RBA cuts rate in first announcement of year

RBA cuts rate in first announcement of year

Posted on Tuesday, February 03 2015 at 1:58 PM

The Reserve Bank of Australia (RBA) has today announced it is lowering the cash rate by 25 basis points to 2.25 per cent.

RBA governor Glenn Stevens says: “For the past year and a

half, the cash rate has been stable, as the Board has taken time to assess the

effects of the substantial easing-in policy that had already been put in place

and monitored developments in Australia and abroad.

“At today’s meeting, taking into account the flow of recent

information and updated forecasts, the board judged that, on balance, a further

reduction in the cash rate was appropriate.

“This action is expected to add some further support to demand,

so as to foster sustainable growth and inflation outcomes consistent with the

target.”

CoreLogic RP Data’s Tim Lawless says in reaction to the news:

“The decision by the Reserve

Bank to cut the cash rate by 25 basis points is likely to take the typical

standard variable mortgage rate down to 5.7 per cent and discounted variable

rates to 4.85 per cent; the lowest cost of mortgage debt since July 1968.

“Lower

mortgage rates have the potential to add some fuel to what are already strong

housing market conditions (dwelling values Australia’s capital cities have

already increased by 19.6 per cent since interest rates started falling back in

November 2011), however the stimulus from lower rates may not be as influential

on housing market conditions as what we have seen in the past.

“Lower

consumer confidence, stricter serviceability requirements for borrowers,

tighter lending conditions for investors, affordability challenges and low

rental yields are all factors that may contribute to the moderation in housing

market conditions over 2015.

“The

ideal outcome for the Reserve Bank under the new interest rate setting would be

that housing market conditions continue to moderate back to more sustainable

levels, but housing demand remains strong enough to keep dwelling construction

at the current high levels and new home sales relatively high.

“The

challenge for the Reserve Bank is to stimulate stronger economic growth without

over stimulating the housing market.”

Loan

Market chairman Sam White has concerns about the long-term effect new cuts to

the interest rate will have on house price growth: “Today’s rate cut is

certainly a game changer for the property market.

“Together

with limited supply of new properties on the market, the RBA’s decision will

most likely prolong strong sales results.

“However,

the issue remains around the long-term sustainability of the market if the

current imbalance between supply and demand of houses continues.”

Real

Estate Institute of New South Wales president Malcolm Gunning says: “We believe this decision will help with consumer

confidence, however while the property market will continue to benefit from the

low interest rate environment, growth levels seen in 2014 are not expected to

continue this year.”

Mortgage Choice spokesperson Jessica Darnbrough

says last month’s disappointing consumer sentiment result combined with a

recent spate of poor economic data ultimately forced the RBA to take action and

cut the cash rate.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/t8bYDB8sHYk/rba-cuts-rate-in-first-announcement-of-year

Price gap fuels unit demand

Price gap fuels unit demand

Posted on Monday, February 02 2015 at 10:59 AM

Demand for attached housing is partly driven by the widening price gap between capital city houses and units prices according to one analyst.

CoreLogic

RP Data have released research showing the value difference between attached

and detached accommodation continues to expand.

Tim

Lawless, research director at CoreLogic RP Data, says price disparity has never

been greater in Sydney, Melbourne and Canberra, while Brisbane and Perth are

also near record highs.

“This

certainly goes some way to explaining why we’re seeing record high dwelling

commencements for units.”

Lawless says there

are a large number of units being constructed in Sydney, Melbourne and Brisbane

in particular.

“Growing demand for

unit stock, both from investors and owner-occupiers, and the sheer

affordability difference between house and unit prices at least partly explains

this growing level of demand.”

The price

differentials according to CoreLogic RP Data are:

Sydney $243,000 Canberra $172,000

Melbourne $170,000 Adelaide $87,800

Brisbane $102,000 Hobart $80,000

Perth $110,000 Darwin $32,000

Lawless warns that

given the lag between approval and construction, there’s potential to

oversupply the market.

“The

challenge will be to ensure that overdevelopment doesn’t occur – demand has

increased for higher density housing stock but the level of apartment

development currently taking place is unprecedented.

“It’s important to remember that units have typically been

the domain of investors rather than owner-occupiers.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/yXbhxSDtrII/price-gap-fuels-unit-demand

Sydney market keeps firing

Sydney market keeps firing

Posted on Thursday, January 29 2015 at 9:24 AM

The New South Wales capital continued to be the nation’s outstanding market performer, according to the Domain Group.

The analyst’s House Price Report for the December quarter of last year shows the

nation’s housing price rose by 2.1 per cent.

Dr Andrew Wilson, senior economist at Domain,

says Sydney’s 4.1 per cent gain for housing and 2.9 per rise for units were the

standout numbers.

“This quarter’s strong national results are largely

due to the momentum of the Sydney market, which is still achieving consistently

strong growth.

“Thanks to its status as the strongest capital

city economy with high migration levels, a chronic shortage of housing and

heady levels of confidence from buyers and sellers, Sydney remains the dominant

force amongst the capital cities.”

Other capitals also saw value rises at the end

of 2014, with all but Darwin recording positive gains.

Brisbane, Perth, Canberra and Hobart all experienced

a rise of more than one per cent.

Melbourne’s 0.6 per cent and Adelaide’s 0.1 per

cent gains were less dramatic, but still in the right direction.

“Melbourne’s modest

results were not surprising given declining local auction clearance rates and

weakening ABS home loan data recorded over spring.”

Darwin’s six per cent fall in values

demonstrates a slowdown in the previously runaway market.

Wilson says to expect a further quieting in

markets, with rate cuts unlikely to influence buyers in 2015.

“Within an environment

of stagnant national economic growth, house price cycles are set to generally

flatten in most capital cities with the exception of Sydney,” he says.

“Further rate cuts,

should they occur, will likely have a minimal impact on housing affordability.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Lvr5j8BnFLY/sydney-market-keeps-firing

School catchment premiums quantified

School catchment premiums quantified

Posted on Wednesday, January 21 2015 at 3:08 PM

Demand for homes in close proximity to highly regarded schools is generating a five per cent value premium, according to one real estate group.

Raine

Horne have released opinion that parents are paying handsomely to secure a

good education for their children.

“With

websites such as myschool.com.au keep tabs on the academic results of schools.

Parents are paying premiums of up to five per cent for a home located close to

school grounds,” Angus Raine, executive chairman of Raine Horne says.

Raine

says Sydney’s North Shore is a good example of the way education helps

recession-proof a suburb.

“This area is an evergreen for sales –

almost irrespective of market conditions.

“The abundance of sought-after schools

in the area including Knox, Barker, Riverview and Pymble Ladies College,

underpins much of the strength of the North Shore market.”

The effect travels across borders to

include schools that offer not just high academic results, but specialist

curriculum, too.

Wellers Hill State School in the

Brisbane suburb of Tarragindi has introduced a bi-lingual education program

that has garnered a lot of interest from family buyers, according to Russell

Matthews of Matthews Real Estate.

“They’re asking specifically for houses

in the catchment.

“One buyer just the other day said she’d

been looking for about five months specifically in the catchment for Wellers Hill.”

Matthews says the premium will rely on

each property’s characteristics, but certainly there’s a school ‘bonus’ for

sellers.

“It’d really go on a case by case basis,

but that buyer would’ve paid an extra $20,000 to $30,000, which is close to the

five per cent mark.”

Property academic Peter Koulizos says

that the premium has a ceiling.

“It’s really only families with

school-age children that would be willing to pay you extra.

“If it’s a $500,000 house normally would

they be prepared to pay $550,000? I don’t think so. Would they be prepared to

pay $520,000 to $525,000? Probably.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/uteW1eBT8do/school-catchment-premiums-quantified

Second consecutive rise for home sales

Second consecutive rise for home sales

Posted on Friday, January 23 2015 at 10:48 AM

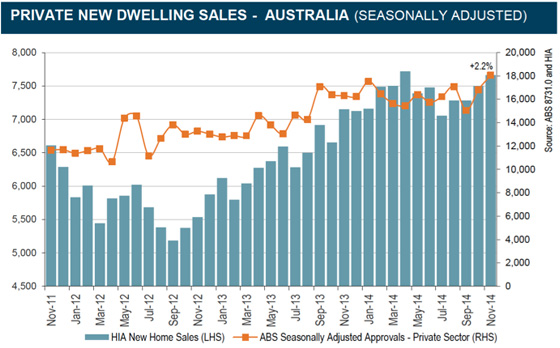

The latest result for the HIA New Home Sales Report, a survey of Australia’s largest volume builders, highlights a second consecutive rise for sales in the month of November 2014.

“Renewed

upward momentum in the multi-unit segment drove growth in overall new home

sales in late 2014, a trend unlikely to be reversed when the December result

comes through,” HIA chief economist Harley Dale explains.

“Total

seasonally adjusted new home sales increased by 2.2 per cent in November last

year following a lift of three per cent the previous month,” Dale notes.

“Sales

of multi-units surged in both October and November to reach their highest level

since September 2003. Detached house sales dipped by 1.5 per cent in November 2014

and are not displaying the upward punch of their multi-unit counterpart.”

Dale

continues: “Upward momentum was evident in both detached house and ‘multi-unit’

construction in 2013/14. However, more recently momentum has been concentrated

in multi-units in a situation akin to stage one of the current up-cycle back in

2012/13.

“The

key leading indicator measures of building approvals and new home sales suggest

this re-concentration of growth in the ‘multi-unit’ segment will persist into

2015.”

“A

focus on housing policy reform would greatly assist in rebalancing the table,

providing a further burst of growth in detached house construction which would

at the same time provide productivity gains for the broader Australian economy.

That should be a policy no-brainer,” Dale says.

In the month of November 2014, detached house

sales increased by four per cent in Victoria, 16 per cent in Queensland, and

0.3 per cent in South Australia. Detached house sales fell in November in New

South Wales (-5.6 per cent) and Western Australia (-10.6 per cent, following a

+24.8 per cent result in October).

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Second consecutive rise for home sales

School catchment premiums quantified

Assessment system ripe for change

Lack of discipline hitting property dreams

WA has most loss-making resales

Aussies now face $1m price tag for homes

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/3ZsqkaE01ws/second-consecutive-rise-for-home-sales

Assessment system ripe for change

Assessment system ripe for change

Posted on Monday, January 19 2015 at 1:44 PM

The Property Council of Australia is calling for reform of Queensland’s planning and development assessment system, saying it’s needed to reduce the cost of new housing for Queenslanders.

Prior

to the last State election, Queensland’s planning and development assessment

system was rated the second worst in the country, according to Chris Mountford,

Queensland executive director of the Property Council.

“Over

the past two years the State Government has set about reforming the planning

system, with a number of positive actions already undertaken,” he says.

“The

introduction of the State Assessment and Referral Agency (SARA) to coordinate

state planning referrals has been a particularly welcome change.

“However,

planning reform is unfinished business from the government’s first term and we

are calling on all parties to commit to making it an election priority.

“Importantly,

planning reform needs to ring true with local governments if it is to have any

real impact. And this is yet to happen.”

Mountford

says that local government planning schemes need to be a key area of focus for

reforms.

“Planning

schemes are key planning documents in Queensland. They determine where building

can occur and to what scale, and how applications will be assessed.

“But

the fact is that these schemes are now excessively complex. We have seen recent

local government schemes in excess of 4500 pages.

“Whether

you’re renovating your house, or looking to develop a whole residential estate,

wading through this mire of local laws adds time and money to your project.

“At

the end of the day, complex local planning laws add to the cost of building a

house in Queensland.

“This

complexity also reduces the community’s ability to have their say on changes to

local planning laws. How can any member of the community be expected to digest

such complicated rules and regulations to determine how the scheme will affect

their local area?”

The

Property Council is calling on all parties to commit to a new step in the

planning scheme approval process – an independent review made available to the

public.

“An

independent review of council schemes should not only assist in making them

simpler to understand,” Mountford says, “it will also provide certainty for the

local government that the outcomes of their scheme will meet their desired

intent. Additionally, it’ll provide the community with further opportunity to

understand any major changes being proposed in their local area.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/FIqVP0nTEx8/assessment-system-ripe-for-change

WA has most loss-making resales

WA has most loss-making resales

Posted on Thursday, January 15 2015 at 9:19 AM

Regional Western Australia surpassed regional Queensland for recording the highest proportion of loss-making resales in the September quarter 2014, according to CoreLogic RP Data.

In its latest Pain Gain report, the company says

regional Western Australia recorded 22.5 per cent of all resales at a loss

while regional Queensland followed at 22 per cent.

Cameron Kusher,

research analyst at CoreLogic RP Data, says the results are connected to slower

activity in mining.

“Recent data

highlights the growing weakness in markets linked to the mining and resources

sector where values are generally falling.”

Based on the report

findings, loss-making resales trended lower in Sydney, Melbourne, Brisbane,

Adelaide and Hobart.

In Perth, Darwin and

Canberra an upward trend was recorded.

The

report says nationally, the proportion of

loss-making resales has peaked and is slowly trending lower.

“These trends are reflective of overall market conditions where values

are still trending higher in most cities, but conditions appear to be slowing

quite rapidly in Perth, Darwin and Canberra.”

According to the report, 9.3 per cent of all

home resales recorded a gross loss compared to their previous purchase price

during the quarter.

“The figure increased slightly from nine per

cent over the June 2014 quarter, but was much lower than the 11 per cent

recorded over the September 2013 quarter.”

The total value of these loss-making resales

over the period was $383 million and the average loss was $62,246.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Lack of discipline hitting property dreams

WA has most loss-making resales

Aussies now face $1m price tag for homes

Rental figures remain flat

Demand drops for fixed-interest loans

2015 outlook mainly positive

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/YU5JX-sJJow/wa-has-most-loss-making-resales

Lack of discipline hitting property dreams

Lack of discipline hitting property dreams

Posted on Friday, January 16 2015 at 10:41 AM

Most property investors know that if you want to play the game right, saving up some cash is going to have to come into play somewhere along the line.

However, a recent survey of Australians’ savings

intentions, undertaken by ME Bank, has found that a lack of money discipline is

keeping many Australian households from realising their financial goals.

According to the figures, about 59 per cent of

Aussie households don’t consistently set a budget and 41 per cent don’t

regularly stick to one.

What’s more, only 38 per cent of Australian

households kept written or electronic records of their monthly expenses in the

past six months – information that builds realistic and effective budget plans.

“Good savings habits require commitment to

detail and discipline,” ME Bank’s Nicolas Emery says.

“But it’s easy to resolve: you just need to

track the real costs of your household expenses, set a realistic budget and

commit to every single detail, consistently.”

In addition to budgeting discipline going awry,

about 46 per cent of Australian households reported they were credit card

‘revolvers’, never or rarely paying off their debt in full; and almost 20 per

cent failed to consistently pay off their household bills on time.

“Real problems start to occur when you get stuck

in a roundabout of not paying your credit card or bills on time,” Emery says.

“We strongly advise anyone struggling with

credit card debt after Christmas, or any time of the year, to address the issue

as soon as possible.

“Consolidating debts… can remove you from the

interest payment roundabout. Once you’re in a position to start saving,

consider making automated deposits into a high-interest savings account or term

deposit to keep you on track.”

Perhaps not too surprisingly, younger generations are less likely to follow good habits

– 72 per cent of gen-Y didn’t or rarely kept a record of monthly expenses, and

67 per cent didn’t or rarely set a weekly or monthly budget.

Despite our record-low interest rates, people’s

financial goals infer a somewhat cautionary or conservative approach, with

three out of the top four financial goals related to paying off debt.

These included ‘paying off a mortgage and/or

debt as fast as possible’ and ‘saving for a rainy day’.

Investors are more confident buying an

investment property this year than those saving enough to buy a property to

live in.

Seven per cent of respondents expect to pay off

their mortgage this year, while 14 per cent of gen-Y and 26 per cent of gen-X

expect to reach their goal of buying a home (compared to 18 per cent overall).

Forty-one per cent expect to reach their goal of buying an investment property.

Apparently we’re using a range of savings

strategies, although a manual savings method was the most popular approach.

Forty-seven per cent transfer money to a savings account when spare funds are

present, 22 per cent set up an automatic transfer to a savings account and 21per

cent pool money into a savings account, transferring an allowance to a

transaction account. Meanwhile, 17 per cent keep savings in accounts with

withdrawal restrictions (i.e. term deposits) and 16 per cent add funds to a

home loan offset account.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/KuO92HeTlfo/lack-of-discipline-hitting-property-dreams

Aussies now face $1m price tag for homes

Aussies now face $1m price tag for homes

Posted on Monday, January 12 2015 at 12:38 PM

The Australian dream of homeownership carries a

$1 million price tag for many, following new research by comparison website finder.com.au.

The research found that Australians with a mortgage of at

least $489,300 will spend $1 million over the life of a 30-year loan (using the

average variable interest rate of about 5.5 per cent).

If this mortgage size is 80 per cent of the property’s value,

any property priced from $611,625 will end up costing borrowers $1 million.

Michelle Hutchison, Money Expert at finder.com.au, says many

borrowers are being stung by this slow-burning hole in their hip pocket.

“When borrowers look at how much they can afford to repay for

a home loan, they might not look down the track to how much they end up

spending. The danger lies with spending a lot more than necessary.”

“While it’s likely that your home will increase in value over

a 30-year loan term, it might not compensate the cost of a home loan as the

money you end up spending can be greatly increased if you have a small deposit

and don’t shop around for a good value deal,” she says.

Sydney tops the list for the most expensive median house

price of $825,000 according to figures by CoreLogic RP Data. For this price

tag, borrowers will hit the $1 million mark by year 11, based on the average

variable rate of about 5.5 per cent with a 20 per cent deposit, which would

mean a loan size of $660,000.

For the

median-priced house in Melbourne of $633,000, a mortgage of $506,400 (with a 20

per cent deposit) would cost borrowers $1.035 million over 30 years – hitting

the $1 million mark by year 24.

“This

research was based on the average variable rate of about 5.5 per cent but

borrowers need to remember that there’s a big difference between what lenders

are offering, which can mean bigger costs for a home if you’re not careful,”

Hutchison says.

“Take

advantage of the online tools and comparisons of different home loans to help

you find the best value deals.”

Click here

for API’s raft of calculators and tools.

Total cost to buy a median-priced house

with a 20% deposit

Source: ranked by highest median house prices, price

figures from CoreLogic RP Data, calculations and analysis by finder.com.au, based on average variable home loan

interest rate of 5.5%, 30-year loan term and 20% deposit

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/GKUo0to2q9o/aussies-now-face-$1m-price-tag-for-homes

Rental figures remain flat

Rental figures remain flat

Posted on Friday, January 09 2015 at 2:16 PM

The CoreLogic RP Data Rental Review, released this week, has confirmed that while dwelling values continue to increase, rental growth is sitting at its lowest annual rate in more than a decade, with combined capital city rents increasing by just 1.8 per cent over the past 12 months.

According

to the key quarterly findings, capital city advertised rents remained unchanged

over the final quarter of 2014, with house rents steady at $430 per week and

unit rents recorded at $410 per week. Across Australia, house rents increased

by 1.3 per cent to $400 per week, while unit rents were unchanged over the

three months to December at $390 per week.

Tasmania

saw the most impressive change for houses, with Hobart rents rising by the most

– 5.4 per cent over the three-month period. Brisbane, meanwhile, had a 2.5 per

cent rise in house rents, Sydney had just one per cent and Melbourne saw no

change whatsoever.

Performance

in units was somewhat weaker, with all capitals except Hobart and Brisbane

recording a fall or staying the same.

The

review also revealed that annual advertised rents are now 2.6 per cent higher

than they were in December 2013 for both houses and units, while across the

combined capital cities house rents have risen by 1.2 per cent, compared to a

stronger level of growth for unit rents, which rose by 2.5 per cent.

CoreLogic RP Data research

analyst Cameron Kusher says that rental rates across the combined capital

cities have remained flat in 2014, which is the most subdued the rental market

has been since the mid-2000s.

“While rental growth remains

slow, rents still increased over the year in most cities, with Perth, Darwin

and Canberra the exceptions,” he says.

“Given the recent high

number of dwelling approvals and commencements coupled with the high level of

purchase activity from investors, we would anticipate that the rate of rental

growth will remain soft throughout 2015.

“Rental market activity will

be largely dependent on what takes place outside of the housing market as

broader economic conditions remain mixed,” he says.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/hb7a5UCSVGA/rental-figures-remain-flat