Cash rate left unchanged

The Reserve Bank of Australia (RBA) has announced the cash rate will remain at 1.5 per cent.

The decision to keep rates on hold was arguably one of the safer bets today, with the outcome widely anticipated by the market.

The performance of the housing market was likely a key topic of discussion among RBA board members, with CoreLogic’s October results, also released today, showing a further 0.5 per cent rise in dwelling values across the capital cities.

Since the first rate cut this year in May, CoreLogic’s hedonic index has increased by 4 per cent across the combined capitals, with more substantial rises reported in Sydney and Melbourne.

With the cash rate on hold, mortgage rates are likely to remain at the lowest level since the mid-1960s.

Ninety per cent of experts and economists asked by finder.com.au were anticipating a cash rate hold this month, though the majority of experts (69 per cent) are tipping a rate cut in the first half of next year.

An analysis by finder.com.au found the RBA cut rates on the first Tuesday of November just four times in the past 26 years.

The last two instances were on Melbourne Cup days in 2011 and 2008, but prior to that, it was more than 20 years ago in 1996.

![]()

View all articles by Angela Young »

<!–

–>

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/ffgxtMMEaQU/

Qld FHBs eyeing off-the-plan purchases

An increasing number of first homebuyers in Queensland are buying off-the-plan homes, according to new data.

Mortgage Choice’s annual first homebuyer survey reveals that 5.8 per cent of first homeowners chose to buy a property off the plan – up from just 2.4 per cent in 2012.

“Interestingly, a further 16.5 per cent of first homebuyers bought a newly built property in 2016, while 4.9 per cent said they purchased a piece of land in order to build a home of their own,” Mortgage Choice’s Queensland state manager Debbie Chambers says.

“In total, 27.2 per cent of first homebuyers purchased either a new home or land to build on – up from 18.4 per cent in 2012.

“Given the amount of construction that has been taking place across the state, the growth in demand for newly built homes can hardly be considered surprising.”

Australian Bureau of Statistics stats show building approvals for units rose 83.4 per cent between 2012 and 2016.

Chambers said first homebuyers were undoubtedly also encouraged to consider newly built and off-the-plan homes because of changes to the first homebuyer grant.

“In 2013, the Queensland state government removed first homebuyer grants for established dwellings. Today, only those buying new homes are entitled to a grant of up to $20,000,” she says.

Meanwhile, the monthly Housing Industry Association (HIA) survey of Australia’s largest volume builders reveals that total seasonally-adjusted new home sales increased in September 2016, the second consecutive month of growth.

“During September, HIA’s new home sales grew by 3.8 per cent, a further increase on the 2.9 per cent rate of growth over the previous month,” HIA senior economist Shane Garrett says.

“Within the month, growth was driven by detached house sales, which rose by 3.8 per cent, while sales of units eased back by 0.8 per cent over the same period.

“However, the mix of available indictors suggests that new home building activity has now passed its peak and that the 2015/16 financial year will not be matched in terms of new dwelling starts.

“This is particularly the case for multi-residential sales, which have eased by 6.2 per cent during the September 2016 quarter compared with the same period a year earlier,” he concludes.

In the month of September 2016, detached house sales fell in four out of the five states covered by the report, an exact reversal of the situation in August. During September 2016, the largest fall in sales was recorded in South Australia (-23.0 per cent), followed by Western Australia (-17.2 per cent), New South Wales (-12.9 per cent) and Queensland (-2.6 per cent). Victoria was the only state to record an increase in new home sales over this period, with 14.0 per cent growth in sales over the past year.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/4miw_8C-tEg/

Survey shows construction sentiment holding up… just

The recent Master Builders survey of building and construction shows industry sentiment is holding up, despite a recent deterioration in some of the leading indicators.

Matthew Pollock, housing national manager, says: “Industry sentiment showed signs of improvement in the September quarter issue of Master Builders’ quarterly National Survey of Building and Construction.

“Builder confidence remained on firm ground, gaining 0.7 points on the Master Builders Building and Construction Market Index (BCMI), supported by a bounce in sales contracts and a loosening of skills shortage constraints.

“By sector, house builders for detached housing were the most positive, particularly in New South Wales, Victoria and Queensland, where strong population growth continues to support a healthy pipeline of work-on-the-books.

“These results show that while activity in inner-city apartment markets may drop off over the next two years, broader industry sentiment remains positive.”

This sentiment is supported by Australian Bureau of Statistics figures, which show residential construction work holding up – up by 1.2 per cent in the June quarter 2016 to be 6.6 per cent up on over the year, according to Pollock.

However, areas of vulnerability remain, he says.

“Non-residential builders have lowered profit expectations and non-residential work-on-the-books is soft. Typically, these are good leading indicators for industry prospects, with the current results pointing to a slower period for the nation’s non-residential builders.

“The CBD office markets in Perth and Brisbane remain a lingering weight on broader sectoral business conditions as the resource boom hangover continues to cast a long shadow. Other pockets of vulnerability include inner-city apartment markets, and pretty much the entire engineering construction sector.

“In terms of employment, the survey shows labour availability has loosened across the board, with all construction-related occupations covered in the survey showing index values of below 50,” Pollock adds.

“The loosening of labour market conditions is good news as long as building activity holds steady, but less positive prospects going forward may pose a risk to employment. Jobs may be at risk if building activity was to deteriorate beyond current market expectations.”

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Varme3B7bm4/

Life after death of the shopping strips

There is life after death for big-name shopping strips in the form of well balanced food, retail and services aimed at locals, according to real estate agency Gunning principal Malcolm Gunning.

Melbourne’s Chapel Street, Prahran, and Bridge Road, Richmond, are going through a slump previously seen in Sydney’s Oxford Street, Paddington, and Brisbane’s James Street, New Farm.

“The more established boutique brands have relocated into the Melbourne CBD just as they did in Sydney with the redevelopment of the CBD and opening of Bondi Junction,” Gunning says.

“What we’re seeing now is that Oxford Street has reinvented itself. Rents have come down because of high and prolonged vacancy rates, attracting a new breed of businesses, which has ultimately enabled ‘life after death’.

“Paddington has evolved into a service, restaurant and provedore area, with young fashion brands entering the scene.

“The pubs are undergoing a transformation, with Justin Hemmes and his group entering the area, the Paddington Inn, Bellevue in Hargrave Street and The Royal at Five Ways have been renovated.

“Other venues, best described as ‘gastropubs’, are moving towards a focus on food,” he adds.

“There are also places like Saint Peter, a high end sea food restaurant, which previously wouldn’t have been there under the high rents.”

Gunning believes a clustering of fashion brands and interesting food has been driven by the community, not weekend tourism.

“Shop tops are being split from the retail area and are now in high demand as fashionable flats,” he says. “Melbourne will experience the same thing. Chapel Street and Bridge Road, tend to be a tourist destination. As the rents go down, the area will evolve, too, and locals will need to be serviced.

“James Street, Brisbane, which is between Fortitude Valley, Teneriffe and New Farm, reinvented itself from its industrial business into an area that services the needs of a vibrant local community.

“It has established brands like Sass Bide, Camilla and Nudi Jeans as well as upcoming designers and high quality food options such as Jocelyn’s Provisions,” Gunning says.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/XHVbBD4TraU/

The latest State of the States report from CommSec Research has been released, revealing New South Wales has held on to its reign as the best performing economy in the country overall.

The Australian Capital Territory remains in third position on the economic performance rankings, with higher home prices and home loans adding momentum.

Holding its top spot for economic growth, construction work done and unemployment is the Northern Territory, while languishing at the bottom is Tasmania, ranking fourth on two indicators and fifth on three.

In four of the states and territories, construction work was higher than decade averages in the June quarter (previously six states).

Leading the way was the NT, with construction work done 30.6 per cent above its decade average – activity associated with the gas projects is still providing solid support. However, construction work in the NT was down 28 per cent in the June quarter compared with a year ago – highlighting the shift in momentum that’s under way.

Victoria continues to record the strongest annual population growth and is now also first on the differential with the decade-average rate. Victoria’s population is 1.94 per cent higher than a year ago and this growth rate is 8.4 per cent above the “normal” or decade-average level.

Queensland is now third on population growth, with an annual growth rate of 1.30 per cent (Queensland’s population growth is the fastest in 15 months), while the state or territory with the slowest annual population growth is the NT, up just 0.40 per cent on a year ago and down 76 per cent on the decade average – the weakest in the nation.

Tasmania’s annual population growth rose from 0.40 per cent to 0.43 per cent in the March quarter and was almost 29 per cent lower than its decade average.

In six of the states and territories – the ACT, NSW, Victoria, South Australia, Tasmania and Queensland – trend housing finance commitments are above decade averages.

The ACT held on to top spot, with the number of commitments 19.2 per cent above the long-term average.

Next strongest was NSW (up 12.1 per cent on decade averages) which leap-frogged Victoria (up 11.5 per cent).

NT remains the weakest for housing finance, with trend commitments more than 19 per cent lower than its decade average.

NSW retains the mantle of the strongest in the nation for new home construction, with starts almost 76 per cent above decade averages.

Queensland has held second spot from Victoria, with starts 34.2 per cent above decade averages. Victorian starts are 30.9 per cent above decade averages.

In terms of annual growth, SA is strongest with dwelling starts at two-year highs, and now up 15.5 per cent on a year ago.

Turning to home prices, in September six of the capital cities had positive annual growth of home prices.

The strongest annual growth was in Sydney (up 10.2 per cent), followed by Melbourne and Canberra (both up 9 per cent) and Hobart (up 8.7 per cent), then there’s quite a gap to the other capital cities.

Next strongest was Adelaide (up 6.5 per cent), and Brisbane (up 3 per cent).

Home prices were lower than a year ago in Perth (down 7 per cent), and Darwin (down 6 per cent).

Generally speaking, the NT is losing momentum, and as key resource projects are completed, activity levels will slow further unless a lift in investment takes place. Slow population growth, weak demand for housing loans and a sharp fall in business investment will constrain economic momentum.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/xXm_QnDrwEY/

Reno risks: Too many don’t insure their renovation

People renovating their properties are taking big financial risks by not putting a contract in place according to new research from ServiceSeeking.com.au.

Of those who have renovated in the past, 45 per cent failed to sign a contract with their builder.

A further 72 per cent didn’t bother to arrange insurance to cover the upgrade of their valuable possessions.

More than one in five (22 per cent) failed to check the qualifications or licences of the builders they hired to redesign their homes.

“It’s alarming that so many renovators take such big risks,” ServiceSeeking.com.au CEO Jeremy Levitt says, “especially considering the often big financial investment a renovation incurs.

“Checking licences doesn’t cost a cent, so we highly recommend doing so before hiring any tradespeople.”

With a quarter of homeowners planning to renovate in the coming year, Levitt says it’s a good reminder to put protections in place.

“A contract will protect you against a host of errors and unforeseeable problems, so it really is worth doing your due diligence to ensure these things are in place.”

This, coupled with the fact that 78 per cent* of businesses think there are still unscrupulous and unlicensed people trying to win work, means there’s always a fear of hiring the wrong person.

Levitt says everyone has heard the horror stories of the few dodgy tradies painting the industry in a bad light. There are always a few bad eggs in any industry, he points out, and that’s why validation checks and customer testimonials are important.

*Business statistic from a survey of 1000 registereed ServiceSeeking.com.au businesses.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/9nYouLHdQY0/

Draft of southeast Queensland regional plan released

The Queensland Government has today released the draft southeast Queensland (SEQ) regional plan Shaping SEQ, which represents one of the most significant planning policy frameworks in the state.

SEQ is Australia’s third-largest capital city region by population and is home to approximately 3.4 million people, covers 22,900 square kilometres and has 12 local government areas.

Indeed, over the past 10 years, 20 per cent of Australia’s economic and employment growth has occurred in the region and it contributes to 17.4 per cent of Australia’s tourism gross domestic product. It also generates nearly two-thirds of Queensland’s gross state product.

President of the Queensland arm of the Urban Development Institute of Australia (UDIA) Stephen Harrison welcomes today’s announcement and acknowledges the government’s consultation process to date.

“With the draft plan providing a 50-year outlook for the region underpinned by a 25-year planning framework, the preeminent plan for the SEQ region is critical in ensuring the industry is able to respond to the region’s community housing demand,” he says.

“UDIA (Qld) looks forward to further engagement during the public consultation process.”

The Shaping SEQ report differs from previous regional plans in a few areas, notably:

- Focuses more development in existing urban areas to accommodate SEQ’s projected population and employment growth.

- Identifyies 8200 hectares of new urban land, as well as the 13,600 hectares added in planned growth areas since 2009 (which includes Greater Flagstone and Yarrabilba Priority Development Areas, Caboolture West, Flinders and Southern Redland Bay), to minimise the risk of land supply constraints placing upward pressure on housing prices.

- Greater emphasis on public and active transport.

- Plans to maximise the use of existing infrastructure before building new, and identify new region-shaping infrastructure only where needed.

- Values design as a way to create more housing choice, and memorable and liveable urban places and spaces, to benefit communities socially, economically and environmentally.

- Ensures flexibility for local governments to plan for rural development.

- A more sophisticated approach to determining urban land supply.

- Improved ways of monitoring land supply and development activity, and the plan’s performance over time.

The regional plan directly affects the type, location and diversity of housing choice provided within the region and, according to the UDIA, it’s important it identifies sufficient land to accommodate a growing population.

While an apartment boom in the inner city has driven a high volume of unit approvals over the course of the past few years, the UDIA says there is now a need to focus on facilitating high quality urban design outcomes in inner- to middle-ring suburbs.

The regional plan also needs to accommodate greenfields, it says, as past regional plans have set ambitious infill targets but not sufficiently guided the implementation side to facilitate the achievement of these targets.

Harrison says the UDIA (Qld) is supportive of a compact urban form, but believes the regional plan needs to ensure an adequate supply of greenfield land to support the formation of new communities and diverse housing choice and to assist in the ongoing supply of affordable housing.

“The supply of infill housing is currently constrained by a number of factors and the regional plan needs to ensure some of the challenges associated with currently delivering infill development, including fragmented land tenure and planning impediments, are addressed, so that the targets of the regional plan can be realised,” adding that critical that there’s a supporting and dedicated infrastructure and public transport plan and implementation measures, including a long-term land supply monitoring system.

“It’s critical that that funding is dedicated to ensure that the outcomes of the regional plan are supported by an extensive performance monitoring program, including land supply,” Harrison continues.

ShapingSEQ is now open for community feedback by formal submission until midnight, Friday, March 3, 2017.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/-36QFjtEUmc/

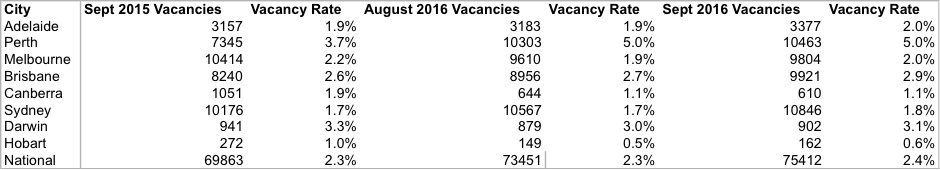

Sydney vacancy rates are up

Residential vacancy rates have jumped in middle Sydney as more stock comes onto the market, according to data released by the Real Estate Institute of New South Wales (REINSW).

REINSW president John Cunningham says that in the September 2016 REINSW Vacancy Rate Survey, middle Sydney, rose 0.5 per cent to 2.1 per cent, leading a 0.1 per cent increase in the overall Sydney vacancy rate to 1.9 per cent.

“The middle Sydney vacancy rate has been affected by more stock coming onto the market,” he explains.

“Elsewhere across Sydney, the inner Sydney vacancy rate fell 0.1 per cent to 1.8 per cent and outer Sydney rose 0.1 per cent to 1.8 per cent.”

In the Hunter region, vacancy rates dropped 0.5 per cent to 2.2, led by a tightening of the Newcastle market at 1.9 per cent down 1.1 per cent.

In the Illawarra region, vacancy rates are back at levels seen six months ago at 1.3 per cent, down 0.3 per cent.

Wollongong was up 0.2 per cent at 1.3 per cent.

Across regional areas, Albury was down 0.2 per cent at 2.9 per cent, while Northern Rivers fell 0.3 per cent at 1.0 per cent and New England remained steady at 3.9 per cent.

In other REINSW news, managing director of propertybuyer.com.au Rich Harvey has been awarded the 2016 REINSW Buyers’ Agent Award for Excellence, a win that follows up his national award win for the Real Estate Business awards in June earlier in the year.

The award is judged by three independent judges who assess the quality of service to clients, accuracy of appraisals, network, leadership skills and professional development.

Harvey paid tribute to his team and clients in winning the award.

“I’m honoured, humbled and grateful to receive the award and this shows the growing popularity and use of buyers’ agents in the general community. “Although my name’s on the award, I am especially proud of my team of buyers’ agents across Sydney and support staff for their continued dedication to customer service, client loyalty and standing up for the rights of buyers.”

Harvey has a reputation for being an advocate for the buyers’ agent industry and serves on a voluntary basis as president of the Real Estate Buyers Agent Association of Australia (REBAA). He’s also chairman of the Buyers’ Agent Chapter of the REINSW.

His lobbying efforts recently led to the inclusion of buyers’ agents on the front page of the new contract for sale and purchase of land and he’s currently lobbying for further changes to improve the licensing and training standards for buyers’ agents.

SQM Research vacancy rate figures:

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/7lV6lTmG3Qk/

Brisbane’s Cross River Rail flythrough

in Property Investment, Queensland

For everyone who read our project profile in the August 2016 issue of API magazine about this major piece of infrastructure, here’s a handy video guide on the CRR route for you to ponder.

![]()

View all articles by Kieran Clair »

Brisbane cross river rail infrastructure 2016-10-12

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/2f2j8ecUduM/

Major industrial land campaign for WA

The Western Australian Government’s land and development agency has launched a major incentive campaign aimed at driving new investment in industrial developments across the state.

The offer, launched today, will see LandCorp pay up to $100,000 of stamp duty for lots sold at 19 regional and four metropolitan estates as part of a campaign to encourage businesses to expand or relocate to industrial developments across the state.

The offer applies to the first 10 lots purchased from participating estates and is available until Friday, December 2.

LandCorp estates accommodate some 2700 businesses that directly employ 67,000 Western Australians, while current and future estates will provide a home for a further 2000 businesses employing 42,000 people.

It’s estimated LandCorp’s future estates will contribute $14.4 billion to the WA economy.

“Western Australia has a mineral and petroleum industry valued at $99.5 billion, and $17 billion in new infrastructure planned in and around the Perth CBD. WA remains open for business and the outlook is strong – and demand for light and heavy industrial land is set to grow,” LandCorp chief executive Frank Marra says.

“Now is the right time to invest in WA industrial property and this offer will provide a clear and compelling opportunity for businesses to do just that.”

Marra says LandCorp planned, designed and delivered strategically located economic and employment land developments, both for commercial use and for light and heavy industry.

The campaign highlighted the range of land options across the state, including in regional areas, with a wide range of industrial land available now in a variety of lot sizes.

He adds local, national and international investors are still looking to Western Australia for well-located industrial land, particularly near established or planned transport infrastructure.

“This campaign is an opportunity for LandCorp to assist any state, national or international business to locate or expand in areas across WA – regardless of size or sector,” Marra says.

“LandCorp’s estates support light, general and heavy industrial uses, providing opportunities for sectors including transport, logistics, fabrication, manufacturing, light industry, agriculture and resources.

“Above all, we work with industry to make sure our developments are sustainable, well-connected, well-designed and well-planned, and meet the needs of businesses.”

As part of the campaign, LandCorp will pay the stamp duty (up to $100,000) off the first 10 lots sold at any participating industrial estate across Western Australia. The offer will deliver a boon for small and medium-sized businesses, which would benefit most from stamp duty relief.

“We’re dedicated to driving WA’s economic growth by making the transition to new or expanded industrial premises easier for businesses,” the chief executive says.

“We are showing this support by providing stamp duty relief, through the range of lots we have on offer, and by offering providing experienced industrial specialists to help all types of businesses invest and expand today.”

PARTICIPATING ESTATES:

Metropolitan estates

Crossroads Industrial, Forrestdale

Meridian Park, Neerabup

Rockingham Industry Zone

Flinders Precinct Latitude 32, Hope Valley

Regional estates

Newman Light Industrial Area (LIA)

Broome Road Industrial Area

Hedland Junction, Wedgefield

Gap Ridge Industrial, Karratha

Pinjarra Industrial Estate

Kalbarri LIA

Carnarvon LIA

Collie LIA

Avon Industrial Park, Northam

Anzac Drive Industrial Park, Kalgoorlie

Kununurra LIA

Hyden LIA

Lake Grace LIA

Merredin LIA

Wagin LIA

Williams LIA

Bencubbin LIA

Cunderdin LIA

Greenhead LIA

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/FmfFjSq4Jhw/