Is it time to get in the zone?

Rezoning

A strategy that has appealed to investors in Brisbane has been to seek post-war homes in low- to medium-density residential (LMR) zoned streets, particularly since the release of the City Plan in 2014.

Depending on the zoning, size and location of the block in question, there are plentiful opportunities to replace an established house with multiple dwellings.

A two- or three-storey LMR zone precinct can allow for a mix of dwelling types, including low-rise apartments, townhouses and dual-occupancy dwellings. Development is predominantly permitted for two storeys, with three storeys sometimes allowed within 400 metres’ walking distance of a rail or busway station. As with all strategies, this game plan has both potential benefits and drawbacks.

Upside potential

An advantage of this approach is that it presents the investor with choices. You can “landbank” the home as a rental in its current form, perhaps with a moderate initial cash outlay on renovations work to make the home attractive to prospective tenants.

Alternatively, you might look to develop the opportunity at the optimal stage of the construction cycle, ideally when prices for new medium-density dwellings such as townhouses are approaching their cyclical peak.

LMR precincts are often zoned accordingly because they’re suburbs or locations in need of gentrification, so there may be capital growth upside as the tone of the neighbourhood steadily improves.

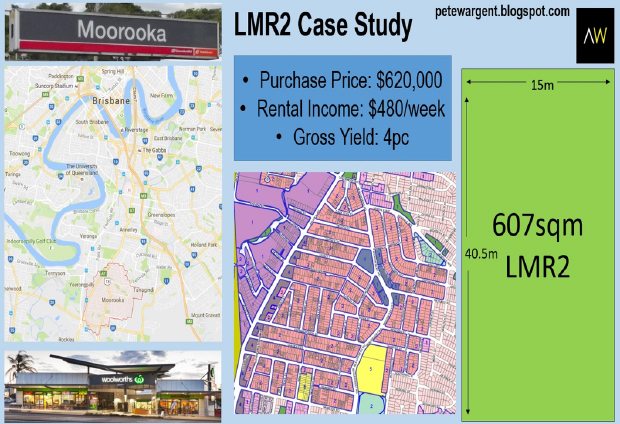

Case study: LMR2 zoned house in Moorooka

A popular strategy for investors has been to buy post-war houses in suburbs such as Moorooka in Brisbane, wherein many more of the streets have been zoned as LMR2 since 2014.

Their goal is typically either to redevelop into townhouses immediately or to landbank until a future market cycle, when sentiment and prices for medium-density dwellings are more favourable.

Since development of multiple dwellings may be restricted to blocks of at least 600 square metres and by a 45-per-cent “site cover” and building envelope, the superior opportunities tend to be regular-shaped blocks, encompassing a minimum of 600 square metres and a frontage of 15 metres or greater.

As a rule of thumb, detached houses on flood-free blocks with development potential have been selling for around $1000 per square metre of land. For a suburb located on a direct train link only seven kilometres from the CBD, this represents an attractive price entry point compared to equivalent suburbs in Sydney or Melbourne.

Gross rental yields tend to be moderate on these often-dated dwellings, however, and after holding costs, the net rental returns can be comparatively weaker still. Consequently, these aren’t ideal assets for yield-focused investors.

Houses in the magenta-shaded LMR2 zoned streets are often tired, post-war homes in need of some loving care and attention, and as such both net rental returns and depreciation benefits tend to be moderate at best.

Steady recovery

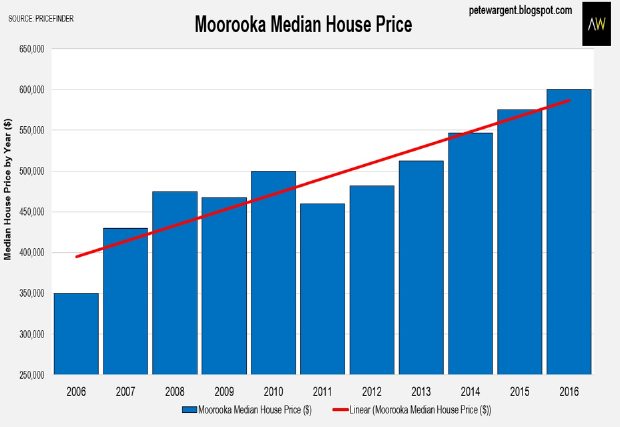

As with many suburbs in Brisbane, median house prices in Moorooka have undertaken a studious recovery following twin setbacks in 2008-9 and 2011.

Median prices can be distorted or skewed by changes to the nature and composition of the dwelling stock – particularly where streets have been rezoned – but houses on attractive blocks of land have delivered a solid compounding annual growth rate of around 5 per cent over the past decade.

Once famous predominantly for its “magic mile” of car dealerships, but more lately for its shifting demographics and a symbolic Woolworths upgrade, being only minutes from the city Moorooka will gentrify, at times perhaps imperceptibly, over the medium term.

It’s reasonable to expect that house prices in more affordable Moorooka will gradually converge over time with those of some of its agreeable and adjacent suburbs.

A trade-off?

All strategies have both their benefits and downsides, and no one strategy is appropriate for everybody. Frequently the houses in question with such development potential are older property types in need of upgrading or maintenance, which can be a drain on cash.

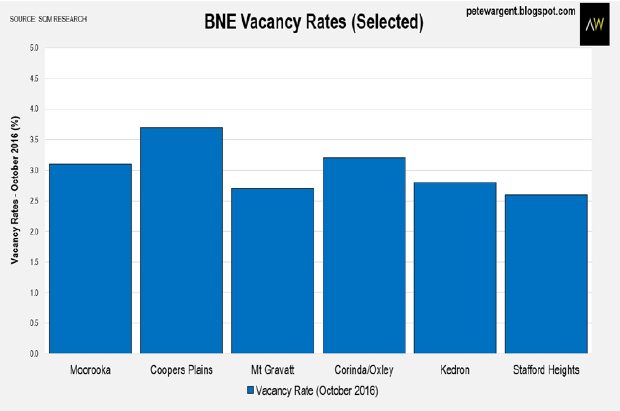

Rental returns in suburbs close to the city are generally not strong, so even with low mortgage rates initial post-tax cash flows for leveraged investors can be negative, perhaps by 1 per cent to 2 per cent in the first year of ownership.

This can be exacerbated by soft rental markets as LMR zones are developed with new units, townhouses and duplexes over time, while further rezoning can be a risk.

Another temporary but literal headache can be construction noise and disruption as streetscapes are developed, and over time it’s inevitable that LMR zones will become denser localities, with more traffic and parked cars than those streets zoned as low-density residential.

Two ways to win

No individual strategy can be suitable for all investors, and if you want a strong rental return you should look at other locations and strategies, and possibly newer property types, which have more attractive depreciation benefits.

There are also alternative strategies that investors can use to manufacture capital growth, including a straightforward renovation or upgrade, subdivision of a larger block, the addition of a granny flat, or in some markets simply knocking down an old weatherboard home to replace it with a new build.

However, buying the right type of house in an LMR precinct can offer investors two viable ways to realise a profit, either by holding a rental house that will retain an inherent scarcity value as the suburb is developed with units, or by developing the asset into multiple dwellings.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/VczDl6lueLU/

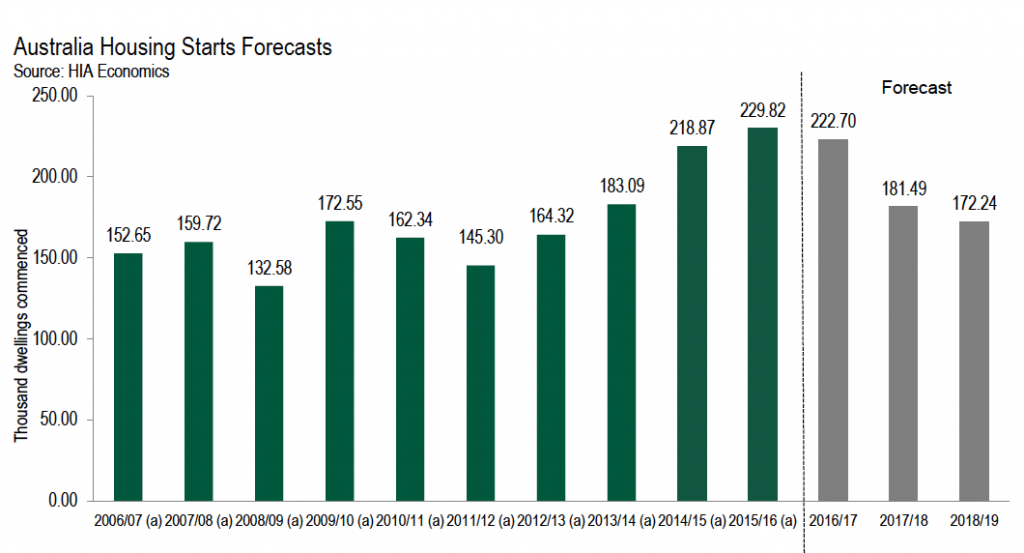

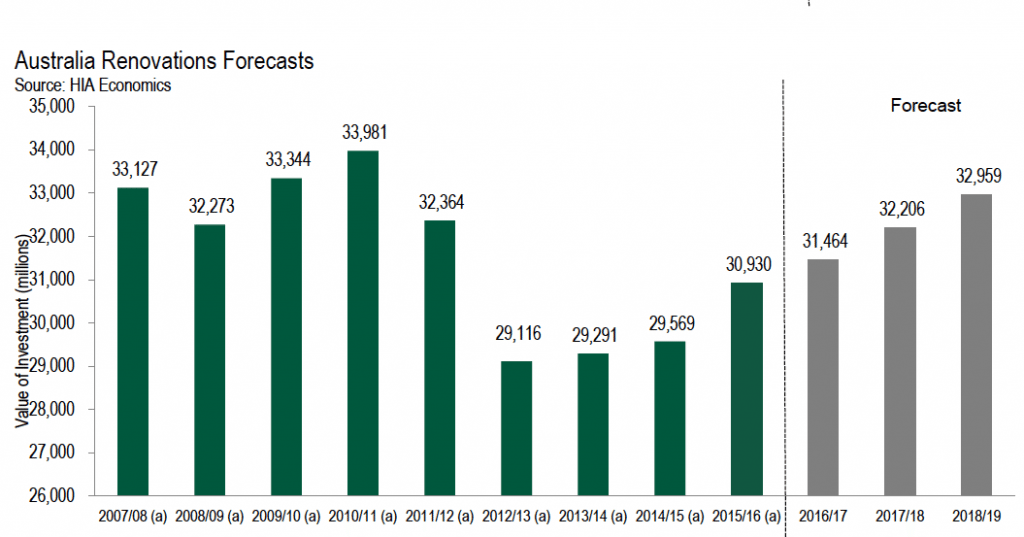

New residential building will slow for the next two years to bottom out at “what will still be a historically healthy level of activity” according to the Housing Industry Association (HIA).

The latest HIA National Outlook, which is released today, looks at conditions in the residential building and renovation markets around the country.

HIA acting chief economist Warwick Temby says: “Notwithstanding the current uncertainties around the broader economic outlook, especially with the future US policy settings up in the air, HIA is forecasting a measured return to more normal levels of home building activity over the next couple of years.

“The recent peak in new home building was unprecedented: an all-time record 229,823 new residential dwellings started building in 2015/16.

“This record level of building has made a major contribution to Australia’s economic growth over the last few years and eased the under-supply of housing for both owner-occupiers and renters that had built up over the previous 10 years.

“Multi-unit building, especially apartments in the eastern states, has driven much of the growth in this cycle and is also forecast to lead the slowdown in new activity over the next couple of years.

“From their peak of 117,000 in this calendar year, multi-unit commencements are expected to fall by over 40 per cent by 2018/19.

“A softer landing is forecast for detached homes with 103,000 starts predicted for 2018/19, down 9 per cent on the peak this year.”

Temby says the forecast falls in new activity won’t be uniform across the country – Western Australia and South Australia started their down-cycle well in advance of other states.

“Total new commencements are forecast to decline 3.1 per cent, 18.5 per cent and 5.1 per cent over the period 2016/1-2018/19, which would take commencements to a trough of 172,242, which is the average for the last 10 years,” he explains.

“Actual building activity on the ground won’t decline in the same way as new starts due to the substantial volume of work under construction that won’t be completed until 2018 and into 2019.

“Dwelling renovations are forecast to grow over the forecast period, counteracting some of the decline in the new home-building activity.

“By 2018/19 renovations are forecasts to have grown by 6.5 per cent to be worth $32.96 billion in that year,” Temby concludes.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/z5656BKO2PE/

5 little known strategies successful investors use

Successful property investing has 2 essential components: finding the right property and having the right loan strategy for your property portfolio.

This FREE REPORT reveals the lesser known loan strategies successful property investors are using right now to secure more funds, more investment opportunities, less interest rates and build a solid property portfolio.

The report also uses real people’s stories to explain what you need to do to be on the right track to long-term investment success.

Strategy #1. Limit credit card limits to secure more funds

If you are like most Australians, you probably have at least one credit card. Accordingly, to the Reserve Bank of Australia (RBA), there were over 16.5 million credit cards in circulation in Australia in June 2016. With Australia’s total credit limit now at a record high of almost $150.5 billion, this averages to a credit limit of $9,121 for each credit card!

Credit cards are great for tiding us over a cash emergency or for earning reward points, but…

Did you know your emergency line of credit could actually affect your ability to borrow and get in the way of getting your next investment property or that house with great development potential?

You may say, “I don’t have any issues with my credit cards, I always pay off my credit card on time!”

DID YOU KNOW? Every $1,000 you have on a CREDIT CARD LIMIT will lower your home loan borrowing capacity by approximately $3,600!

The key words are: CREDIT CARD LIMIT!

not the amount you owe!

Even though you might only owe $2,000 on a $25,000 limit credit card, lenders will still take the limit of $25,000 into account when assessing your loan. This is because your limit reflects how much you could go out and spend tomorrow.

Whilst this doesn’t sound like much, if you have a $25,000 credit card limit then you’ve just lowered your borrowing capacity on your loan by over $95,000 – that’s a lot of borrowing power LOST!

What does this mean for you?

Well it means that you may not be able to afford that perfect rental property worth $750,000 with 3 bedrooms, 2 bathrooms and 2 garages. You may have to set your sights lower on properties worth around $650,000, which may mean either downsizing in the same suburb to 2 bedrooms, 1 bathroom and 1 garage, or looking further out from the city.

This can not only hit the amount of rent you receive in the short term, but also affect your capital growth in the long run!

A REAL MORTGAGE CORP CLIENT STORY

How eliminating credit cards allowed a client to buy their first investment property

A Mortgage Corp client, an IT manager with a $100K+ salary who owns a $750,000 home, asked us recently to help him and his wife look for an investment loan. They were looking at buying their first investment property and it was all looking good until we asked – how many credit cards do you have?

The answer? 3 credit cards for him and his wife with multiple cards ranging from $18,000, $21,000 and $22,000+ limits. We asked them WHY!? They simply shrugged their shoulders and said they didn’t use those cards anyway. The banks kept increasing their limits and they thought it would be good to have those extra credit cards around for emergencies…WELL THAT’S $220,000 LESS THEY COULD BORROW WITH $61,000 IN CREDIT CARD LIMITS!

Thankfully, the broker was our senior mortgage strategist Neil Carstairs who advised them to cancel the cards they didn’t need, keep only one credit account with joint access and to lower the limit.

The result? 2 cards sharing a $6,000 credit card limit

Neil put together a strategic loan package and submitted it to a different bank – not the bank they had the credit card with. He structured it in a way to not only get the loan they wanted but also in a way that makes it possible for them to potentially purchase multiple investments in the future, which is part of their investment goals.

Last month, our client finally bought their 1st investment!

We also advised them that their next step was to get settled into the new set up and to manage their lifestyle more effectively using the new credit card arrangement and mortgage offset account to help reduce the home loan interest more effectively.

Once they get settled in they’ll be off looking for their next investment in no time!

DID YOU KNOW? For some loan products, lenders automatically add a $6,000 credit card to your application even if you didn’t ask for it! This adds unnecessary credit limits that will affect your future borrowing capacity.

This shows how crucial it is to know how to properly structure your loan application and not just your loan.

For example, if you have a credit card and you owe money that you can’t pay off during the application process, it may be a good idea to do a ‘balance transfer’ so you can transfer the amount owing to the bank you’re applying to for the loan. You will save more money on fees when you bundle your existing credit card with your mortgage. Some lenders will also assess your loan application more favourably if you switch over your credit card balance.

Strategy #2: Realistically assess your borrowing power and serviceability

Property investors often think that their rental income increases their borrowing power dramatically.

In short “yes it does”, but often by not as much as they think.

Not all your rental income

can be used for serviceability!

DID YOU KNOW? Banks will only factor in 80% or less of your rental income when assessing your loan application?

This means that if you’re earning rent of $400 per week, your lender only sees $320 or less per week on your application. Even if YOUR OWN figures show that rent should cover interest and you were counting on your rental income to get your loan application over the line, sorry to say, but you might be disappointed to find out how much the bank will actually use!

This isn’t all bad news as it means that even in a worst case scenario you would still be able to maintain the mortgage repayments. The upside is that in a rate rise you will have peace of mind knowing that you have a buffer so you won’t fall behind on payments.

This leads us to the next strategy related to negative gearing.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/aEs_qa8IhpM/

Concerns NSW could match Qld smoke alarm legislation

Homeowners and landlords in New South Wales are concerned that they too will face costly changes to become compliant, now that Queensland authorities have started to promote stringent new smoke alarm legislation, which was announced a few months ago.

According to national smoke alarm compliance company, Smoke Alarm Solutions (SAS), current legislation in NSW requires at least one operational smoke alarm on each level of the occupancy, which could be owner-occupied or rental homes, caravans, relocated homes or any building where people sleep.

Julieanne Worchurst, Australia and New Zealand sales and marketing director of SAS, says that used to be the case in Queensland too, but following a tragic house fire in which 11 people perished five years ago, legislation has become much more stringent to provide a greater level of safety.

“The additional measures include smoke alarms to be installed in every bedroom of a home by a qualified electrician,” Worchurst explains.

“They also need to be interconnected with one another so that they all sound when smoke is detected.”

Currently, there are currently no plans in NSW for smoke alarm legislation changes.

“A crucial part of the current NSW legislation forbids tenants to remove the battery or otherwise tamper with the smoke alarms,” Worchurst adds.

“This is to prevent families inadvertently breaking them or forgetting to replace the smoke alarm battery and switch it on.

“Normally, there’s no reason for a tenant to tamper with the smoke alarms, and they don’t, but sometimes the alarm starts to sound accidentally (eg. when cooking) or it starts to beep, indicating the battery needs to be replaced.”

In this case, the required action is for a tenant to contact their property manager, who’ll organise for a qualified electrician or smoke alarm technician to attend the property and fix the problem.

“The only time this is a problem is when it occurs in the middle of the night, a public holiday or on a weekend, when the property manager isn’t working,” she says.

“With few other options, families may attempt to stop the alarm sounding themselves. However, under no circumstances should this happen, because of the danger it places on the lives of those who live there.

“On the other hand, families shouldn’t have to stay awake during the night by a beeping alarm, waiting for the property manager to start work so they can report it. This is why we launched our 24/7 Emergency Service, which ensures attendance to alarms outside of business hours,” she said.

Landlords enrolled on the Smoke Alarm Solutions’ Platinum program ensure that their tenants and investment are constantly protected through unlimited inspections to ensure compliancy, repairs or replacements of faulty alarms. The company also attends to alarms in emergency situations outside business hours.

The service is 100 per cent tax deductible for landlords.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/yiZVlEY0CPo/

Debt and retirement worries are high

Australians are in a rush to pay off their home loans, with almost nine out of 10 mortgage holders trying to get out of debt sooner, while three in five Aussies are worried they won’t have enough money in retirement.

According to Mortgage Choice’s Diversified survey, 65 per cent of Australians believe they won’t have the funds they need come retirement, and 54 per cent won’t give their retirement serious thought until they’re 50 or older.

Mortgage Choice chief executive officer John Flavell says: “Many don’t realise that 50 is simply too old to start saving and planning for retirement. In reality, people should start their retirement planning much earlier in life.”

According to the Association of Superannuation Funds of Australia, couples will need approximately $640,000 in savings, while singles will need approximately $545,000 in order to live a comfortable lifestyle in retirement.

Little wonder, then, that it’s so important to start the planning process early, Flavell says.

“Furthermore, most people don’t realise that they may head into retirement with debt hanging over their heads, which can have a significant impact on their savings and cash flow.

“Over the coming years, statistics suggest that many Australians will reach retirement age and still have a mortgage. Soaring property prices combined with the fact that people are taking out home loans later in life, will ensure many still have debt in their twilight years.”

Meanwhile, a survey by comparison website finder.com.au found 89 per cent of borrowers have tried to pay down their mortgage sooner, with the majority (60 per cent) of homeowners opting to make extra repayments.

Forty per cent of borrowers commit to making more frequent payments either fortnightly or weekly, instead of monthly.

Rounding out the top three ways borrowers fast-track their home loan repayments is using a linked offset account, with 34 per cent opting for this strategy.

Women are marginally more likely (90 per cent) than men (88 per cent) to pay down their mortgage faster, while baby boomers (18 per cent) are twice as likely as generation X (9 per cent) to have never tried paying off their mortgage faster.

Bessie Hassan, money expert at finder.com.au, says borrowers feel burdened by carrying around a mortgage for 30 years and are going to great lengths to break free sooner, adding that it’s promising that borrowers have bought within their means and are taking initiative by getting ahead on their mortgage debt.

“Fast-tracking your mortgage repayments could save you thousands of dollars in interest over the life of a loan, and a good way to do this is to make more frequent periodic repayments,” she says.

“If you had a $367,600 mortgage (the average national loan size) at 4.73 per cent interest (the average standard variable rate) your monthly repayments would be $1,913.15 and total cost of the loan would be $688,732.79.

“However, if you switched to fortnightly repayments of $956.57, you would save $56,654.18 in interest and you’d reduce your loan term by four years and seven months, as you end up making one additional repayment each year.”

It does need to become a habit rather than a once-off contribution, she points out, as consistency is key.

Other tactics employed by savvy homeowners included negotiating a cheaper interest rate with an existing lender (5 per cent) and refinancing to a new lender that offers a lower rate or other money-savings features (5 per cent).

Photo credit: photoloni via Visualhunt / CC BY

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/jv4akLWAfi8/

Top 10 Tips for Buying Off the Plan

Buying property off the plan is becoming an increasingly more popular choice, helped by its wealth of benefits and affordability, compared to buying an established property. With just a 10% deposit required, it’s easy to see why owner occupiers and savvy investors are attracted to this property option.

However, there are plenty of important factors you need to consider when buying off the plan, so before you decide to buy, make sure you review our top 10 tips.

Top 10 tips for buying off the plan

1. Get your finances in order

Firstly, you need to get your finances sorted, pay off any outstanding debts and learn what your borrowing capacity is. This will determine your maximum budget and what properties you can afford to buy. A reputable Mortgage Broker can help with this.

2. Understand the property market

Whether you are an owner occupier or investor you need to understand the property market which means thorough research is required. You should look at current vacancy rates, rental yields, and demographics alongside comparable sales and any proposed future developments which could impact your property purchase.

3. Research the developer

You also need to research the developer to ensure they are reputable and trustworthy. Find out their experience, what past projects they have worked on and whether these were completed on time. You should also check the developer has received DA Approval, to reduce the risk of the development not proceeding.

4. Don’t get emotionally attached

It’s easy to get emotionally attached when buying property particularly as a first home buyer. However, you shouldn’t let your emotions cloud your judgement as it can mean you overlook the more important factors such as capital growth, rental yields and vacancy rates.

Try to concentrate on the solid facts and figures to determine whether this property is a good investment or not, rather than letting the pretty pictures sway your decision.

5. Be prepared for delays

Before you purchase, find out whether the developer has reached their pre-sales target and when construction is expected to start. A boutique development will have a shorter build time compared to a high-rise development. However, bad weather can create delays, pushing back settlement.

6. Consider the risks

Buying off the plan has its risks, but knowing what these risks are and how you can mitigate them will help you to minimise your risk. Things to consider include:

- Property might not proceed – If the development does not have DA Approval, then there is a chance the property might not proceed.

- Settlement might be delayed – Adverse weather can cause delays so make sure the sunset clause provides ample time to cover this.

- Capital growth lower than expected – Your property might have been overvalued, which means you might have to pay more towards this if your lender won’t provide additional funding.

In spite of the risks, property is one of the safest means of investing. As banks back property, they have a vested interest to help maintain a stable property market.

7. Buying costs

Although you won’t be paying a mortgage yet, there are other costs you need to be mindful of. Besides the 10% deposit, you also need to pay legal fees, whilst on settlement there are also stamp duty, borrowing costs and even property management fees to consider, so make sure you have sufficient savings to cover this.

8. Seek legal advice

As buying off the plan is slightly different to buying an established property, it is essential that you use a reputable lawyer or conveyancer who is familiar with off the plan contracts to review the contract first before you sign.

Avoid using the cheapest lawyer as this could cost you dearly in the future if your property faces problems and you need to refer back to your signed contract.

9. Think of the majority of buyers

Keep in mind future buyers when you buy your property, as if you end up selling later on, you want your property to appeal to as many buyers as possible. It would be harder to sell a one-bedroom apartment in an area known for families with children.

10. Speak to a Property Consultant

As buying a property is likely to be one of the largest purchases you will ever make, it can be quite a daunting and stressful experience. Working with a Property Consultant such as iBuyNew can help make this buying process easier. We can provide you with the latest research whilst inform you of the best areas to buy in right now.

To learn more about buying property off the plan, whether you are a first home buyer, owner occupier or investor, why not get in touch with iBuyNew today. Call 1300 123 463.

![]()

View all articles by Mark Mendel »

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/BmvGUXcbOy4/

WA paint drop-offs announced

Renovators in Western Australia can dispose of waste paint and packaging responsibly at the following collection events:

City of Stirling

November 19, 2016, 8am-12pm

Council car park at 25 Cedric Street, Balcatta.

City of Wanneroo

December 3, 2016, 8am-12pm

Operations Depot front car park, 1204 Wanneroo Road, Ashby.

City of Rockingham

December 10, 2016, 8am-12pm

Council car park, off Ameer Street, Rockingham.

The national Paint Product Stewardship Scheme Paintback has been launched, and these collection events are being hosted and funded by Paintback.

The Western Australian Local Government Association (WALGA) is working with Paintback to facilitate the easy disposal of waste paint and packaging from trade painters and householders, through the local government collection event sites noted above.

The events enable people to dispose of architectural and decorative waste paint that’s no longer required.

Paintback accepts up to 100 litres per visit per vehicle, secured in containers of 20 litres or less.

Permanent site

People are also still able to take their waste paint and packaging to the Welshpool Cleanaway Paintback site Monday to Friday, 9am-2pm throughout the year (maximum of 100 litres stowed in up to 20-litre containers per visit).

Products accepted

Water and solvent-based interior and exterior paints, deck coatings, floor paints, primers, undercoats, sealers, stains, shellacs, varnish, urethanes (single component), wood coatings and packaging. NO OTHER MATERIALS WILL BE ACCEPTED ON THE DAY.

Products not accepted

Industrial maintenance coatings, automotive and industrial surface coating (shop application) paints and finishes, aerosol paint, automotive paint, anti-fouling paints, melamine, metal and rust preventative, caulking compounds, epoxies, glues or adhesives, colourants and tints, resins, paint thinners, mineral spirits or solvents, paint additives, roof patch or repair, tar-based or bitumen-based products, two-component coatings, traffic paints, texture coatings, bagged render, isocyanides and industrial coatings.

To enable Paintback to plan for the collection events, people are asked to complete the registration form by visiting www.paintback.com.au/trade/registration_wa

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/qIi6kxVBg6o/

Mark Chou, Australian Catholic University; Gorana Grgic, University of Sydney; Kumuda Simpson, La Trobe University; Peter Christoff, University of Melbourne, and Rodney Maddock, Monash University

Leading Australian academics respond to Donald Trump’s victory, and look ahead to what kind of president he might be.

Much unknown about Trump’s foreign policy, but expect instability

Gorana Grgic, lecturer in US politics and foreign policy, University of Sydney

This result confirms that 2016 is a year of tectonic shifts in politics of the Western democracies. The surge of populism, Brexit and Trump’s victory are all testament that it is no longer “business as usual”. This is perhaps the most critical departure from the way US politics has been operating in the post-Cold War era. It has shown that the population rejects some of the main tenets of globalisation, such as free trade and open borders, and sees little value in internationalist foreign policy.

In terms of how the world sees the result, I think there’s going to be a lot of trepidation over the “unknowns” of Trump’s foreign policy. His foreign security policy sees little place for values and international norms, emphasising interest instead. This will undoubtedly have major repercussions for US standing in the world, particularly if we take into account the global public opinion polls have been assessing Trump.

Finally, in denouncing major alliances and partnerships, Australia has been conspicuously missing from Trump’s campaigns. There are reasons to believe that not much will change in terms of the commitment to ANZUS treaty. However, given Trump’s disinclination to maintain some of the key alliances in East Asia, it is possible that the Asia-Pacific region will grow unstable.

Moreover, trade protectionism, especially in terms of China, could contribute trade disruptions and market instabilities that could well impact Australia.

A Trump victory may not spell doom and gloom

Mark Chou, Associate Professor of Politics, Australian Catholic University

So Allan Lichtman, the American professor who’s correctly predicted every presidential election since 1984, just got another election right. Donald Trump will be the next American president.

This result, which proved most polls wrong, will no doubt shock many. But with the election done, it’s important to take stock and ask the question: what now?

In his victory speech, Trump presented an uncharacteristically measured and gracious front, calling for national unity. It’s “time for us to come together as one united people,” Trump said, adding, “I will be president for all Americans.” But if a recent Pew Research Center study is to be believed, close to 60% of voters think that America is set to become even more divided under Trump’s watch.

There may be no more prominent a battlefield for these divisions than in Congress. Yes, the GOP now controls both the House and Senate, and there’s good reason to expect that even Republicans who openly opposed Trump during the campaign will now want to build ties with the incoming president. But political candidates, once elected to office, have a tendency to want to keep the public on side so that they might win re-election. Trump’s victory was no landslide, and Republicans on the Hill with 2018 and 2020 in mind have plenty of incentive to do all they can to “keep Trump’s worst tendencies in check”.

For now, it’s too early to know for sure what President Trump’s first 100 days in office will hold. But for those looking for a silver lining to this nightmare, there may be some solace in the words of Alexis de Tocqueville. He once wrote that the “frenzied state” whipped up by elections, when “intrigue becomes more active, agitation more lively and more widespread,” never remains for long. In fact, the divisions and passions which “one moment overflowed” during the election proper always evaporates and everything “returns peacefully to its bed”.

Let’s hope he’s right.

Trump wins by breaking every rule of politics

Kumuda Simpson, lecturer in international relations, La Trobe University

Donald Trump’s win today is a deeply disturbing sign of just how divided America is. This election has at times brought out the very worst in American politics. Trump’s campaign fed on people’s fear and paranoia, and it is deeply troubling that this message resonated with so many. Yet it also highlights just how many people in America have lost faith in the political class. It’s clear that American democracy and political institutions are more vulnerable than we thought.

Trump defied all expectations, throughout the primaries and during the presidential campaign. He broke every rule of politics. He targeted minorities and railed against illegal immigrants. He weathered countless scandals, including bragging about sexually assaulting women. He brazenly lied too many times to count. He caused widespread disagreement and anger within the GOP.

And yet his win is evidence that the Republican Party has lost touch with the very people they claim to represent. Despite the high profile defection of various GOP establishment figures, his message of economic disenfranchisement and anger at globalisation must be taken seriously. The Republican and Democratic Parties can no longer ignore just how much their policies of the past two decades have hurt a significant number of Americans.

The implications of his win are worrying for many reasons. It is unclear whether Trump can unite the country behind him or whether his win presages a permanently more angry and partisan country. Hopefully we have seen the worst and America can repair some of the damage this campaign has done.

International climate ambition at stake

Peter Christoff, Associate Professor, School of Geography, University of Melbourne

In his first major speech on energy policy, in May this year, Donald Trump said he will “cancel the Paris climate Agreement”

As President, he can end the United States’ ratification by rescinding the executive order used by President Obama to bypass an oppositional Republican US Senate.

The Agreement came into force last week, 30 days after its ratification threshold was met. This threshold required the support of 55 parties responsible for at least 55% of global greenhouse emissions.

At the time of writing, 103 countries have ratified the agreement, which now covers some 70% of global emissions. The United States – the world’s second largest emitter and responsible for somewhere between 14.5-15% of global emissions – is a major contributor to this coverage.

If the US were to decide to withdraw from the agreement, this would occur one year after notification of withdrawal was made to the United Nations. Coverage would fall close to the agreement’s emissions threshold if no other parties joined in the meantime.

However, numerous additional states – the United Kingdom (1.5%), Australia (1.3%) and Italy (1.2%), Turkey and Thailand (1% each) – are expected to ratify shortly, which would be enough to ensure the agreement’s survival.

This means that Trump won’t be able to cancel the agreement.

But a US withdrawal may have a chilling effect on the agreement’s implementation, and could encourage defections by other parties with major fossil fuel interests, such as Saudi Arabia. Moreover, withdrawal would likely see the US also renege on its internationally promised emission targets.

Trump’s agenda for an “America First Energy Plan” emphasises “American energy dominance [as] a strategic economic and foreign policy goal”, by promoting the production of untapped shale oil, gas and “clean coal”.

This plan peripherally mentions the benefits of gas and “other American energy resources” in reducing emissions.

What a Trump presidency will mean for America’s national mitigation performance is now of critical international interest as well as planetary importance.

Lasting economic change

Rodney Maddock, Interim Director of the Australian Centre for Financial Studies at Monash University

Donald Trump is not as odd to Americans as he is to Australians. Remember that Republicans will retain control of the Senate, the House and many State governments. Mainstream Republicans voted for him in droves.

The financial markets reacted quickly and badly to Trump’s likely election. That will almost certainly turn out to be an over-reaction. Economies change gradually, and governments have less power to move them than most people think. The underlying trend in the US economy has been one of sustained if slow strengthening. This will almost certainly continue.

For Australia too the economy appears to be strengthening. Commodity prices seem likely to be stronger, government revenues stronger, and unemployment seems likely to fall. My guess is that a President Trump will make less difference than most of us assume.

I see two main areas of lasting change.

President Trump will get to make a number of appointments to the US Supreme Court. This will change the majority in the Court towards a much more conservative line on social issues. The various “rights” movements will be slowed as a result. And because justices stay on the Court for decades, the impact will be long-lasting and US cultural tensions will intensify.

The second major area is America’s positioning in the world. The long period where America’s position on issues was predictable, where America supported freer trade and helped move the world towards more open engagement, is likely to change. We won’t know how far Clinton might have reversed traditional policies on trade, but she was clearly in internationalist, Trump is not. I think Trump’s moves will not be helpful but I also remember opposing Ronald Reagan’s “star wars” defence strategy. It seems certain the world will be less predictable but we won’t know for a long time how that plays out.

The Australian press is likely to go into meltdown about the outcome. Trump challenges their ideas of civilised discourse and many of their values. The correct approach is to separate the issues. As democrats we should bemoan the way people have engaged in slanging matches rather than constructive debates. As democrats though we should also accept that differences in values need to be expressed through the political system and not disparaged. We need to engage with alternative views, not censor them or rubbish them.

![]()

Mark Chou, Associate Professor of Politics, Australian Catholic University; Gorana Grgic, Lecturer in US Politics and Foreign Policy, US Studies Centre, University of Sydney; Kumuda Simpson, Lecturer in International Relations, La Trobe University; Peter Christoff, Associate Professor, School of Geography, University of Melbourne, and Rodney Maddock, Vice Chancellor’s Fellow at Victoria University and Adjunct Professor of Economics, Monash University

This article was originally published on The Conversation. Read the original article.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/o1yxCI9qxgg/

It’s spring and the property market’s blooming

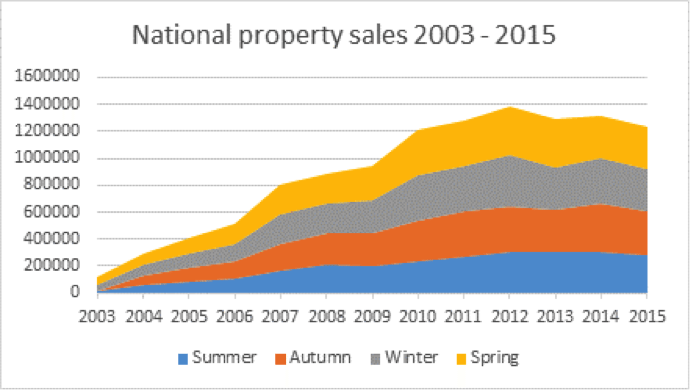

Spring season sees more property settlements and transactions across Australia than any other season, according to conveyancing technology experts GlobalX.

GlobalX CEO Peter Maloney says that from September to November the grass is greener, gardens are in full bloom and the weather is comfortably warm, making for optimal house selling conditions.

Source: GlobalX

Maloney says spring sales are often driven by the desire for a new beginning, with individuals, couples and families preferring to move before the end of the year.

“Buyers who have children prefer to get settled ahead of the new school year, and a spring sale means relocation can take place near or over the holiday period, allowing ample time for unpacking,” he explains.

“Similarly, investment properties can be renovated in time for the January-February period, which sees many people searching for rental properties before universities and training institutions begin the academic year.”

This year’s spring sales are off to a strong start, with auction clearance rates over the past nine weeks above 75 per cent, according to CoreLogic’s November market report.

“That puts them at their strongest level in more than a year and only marginally under a five-year high,” Maloney says.

Over the past 12 months, combined capital city home values have increased by 7.5 per cent, which is trending up from a recent low of 6.1 per cent at the end of July.

Nationally, capital city home values rose by 9.1 per cent over the first 10 months of 2016, with only two cities – Perth and Darwin – recording falling values over the past quarter.

Annually, home value increases have been strongest in Sydney (10.6 per cent), Melbourne (9.1 per cent) and Canberra (7.9 per cent), Hobart (5 per cent), Adelaide (2.5 per cent) and Brisbane (4.1 per cent), while falls were recorded in Perth (down 3.7 per cent) and Darwin (down 3.8 per cent).

“It’s also worth noting that the average level of discount (to a property’s listed or reserve price) on homes has eased from 6.1 per cent a year ago to 5.8 per cent, so home sellers are coming away with more cash from their sales,” Maloney says.

“It’s the same for unit owners, with the average discount reducing slightly from 6.1 per cent a year ago to now 5.5 per cent.”

In a market where Australian residential real estate is worth around $6.7 trillion, six out of every 10 new home listings are currently located in capital cities.

However, while the nation’s total mortgage debt of $1.59 trillion represents around 23 per cent of the value of residential real estate, just more than half the average Australian’s household’s wealth is invested in housing (51.5 per cent).

“To put the nation’s accumulated mortgage debt into context, the total value of Australia’s residential real estate market is more than three times the funds held in the nation’s superannuation accounts, and just under four times the amount held in Australian listed stocks,” Maloney says.

In the past year, more than 451,000 properties changed hands, with the average house price sitting at $600,000 nationally and the average unit price at $510,000.

“With the Reserve Bank of Australia holding the official cash rate at a historically low 1.5 per cent, and lending institutions vying fiercely for every mortgage dollar, now is a good time to consider purchasing property,” Maloney says.

“It’s spring and the market is showing signs of blooming once more.”

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/T289lgDoo0I/

James Lesh, University of Melbourne

The Australian Ugliness, architect and critic Robin Boyd wrote in 1960, incorporated the “background ugliness” of Australia’s cities: a suburbia of:

… unloved veneer villas and wanton little shops, and big worried factories.

These are the kinds of suburban places that in 2016 sell at weekend real estate auctions for six or seven figures. Despite the frequent outcries of today’s residents of “Trendyville”, these buildings are readily converted to fashionable heritage homes, or demolished to make way for new apartment blocks.

Heritage has a history. The kinds of things and places that Australians have preserved and the ways they have gone about preserving them have expanded in recent decades.

This heritage exists not only in museums and galleries or at historic properties and CBD buildings. It also forms part of our everyday urban experiences: located in suburbs and neighbourhoods, along and between streets, among current and former factories, stores, pubs and homes.

Finding Trendyville

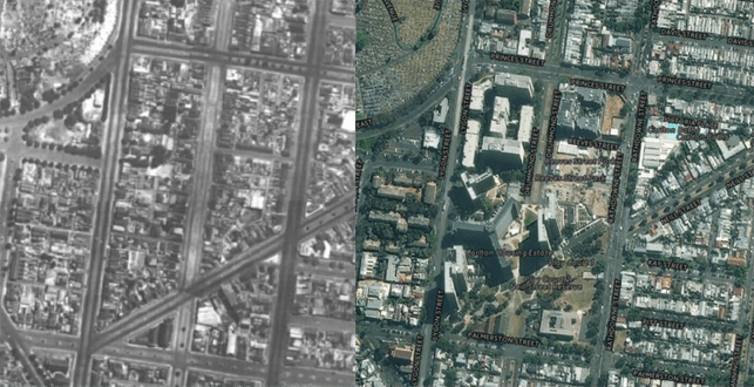

A place where this heritage history has played out dramatically has been in the inner suburbs of the Australian city.

Why call this place Trendyville? Without a conventional gentry, the term gentrification is arguably historically inappropriate for Australia. So we might instead consider gentrification as trendification, the inner suburbs as Trendyville, and the residents as trendies.

The trendies arrived in the late 1960s. Like hipsters today, few people considered themselves a trendy, except perhaps ironically. More commonly, a trendy was identified by another person based on dress, clothing and shopping bags.

For urban historians Renate Howe, David Nichols and Graeme Davison, Trendyville evokes:

… the junction between geography, culture and politics, on the road between memory and history.

The city of memory is a productive way of thinking about urban heritage. It is also a powerful way of tackling the relationship between cities, people and history.

‘Trendies’, Greville Street, Prahran, Melbourne, 1973. State Library of Victoria

Before Trendyville

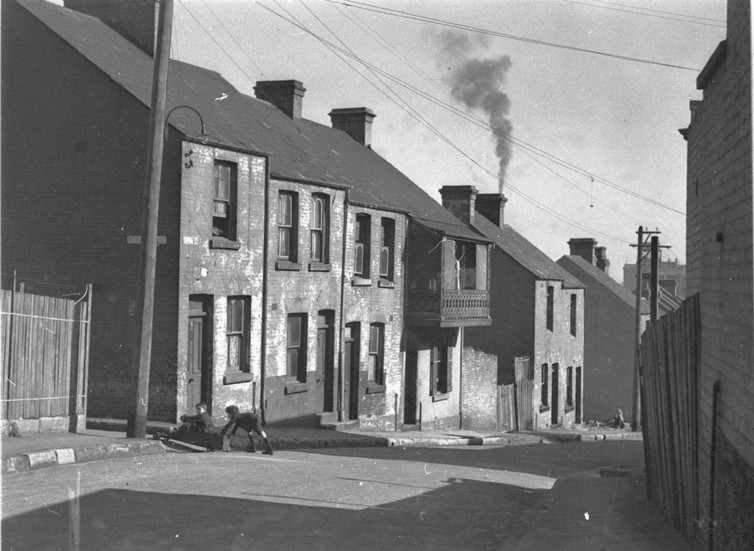

Until the mid-to-late 20th century, the Australian inner suburbs – New Farm and Subiaco, Carlton and Glebe – were not the desirable places of today.

The houses, terraces, villas, cottages and other buildings that lined the streets of Trendyville had been built in the 19th and early 20th century. By the post-war period, many of these buildings had become run down, perceived as both unsustainable and contrary to social progress: in need of urban renewal.

Surry Hills and Redfern, Sydney, ca. 1930s. State Library of NSW

These rings included a CBD core for commercial activities, an underdeveloped inner circle, and an aspirational outer suburban circle. Post-war urban planners thought the emptying out of the inner-city – “the doughnut effect” – was inevitable.

The residential suburbs of the inner circle were identified as transitional zones, assuming that aspiring residents would eventually seek out the outer suburbs. Urbanists designated these seemingly dilapidated areas as slums, to be cleared for comprehensive modern redevelopment.

Aerial view of Carlton, Melbourne before and after Housing Commission of Victoria high-rise flats, 1945 and today. www.1945.melbourne

High-rise social housing schemes were built, inspired by French architect Le Corbusier. The results of these policies include the Brutalist Sirius Apartments in Sydney and the 1960s high-rise housing that circles inner Melbourne.

Sirius Apartments from Circular Quay, Sydney, 2014. hpeterswald/Wikimedia

Heritage in Trendyville

From the 1960s, the backlash against these inner-suburban clearances was led by the trendies. Not everyone was enraptured by the “white-picket fence” suburban ideal. Following southern and eastern European migrants, students and middle-class professionals moved to the inner suburbs. Other people had never left, witnessing the demolitions around them.

Resident protest, Brisbane. 1970. Brisbane City Council

The union-imposed “green bans” – at places like the Rocks and Woolloomooloo, South Melbourne and Collingwood, Highbury Park, and Fremantle – was another powerful way to intensify this heritage advocacy.

Resident protest, Woolloomooloo, Sydney, ca. 1973. City of Sydney Archives

The trendies transformed Boyd’s “background ugliness” into heritage that warranted preservation. Australia’s residential vernacular, its neighbourhoods, streets and homes, were looked upon with increasing fondness. This occurred amid a shifting mentality toward community building, the environment, sustainability and local amenity.

Drawing on urbanists such as North American Jane Jacobs, heritage preservation became an aspect of community-making. The resident action groups brought people together, and the green bans helped people to claim their right to the city.

Trendyville’s troubles

From the 1970s, Trendyville became subject to new heritage laws, which sought to preserve its “historic character”.

Although these heritage protections were in part intended to give residents a greater say, those responsible for making the assessments were nevertheless heritage experts, often distanced from the communities.

Catherine Street, Subiaco, Perth, 1984. State Library of Western Australia

The trendies had arrived at a time when the inner suburbs were still perceived as in decline. The heritage protections had been implemented in response to their aesthetic and historical sensibilities.

Today, those heritage protections envelope large and sought-after areas of the inner city. With Australia’s population booming, urbanists advocate for greater density. More people will need to live in existing suburbs to make our cities sustainable.

Former Tip Top Bakeries, Brunswick East, Melbourne, 2014. Little Projects

What it means to meaningfully preserve Trendyville’s heritage, Australian inner-suburbia, must be rethought for the 21st century.

After all, as illustrated by recent calls to preserve Sydney’s Sirius Apartments (which were once opposed by heritage advocates) our understandings of heritage are always shifting.

![]()

James Lesh, PhD Candidate, School of Historical and Philosophical Studies and Melbourne School of Design, University of Melbourne

This article was originally published on The Conversation. Read the original article.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/I1iuehptHJk/