NSW first homebuyers head west

NSW first homebuyers head west

Posted on Wednesday, July 23 2014 at 1:50 PM

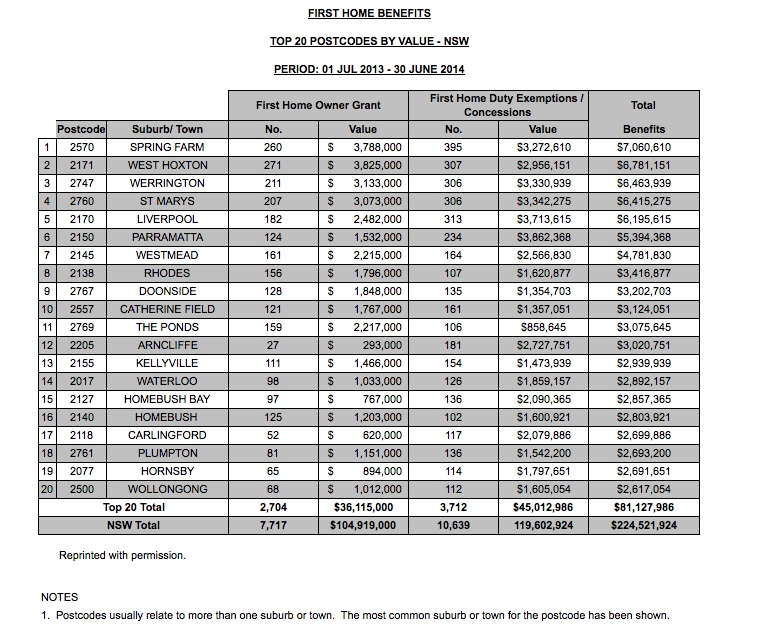

Analysis by the New South Wales Government shows the majority of first homeowner activity is in the

NSW first

homebuyers head west

Analysis by the New South

Wales Government shows the majority of first homeowner activity is in the State’s

western growth corridor.

The government ranked the state’s

suburbs by the dollar-value take-up of First Home Owner Grants and stamp duty

concessions for the 2013/2014 financial year.

The data reveals 16 out of the top 20 suburbs

utilising benefits are west of Sydney.

Spring Farm tops the list with over $7

million of benefits claimed.

West Hoxton and Werrington, at $6.78 million

and $6.46 million respectively, fill out the podium positions.

Parramatta came sixth in the rankings, while

the suburbs of Plumpton and Hornsby made it into the top 20 for the first time.

Andrew Constance, NSW’s State Treasurer, says

they’re pleased with the take up of grants and growth in new home construction

throughout this corridor.

“We’ve got new home starts at 10-year highs,

and a growing number of first-time buyers taking advantage of those new builds

in our vibrant west.”

Constance says the government has eased

criteria to stimulate new home construction and first buyer activity.

“We’ve also increased the threshold for the

First Home Owners Grant by $100,000, meaning families can buy new homes valued

up to $750,000 and still remain eligible.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

NSW first homebuyers head west

Housing construction to peak in 2014

Vacancy rates on the rise

Debt reduction before fun when it comes to tax returns

SA property market upswing

Property promoters put on notice

Leave a comment

Comments

SA property market upswing

SA property market upswing

Posted on Monday, July 14 2014 at 10:37 AM

South Australia’s property market is on the upswing according to the Real Estate Institute of South Australia (REISA).

Adelaide’s

median house price recorded an increase of 3.98 per cent from $399,100 to a

record $415,000 over 12 months to June. It also increased 0.42 per cent over

the quarter.

REISA

president Ted Piteo says it’s positive news for the South Australian property

market.

“The

median price continues its upward trend on comparison from the same quarter

last year and the immediately preceding quarter,” he says.

And

the suburbs that have seen the most growth over 12 months were Glenunga,

Gulfview Heights and Eden Hills. Other big movers were St Peters, Hyde Park and

South Brighton.

The

top selling suburbs in terms of recorded sales over the June quarter were

Morphett Vale, Aldinga Beach and Paralowie.

Piteo

says Morphett Vale and Aldinga Beach continue to lead the pack in terms of

sales.

“Affordable

suburbs that offer premiums to first homebuyers and investors such as infrastructure,

quality transport avenues and a life by the sea will always be highly sought

after,” Piteo says.

The

unit and apartment market also saw an upward trend with a 1.59 per cent rise in

median price compared to the same quarter last year.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Housing construction to peak in 2014

Vacancy rates on the rise

Debt reduction before fun when it comes to tax returns

SA property market upswing

Property promoters put on notice

Tourism towns given a boost

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/jUEFNZEb-74/sa-property-market-upswing

Housing construction to peak in 2014

Housing construction to peak in 2014

Posted on Friday, July 18 2014 at 12:20 PM

The Housing Industry Association (HIA) says detached housing construction numbers will peak in Australia this year.

The HIA-RP Data Residential Land Report shows a 4.7 per cent decline in residential land sales between

March 2013 and March 2014.

Harley Dale, chief economist at the HIA, says

the flow-on for construction can’t be ignored.

“There’s a close relationship between

residential land sales and detached house starts,” he says.

“The indication is that the upcycle in

detached housing will peak during 2014.”

Over the six months to March 2014,

residential land sales were still up by 5.9 per cent when compared to the

six-month period to March 2013.

In the March 2014 quarter the weighted median

price of residential lots increased by two per cent to $205,248, marking only

the second time the value has exceeded the $200,000 threshold.

Capital city lot prices increased by 3.3 per

cent in the quarter to be up by 7.5 per cent compared to the March 2013

quarter.

Dale says the speeding up of land price

growth should be concerning.

“The upward trajectory for residential land

prices since mid-last year is steeper than it should be.

“There’s clearly a policy failure this cycle,

as in many before it, to ensure a supply of shovel-ready land commensurate with

the demand for new housing.”

Tim Lawless, a research director at RP Data,

says the results indicate house construction will not play as large a role in

the nation’s post-mining economy as first expected.

“Policy makers were placing a great deal of

importance on renewed levels of housing construction to act as a new pillar for

economic expansion,” Lawless says.

“While there has been uplift in approvals and

new housing starts, the trend towards fewer land sales since September last

year suggests that the housing construction cycle, at least for detached

housing, is close to peaking.”

Lawless has also expressed concern at the

results in light of strong property price growth in the New South Wales

capital.

“The ongoing rise in land prices at a time when

sales are falling is a worry, particularly in Sydney where the number of sales

over the March quarter was about level with the previous year but the median

price of land has moved 5.6 per cent higher over the year.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/K2NTN97yKp8/housing-construction-to-peak-in-2014

Vacancy rates on the rise

Vacancy rates on the rise

Posted on Wednesday, July 16 2014 at 2:17 PM

SQM Research has released figures revealing an increase in residential vacancy rates across the nation.

According to SQM, national

vacancies came in at 2.3 per cent in June – a rise of 0.1 per cent.

The vacancy rate for all

capital cities either rose or remained steady, except for Hobart, which experienced

a 0.2 per cent fall.

Perth’s

vacancy rate has risen dramatically from the June 2013 figure of 1.6 per cent,

to record a 2.3 per cent result for June this year.

Darwin

has similarly climbed in rental vacancies, doubling from a 0.8 per cent rate in

June 2013 to 1.6 per cent in June 2014.

Louis

Christopher, managing director at SQM Research, says a definite slowdown in the

nation’s rental market is occurring.

“At

this stage the market is increasingly favouring tenants across the country.”

Christopher

says vacancy rate increases are at their early phase in the cycle.

“While this is not yet a

rout for landlords, it certainly is at a stage where rents will unlikely rise

above inflation for the next 12 months.

“This

means that rental yields will continue to fall, thereby reducing the net cash

flows for new property investors in the marketplace.”

SQM

Research’s Asking

Rent’s Index has also revealed a monthly stagnation in the capital

city average asking rents with no change recorded month-on-month for houses,

and a 0.7 per cent decrease in asking rents for units.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Vacancy rates on the rise

Debt reduction before fun when it comes to tax returns

SA property market upswing

Property promoters put on notice

Tourism towns given a boost

Holland Park tops suburb searches

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/-3eyFFHhjrw/vacancy-rates-on-the-rise

Debt reduction before fun when it comes to tax returns

Posted on Monday, July 14 2014 at 3:01 PM

Australians who receive a tax refund this year will most likely to pay down existing debt, such as their mortgage or credit cards, according to a survey by non-bank mortgage provider, Homeloans.

When asked to identify all the ways they would spend a tax refund, 21 per

cent said they’d use it to pay down their mortgage, while one in three said

they’d put it towards other debt, such as their credit card. Just over one

quarter, 26 per cent, said they would invest any refund or put it into a

savings account.

The Homeloans poll also showed that debt reduction and investing aren’t the

only strategies on the list when it comes to tax refunds. Holidays and house

renovations (18 per cent and 13 per cent respectively) were also on

respondents’ wish lists.

The Australian Bureau of Statistics reported in May this year that

household debt in Australia is at its highest level since 1988. Australians owe

$1.8 trillion to lenders, a figure that’s the equivalent of $80,000 per person.

“The results of our survey show that far from being irresponsible with

their money, Australians are aware of the need to get their debt under control,

while shopping and holidaying are secondary considerations,” Homeloans’

national marketing manager Will Keall says.

In the 2012/2013 financial year, the average Australian taxpayer received a

tax return of around $2000, according to the Australian Tax Office (ATO).

“A sum of $2000 can make a big difference when paying off a credit card or

making a dent in your mortgage,” Keall says.

“Tax time is an opportunity to take stock of your finances and to look at

how any extra funds can benefit your financial situation.”

The Homeloans survey also revealed that nearly one third, or 31 per cent,

of respondents complete their tax return themselves.

Other respondents of the survey said they intend to put their refund

towards paying off their HECS debt, bolstering maternity leave savings,

childcare or school fees, weddings and honeymoons, council/land rates, and

buying solar panels for the home.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/cCX_VvU7sBw/debt-reduction-before-fun-when-it-comes-to-tax-returns

Holland Park tops suburb searches

Holland Park tops suburb searches

Posted on Tuesday, July 08 2014 at 9:14 AM

Holland Park has been named as the top Queensland suburb for online searches, according to new data.

The

top 10 Queensland suburbs that have the most people looking per listing,

according to realestate.com.au data were released at the weekend.

The

top suburbs are:

- Holland Park

- Newmarket

- Wilston’

- Camp Hill

- Stafford Heights

- Grange

- Spring Hill

- Mansfield

- Ashgrove

- Holland Park West

According

to the data, there’s little change to the Queensland suburbs this quarter with

the exception of emerging suburbs, Newmarket and Ashgrove, placed in second and

ninth place.

Demand

for property in Holland Park continues to grow with the suburb taking top

position once again as Queensland’s hottest suburb for potential sellers.

Piers

Crawford from Ray White Holland Park believes the suburb has a lot to offer.

“Holland Park has this vibrant feel about it,” he

says.

“A large number of young professionals are

moving to this area because of what it offers. Along with good schools and

transport, there’s always a new café popping up where people often flock to

during the week.”

Crawford says the area is also set for growth and further development.

“Having pockets of low medium density, there are

always active developers putting in new units or offices. Building

opportunities are growing with a development site having 14 offers within five

days. This was an absolutely fantastic result for the owner,” he says.

A

position in the top 10 list reveals increased buyer interest in the suburb

according to realestate.com.au’s Queensland sales manager, Ben Hodge.

“(The data) looks at supply and demand in each suburb and

ranks the suburbs based on ratio of buyer demand,” he says.

“A position in this list suggests that it could be

a good time for property owners in these areas to consider selling as there are

a high number of buyers looking for property in that area.

“Now potential vendors can make a more informed

decision when thinking of selling property.”

While

Holland Park kept first place, Stafford Heights has slipped from second to

fifth place since last quarter. Spring Hill and Holland Park West have both

moved down the list, to seventh and 10th place respectively.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/CemC4Y_UdP0/holland-park-tops-suburb-searches

Property promoters put on notice

Property promoters put on notice

Posted on Thursday, July 10 2014 at 12:09 PM

Anyone marketing investment property in Victoria has been warned to ‘play it straight’ with consumers about their legal rights.

Heidi

Victoria, the State’s Minister for Consumer Affairs, says her department is

working with regulators to examine the practices of property investment

promoters.

She says

nearly 20 investment property marketers have been contacted in relation to

compliance with Australian

Consumer Law.

“The Australian Consumer

Law provides cooling-off rights on contracts signed in certain

circumstances, and promoters must also ensure only true and accurate

information is given during seminar presentations.”

Victoria says when

potential investors attend a free seminar for information and advice they

shouldn’t be subject to a hard sell.

“Some

promoters are using high-pressure sales tactics at such seminars to push

training packages or educational services.”

The

Minister has urged potential buyers to be wary of those selling extraordinary financial

gains.

“If the claims

about the returns from the scheme sound too good to be true, they probably

are.”

Victoria says

consumers should be extra cautious when it comes to their retirement savings.

“Be

particularly wary of property investment promoters who advocate high-risk property

investment through self-managed super funds.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Property promoters put on notice

Tourism towns given a boost

Holland Park tops suburb searches

Financial year produces property price rises

Interest rates stay on hold

Darwin market steadies

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/7vrMHwGRxOw/property-promoters-put-on-notice

Property promoters put on notice

Property promoters put on notice

Posted on Thursday, July 10 2014 at 12:09 PM

Anyone marketing investment property in Victoria has been warned to ‘play it straight’ with consumers about their legal rights.

Heidi

Victoria, the State’s Minister for Consumer Affairs, says her department is

working with regulators to examine the practices of property investment

promoters.

She says

nearly 20 investment property marketers have been contacted in relation to

compliance with Australian

Consumer Law.

“The Australian Consumer

Law provides cooling-off rights on contracts signed in certain

circumstances, and promoters must also ensure only true and accurate

information is given during seminar presentations.”

Victoria says when

potential investors attend a free seminar for information and advice they

shouldn’t be subject to a hard sell.

“Some

promoters are using high-pressure sales tactics at such seminars to push

training packages or educational services.”

The

Minister has urged potential buyers to be wary of those selling extraordinary financial

gains.

“If the claims

about the returns from the scheme sound too good to be true, they probably

are.”

Victoria says

consumers should be extra cautious when it comes to their retirement savings.

“Be

particularly wary of property investment promoters who advocate high-risk property

investment through self-managed super funds.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Property promoters put on notice

Tourism towns given a boost

Holland Park tops suburb searches

Financial year produces property price rises

Interest rates stay on hold

Darwin market steadies

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/7vrMHwGRxOw/property-promoters-put-on-notice

Tourism towns given a boost

Tourism towns given a boost

Posted on Tuesday, July 08 2014 at 3:34 PM

Tourism locations around the country are gaining popularity, as more and more international travellers visit Australia.

Tourism arrivals are now at their strongest levels in 14 years,

according to CommSec.

“The number of Chinese tourists hit a record high of 761,600 in May, up

11.9 per cent on a year ago,” CommSec economist Savanth Sebastian says.

“In just under four years, the annual number of Chinese tourists to

Australia has doubled. And although the growth rate has slowed a touch in

recent months, China will still surpass New Zealand as our primary source of

tourists in around four years’ time.”

Sebastian adds the other important development is that overall tourist

arrivals are growing as the fastest pace in 14 years.

He suspects tourism numbers have been boosted by the improvement in the

global economy and also the mildly weaker Australian dollar.

So think Gold Coast, Sunshine Coast and Cairns – and with that,

hospitality jobs.

In fact, Sebastian believes there are clear signs of improvement in the

job market as the economy gathers momentum, underpinned by consumer spending

and housing construction.

“The Reserve Bank would be comforted by the lift in job advertisements,”

Sebastian says.

“However, it’s still early days in the recovery. And the Reserve Bank

Governor (says) the underlying strength in the Australian dollar continues to

hamper rebalancing efforts across the broader economy. While rates are on hold

and the central bank holds to a neutral setting, it’s likely that policy makers

will continue to jaw-bone. That is, talk down the Australian dollar.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Tourism towns given a boost

Holland Park tops suburb searches

Financial year produces property price rises

Interest rates stay on hold

Darwin market steadies

Budget release prompts calls for GST reform

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/S8BHp_lNBwc/tourism-towns-given-a-boost

$400m for Parramatta light rail

$400m for Parramatta light rail

Posted on Monday, June 23 2014 at 11:19 AM

Referred to as Sydney’s second CBD, Parramatta will soon see the progression of plans for its light rail system.

The

New South Wales Government has set aside $400 million from its major

infrastructure fund, Restart NSW, to accelerate work on the Western

Sydney light rail.

NSW

Premier and Minister for Sydney Mike Baird says plans for the light rail system

marks a new chapter in the agenda to reduce congestion.

“We’ve promised to transform this great state and

today’s major commitment for Western Sydney could provide a key missing

transport link and change the way people travel in and around Sydney’s west,”

he says.

The NSW Government will now also explore a number of potential light

rail routes including:

• Parramatta to Macquarie Park

via Carlingford.

• Parramatta to Castle Hill via

Old Northern Road.

• Parramatta to Liverpool via

the T-way.

• Parramatta to Bankstown.

• Parramatta to Sydney Olympic

Park.

• Parramatta to Rouse Hill.

• Parramatta to Ryde via

Victoria Road.

• Parramatta to Sydney CBD via

Parramatta Road.

• Parramatta to Macquarie Park

via Eastwood (proposed by Parramatta

Council).

• Parramatta to Castle Hill via

Windsor Road (proposed by Parramatta

Council).

Once the initial stage of work to find the best light rail route is

completed, a number of viable options will be taken forward for detailed design

and feasibility.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Financial year produces property price rises

Interest rates stay on hold

Darwin market steadies

Budget release prompts calls for GST reform

Positive results for Brisbane market

Sydney’s inner west outperforms the market

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/vuRVBGfvNHU/$400m-for-parramatta-light-rail