approvals (23.4 per cent). Total house approvals fell 0.6 per cent.

“Looking through the inevitable monthly volatility, both ABS Building Approvals and [Housing Industry Association] HIA New Home Sales are signalling some further growth in ‘multi-unit’ construction, but a gradual decline in detached house building,” HIA chief economist Harley Dale notes.

“There is some further spark to semi-detached/townhouse dwellings – this is a market to keep a positive eye on.”

Urban Taskforce CEO Chris Johnson says the apartment market is taking over NSW and Sydney housing numbers, with 4178 approvals in July compared to 2367 house approvals.

“Apartments are clearly the way of the future in terms of urban living in Sydney and NSW towns,” he says.

“The July ABS data also shows an uplift in the value of non-residential building approvals to $960,102,000 compared to $767,194,000 in January 2016,” he adds.

“This is a big jump in six months but this may be through one or two large projects being approved.”

Treasurer Scott Morrison feels the figures highlight the importance of the building and construction industry to the economy and says he believes that’s why it’s “critical” to restore the Australian Building and Construction Commission (ABCC).

“The construction sector has been buoyed recently by the strong demand for residential construction,” he says, “and while the 11.3 per cent jump in the number of residential dwelling approvals in July was very positive, we still need the non-residential sector to pick-up further.

“The value of residential approvals rose by 6.2 per cent in July, but the value of non residential approvals fell by 2.5 per cent.

“In the face of these headwinds and given the importance of the construction industry to the economy, we must ensure that our building and construction industry remains vibrant and competitive, with lower costs and greater efficiencies.

“This is why the government remains committed to re-establishing the ABCC and building code.

“The ABCC laws will ensure that Australia’s building and construction industry is not hampered by unnecessary and costly industrial action, as well as bullying, intimidation and unlawful behaviour that promotes inefficiency and pushes up costs.

“Unlawful conduct on building sites around Australia is costing jobs and is making local infrastructure more expensive,” Morrison adds.

“Master Builders Australia estimates that important infrastructure like schools and hospitals cost taxpayers up to 30 per cent more, due to the extraordinary level of industrial action.”

Prior to the creation of the ABCC, the average number of working days lost to industrial disputes in the construction industry was a huge five times the rate in other industries.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/WCIkw2AE05k/