Sydney auction fatigue a risk

Sydney auction fatigue a risk

Posted on Wednesday, November 20 2013 at 3:37 PM

High clearance rates and limited stock could result in buyers suffering ‘auction fatigue’, according to one real estate agent.

Braden Walters, principal of True Property and Real Estate Institute of

New South Wales 2013 Salesperson of the Year, says sellers may start adopting other

sale methods if buyers continue to miss out at auction.

“If they miss out on five or six or seven auctions in a row, you’ll find

there’s a lot of negativity from the buyers around the auction.”

Walters says some sellers will start turning this to their advantage by

creating a marketing point of difference.

“If you start getting into an environment where buyers are shying away

from auctions because they’ve been burnt by them, then there’s an opportunity

to go against the crowd and put a price on the property.”

Sydney and Melbourne have been achieving clearance rates around 80 per

cent in 2013, and this can result in buyers becoming disillusioned with the

process.

Walters says despite this, he still considers taking your property to

bidders as the most effective method of marketing.

“Auctions work in any market.

“If the market is falling or is on a slight decline, the auction

strategy is great because it draws a line in the sand for buyers to make a

decision if they want to buy it.”

Walter says while most properties will suit the process, auctions

achieve their best outcome with uncommon real estate.

“As an agent, if you see a property that they’ve renovated really

uniquely, or its in a location were there hasn’t been any recent comparable

sales, you may find the auction strategy is much better because buyers will

come and get emotionally attached to it regardless of the price.”

John Potter, author of A Property Investor’s Guide to Negotiating, says

auctions continue to be the most effective method for achieving a sale if

there’s pressure to sell and you’re prepared to meet the market.

“Auction is the best way to go because you’ll get a result on the day,

or at the very least you’ll get an indication of where the market lies.”

Potter says it’s more important to read the property cycle and level of

demand accurately.

He says having your property ‘pass in’ can put you on the back foot.

“You can be unlucky and have a good property but, for one reason or

another, you don’t get the interest that you’d have liked, and the price it’s

passed in at has exposed what you’re going to take, so you’re open to the

vultures a bit. “That can be a bit of a disadvantage, but in most cases,

auctions work well.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/ssPU0z8p0ds/sydney-auction-fatigue-a-risk

Rental vacancies drop nationally

Rental vacancies drop nationally

Posted on Monday, November 18 2013 at 8:38 AM

Data released by SQM Research shows rental vacancy rates continue to fall across Australia.

The researcher says

during October this year, the vacancy rate fell to two per cent with a total of

57,471 vacancies nationwide.

Five of the

country’s eight capital cities saw their vacancies decline.

Hobart had the

largest percentage drop in the month with a fall of 0.3 per cent.

Adelaide had the

next largest fall recording a 0.2 per cent drop.

Other capitals to

see vacancies reduce were Sydney, Perth and Canberra.

Melbourne’s

vacancy rate held steady, while Brisbane and Darwin saw a rise of 0.1 per cent

during the month.

SQM says Hobart is likely to see some upwards sustained pressure on

rents as it’s clearly recording lower vacancies than 12 months ago.

Louis Christopher, managing director at SQM Research, says this is the

fourth straight month of a national tightening in vacancies.

Christopher notes the numbers for Sydney in particular are unusual.

“We know the sales market is very active and normally, in most

recoveries, vacancies rise as renters turn themselves into first homebuyers,

“But Sydney is now recording a very tight vacancy rate of 1.5 per cent.”

Christopher says this shows first homebuyers are remaining renters for

longer in the New South Wales capital.

“If Sydney vacancies remain this low, that will put renewed upward

pressure on rents again for next year.”

While the results are positive for landlords, SQM Research does expect

vacancies to begin to rise in the lead up to Christmas as part of the normal

yearly cycle.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Rental vacancies drop nationally

Landlords urged to prioritise repairs

Valuers predict southeast Queensland property to strengthen in 2014

More new housing and renovation investments

NSW unit owners could be forced to sell up

Proposed planning change in Perth could cost investors

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/BsRi9xCV7XI/rental-vacancies-drop-nationally

Landlords urged to prioritise repairs

Landlords urged to prioritise repairs

Posted on Friday, November 15 2013 at 11:00 AM

Landlords and real estate agents have been warned to ensure regular maintenance of their properties after a Melbourne man was awarded $300,000 for injuries sustained after a balcony collapse.

Three people were injured at the rental property when the balustrade of

a balcony collapsed causing them to fall approximately five metres.

Trang Tran, senior associate with Maurice Blackburn Lawyers, says the

balcony wasn’t property maintained or routinely inspected.

Tran represented the injured man who successfully sued his landlord.

“Our client sustained severe injuries to his arm and shoulder that

have resulted in multiple hospitalisations and surgery, including a total

shoulder replacement,” Tran says.

“He remains in constant pain and discomfort. This case highlights the

need to ensure premises are properly and adequately inspected and kept in good

repair to avoid serious injuries and even death to tenants and visitors.”

It was revealed that repair work done prior to the man’s tenancy wasn’t

adequately performed.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Landlords urged to prioritise repairs

Valuers predict southeast Queensland property to strengthen in 2014

More new housing and renovation investments

NSW unit owners could be forced to sell up

Proposed planning change in Perth could cost investors

Average Aussie house size continues to shrink

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/A8XgwVTccM0/landlords-urged-to-prioritise-repairs

More new housing and renovation investments

More new housing and renovation investments

Posted on Thursday, November 14 2013 at 11:59 AM

New dwelling commencements will improve and renovation investments will increase in 2014, according to the latest report from the Housing Industry Association (HIA).

The improvements will match the highs achieved during the post-GFC

stimulus with dwelling commencements lifting above 170,000 per year by 2016/17,

HIA senior economist Shane Garrett says.

“The improving level of dwelling commencements achieved in 2012/13 will

be consolidated this year before moving up a further leg in 2014/15,” he says.

“Growth in housing starts during 2013/14 will be concentrated in large

states like New South Wales, Queensland and Western Australia.”

Garrett says the growth in renovations will be much more broad-based

with increases occurring across most states.

In order to maintain the momentum Garrett called on state and federal

governments to look at addressing issues impeding the industry such as land

supply, infrastructure and planning approval delays.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Valuers predict southeast Queensland property to strengthen in 2014

More new housing and renovation investments

NSW unit owners could be forced to sell up

Proposed planning change in Perth could cost investors

Average Aussie house size continues to shrink

Cash splash for first-time new homebuyers in Tasmania

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/IVPoJbP9pEo/more-new-housing-and-renovation-investments

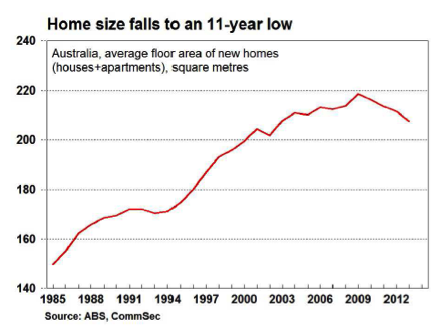

Average Aussie house size continues to shrink

Average Aussie house size continues to shrink

Posted on Tuesday, November 12 2013 at 11:53 AM

While new homes in Australia remain among the biggest in the world, the average floor size of dwellings built has fallen to an 11-year low.

Analysis by CommSec has found that the

McMansion trend – a massive, oversized house with more space than is reasonably

needed – looks to be coming to an end.

The shift from building bigger homes is a

profound one, CommSec says, and illustrates how Australia’s demographics and

lifestyle drivers continue to change.

“In part, generation Y are driving the

trend, but baby boomers are also in the process of downsizing, perhaps selling

their four to five-bedroom homes in preference for retirement homes or city

pads,” the CommSec analysis report says.

New houses built in 2012-13 had an average

floor area of 241 square metres, which represented a reduction of 1.6 per cent

on the previous year.

In contrast, the average floor area of new

apartments rose by 1.3 per cent to 133 square metres over the same period.

But overall, the average size of all newly

constructed dwellings fell 1.9 per cent in the past financial year, the fourth

consecutive year of space consolidation and the smallest home size recorded in

11 years.

CommSec chief economist Craig James says

the move towards smaller homes is thanks to a focus on “experiences” rather

than an aspiration for a “bigger castle”.

Travel, attending sporting events and

eating out at restaurants and cafés are more desirable to the average

Australian than a sprawling home, he believes.

“Aussies are building smaller homes and

utilising the homes more efficiently. That is, more people are occupying houses

and apartments. The new trends mean less demand for building materials while

fewer homes need to be built to accommodate the expanding population.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Average Aussie house size continues to shrink

Cash splash for first-time new homebuyers in Tasmania

Push for Galilee Basin development

ASIC warns agents on giving SMSF advice

Melbourne Cup day rate hold was always a safe bet

Sydney leads the property value charge

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/_hgEdyMRsKc/average-aussie-house-size-continues-to-shrink

Push for Galilee Basin development

Push for Galilee Basin development

Posted on Thursday, November 07 2013 at 3:29 PM

A State Government initiative promoting fast-tracked development of the Galilee Basin in Queensland has been announced by Premier Campbell Newman.

The

Galilee Basin

Development Strategy has been released in a bid to grow the

resources sector in this region and encourage private sector investment to

facilitate this.

Newman

says the strategy will fast-track environmental approvals, improve

infrastructure such as power, water and rail, as well as support the transport

of coal to port by streamlining land acquisition and reducing red tape.

Deputy Premier Jeff Seeney

says the proposed projects for the region have a total forecast investment of

$28.4 billion and would provide more than 15,000 jobs during construction.

“Companies that are

currently investigating opening mines in the Galilee Basin are contemplating

many billions of dollars of investments,” Seeney says.

Due to the large financial

outlay required to get resource projects off the ground

and the long lead times between financial commitment and shipping the first

coal, the government will offer companies incentives, Seeney says.

“The Galilee Basin Development Strategy is designed to

encourage first movers – those proponents whom the government consider would

play a vital role in opening up the basin for their own projects and opening up

the basin for other miners as well.

“The Newman Government is

offering a ramp-up-to-royalty initiative whereby the government will consider

offering reduced royalties for an initial period of time,” he says.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Cash splash for first-time new homebuyers in Tasmania

Push for Galilee Basin development

ASIC warns agents on giving SMSF advice

Melbourne Cup day rate hold was always a safe bet

Sydney leads the property value charge

Foreign investment rises in Queensland

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/lAae5PUnuwo/push-for-galilee-basin-development

Cash splash for first-time new homebuyers in Tasmania

Posted on Friday, November 08 2013 at 4:10 PM

First homebuyers in Tasmania who buy or build a new home will now get double the government grant to do so.

Premier Lara Giddings today announced a

“supercharging” of the First Home Builder Boost to $30,000, in a bid to

stimulate activity in the construction industry.

That’s an immediate increase from the

$15,000 cash splash, which was boosted last year from the previous $7000

incentive.

Back then, it was hoped the extra

generosity would spark a slew of first-time buyers, but take-up was slower than

expected.

“It was always expected the applications

would accelerate over time, but we recognise the need to create jobs right

now,” Giddings says.

“Builders have told us there has been a lot

of interest from people wanting to build their first home, but they needed more

time to accumulate a deposit. This is why we’ve taken the decision to

turbo-charge the incentive.”

Based on the average cost of building a new

home, the grant should cover most of the deposit required, Giddings believes.

The grant is now the most generous in

Australia. The boosted scheme will run until December 2014.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Cash splash for first-time new homebuyers in Tasmania

Push for Galilee Basin development

ASIC warns agents on giving SMSF advice

Melbourne Cup day rate hold was always a safe bet

Sydney leads the property value charge

Foreign investment rises in Queensland

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Wqw0HV3QTdo/cash-splash-for-first-time-new-homebuyers-in-tasmania

Melbourne Cup day rate hold was always a safe bet

Posted on Tuesday, November 05 2013 at 2:52 PM

While the Melbourne Cup captivated millions of Australians, the RBA Board held its monthly meeting and reaffirmed its stance that interest rates should hold steady.

RP Data research director Tim Lawless says

the move came as no surprise and, from a housing market perspective, the

current rate setting is sufficient.

“(It’s) clearly having the intended effect

of encouraging more buyers into the housing market, stimulating new housing

construction,” Lawless says.

Home sale transaction numbers are about 20

per cent higher than they were this time last year, while dwelling values

across the combined capital cities have risen by 7.9 per cent in the past 12

months, he says.

“The RBA has on several occasions now

stated that they’re comfortable with the level of capital gains in the housing

market.

“In fact, the current rate of growth is

well below the highs achieved over previous growth cycles and dwelling values

(in) every capital city apart from Sydney remain below their previous peaks.”

Recent inflation, unemployment and economic

growth data also likely contributed to the decision to leave the cash rate on

hold.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Melbourne Cup day rate hold was always a safe bet

Sydney leads the property value charge

Foreign investment rises in Queensland

Home loan demand surges in October

House prices continue to rise

More incentive to go bush

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/9lOlqQnoP_0/melbourne-cup-day-rate-hold-was-always-a-safe-bet

Sydney leads the property value charge

Sydney leads the property value charge

Posted on Monday, November 04 2013 at 3:51 PM

Numbers released by the Australian Bureau of Statistics (ABS) confirm Sydney as the number one capital city for property value growth across the nation.

According to the ABS, the established house price index for Sydney

rose 3.6 per cent, the largest for any capital in the September 2013 quarter.

Melbourne took second spot with a gain of 1.9 per cent

for the quarter, while Brisbane saw a 1.2 per cent rise to round out the top

three spots.

The eight capital city weighted average increased 1.9

per cent in the quarter, for a total rise of 7.6 per cent over the past year.

“This is the first time

since 2010 that the capital city average has shown four consecutive quarters of

growth year on year,” says Robin Ashburn, spokesperson for the ABS.

“Sydney’s rises were

broad based in the September quarter, with most areas going up, but prices were

mixed in Melbourne, with some areas showing rises and others falls.”

The dark horse was Hobart, which came in fourth for quarterly

capital growth with a 1.4 per cent gain.

This presents good news for the Tasmanian capital as it

continues to look forward to coming off its low base.

Adrian Kelly, president of the Real Estate Institute

of Tasmania, says the good result is being reflected in their numbers too.

“I’m not surprised… our own quarterly figures came out

and they show a little bit larger increase than that. That was pretty much the

same (result) right around the state.

“The other thing we’ve recorded is the volume of sales

being transacted is 17 per cent greater than the same time last year, so the

number of sales is being correlated with property values.

“Everyone’s saying that this calendar year is the best

we’ve had in the last five or six years.”

Other capital city price movements include Perth and

Darwin, up 0.2 per cent and 1.4 per cent respectively.

The two cities to fall in value were Canberra,

which dropped 1.2 per cent, and Adelaide down 0.6 per cent for the three

months.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/7P7dOeyUqkI/sydney-leads-the-property-value-charge

House prices continue to rise

House prices continue to rise

Posted on Friday, November 01 2013 at 12:22 PM

Capital city dwelling values increased by 1.3 per cent over the month of October, driven largely by the strong-performing Sydney market.

Data released today by RP Data and Rismark

international shows a continued growth across many markets, with the rolling 12

month combined capital city index recording its fastest pace in three years.

Across all the capitals, home values are

now up 7.9 per cent over the past 12 months and 8.2 per cent over the year to

date.

RP Data senior research analyst Cameron

Kusher says Sydney and Melbourne are continuing to have a strong influence on

the national result.

“Sydney home values increased by 2.4 per

cent in October and have increased by 5.5 per cent over the past three months,”

Kusher says.

“In Melbourne, home values increased by 1.2

per cent in October and recorded an increase of 3.8 per cent over the past

three months.

“For the first 10 months of this year,

Sydney and Melbourne home values have performed very strongly, achieving growth

of 13.4 per cent and 8.7 per cent respectively.”

After several somewhat sluggish months,

Brisbane home values posted a 1.4 per cent increase in October, however median

prices in the Queensland capital remain some 8.4 per cent below the previous

peak.

Ben Skilbeck, chief executive officer of

Rismark international, says there are signs of growing confidence in Brisbane.

“While Brisbane auction clearance rates are

typically low in comparison to Sydney and Melbourne, due to differences in the

preferred sale mechanism, Brisbane clearance rates are approaching the 50 per

cent mark.

“That was last consistently observed in

2009 when values increased by 7.1 per cent over the year.”

Elsewhere, the October index results confirmed

that dwelling values also rose in Adelaide by 0.3 per cent and Darwin by 1.6

per cent.

It was a different story in other centres

where dips were recorded, with a 0.2 per cent slip in Perth, a 2.3 per cent

decline in Hobart and a 1.5 per cent fall in Canberra.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/1VNC_BnVLHg/house-prices-continue-to-rise