Interest rate reduction predicted

Interest rate reduction predicted

Posted on Tuesday, May 05 2015 at 2:32 PM

The decision by the Reserve Bank of Australia (RBA) to reduce the cash rate 25 basis points to two per cent today was widely predicted and is an unfortunate sign of deepening economic woes.

While the Sydney property

market continues its strong run, the majority of other capital city markets –

with the exception of Melbourne – are showing sustainable results. API editor

Nicola McDougall say the RBA has little room to move given the wider economy

continues to struggle.

“Just as the mining sector was the saving grace for our economy during the GFC,

today it’s the real estate and construction sectors that are providing some

rare good fortune,” she says.

“While many commentators may question the Sydney market, we need to remember

that that market was fairly stagnant there for the best part of a decade. We

also need to consider what shape our economy would be in without these strong

results, as well as the buoyant construction sector.”

CoreLogic RP Data head of research Tim Lawless agrees that the RBA was in a

tricky position.

“The RBA is in a tough position, aiming to drag the

Australian dollar lower and stimulate economic growth without adding more fuel

to housing market demand,” he says.

“The Sydney and Melbourne housing markets are already responding to lower

mortgage rates. Since the previous interest rate cut in February CoreLogic RP

Data has reported auction clearance rates moving to new record highs and the

annual trend in capital gains has rebounded higher after moderating over most

of 2014.

“The RBA is clearly prepared to look through the strong housing market results,

as they should be well aware that the high rate of capital growth is evident

only in Sydney where dwelling values are up 14.5 per cent over the past 12

months and Melbourne where values have moved 6.9 per cent higher. Every

other capital city is recording annual growth in dwelling values of less than

2.5 per cent. With mortgage rates now moving even lower we are expecting

dwelling values will continue rising, however it’s hard to imagine the high

rate of capital gain in Sydney won’t start to moderate over the coming months

as investor demand is curbed by tougher lending standards for investment loans

and also by diminishing rental yields and affordability.”

Lawless says there is potential for stronger housing market conditions in

cities like Brisbane and Adelaide where capital gains have been relatively

muted over the past two cycles of growth.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Interest rate reduction predicted

Sydney’s median house price bolts past $900,000

Real estate roadshow a chance to share ideas

Home renovations slow in 2015

Research reveals importance of foreign investment

Land value rises fuelled by undersupply

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Pb9zEHJNgA4/interest-rate-reduction-predicted

Research reveals importance of foreign investment

Posted on Friday, April 24 2015 at 11:54 AM

Data released today shows foreign investment is an essential ingredient in Australia’s property industry that helps drive new residential supply and ease pressure on housing affordability.

The ANZ/Property Council

Survey June quarter 2015 results

show relatively stable but significant levels of foreign investment are helping

bring new housing supply to market.

More

than 1850 survey respondents were asked what level of foreign purchasers

occurred in their newly constructed residential and non-residential projects.

The sentiment from the survey indicates that nationwide, foreign investment

accounts for about 22 per cent of new residential property sales, and this has

remained constant over the previous two quarters.

Property

Council of Australia chief executive Ken Morrison says the survey results

underscore the fundamental importance of foreign investment in making new

housing stock available for Australians.

“The

only way to improve housing affordability is to get more housing on the ground

earlier, and foreign investment is a key ingredient in making this happen,”

Morrison says.

“Foreign

investors don’t reduce the availability of housing for Australians, they

increase it.

“Every

newly constructed home that a foreign investor purchases enables up to four

other homes to be built.

“Foreign

investment provides the crucial early stage capital to get big new housing

developments over the line and into construction, delivering the twin benefits

of more jobs and more new homes.

“Our

research clearly establishes the critical link between foreign investment and

new housing supply.

“Big

new fees on foreign investors will act as a deterrent and without foreign

investment new projects will come online later or not at all.

“Introducing

a new stamp duty-like fee on foreign investors will actually diminish the

supply of housing, and the losers in this equation will be ordinary

Australians.

“There’s

a striking correlation in the data between those states with high confidence

and solid forward expectations and those that record solid levels of foreign

investment, like NSW and Victoria.

“Continued

foreign investment in new housing supply is a critical element to ensuring we

meet demand and keep pressure off house prices.”

ANZ

chief economist Warren Hogan says foreign investment is playing a key role in

boosting housing construction.

“Low

interest rates, increasing home prices and solid population gains, look to be

buoying expectations of increased housing construction activity in the coming

year, according to the ANZ/Property Council

Survey.

“In

addition to the positive impact of these housing market conditions, solid

foreign investment in new housing has also continued to drive a strong upturn

in housing construction.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Sydney’s median house price bolts past $900,000

Real estate roadshow a chance to share ideas

Home renovations slow in 2015

Research reveals importance of foreign investment

Land value rises fuelled by undersupply

Crackdown on underquoting questioned

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/HkVG9QiTCd0/research-reveals-importance-of-foreign-investment

Sydney’s median house price bolts past $900,000

Sydney’s median house price bolts past $900,000

Posted on Thursday, April 30 2015 at 12:17 PM

According to the Domain Group’s House Price Report for March Quarter 2015, the New South Wales capital now has a median house price of $914,056.

While the national median house and unit price

recorded modest growth during the period, Sydney once again proved it’s the

nations mega-market.

Dr Andrew Wilson, senior economist at the Domain Group,

says the result exceeds other centres with varied numbers across all other

capital cities.

“Reflecting the local economic environment and supply

and demand drivers, capital cities around Australia recorded mixed results for

house and unit price growth over the March quarter.”

Domain Group data shows the national median house

price increased by 1.8 per cent over the quarter, contributing to an annual

increase of eight per cent. The national median unit price increased by 0.4 per

cent over the quarter, and 5.2 per cent over the year to end March.

Sydney’s result was in stark contrast to Perth, which

saw median house prices fall 2.1 per cent, while unit numbers

remained flat.

Adelaide and Darwin were the only two other capital

cities to record increases in both house and unit prices over the quarter.

Melbourne and Canberra both saw an increase in the

median house price, 2.2 per cent and 1.1 per cent respectively, and falls in

unit prices, 0.3 per cent and 3.6 per cent respectively.

Brisbane saw a fall of 0.7 per cent in housing prices

and 2.3 per cent for units.

Hobart recorded houses weakening, with the median

falling by 0.6 per cent while unit prices increased strongly by five per cent

over the quarter.

Wilson says prices growth should track local economic

performance as the chance of an interest rate cut diminishes.

“Sydney will continue to lead the pack in house price

growth – clearly ahead of Melbourne, Adelaide, Canberra, Brisbane and Hobart,

which are set to continue to record modest to moderate prices growth on the

back of improving economies.

“Flattening economic activity and falling confidence

in Perth, and to a lesser degree Darwin, will continue to put downward pressure

on house price growth as those capital cities transition rapidly from their

previous resource and population boom environments.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/9JLEie1pODM/sydneys-median-house-price-bolts-past-$900000

Real estate roadshow a chance to share ideas

Real estate roadshow a chance to share ideas

Posted on Tuesday, April 28 2015 at 1:19 PM

The Real Estate Institute of New South Wales says it will be highlighting “the issues that matter” in its sixth annual state-wide roadshow throughout the months of May and June.

REINSW president Malcolm Gunning says the Big Day Out

tour represents a unique opportunity for real estate professionals to come

together to share thoughts and ideas.

“The REINSW Roadshow is one of the highlights of our

event calendar. It’s great to travel the length and breadth of the state and

find out what issues matter to our members.

“This year, REINSW CEO Tim McKibbin and I will be

joined by Domain Group economist Dr Andrew Wilson, who’ll share insights into

the market and future prospects.

“We’ll also hear from about the digital revolution

from realestate.com.au sales manager NSW Derek Taylor and receive practical

advice direct from NSW Fair Trading and the Real Estate Employers’ Federation

(REEF),” he says.

“Our program is packed with essential information for

our member agents and is a great opportunity to come together and network with

other industry professionals.

“We use this event as a stepping stone for other key

member activities including our Industry Summit in November. It really is a

great way to become more involved and informed about the future and how we can

improve our industry,” Gunning says.

Roadshow

tour dates

Gymea 4 May 2015

Wollongong 5 May 2015

Batemans Bay 6

May 2015

Queanbeyan 7 May

2015

Newcastle 13 May 2015

Gosford 14 May 2015

Sydney 18 May 2015

North Sydney 19

May 2015

Parramatta 20 May 2015

Penrith 21 May 2015

Lismore 3 June 2015

Coffs Harbour 4

June 2015

Port Macquarie 5

June 2015

Wagga Wagga 10

June 2015

Albury 11 June 2015

Narranderra 12 June 2015

Tamworth 16 June 2015

Dubbo 18 June 2015

Orange 19 June 2015

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/XEH29zOwqhQ/real-estate-roadshow-a-chance-to-share-ideas

Home renovations slow in 2015

Home renovations slow in 2015

Posted on Friday, April 24 2015 at 4:46 PM

The Housing Industry Association (HIA) has released its Autumn 2015 Renovations Roundup report concluding that the home renovation industry has softened this year.

Shane

Garrett, a senior economist at the HIA, says new home building has hit record

levels but renovations will continue to struggle.

“This

represented a continuation of the slump which has blighted the sector since

2011.”

Garrett

says the volume of renovations activity has dropped by 15 per cent over the

past three years.

“The

performance of South Australia typified the national trend.

“Over

the 2012/13 period, renovations activity in SA declined from $2.1 billion to

$1.78 billion – a contraction of 15.1 per cent.”

Garrett

says home renovations are an important component of the construction sector.

“Valued

at $29.66 billion during 2014, the renovations sector accounts for over one

third of all residential construction activity and about two per cent of GDP.”

The

report predicts a further decline of 2.8 per cent in renovations activity

during 2015, although uplift is expected between 2015 and

2018 because of of low interest rates and the gradual recovery of economic

activity.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Home renovations slow in 2015

Research reveals importance of foreign investment

Land value rises fuelled by undersupply

Crackdown on underquoting questioned

The positives of negative gearing for middle Income earners

Low interest rates are having effect

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/DqZe7nIA-KY/home-renovations-slow-in-2015

Land value rises fuelled by undersupply

Land value rises fuelled by undersupply

Posted on Wednesday, April 22 2015 at 5:03 PM

Vacant sites are set to see price growth as demand continues to outstrip supply, according to one industry report.

Harley Dale, chief economist of the Housing Industry

Association (HIA), says the latest HIA-CoreLogic

RP Data Residential Land Report signals increased price pressure.

“The number of residential land sales fell by 11.8 per cent

over the year to the December 2014 quarter,” he says.

“In contrast, the weighted median residential land value

increased by 2.8 per cent in the December 2014 quarter to be up by 6.3 per cent

over the year.”

Dale says an increase in the weighted median value is driven

primarily by Sydney, with significant growth also evident for Perth and

Melbourne.

The pressure is, however, widespread.

“There’s insufficient shovel-ready land in some markets and

this is placing undue upward pressure on residential land values.

“Construction of detached houses looks to be peaking for the

cycle, but there’s unrealised demand out there because of that lack of readily

available and affordable land.”

Tim Lawless, research director at CoreLogic RP Data, says the

number of vacant residential land sales has been trending lower since mid-2013

and, concurrently, median land prices have been rising to new record highs.

“The opposing trends are a clear sign that demand is

outweighing supply, which is pushing land prices higher.

“Higher land prices ultimately lead to less affordable homes –

it’s the high cost of vacant land that significantly

contributes to the increasing cost of housing.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Land value rises fuelled by undersupply

Crackdown on underquoting questioned

The positives of negative gearing for middle Income earners

Low interest rates are having effect

Auction volumes slow to pick up after long weekend

Interest rates on hold for now

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/59pVrd2RnAg/land-value-rises-fuelled-by-undersupply

Crackdown on underquoting questioned

Crackdown on underquoting questioned

Posted on Friday, April 17 2015 at 3:53 PM

Experts in the real estate industry are questioning the effectiveness of New South Wales Premier Mike Baird’s recent pledge to crack down on underquoting.

In a bid to create a fairer buying

system and strengthen the integrity of the real estate industry, Baird promised

to beef up fines and enforce new legislation that leaves no wriggle room for

sly agents.

But it’s not just agents perpetuating

underquoting in the market – savvy sellers are building a margin into their

price expectations to accommodate the practice.

Local Agent Finder CEO Michael Banks

claims that while buyers may lose a thousand or so dollars to scout a property,

for vendors who make a stand against underquoting it can cost them upwards of

tens of thousands of dollars.

“Tough market competition means that

vendors are given little choice but to participate in underquoting and to take

the moral high ground would only cut them out of the market at this stage” he

says.

He also questions just how the new

crackdown will have an impact.

“Underquoting is so prevalent, and so

deep-seated within the industry, it’s foolish to believe the industry can

self-regulate. Unless Baird and Fair Trading plan to rigorously police the real

estate industry, underquoting will likely persist because agents and vendors

have too much to lose by bowing out independently.

“Any law is useless if not enforced. If

Baird truly means to abolish underquoting, his new reforms will need to clearly

define the practice and introduce specific instructions as to how property

values can be advertised. The industry requires systematic checking, and only

after adequate regulation can agents and vendors viably discontinue

underquoting.”

Underquoting is rampant across

Melbourne and Sydney, with research indicating that agents routinely underquote

properties by up to 30 per cent.

The underquoting charges recently

brought against BresicWhitney represent the first of their kind since 2004.

Banks acknowledges that agent

comparison services, such as Local Agent Finder, can currently do little to

hamper underquoting.

“While we can’t stop underquoting, we

can equip homeowners with the resources to make diligent decisions when

selecting a real estate agent to manage their property,” he says.

“There’s little anyone can do from

within the industry; the responsibility falls on external regulators.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Crackdown on underquoting questioned

The positives of negative gearing for middle Income earners

Low interest rates are having effect

Auction volumes slow to pick up after long weekend

Interest rates on hold for now

Pain and gain depends on postcode

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Yp03SOMHels/crackdown-on-underquoting-questioned

The positives of negative gearing for middle Income earners

Posted on Thursday, April 16 2015 at 8:55 AM

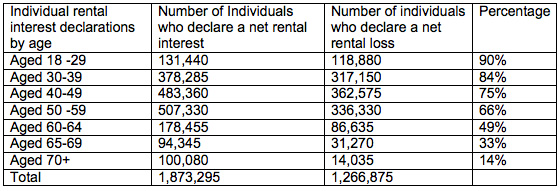

Forget big time property magnates as the major beneficiaries of negative gearing; the latest Australian Taxation Office (ATO) statistics show it’s middle-income earners as the chief recipients.

Of the 1.87 million people who declare a net rental interest (i.e. own a rental property), 1.34 million of those earn around $80,000 or less. While nearly 1.26 million Australians declare a net rental loss, of this group 79 per cent (or 883, 325 people) earn around $80,000 per annum or less according to ATO statistics.

Nick Proud, Executive Director of Property Council of Australia says accurately determining the cost of negative gearing to the federal budget is imprecise due to gaps in the publicly available data, although analysis of ATO statistics indicates it’s well below estimates of $4 to $5 billion.

“The significant benefits of negative gearing in terms of housing affordability and retirements savings must be factored in to any analysis of the costs,” Proud says.

“Negative gearing is an indispensable tax measure that enables average workers to save for their retirement.”

The majority of Australians who declare a net rental loss (73 per cent) only own one investment property, and a further 18 per cent own only two properties.

“The ability for low to middle income Australians to negatively gear their investments also unlocks an important source of finance to boost the supply of new housing stock, which benefits affordability in the rental market,” Proud says.

“What is crystal clear from the available data is that negative gearing is overwhelmingly used by middle-income Australians earning around $80,000 p.a. or less.”

Analysis of net rental interest and loss by age group. ATO Statistics 2011/12

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

The positives of negative gearing for middle Income earners

Low interest rates are having effect

Auction volumes slow to pick up after long weekend

Interest rates on hold for now

Pain and gain depends on postcode

Owners holding homes for longer

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/RHuvOvjZg04/the-positives-of-negative-gearing-for-middle-income-earners

Low interest rates are having effect

Low interest rates are having effect

Posted on Monday, April 13 2015 at 11:52 AM

The April St. George-Melbourne Institute Household Financial Conditions Report reveals that financial conditions for Australians have improved on a year ago, home renovations are at a 10-year high and renters are becoming big winners.

The quarterly St. George-Melbourne

Institute Household Financial Conditions Index, which reports on the

key savings behaviours of households, has increased its value by 5.2 per cent over the past 12 months.

The index reveals how household balance sheet repair is very

evident with mortgage holders dropping debt by 5.9 per cent over the past 12

months. In addition, for almost 75 per cent of respondents, servicing debt is

below 25 per cent of after-tax income, indicating most Australians are not over

extending themselves.

St. George retail banking general manager Andy Fell says the low

interest rates we’ve seen in the past couple of years are assisting homeowners

to lower their debt quicker and get themselves into a better financial

position.

“Australia’s love affair with the property market also shined through

this quarter, with low interest rates directing households to real estate as a

popular source of new savings.

“The findings show there was a 5.4-point lift over the quarter in

savings directed to real estate, making it the second preference after bank

deposits and perhaps signalling a trend in buying to invest, rather than to own.”

According to the index, households’ motivation behind savings is being

driven by holidays and travel (60 per cent) and ‘saving for a rainy day’ (57

per cent), which were the two most popular reasons for saving in the March

quarter.

“We’re also seeing that Australians are continuing their trend to be a

nation of renovators, with 41 per cent indicating they’re saving for home

improvements and renovations, an increase of 7.6 per cent since December,” Fell

adds.

“This was the highest proportion since at least 2005, when records began.”

Chief economist for St. George Bank Besa Deda says that some of the big

winners this quarter were renters, who enjoyed a big jump in financial

conditions by 14.3 per cent.

“The findings indicate that renters could be reaping the benefits of

strong investor activity, which is limiting growth in residential rents.

“Rental vacancy rates are creeping higher across most capital cities,

suggesting renters are benefiting from a softening in rental conditions,” she

adds.

When it comes to state comparison, NSW, SA and QLD improved with leaps

and bounds compared to other states.

Key findings

- The St. George-Melbourne Institute Household

Financial Conditions Index fell marginally, down 0.2 per cent to 128.1 from

December 2014 to March 2015. The index is now 5.2 per cent above its value a

year ago. - Large falls

over 7 per cent were recorded by those aged between 45 years and 64 years, and

by those earning between $80,000 and $100,000. In contrast, a big rise was

recorded by those who are renting (14.3 per cent). - 34.3 per cent

of Australian households hold mortgage debt, a slight decrease since December

and a 5.9 per cent decrease over the year. - Some 25.5 per cent of respondents reported a

preference to invest their savings in real estate in March, up from 20 per cent

per cent in December. - Two of the five

states recorded decreases in their household financial conditions indices. The

financial conditions index for Western Australia recorded the largest fall of

13.5 per cent, followed by a decrease of 7.0 per cent in Victoria. On the other

hand, the household financial conditions indices for New South Wales,

Queensland and South Australia reported increases over 6 per cent. - More respondents were

motivated to save to “improve/renovate their own home” up from 34.2 per cent in

December to 41.8 per cent in March. This was the highest proportion since the

survey began in 2005. Fewer respondents were motivated to save to “buy or

put a deposit on house” – a decrease to 13.9 per cent in March from 15.8 per

cent in December.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/iFtLj4tjGII/low-interest-rates-are-having-effect

Auction volumes slow to pick up after long weekend

Auction volumes slow to pick up after long weekend

Posted on Friday, April 10 2015 at 10:22 AM

In response to the Easter long weekend, capital city auction markets took a break last week, with only 653 capital city auctions held, down significantly from 3668 over the previous week.

The

auction clearance rate, however, maintained its strength, with 78.9 per cent of

auctions recording a successful sale, compared to 77.6 per cent the previous

week and a much lower 66.2 per cent over the same week last year.

Given

that school holidays continue, auction markets remain relatively quiet, with

only 1478 capital city auctions set to take place this week and 1958

nationally. In comparison, at the same time last year, 3534 capital city homes

went to auction in what was last year’s lead up to the Easter long weekend. To

put this into perspective, if we exclude last week, so far this year there has

been an average of over 2100 across the combined capital cities each week.

Across

Melbourne this week, 626 auctions are set to take place, up from 63 last week

and lower than the 1530 at the same time last year. For the past seven weeks,

Melbourne’s clearance rate has consistently remained above 75 per cent. The

clearance rate across Melbourne has not been this strong since early 2010.

Last

week there were 427 residential properties taken to auction in Sydney, with 586

expected this week. In comparison, at the same time last year 1496 auctions

were held. So far this year, Sydney is currently experiencing the strongest

auction clearance rate conditions that CoreLogic RP Data has on record.

There

are 102 auctions expected in Brisbane this week and 289 across the state. In

comparison, there were 61 Brisbane auctions last week and 240 over the same

week last year.

Adelaide

is set to see 82 properties taken to auction this week, up from 34 last week

and 144 at the same time last year. Adelaide’s clearance rate has been

fluctuating between 52 per cent and 84 per cent so far this year, with the

average number of homes taken to auction each week around the 100 mark.

In

Canberra, CoreLogic RP Data is expecting 52 auctions this week, similar to the

volume seen last week (49) and at the same time last year (51). Although

Canberra’s auction market is much smaller than some of the other capital city

auctions markets, volumes have increased this year, with the year to date

number of auctions held this year 26 per cent higher than at the same time last

year.

Currently

there are 20 auctions scheduled across Perth for this week, up from just six

auctions last week and 56 at the same time last year

Auction preview provided

by CoreLogic RP Data.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/8uyeQ2b8apc/auction-volumes-slow-to-pick-up-after-long-weekend