RBA leaves cash rate unchanged for March

RBA leaves cash rate unchanged for March

Posted on Tuesday, March 03 2015 at 1:51 PM

In a move many industry experts had been predicting, the Reserve Bank of Australia (RBA) announced today that it will not be amending the cash rate, so it still stands at 2.25 per cent.

It was felt by many that the

RBA would wait at least a month to see what effect the February cuts had had.

Governor Glenn Stevens said

in his statement: “The available

information suggests that growth is continuing at a below-trend pace, with

domestic demand growth overall quite weak. As a result, the unemployment rate

has gradually moved higher over the past year. The economy is likely to be

operating with a degree of spare capacity for some time yet. With growth in

labour costs subdued, it appears likely that inflation will remain consistent

with the target over the next one to two years, even with a lower exchange

rate.”

He went on: “Credit is recording

moderate growth overall, with stronger growth in lending to investors in

housing assets. Dwelling prices continue to rise strongly in Sydney, though

trends have been more varied in a number of other cities over recent months.

“The Bank is working with other

regulators to assess and contain risks that may arise from the housing market.”

He also noted that the Australian

dollar has declined noticeably against a rising US dollar, though less so

against “a basket of currencies”, and remains above most estimates of its

fundamental value. While conceding that a lower exchange rate is likely to be

needed in the near future to achieve balanced growth, he said: “The Board judged that, having

eased monetary policy at the previous meeting, it was appropriate to hold interest

rates steady for the time being.”

Westpac chief economist Bill

Evans, who rightly predicted February’s cut, had said that a major

cost in delaying the next interest rate cut for another month or more was that

the Australian dollar might start responding to a benign rates outlook.

Domain Group’s Andrew

Wilson, who did not anticipate last month’s move by the RBA, had predicted a

March cut, citing poor

recent data, particularly unemployment. He said: “The new easing cycle must maintain

momentum to be effective given the marginal level of cuts and conservative

mindset of consumers.”

According

to comparison website finder.com.au, of the 37 experts questioned on their

predictions for the March announcement, 16 (43 per cent) were predicting a cut.

Those that felt movement was

unlikely at this stage said they believed the most recent cut needed more time

to filter through the economy before the Reserve Bank would cut again.

In the finder.com.au Monthly

Reserve Bank Survey, BIS Shrapnel’s Richard Robinson said: “They’ll hold to

avoid overheating the housing market and to keep their powder dry for when they

might want to ‘encourage’ another drop in the exchange rate.”

Onthehouse.com.au’s Peter

Boehm says: “You need more than a 0.25 per cent drop in interest rates to

materially stimulate the economy.”

China cut

its interest rate by 25 basis points at the weekend.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/R3Q6j4r2EuI/rba-leaves-cash-rate-unchanged-for-march

Overseas buyers fees described as insufficient

Overseas buyers fees described as insufficient

Posted on Friday, February 27 2015 at 4:36 PM

A Federal Government proposal to charge foreign buyers application fees each time they buy property in Australia is ‘tickling around the edges’ – and it won’t tackle the ‘seismic’ changes in Melbourne’s housing market according to one buyers’ agent.

Mal James, of James

Buyer Advocates in Melbourne, says 50 to 75 per cent of properties on the books

of some real estate agents are now being sold to overseas buyers. He says the

latest Government proposal won’t slow the influx of international buyers

snapping up properties in Melbourne.

“This has serious ramifications. In many cases,

we are seeing local buyers almost giving up because the market has changed so

dramatically,” James says.

“And it’s not just young homebuyers who are

missing out. Middle-aged buyers and middle class Australians are also being

priced out of the market. For people climbing the ladder, the only choice is to

be pushed further and further away from the city and into the outer suburbs.”

James says the government proposal to charge

foreign buyers a $5,000 application fee to buy property of less than $1

million, and $10,000 for every extra $1 million in the purchase price won’t

have any impact on wealthy overseas investors. The proposed fees apply whether

potential purchasers are successful or not.

“Do you really think a $10,000 or $20,000 fee is

going to bother a Chinese buyer of a $3 million or $4 million home?” he asks.

He cites the sale of a property in the Scotch

Hill precinct this week as a prime example of the pressures created by overseas

buyers. The five-bedroom home in Kembla Street sold before auction for $5.35

million. James says the seven bidders vying for the home were all of Asian

background.

He says this pressure cooker effect has also

been seen in Balwyn and North Balwyn, where some property prices are now on a

par with Bayside suburbs, such as Hampton. Ten years ago, he says, Bayside

prices were 50 per cent higher until the eastern suburbs began attracting

Chinese and Indian buyers.

Policy changes in 2008 made it easier for

overseas buyers to purchase property and were the start of the seismic shift, he

adds.

“We all loved it in 2008 … but now it’s

significantly changing the game.

“Is it healthy to have a lot of money coming

into a market segment that’s distorting values significantly? When the rules

changed in 2008 the dam was broken and it has never been patched up.

“There needs to be a fuller understanding of the

problem. At the moment many young people, many middle class Australians and

even upper class Australians, are being priced out of their own markets.

“If you’re an older

person downsizing now, you’ve hit Tattslotto. You’ll dismiss what I’m saying

because you’re getting a huge windfall.

“But people climbing

the property ladder are facing significant and very real problems.”

Read more on this GREAT DEBATE in the April

issue of API magazine, in shops from Monday.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Overseas buyers fees described as insufficient

Government to toughen foreign investment laws

Depreciation claims to be found everywhere

Is there an ‘investor frenzy’ going on?

Property a major player in retirement plans

Lending showing real strength

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/1GKe5-FxfWs/overseas-buyers-fees-described-as-insufficient

Government to toughen foreign investment laws

Government to toughen foreign investment laws

Posted on Wednesday, February 25 2015 at 12:09 PM

The Federal Government is looking to implement fees and beef up controls around foreign investment in property.

The

Prime Minister’s office has released details designed to put property purchased

by foreign investors under the microscope.

“Australia’s foreign investment policy for

residential real estate is designed to increase Australia’s housing stock.

“This policy remains

appropriate, but a lack of compliance and enforcement of the rules over recent

years is threatening the integrity of the framework,” the release says.

The

government is concerned some foreign investors are breaking existing rules, and

they’re looking to a specialist unit to deal with the issue.

“The government intends to establish a

small, specialised compliance and enforcement area within the Australian

Taxation Office to identify and investigate breaches.”

New

penalties have been introduced for breaches of the legislation.

The

plan includes introducing an application fee attached to each investment

proposals

“The application fees will fund increased

enforcement activity and ensure that the cost of administering the foreign

investment framework is not borne by the Australian taxpayer.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Government to toughen foreign investment laws

Depreciation claims to be found everywhere

Is there an ‘investor frenzy’ going on?

Property a major player in retirement plans

Lending showing real strength

Prices up, volumes down in WA

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/hTM3rR5QMLA/government-to-toughen-foreign-investment-laws

Depreciation claims to be found everywhere

Depreciation claims to be found everywhere

Posted on Monday, February 23 2015 at 12:39 PM

A list of the unusual landmarks and structures that have generated additional cash flow for their owners through the use of tax depreciation schedules has been revealed by tax depreciation specialist BMT.

The world’s largest rocking horse in South

Australia, the Sydney Polo Club, and the iconic Melbourne Star ‘Observation

Wheel’ are just some of the unique landmarks and items for which tax

depreciation claims have been made to uncover savings.

“Servicing a large range of commercial property

owners across Australia has meant working with some unique, and sometimes

unusual, buildings in the process,” BMT managing director Brad Beer says.

“Many people would be surprised by some of the

plant and equipment inside these buildings which qualify for tax depreciation

deductions, allowing their owner to claim back significant amounts when lodging

their tax return.”

The Big Rocking Horse in South Australia, as an

example, stands at over 18 metres tall and attracts about 300,000 visitors every

year.

Though most non-residential buildings erected

before 1982 aren’t eligible to claim capital works deductions, the owners of

the Rocking Horse (constructed in 1981) were able to claim on much of the plant

and equipment that comprised the unusual structure.

According to BMT, there’s a common

misunderstanding among property owners and investors that older buildings won’t

qualify for any depreciation deductions at all.

“We hear property owners and investors tell us

time and again that they never considered making depreciation claims due to the

age of their building. However, even in the case of older buildings, there can

still be many pockets of savings due to the depreciation of plant and equipment

items,” Beer says.

“Each of these three properties were able to

generate tens of thousands of dollars in extra deductions for their

respective owners.

“Furthermore, there was no need for the owners

to outlay any cash in order to attain this additional cash flow, as

depreciation is a non-cash deduction meaning it does not require any expense to

be made in order for it to be claimed.”.

The owners of Melbourne Star’s 120-metre tall

Observation Wheel were able to claim on a number of the fixtures inside the ferris

wheel’s pods, which passengers ride to take in the 40 kilometre-plus views.

The horse stalls and shelters, dams, pumps,

silos, fencing and plethora of other horse-related paraphernalia were also

claimed by owners of the Sydney Polo Club, which has previously hosted The Bachelor contestants and assorted

visiting royalty.

BMT believes many property owners and investors

remain unaware of the extent to which they might be able to claim depreciation

on the plant and equipment assets in their own buildings.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Op90HgnTaMw/depreciation-claims-to-be-found-everywhere

Is there an ‘investor frenzy’ going on?

Is there an ‘investor frenzy’ going on?

Posted on Friday, February 20 2015 at 10:30 AM

Recent data from the Australian Bureau of Statistics (ABS) confirms that investors in the property market are increasing rapidly and gathered even more pace during December 2014.

CoreLogic

RP Data’s research analyst Cameron Kusher says: “Data over December 2014 shows that finance commitments reached a record

high at $12.6 billion in investor housing finance commitments, up 6.0 per cent

from November 2014. Simultaneously, the value of investor housing finance

commitments was 18.8 per cent higher in December 2014 than it was in December

2013.

“As a proportion of the

total value of housing finance commitments, investors accounted for 41 per cent

of all commitments in December 2014 (including refinanced loans), a result

slightly shy of the record high of 41.2 per cent recorded in October 2003.

“To put the rise in investor activity into

perspective, in December 2012, investors committed to $7.6 billion compared to

$12.6 billion currently, a rise of 66 per cent over the two years – the largest

rise over a two-year period since December 2003.

“ABS

investor housing finance commitments data report an overwhelming majority of

investor housing finance commitments are for the purchase of existing homes,”

Kusher continues.

Year-on-year,

the value of investor housing finance commitments has increased by 59.8 per

cent for newly constructed properties compared to 16.1 per cent for established

properties.

ABS

lending finance data provides insight into investor housing finance commitments

by state that, unlike the national data, isn’t seasonally adjusted. All states

recorded a greater value of commitments in December 2014 than they did in

December 2013. Year-on-year, the increases were recorded at 34.1 per cent in

New South Wales, 30.3 per cent in Victoria, 8.6 per cent in Queensland, 14.1

per cent in South Australia, 4.5 per cent in Western Australia, 8.3 per cent in

Tasmania, 10.6 per cent in the Northern Territory and in the Australian Capital

Territory, 43.0 per cent.

Kusher

notes that investment is largely focused within NSW and to a lesser degree

Victoria.

“These

results provide a proxy for the capital cities of these states (Sydney and

Melbourne). These two capital cities have recorded the greatest increases in

home values over the past year and have also recorded the lowest rental yields.

This seems to indicate that the majority of investment activity is premised on

expectations of capital growth rather than rental return.”

Investor commitments by

state

• NSW – 45.3%

• Victoria – 26.8%

• Qld – 13.1%

• South Australia – 3.3 %

• Western Australia – 8.8 %

• Tasmania – 0.4%

• Northern Territory– 0.8%

• ACT – 1.4%

Source: CoreLogic RP Data,

ABS

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/XK6A6OanHs0/is-there-an-investor-frenzy-going-on

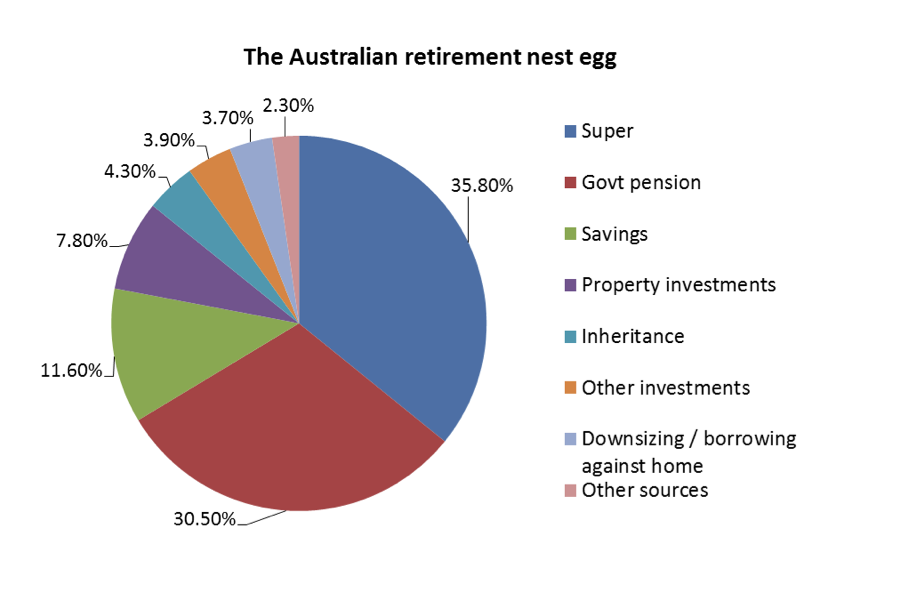

Property a major player in retirement plans

Property a major player in retirement plans

Posted on Wednesday, February 18 2015 at 3:07 PM

Property investment is seen as a way to boost superannuation retirement savings by most Australians, according to a survey by ING Direct.

The financier has released

figures showing Australians believe their superannuation will provide just only

around one-third of their retirement nest egg with pensions, savings and

property filing out the top four income sources.

Property investment is

expected to provide almost eight per cent of retirement saving according to the

research.

John Arnott, an executive

director at ING Direct, says superannuation should play a bigger role in

retirement plans.

“Working Australians are

contributing almost one tenth of their salary into super every year.

“That’s a significant investment

over a working life and yet people still have limited belief in their super to

support their retirement.”

Arnott says Australians seem

more comfortable with traditional forms of investment.

“It all comes down to a fear

of the unfamiliar.

“We don’t see or hear about

our super every day, so we put our faith in things we know – things like

property and savings.”

A breakdown of the

Australian retirement nest egg as sourced from ING Direct reflects:

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Property a major player in retirement plans

Lending showing real strength

Prices up, volumes down in WA

First homebuyer numbers rise after reporting error found

RBA cuts rate in first announcement of year

Renovations not on the radar

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/roO2D4rGf2E/property-a-major-player-in-retirement-plans

Lending showing real strength

Lending showing real strength

Posted on Monday, February 16 2015 at 4:14 PM

Australians sure are in the home-buying frame of mind it would seem – backed up by recent statistics releases as well as some figures from customer-owned financial institution CUA – it lent its customers a record $1.8 billion in the second half of 2014.

The value of new loans to customers from July 1

to December 31, 2014 was up by around 75 per cent – or $800 million – compared

to the corresponding six-month period the previous year according to general manager,

products and marketing, Jason Murray.

He says that on the back of strong lending

results for July to September, CUA finished the year with three consecutive

record-breaking months for lending.

“In December alone we issued $373 million in

new loans, with more than 95 per cent of that being for housing. That’s the highest

value for new lending in one month that CUA has ever achieved in our 70-year

history,” Murray says.

“The record-breaking run started in October

when we issued a massive $350 million in new loans.

“In November, we broke that record with $357

million of new loans. And we topped it yet again in December.

“Mortgage brokers are also contributing to our

lending growth, generating close to half of our new loans, which reflects a

trend across the industry. Consumers are increasingly using comparison services

and brokers for everything from hotel bookings to insurance, and banking is no

different.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Lending showing real strength

Prices up, volumes down in WA

First homebuyer numbers rise after reporting error found

RBA cuts rate in first announcement of year

Renovations not on the radar

Price gap fuels unit demand

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/xRDOf7sElYk/lending-showing-real-strength

Prices up, volumes down in WA

Prices up, volumes down in WA

Posted on Monday, February 09 2015 at 4:24 PM

Data released by the Real Estate Institute of Western Australia (REIWA) indicates a steadying state market.

After

being a superstar of Australian property for many years, the December quarter

2014 statistics show the WA market continues to consolidate.

According

to REIWA, Perth house price lifted marginally during the quarter to settle at a

median of $553,000.

David

Airey, president of REIWA, says Perth has shown positive price gains over the

past 12 months as well.

“It

looks like Perth will have experienced growth of around 4.6 per cent when

compared to 2013.”

Sales

volumes are, however, down which continues a trend initiated in March 2013.

“Turnover

for the December quarter is about 14 per cent below the 15-year average.

“The

distribution of sales within various price ranges was pretty steady, although

there was greater activity in the more affordable $400,000 to $450,000 range,

as well as some increased sales with homes over $1 million.”

REIWA

found the increase in sales with more expensive properties was more notable

through the western suburbs, the coastal edge of the City of Stirling and the

City of Melville.

“While

most of the outer areas popular with first homebuyers saw a decline in

activity, Kwinana and Serpentine-Jarrahdale were exceptions.

“In

fact, Kwinana saw a notional six per cent lift in median house price, probably

due to the increased number of sales from brand new stock.”

Overall,

Airey says the slowdown in the mining and resources sector was causing the

population growth rate to fall.

“This

situation is likely to affect the housing market for all of 2015, but we should

have a clearer picture of trends by the end of the March

quarter.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/T5K_B0LFpQY/prices-up-volumes-down-in-wa

Renovations not on the radar

Renovations not on the radar

Posted on Monday, February 02 2015 at 10:57 AM

According to a study commissioned by financial comparison site Finder.com.au, Australian homeowners are dodging renovations funded by the equity in their mortgage because it’s just too difficult.

The survey

of more than 1,000 homeowners found that the vast majority (90 per cent) have

never refinanced their home to renovate. Of those who haven’t refinanced to

renovate their home, only 17 per cent would consider it.

Almost three

in four (73 per cent) homeowners think it would be difficult to refinance their

mortgage to renovate and 14 per cent find the idea

overwhelming, with women slightly more overwhelmed than men.

Michelle

Hutchison, money expert at Finder.com.au, says she’s not surprised by the findings, given the decline

in borrowers financing home loans for alterations and additions.

“Many

borrowers are dodging the idea of refinancing their home to renovate because

they just don’t know where to start.

“We found

that the value of home loans being financed for alterations and additions

averaged $352 million per month for the past five years (since January 2010).

It’s almost halved compared to over a decade ago, hitting a peak of almost $640

million in one month in 2003.

“It’s not

surprising when our survey found that most people are in the dark with the

costs and value a reno will add,” she says.

The survey found that more than one in three homeowners who

haven’t refinanced to renovate are unsure how much

it would cost, if they can afford to, how much value it would add or where to

start.

Of those who have refinanced to renovate,

the vast majority (93 per cent) had concerns whether they could afford to, what

their mortgage repayments would be and their biggest concern was how much value

it would add.

More than two in five homeowners (42 per cent)

are worried about rising interest rates, as unlocking equity to renovate means

borrowers will have a bigger mortgage with higher repayments.

“The problem with refinancing to renovate

is that every household is different,” Hutchison says. “Everyone has different

financial situations, mortgage sizes, equity and work needing or wanting to be

completed. The amount of money people want to spend can also vary

significantly.

“It doesn’t need to be overwhelming if

you want to unlock equity to renovate your home,” she adds.

National average

costs for renovation jobs

Source:

Finder.com.au, Australian Institute of Architects

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/3QzzHY-YNlQ/renovations-not-on-the-radar

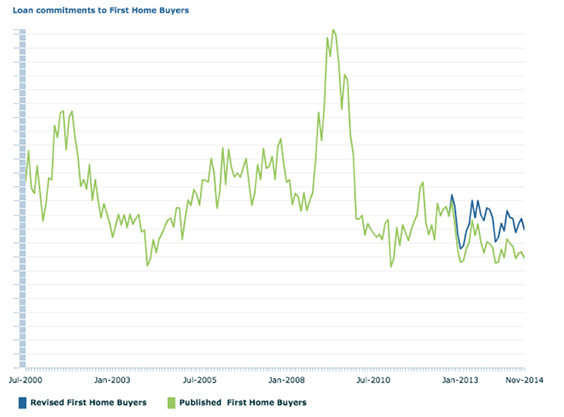

First homebuyer numbers rise after reporting error found

Posted on Wednesday, February 04 2015 at 4:51 PM

Prepare to see an upswing in first time buyer data – but not for reasons you might think.

The

Australian Bureau of Statistics (ABS) has confirmed an inaccuracy in the

reporting of first homebuyer numbers that’s impacted its analysis.

The

ABS says an investigation revealed some lenders weren’t including first

homebuyers in their reports if they weren’t receiving the First Home Owners Grant

(FHOG).

The

FHOG is a one-off grant for first homeowners introduced in July 2000.

State and Territory

governments have progressively restricted the FHOG to new homebuyers only.

Those purchasing

established property were no longer eligible and had been excluded from

financial institution reports.

Jackie

Hodge, an ABS spokesperson, admits the underreporting has impacted their analysis.

“The ABS has published first homebuyer loan figures since the early 1990s

and initially we thought the fall off in first homebuyer loans over the last

two years was due to reduced affordability arising from changes in grants,

rising house prices, increased investment housing loan activity and general

economic conditions.

“However, subsequent analysis and follow-up with

lenders has confirmed that the drop was partly due to under-reporting by some

lenders.”

The ABS estimates the number

of loans to first homebuyers currently being reported is approximately 80 per

cent of the total number of loans to first homebuyers.

The ABS is now working with lenders to ensure

more accurate reporting.

The graph below

illustrates the impact of the adjustments to previously published estimates.

Source:

Australian Bureau of Statistics

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

First homebuyer numbers rise after reporting error found

RBA cuts rate in first announcement of year

Renovations not on the radar

Price gap fuels unit demand

Sydney market keeps firing

Second consecutive rise for home sales

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/N4MJ76sQajY/first-homebuyer-numbers-rise-after-reporting-error-found