Mortgage repayments on the rise

Mortgage repayments on the rise

Posted on Tuesday, November 19 2013 at 3:21 PM

Median monthly mortgage repayments in Australia climbed by 38.5 per cent in the period between 2006 and 2011, from $1300 to $1800.

But in a surprise trend, data released by the Australian

Bureau of Statistics (ABS) today shows that the fastest growing mortgage costs

were seen in areas outside major capital cities.

Between 2006 and 2011, mortgage costs increased more than

wages. The median weekly household income grew by 20.2 per cent in that period,

compared to an increase of 38.5 per cent in mortgage repayments.

The Sydney suburb of Woollahra has the most expensive median

monthly mortgage repayments at $3250.

The fastest increase was recorded in

Ashburton in Western Australia, where median monthly repayments increased by a staggering

278.6 per cent.

ABS director of rural and regional statistics, Lisa Conolly,

says analysing growth in regional areas is complex due to a range of factors

influencing mortgage costs.

“Regions such as Ashburton

and Port Hedland in WA have experienced high population growth and turnover,

meaning there would be increased demand for housing and possibly new homeowners

with new mortgages,” Conolly says.

FASTEST GROWING

MORTGAGE INCREASES WITHIN EACH STATE/TERRITORY (a)

Source: Australian Bureau of Statistics

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Housing types determine insurance options

Two major mine projects approved

Where to buy in the hot Sydney market

Finding a rental in Sydney getting tougher

Online property transactions begin in Queensland

Housing market experiences growth

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/kqK58fO2aXw/mortgage-repayments-on-the-rise

Real estate reforms tabled in Queensland Parliament

Real estate reforms tabled in Queensland Parliament

Posted on Thursday, November 21 2013 at 3:24 PM

Legislative changes tabled in the Queensland Parliament will make commissions less transparent to buyers and extend sole agency timeframes, according to the Real Estate Institute of Queensland (REIQ).

The

lobby group believes the amendments will simplify the process of buying and

selling property across the state.

Changes

to the rules governing the real estate industry include:

- Removing the requirement for agents to disclose to

a buyer the commission they’re receiving from the seller. - Extending the statutory limit on lengths of sole or

exclusive agency appointments from 60 days to 90 days. - Removing a limit on the maximum commissions payable.

- Abolition of a separate warning statement by

incorporating it into the contract itself. - Stricter disclosure of third party benefits to

buyers.

Pamela Bennett, chairman of the REIQ, says the introduction of the Property Occupations Bill and the Agents Financial Administration Bill into Parliament

is the result of more than 12 months of collaboration between the State

Government and the real estate sector.

“The real estate industry has long been legislatively bundled in with a

variety of other occupations and the REIQ always felt that our profession

deserved its own specific legislation.”

Bennett says the organisation is happy to see agents regulated under

legislation separated from other professions.

“For more than a year, the REIQ has fought for major legal reforms

during the review of the Property

Agents and Motor Dealers Act and the splitting of (it) into

occupation-specific legislation.”

Anton Kardash, the REIQ’s chief executive officer, believes the legislative

reforms will improve conditions for both agents and consumers.

“The majority of the changes also allow for the real estate industry to

become more professional and ultimately more accountable, and that is good news

for everyone as well as for the property market.”

Attorney-General Jarrod Bleijie says the overhaul of the legislation will

cut red tape.

“Lengthy contracts can often do more harm than good, with many people

either skimming over important information, or in some cases people are not reading

the finer detail at all,” Bleijie says.

“Buying a house or car is one of the biggest decisions we can make in

our life time and the simpler we can make the process, the greater

Queenslanders are protected.

“By reducing the number of approved government forms and incorporating

warning statements into contracts, we can achieve this.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Housing types determine insurance options

Two major mine projects approved

Where to buy in the hot Sydney market

Finding a rental in Sydney getting tougher

Online property transactions begin in Queensland

Housing market experiences growth

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/MWmme1ylDYE/real-estate-reforms-tabled-in-queensland-parliament

Two major mine projects approved

Two major mine projects approved

Posted on Monday, December 23 2013 at 4:49 PM

The Federal Government has granted approval to a new major coalmine owned by mining billionaire Clive Palmer.

The China

First mine operation, located in Queensland’s Galilee Basin, will have the

capacity to produce up to 40 million tonnes of coal each year.

While

Palmer’s company will have to comply with 49 special conditions, environmental

groups claim it doesn’t go far enough to limit the impact on the Bimblebox

protected area.

Greens

environment spokesperson Senator Larissa Waters claims the mammoth mine will

worsen climate change, harm the Great Barrier Reef and encroach on the habitats

of native wildlife.

“The condition attached to offset Bimblebox with another area is

ridiculous – you can’t offset the loss of the last remaining significant

woodland in the Galilee Basin,” she says.

The government also last week approved Arrow Energy’s the Surat Gas

Expansion project, which includes 6500 new coal seam gas wells, to the west of

Brisbane.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Housing types determine insurance options

Two major mine projects approved

Where to buy in the hot Sydney market

Finding a rental in Sydney getting tougher

Online property transactions begin in Queensland

Housing market experiences growth

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/WgHgTpBoApA/two-major-mine-projects-approved

Housing types determine insurance options

Housing types determine insurance options

Posted on Tuesday, December 24 2013 at 10:54 AM

One of Australia’s peak insurance bodies has called on landlords to ensure they have the appropriate cover for their investment property.

Terri Scheer Insurance executive Carolyn Majda says it’s vital for landlords to understand the various insurance options available and what’s covered depending on whether they own a unit, home or townhouse.

“In a strata-titled apartment situation, strata insurance is held by the body corporate and paid for by owners’ levies,” she says.

“The body corporate is legally responsible for insuring the buildings at the strata-title site, as well as the owner’s legal liability for common property areas.”

However, Majda warns that strata insurance usually doesn’t include the interior of individual units, which means if a tenant injures themselves inside a rented apartment the landlord may be found liable.

“Landlord insurance can help to protect investors from the specific risks associated with owning a rental property, including malicious damage by a tenant, theft, accidental damage, legal liability and loss of rental income,” she says.

“Generally speaking, the cost to insure a unit is lower than a house, so it’s important to consider these features and the impact they could have on premiums when looking to buy an investment property.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Housing types determine insurance options

Two major mine projects approved

Where to buy in the hot Sydney market

Finding a rental in Sydney getting tougher

Online property transactions begin in Queensland

Housing market experiences growth

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/yCU2yXtR_6s/housing-types-determine-insurance-options

First homebuyers still slow to act

First homebuyers still slow to act

Posted on Monday, December 02 2013 at 3:03 PM

The proportion of first homebuyers entering the property market remains flat, with the country’s largest mortgage brokerage recording continued declines.

Of all the home loans processed across

Australia by Australian Finance Group (AFG) in the month of November, just 10.3

per cent were for first-time buyers.

That result is in stark contrast to

investor numbers, which the company reports rose again last month to 39.9 per

cent of all loans.

All up, AFG processed $3.99 billion worth

of loans in November. The average mortgage was for $436,000, which represents

an increase of eight per cent since May.

“The increase in average home loans may be

as much a consequence of greater participation by investors and borrowers

seeking to upgrade their homes, than of rising house prices,” the company says.

First homebuyer participation varied state

to state, with AFG recording its worst ever figure for New South Wales of 2.8

per cent.

Elsewhere, first-timers comprised 6.2 per

cent of all processed loans in Queensland, 11.4 per cent in Victoria, 16 per

cent in South Australia and 20.2 per cent in Western Australia.

Mark Hewitt, general manager of sales and

operations for AFG, says the overall mortgage market is robust and in “good

health”.

“It’s encouraging to see more people

willing to upgrade their homes and buy investment properties.”

Urgent action is needed to address the

absence of first homebuyers, he says, particularly in NSW and Queensland.

“We need to see a lot more people get on the

property ladder to underpin the long-term sustainability of those markets.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Where to buy in the hot Sydney market

Finding a rental in Sydney getting tougher

Online property transactions begin in Queensland

Housing market experiences growth

Abbot Point approval a win for local property market

Housing outlook mixed

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/QVYhsKzlKiE/first-homebuyers-still-slow-to-act

Abbot Point approval a win for local property market

Abbot Point approval a win for local property market

Posted on Wednesday, December 11 2013 at 3:18 PM

The approval of the Abbot Point coal terminal at Bowen is expected to have a significant impact on both property and businesses in the local area, with real estate agents saying the market has suffered as a result of the uncertainty around the port.

Environment Minister Greg Hunt yesterday approved the expansion of the

terminal, which is expected to be one of the largest in the world.

Despite backlash from conservationists and green groups, real estate

agents in the Bowen township see the development as a boon to the local economy

and a milestone that will reduce the risk around the property market.

Bowen LJ Hooker principal Tony Doyle says the announcement removes the

uncertainty for investors.

“I do believe it might take another few months to settle down before

people start making investment decisions, but there’s now a good long-term

future in Bowen,” he says.

“They’ll be building here for years now. That will be good for the town.

It’s certainly good news for everybody. It’s just been so frustrating in the

lead up to this.

“I believe it will definitely put confidence back in the market. We’ve

got a lot of clients who have said ‘oh if it happens I’ll probably come and buy

something, but the way it is now, why would I? It’s too much of a risk’.”

Doyle says a very high vacancy rate currently exists in Bowen, which

will be difficult to overcome and is a result of hype around the anticipated

expansion over the past 12 months.

“This announcement may see some investors come back to the market but

the last 12 months has probably been the hardest 12 months in real estate that

I’ve been in for 30 years,” he says.

“I think this project has been talked about for such a long time and

we’ve all been to more industry forums than I’ve had hot breakfasts and it’s

now the end of 2013, but this was all supposed to happen in 2012.

“We still don’t have people out there swinging hammers, this is just an

approval. So what’s happened is all the marketing companies got on the band

wagon for the last two years and went crazy and put out some fairly outrageous

investment seminars around the country and we ended up with what we have today

– a vacancy rate that’s probably the highest on the east coast of Australia.

“We’ve got 270 vacant properties in Bowen today and that will be 300 by

February, which would equate to about 25 per cent. So there’s no joy there for

investors. It’s been a hard slog. This is as bad as it gets.

“My take is that it will be a very slow and gradual change. They aren’t

going to build the biggest coal port in the world in 12 months.

“If they brought 500 men to town, that would only fill up the vacancy.

We’ve got that much vacant property and also we have a construction camp.

Nothing much is going to change here for the next 12 months.

“There are a lot of people coming and going all the time, so they aren’t

going to take 12-month leases on houses.”

Doyle says the previous expansion at the port saw an influx of about 700

people with little impact on housing.

“There has already been an expansion of the port and we’ve been through

this once before with 600 or 700 men in town, of which we only rented about 40

or 50 houses.”

According to Doyle, the real estate industry has been given an

undertaking by industry that they won’t be buying up land or building any

additional houses for employees.

“We’ve already had an undertaking from the companies that they won’t

come to town and buy subdivisions and build houses. They’ve told us that in no

uncertain terms.

“At the peak of this construction there could be 2000 people here, but when the construction is finished it’s about 20 so they

don’t’ want to create an artificial market for one or two years and then

disappear.”

Doyle says locally there’s only a minority of people in the township who

are against the expansion.

“There’s a very small minority who aren’t happy about it. On a ratio of

100 I’d say there are about 99 who are in favour of it.

“These workers do get time off and they spend it in the town, so they’re

great for the town and the local businesses.”

Bowen Chamber of Commerce chairman Bruce Heddich has told

the ABC he’s thrilled about the announcement.

“Bowen, being adjacent to Abbot Point, is the real winner

in this decision. It can only go well for the future of the town,” he says.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/9s-akjtXlDE/abbot-point-approval-a-win-for-local-property-market

Abbot Point approval a win for local property market

Abbot Point approval a win for local property market

Posted on Wednesday, December 11 2013 at 3:18 PM

The approval of the Abbot Point coal terminal at Bowen is expected to have a significant impact on both property and businesses in the local area, with real estate agents saying the market has suffered as a result of the uncertainty around the port.

Environment Minister Greg Hunt yesterday approved the expansion of the

terminal, which is expected to be one of the largest in the world.

Despite backlash from conservationists and green groups, real estate

agents in the Bowen township see the development as a boon to the local economy

and a milestone that will reduce the risk around the property market.

Bowen LJ Hooker principal Tony Doyle says the announcement removes the

uncertainty for investors.

“I do believe it might take another few months to settle down before

people start making investment decisions, but there’s now a good long-term

future in Bowen,” he says.

“They’ll be building here for years now. That will be good for the town.

It’s certainly good news for everybody. It’s just been so frustrating in the

lead up to this.

“I believe it will definitely put confidence back in the market. We’ve

got a lot of clients who have said ‘oh if it happens I’ll probably come and buy

something, but the way it is now, why would I? It’s too much of a risk’.”

Doyle says a very high vacancy rate currently exists in Bowen, which

will be difficult to overcome and is a result of hype around the anticipated

expansion over the past 12 months.

“This announcement may see some investors come back to the market but

the last 12 months has probably been the hardest 12 months in real estate that

I’ve been in for 30 years,” he says.

“I think this project has been talked about for such a long time and

we’ve all been to more industry forums than I’ve had hot breakfasts and it’s

now the end of 2013, but this was all supposed to happen in 2012.

“We still don’t have people out there swinging hammers, this is just an

approval. So what’s happened is all the marketing companies got on the band

wagon for the last two years and went crazy and put out some fairly outrageous

investment seminars around the country and we ended up with what we have today

– a vacancy rate that’s probably the highest on the east coast of Australia.

“We’ve got 270 vacant properties in Bowen today and that will be 300 by

February, which would equate to about 25 per cent. So there’s no joy there for

investors. It’s been a hard slog. This is as bad as it gets.

“My take is that it will be a very slow and gradual change. They aren’t

going to build the biggest coal port in the world in 12 months.

“If they brought 500 men to town, that would only fill up the vacancy.

We’ve got that much vacant property and also we have a construction camp.

Nothing much is going to change here for the next 12 months.

“There are a lot of people coming and going all the time, so they aren’t

going to take 12-month leases on houses.”

Doyle says the previous expansion at the port saw an influx of about 700

people with little impact on housing.

“There has already been an expansion of the port and we’ve been through

this once before with 600 or 700 men in town, of which we only rented about 40

or 50 houses.”

According to Doyle, the real estate industry has been given an

undertaking by industry that they won’t be buying up land or building any

additional houses for employees.

“We’ve already had an undertaking from the companies that they won’t

come to town and buy subdivisions and build houses. They’ve told us that in no

uncertain terms.

“At the peak of this construction there could be 2000 people here, but when the construction is finished it’s about 20 so they

don’t’ want to create an artificial market for one or two years and then

disappear.”

Doyle says locally there’s only a minority of people in the township who

are against the expansion.

“There’s a very small minority who aren’t happy about it. On a ratio of

100 I’d say there are about 99 who are in favour of it.

“These workers do get time off and they spend it in the town, so they’re

great for the town and the local businesses.”

Bowen Chamber of Commerce chairman Bruce Heddich has told

the ABC he’s thrilled about the announcement.

“Bowen, being adjacent to Abbot Point, is the real winner

in this decision. It can only go well for the future of the town,” he says.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/9s-akjtXlDE/abbot-point-approval-a-win-for-local-property-market

Where to buy in the hot Sydney market

Where to buy in the hot Sydney market

Posted on Wednesday, December 18 2013 at 11:25 AM

Sydney’s property market had a stellar year and shows no immediate signs of slowing down, but new analysis shows some suburbs are flying under the radar.

According to research by Onthehouse’s property research arm Resdiex, some suburbs haven’t yet taken off and could offer potential investment opportunities.

The growth in the top performing Sydney suburbs over the past 12 months was significant, with property owners in Northbridge increasing their net worth by more than $300,000 on average.

John Edwards, consulting analyst for Onthehouse and founder

of Residex, says strong performing suburbs are often ones that have already

experienced the majority of their growth for the current cycle.

“On the other hand, the poor performers are probably yet to

see significant growth during this cycle and may offer investors very good

growth prospects and homebuyers an opportunity to purchase well from despondent

vendors,” Edwards says.

“For example, the data suggests that North Parramatta has probably seen the

majority of its growth, whereas suburbs like Green Valley and Camden South are

yet to see their period of strong growth.

“Recent auction activity and the numbers point to a market where the upper

end is beginning to slow and the lower cost areas are currently the most sought

after. Based on the data, it would appear that lower cost suburbs will see the

strongest growth in the next 12 months.”

His analysis has identified the worst performing capital

growth suburbs in Sydney for both houses and units.

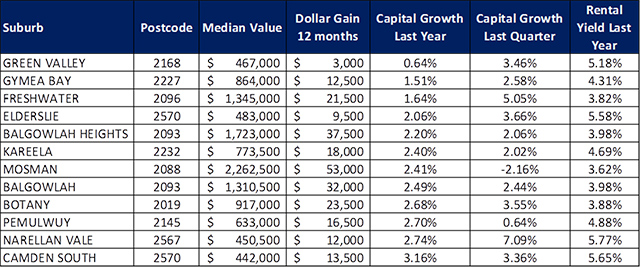

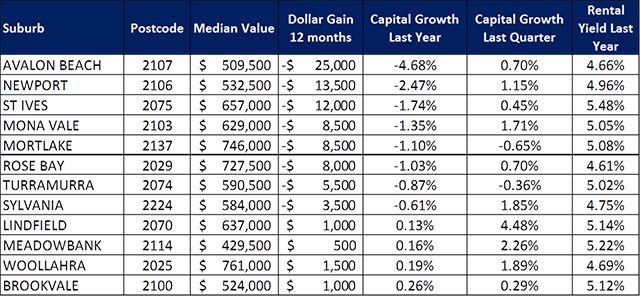

Slow growth movers –

houses

Slow growth movers –

units

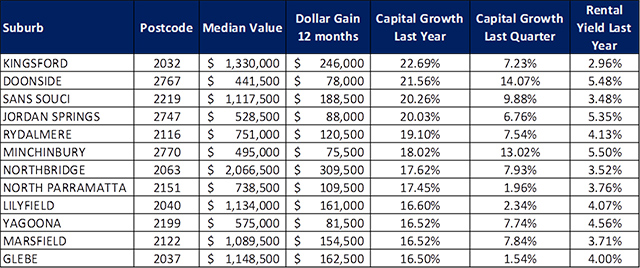

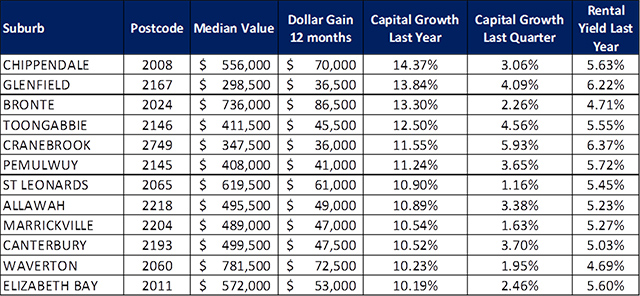

When it comes to the top performers for 2013, house and

landowners have done better in all respects compared to unit owners.

Capital growth top

performers – houses

Capital growth top

performers – units

Knowing where a suburb is in its growth cycle is key to identifying the

opportunity within that area, Edwards says.

“If you combine the knowledge about a suburb’s growth cycle along with

research data, suburb information and if you find out what the public considers

the best streets are, then good buying decisions should result.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/ADpP7X_4_rg/where-to-buy-in-the-hot-sydney-market

Finding a rental in Sydney getting tougher

Finding a rental in Sydney getting tougher

Posted on Monday, December 16 2013 at 1:11 PM

Rental vacancy rates across Sydney tightened even further in the month of November, falling to their lowest levels in nearly two years.

According to data released by the Real Estate Institute of

New South Wales (REINSW), the availability of residential rental accommodation

in the state’s capital declined 0.1 per cent last month.

The final half of 2013 saw Sydney rates steadily declining,

REINSW president Malcolm Gunning says, creating an increasingly difficult situation

for tenants hoping to secure a property.

Rates dropped in both the inner and outer suburbs of Sydney.

Closer to the CBD, rental vacancies are at 1.6 per cent, while further out

they’re even lower at 1.3 per cent.

“The rising population and lack of new housing developments

is fueling the shortage,” Gunning says. “It’s difficult for people to find

housing and this is of grave concern.”

Metropolitan vacancy rates were last at these low levels in

March 2012, he says.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Finding a rental in Sydney getting tougher

Online property transactions begin in Queensland

Housing market experiences growth

Abbot Point approval a win for local property market

Housing outlook mixed

Australian housing affordability improves

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Ac5nALJGOYE/finding-a-rental-in-sydney-getting-tougher

Online property transactions begin in Queensland

Online property transactions begin in Queensland

Posted on Friday, December 13 2013 at 12:32 PM

The first stage of a national electronic conveyancing system is now operating in Queensland.

Andrew

Cripps, the state’s Minister for Natural Resources and Mines, says the release

of Property Exchange Australia will allow mortgage dealings and releases to be

processed online.

The

state has now joined Victoria and New South Wales in using e-conveyancing for

property related transactions.

“The

majority of mortgages lodged online will be registered within minutes instead

of the current one or two-day turnaround,” Cripps says.

The

move marks the first step towards full online processing.

“The

release of stage one is a significant milestone and sets the foundations for

the next phase of e-conveyancing, which will accommodate a broader range of

property and title transactions.

“The

planned release in 2015 of stage two will open the system to lawyers conducting

property transfers on behalf of their clients, extending the benefits more

widely across the Queensland economy.”

Cripps

says e-conveyancing will eventually encompass all processes required in

property transfers and transactions.

“The

national e-conveyancing system will allow the settlement and lodgement of

documents through a nationally accessible system, no matter where the land and

the parties are located.

“The

system will be fast and secure and will allow subscribers to interact with the

land title registries at various stages to transfer data, alert parties of

relevant activity and confirm accuracy before lodgement.”

The

Queensland Government says e-conveyancing will not change each state’s control

over its land titling laws and titles register.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Online property transactions begin in Queensland

Housing market experiences growth

Abbot Point approval a win for local property market

Housing outlook mixed

Australian housing affordability improves

Building approvals hit record highs

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/2Y_qDAE1W0Q/online-property-transactions-begin-in-queensland