Sydney and Melbourne values continue to increase

Sydney and Melbourne values continue to increase

Posted on Monday, September 29 2014 at 1:01 PM

The Sydney and Melbourne markets have continued to shine in the month of August, according to new data from Onthehouse.com.au.

The Sydney property boom is still under way, with

house prices rising by 1.52 per cent over the past month.

The Melbourne house market also rose by 2.31 per

cent in August, which is the highest monthly growth rate seen in this market since March,

2013. Growth in the unit market

was also positive in August, at one per cent.

However, the overall national growth

rate has slowed, with growth in the house market falling from 0.86 per cent in

July to 0.02 per cent in August. Growth in the unit market has also dropped

during the same time period, from 1.62 per cent to -0.37 per cent.

The Brisbane and Perth house markets recorded the worst rates of growth in

August, with values dropping -1.70 per cent and -1.84 per cent respectively.

Consulting analyst for Onthehouse.com.au, John Edwards, says the Brisbane

housing market continues to defy the growth trend seen across other capital

city markets.

“Brisbane now offers an attractive affordable-lifestyle balance – and as

the Queensland Government repairs its balance sheet, job opportunities and

housing values will begin to increase,” he says.

“Melbourne has seen an unexpected increase in its August growth figures.

This is due to a predominately auction driven selling process that results in a

more volatile market. The quarterly trend report suggests that this number is

probably unsustainable, and I expect a more moderate growth rate to resume in

September.

“The Sydney market does seem to be slowing, although not as quickly as we

expected. Taking into account the median household income, the affordability

measure is now at historic heights, with loan repayments taking about 54 per

cent of the after tax income.

“The current median house price is now only $147,500 away from breaching

the million dollar mark. At this rate, we expect to hit this median within a

five-year period.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/wwDZE3WFbZM/sydney-and-melbourne-values-continue-to-increase

Sydney apartments to have fewer car spaces

Sydney apartments to have fewer car spaces

Posted on Tuesday, September 23 2014 at 11:26 AM

Homebuyers and investors trying to break into the booming Sydney market might soon find many off-the-plan apartments have fewer car spaces.

It’s part of new guidelines being introduced by the NSW Government, in a

bid to get more people to use public transport.

Minister for Planning Pru Goward is promoting the concept as saving

buyers up to $50,000, or roughly, the cost of a car space in Sydney’s market.

She says the NSW Government’s record investment in better public

transport is giving Sydneysiders more choice in where they want to live and how

they get around.

“The closer people live to public transport hubs, the less likely they

are to rely on cars,” Goward says.

“A car space can add up to $50,000 to the cost of a new apartment, so

providing more flexibility around car park requirements could lead to savings

of up to the same amount for homebuyers.

“Importantly, this change is restricted only to particular councils,

applies only to development within close walking distance of transport services

and strongly discourages councils from allowing residents of these buildings to

receive street parking permits.”

The areas include Ashfield, Auburn, Bankstown, Botany Bay, Burwood,

Canada Bay, Canterbury, City of Sydney, Hurstville, Kogarah, Lane Cove,

Marrickville, Leichhardt, North Sydney, Parramatta, Randwick, Ryde,

Strathfield, Waverley, Willoughby and Woollahra.

Updates to the policy and apartment design guidelines include:

– Ensuring every new apartment has a balcony

and access to well-designed and functional shared open space

– Allowing no car spaces in new apartment

buildings in certain council areas within 400 metres of a transport hub like a

train station or light rail stop

– Greater protections from noise in

surrounding streets

– More flexibility around design to suit

particular sites

– Independent design experts to provide

advice to councils

– Extension of the policy to include mixed

use and shop-top housing

– A minimum size of 35 square metres for

studio apartments

– New sections dealing with the adaptive reuse

of buildings to apartments.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/R8PJAv2oG5I/sydney-apartments-to-have-fewer-car-spaces

House price growth far from over

House price growth far from over

Posted on Monday, September 22 2014 at 12:58 PM

The housing market recovery is far from over according to this year’s national outlook report by SQM Research with growth forecast to continue for the remainder of 2014 and into 2015.

SQM

Research predicts continued price rises for Sydney of between eight to 12 per

cent.

The

forecast takes into account where the economy is steady, interest rates remain

unchanged and the AUD stays above US85 cents.

The

SQM Research base case forecast for the remainder of 2014 and 2015 is:

SQM

Research managing director Louis Christopher says the market is somewhat

overvalued.

“But

not by as much as what some have very publicly stated,” he says.

“I

don’t believe at this stage the market is in a bubble. Some cities are heading

into overvalued territory, but the point overall is the market is far from a

bubble situation when taking into account historical valuations over the past

30 years.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

House price growth far from over

First homebuyer numbers continue to fall

Victorian first homebuyers receive half-price stamp duty

Interest rates on hold

Perth market remains steady

Mosman home to number one million-dollar street

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/82SgKpz-gm8/house-price-growth-far-from-over

First homebuyer numbers continue to fall

First homebuyer numbers continue to fall

Posted on Wednesday, September 10 2014 at 1:48 PM

The Real Estate Institute of Australia (REIA) says the Australian Bureau of Statistics (ABS) July 2014 housing finance data shows first homebuyer activity is at a record low.

Peter

Bushby, president of the REIA, says the softening is becoming entrenched.

“The proportion of first home buyers, as part of the total

owner-occupied housing finance commitments, fell to 12.2 per cent compared to

13.2 per cent in June.

“This is the lowest since the series commenced in July 1991.”

Bushby says the rest of the ABS numbers show relatively flat performance

for the month.

“In

trend terms, the number of commitments for new dwellings purchases increased by

1.3 per cent while construction of new dwellings decreased three per cent and

the purchase of established dwellings decreased by 0.1 per cent.”

Investors

again showed they are a driving force in property across the nation, Bushby

says.

“The

value of investment housing commitments again increased by 1.2 per cent in

July, following over three years of consecutive monthly increases.”

Bushby

believes the fall in first homebuyers should be more worrying for policymakers.

“This figure for first homebuyers is very concerning and governments

need to look at the issues impacting on this important group.

“There’s a chronic under-supply of housing, and added to this, many

state and territories have abolished homebuyer grants for established dwellings

which has further undermined the confidence this group needs to enter the

market.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

First homebuyer numbers continue to fall

Victorian first homebuyers receive half-price stamp duty

Interest rates on hold

Perth market remains steady

Mosman home to number one million-dollar street

Million dollar smiles

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/5FXtJCJMRGU/first-homebuyer-numbers-continue-to-fall

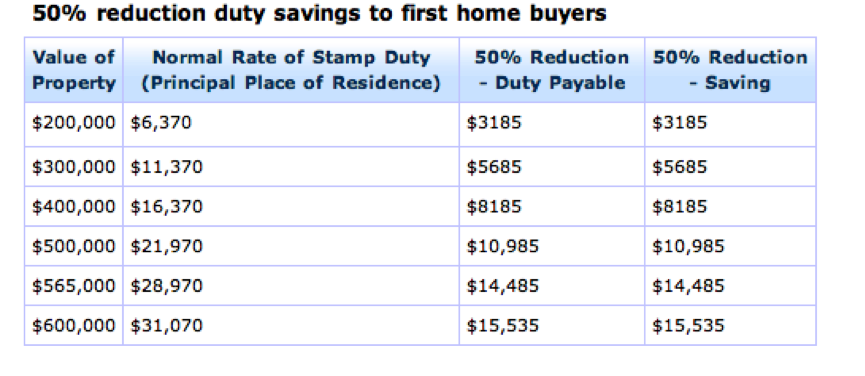

Victorian first homebuyers receive half-price stamp duty

Posted on Wednesday, September 03 2014 at 3:32 PM

Qualifying first homebuyers in Victoria now receive a 50 per cent discount on their stamp duty as part of a phased in scheme.

A

final 10 per cent increase in the concession this week completes a stepped

programme initiated in July 2011.

According

to the State’s treasurer, Michael O’Brien, the move will stimulate activity in

the sector.

“This makes home ownership more affordable,

especially for young Victorians looking to buy their first home.”

The concession applies to the purchase of new

or established homes valued below $600,000.

According to the Government, almost 60,000

eligible first homebuyers have benefited from the stamp duty concession in

Victoria since it was introduced.

“This tax cut will save 26,000 Victorians

around $200 million over the next year.

“This boosted stamp duty concession will make

home ownership more affordable and support jobs by stimulating the housing

construction industry.”

O’Brien says the Government is providing

further support with the $10,000 First Home Owner Grant (FHOG) for newly

constructed homes.

The FHOG applies in addition to the stamp

duty concession, but does not include established home purchases.

“From 1 September, an eligible first home

buyer purchasing a new $600,000 house and land package will receive a combined

stamp duty cut and FHOG worth $25,535.”

Source: State Revenue Office of Victoria

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Victorian first homebuyers receive half-price stamp duty

Interest rates on hold

Perth market remains steady

Mosman home to number one million-dollar street

Million dollar smiles

Rental market continues to slow

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/UwI1_ho9zyA/victorian-first-homebuyers-receive-half-price-stamp-duty

Perth market remains steady

Perth market remains steady

Posted on Friday, August 29 2014 at 4:30 PM

Perth’s median house price remains steady for the month of August according to data from the Real Estate Institute of Western Australia (REIWA).

REIWA

president David Airey says sales turnover has slumped but metropolitan prices

showed no movement, remaining at $540,000.

“Turnover for houses is down by almost 25 per

cent for the three months to August, however there’s always a seasonal dip in

sales during the winter months and this tends to pick up as we head into spring

weather,” he says.

Sales were weakest through the cities of Stirling,

Fremantle, Vincent, Kwinana and the western suburbs. Low consumer confidence has

had an impact on the market according to Airey.

“The number of properties on the market is up by

one per cent for the month of August,” he says.

Listings

increased the strongest through the cities of Bayswater, Bassendean, and the City of Vincent. Listings through the northern end

of Joondalup fell most strongly.

The

rental market shows signs of stabilisation, says Airey, with no change in the

median rent.

“This is steady at $450 per week despite the

high vacancy rate of 4.2 per cent in the three months to August,” he says.

The number of rental listings is up by 47 per

cent on the same time last year, with 5903 properties currently on the market.

“While these listings came down a little for the

month of August, they had increased through June and July by around 10 per

cent. Many of these new rentals were through Joondalup, Wanneroo, Armadale and

Cockburn,” Airey says.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Ap3qoIT41MA/perth-market-remains-steady

Top affordable inner city suburbs

Top affordable inner city suburbs

Posted on Friday, August 15 2014 at 1:31 PM

They say buying the right property close to the CBD pays. But generally property prices in these central locations can hurt the hip pocket in comparison to purchasing further afield. Investors and owner-occupiers could be delighted by RP Data’s latest findings revealing affordable inner city suburbs do still exist.

RP

Data research analyst Cameron Kusher highlights the top five most affordable

suburbs for houses and units within 10 kilometres of Australia’s capital

cities.

“Inner city suburbs are also generally better

serviced by both essential and desirable amenities such as schools, medical

services, shopping centres, social amenity, roads and public transport

infrastructure,”

he says.

There’s a large divergence in results across the

cities, when looking at the most affordable median value suburbs in close

proximity to the CBD. Sydney’s Wolli Creek, for example, has the lowest median

house value at $710,303 (which is not very affordable) but in Melbourne the

most affordable suburb is Bellfield at $533,252. In most other capital cities,

except for Darwin the starting point for a house is significantly lower.

In many cities these areas are less desirable

than other inner city suburbs however they’re close to the city and potentially

have scope for urban renewal over the coming years says Kusher.

“Home values in inner-city areas are likely to

continue to increase particularly as mortgage rates remain at such low levels,”

he says.

And as a result more and more potential buyers

are likely to be priced out of the inner city housing market.

“This scenario creates good opportunity for

other city areas – if buyers can’t afford to purchase a home within the inner

city, they will most likely look to those locations that tick as many of the

inner city boxes, just at a lower price point than the inner city areas,” he

says.

“Given this, suburbs featuring quality public

transport connections, abundant retail and social amenity, quality schools and

medical amenity will likely see renewed interest as inner city buyers look to

these more affordable alternatives.”

Most affordable

suburbs within 10km of capital city CBDs

(As of June 2014)

HOUSES UNITS

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/UytzTPrRzJU/top-affordable-inner-city-suburbs

Mosman home to number one million-dollar street

Mosman home to number one million-dollar street

Posted on Monday, August 25 2014 at 1:44 PM

It’s no surprise Sydney is home to an increasing number of million dollar streets. And the blue-chip and highly sought after suburb of Mosman, on the Lower North Shore, has been revealed as one of the best destinations for million dollar houses.

Raglan Street, which runs off the shopping precinct on

Military Road and all the way down to the ferry terminal, is hot property and

the number one street in all of Sydney and Australia, according to

Onthehouse.com.au.

Consulting analyst John Edwards says while Raglan Street is

ranked the top street, the suburb of Mosman itself came in as the state’s 11th

wealthiest for percentage of million-dollar homes (with 99.87 per cent of

houses in the millionaire’s club).

Balgowlah Heights, Clontarf, Cremorne Point, Duffys Forest,

Henley, Huntleys Point and Huntleys Cove all ranked joint first on the scale,

with a hit rate of 99.99 per cent.

“It’s no surprise to see so many of New South Wales’ suburbs

housing some of Australia’s most expensive properties,” he says.

“Within the top 10, no suburb drops below 99 per cent, and

while Mosman didn’t make the top 10, the fact it hosts Australia’s number one

street cements its position as one of Australia’s most prosperous localities.”

He adds you don’t necessarily have to live in Mosman or

Vaucluse to boast a million dollar home anymore either.

“Many more properties are breaking through the million

dollar value. The fact is, many of our property millionaires may not even know

the value of their property. Based on our findings, we expect to see more

suburbs emerge as millionaire property hotspots over the coming year.

“It was interesting to note that Castle Hill topped the

chart as the suburb with the largest increase in million dollar properties over

the last 12 months, closely followed by Ryde, Epping, Cherrybrook and

Carlingford.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Yt9RSVt-P8U/mosman-home-to-number-one-million-dollar-street

Million dollar smiles

Million dollar smiles

Posted on Friday, August 22 2014 at 1:15 PM

Australia’s million-dollar property club has exploded to 417 suburbs with a median value of $1 million or more.

As of June this year there were 397 suburbs nationally with a median

house value in excess of $1 million and 20 suburbs for units. The 417 total

suburbs with a median value of $1 million or more is the highest number over

the past five years. Sydney led the pack claiming the majority of market share

with 22 suburbs ranked in the top-performing list out of 25.

RP Data’s findings

show values have increased by 10.2 per cent over the 12 months to July 2014. RP

Data research analyst Cameron Kusher says the large rise in the numbers of

suburbs with a $1 million or more median in NSW alone is reflective of the

strong home value growth in Sydney over the past year.

“Sydney home values have increased by 14.8 per cent over the 12 months

to July 2014,” he says.

“Proportionately, Sydney suburbs comprise 61 per cent of all million dollar

plus suburbs nationally, followed by Melbourne at 14 per cent and Perth at 12

per cent.”

Significantly the number of suburbs with a median value of more than $2

million has also increased to 42 suburbs from 37 suburbs last year.

The number of suburbs with a $1

million median house price is up 42 per cent over the year in New South Wales.

There’s been a 24 per cent rise in Victoria, 25 per cent increase in

Queensland, 44 per cent rise in South Australia, 22 per cent rise in Western

Australia, no change in the Northern Territory and a 11 per cent fall in the

Australian Capital Territory. And Tasmania has zero suburbs with a median value

of $1 million or more.

And the rise in suburbs with a million-dollar plus price tag is good

news for those who own a property in these areas. Kusher says low mortgage

rates have been creating a surge in market activity and higher values,

particularly in Sydney, is becoming more prevalent.

“Although we anticipate the rate of value growth is likely to slow over

the coming year, we do expect further increases,” he says.

Number of suburbs

with a median value of $1million or more – to June

Jun- 12 Jun-13 Jun-14

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Million dollar smiles

Rental market continues to slow

Top affordable inner city suburbs

Borrowers shun fixed loans

Renovation revolution

Interstate migration slows

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/A3HDIQwFlj8/million-dollar-smiles

Rental market continues to slow

Rental market continues to slow

Posted on Wednesday, August 20 2014 at 4:08 PM

Data released by a leading analyst confirms an overall slowing in the national rental market.

A

report by SQM Research says their latest analysis of rental vacancies and

asking prices shows the number of residential vacancies nationally decreased

slightly during July, recording a stable vacancy rate of 2.3 per cent

nationally.

“Higher

vacancies of course, allude to an increase of supply in the rental market,

shifting the balance of power from landlords to tenants,” the report says.

On

a city-by-city basis, the results were mixed with Perth and Darwin’s vacancies increasing

since July 2013, and Hobart’s dropping dramatically over the same period.

Sydney

and Melbourne have remained flat while Brisbane has seen a rise over the 23-month

period.

SQM

Research’s Asking

Rents Index revealed rental asking prices have only lifted by 0.7

per cent for houses and 0.6 per cent for units nationally since the same week

in 2013.

“This

reveals that the expectation of landlords has stagnated on a national level,

with Darwin and Sydney being the only two capital cities to record substantial

increases in asking rents since this time last year, and Perth and Canberra

both recording considerable decreases during the same period,” the report says.

Louis

Christopher, managing director of SQM Research says they expect the market to

continue to weaken.

“The

rental market overall remains sluggish with asking rents showing rises of just

1.2 per cent to 1.7 per cent at the average capital city level.”

Christopher

says Perth’s rents have dragged down the overall result.

“It’s

quite clear rents in Western Australia are falling quickly.

“Given

our view that vacancy rates are likely to rise from these levels, we are

expecting a soft rental market for quite some time and certainly, well into

2015.”

The

full results as published on www.sqmresearch.com.au are:

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Rental market continues to slow

TOP AFFORDABLE INNER CITY SUBURBS

Borrowers shun fixed loans

Renovation revolution

Interstate migration slows

Brisbane winter breaks 23-year growth drought

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/SW00-Z8U_Ec/rental-market-continues-to-slow