Excessive yearly falls in sales listings

Excessive yearly falls in sales listings

Posted on Monday, July 06 2015 at 12:36 PM

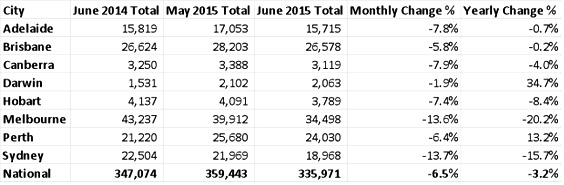

The number of Australian residential property sale listings fell in all capital cities during the month of June, according to SQM Research, with falls in Sydney and Melbourne larger than expected for this time of year.

Nationally, the number of listed properties fell to 335,971 in June

2015, falling 6.5 per cent from May 2015, with the number of listings down 3.2

per cent from a year earlier.

Once again Sydney and Melbourne recorded the heaviest monthly change, as

a result bringing the national average down.

Year-on-year results indicate that Melbourne, Sydney and to a lesser

extent Hobart, experienced excessive yearly falls.

Melbourne recorded the biggest yearly change, with listings falling by

20.2 per cent, reducing the number of properties for sale to 34,498. Sydney

soon followed with listings down 15.7 per cent from this time last year. Hobart

recorded a yearly change of 8.4 per cent.

Managing director of SQM Research Louis Christopher says: “While

the national result is only down marginally from levels recorded this time last

year, the Sydney and Melbourne result clearly reveals the ongoing boom in these

two cities.

“We have not seen Sydney with so

few listings and Melbourne’s stock is now being quickly absorbed. Potential

vendors in these two cities are holding back on selling their property in the

hope (and fear) that the market is going to rise from here.

“And with this type of squeeze on

the market, prices will indeed most likely rise from here.”

SQM Research figures show that asking prices for Sydney houses continued

to climb over June, with a total monthly rise of 2.8 per cent. The median

asking price for a house has now reached $1,120,700 while the median unit in

Sydney dropped over June and is now advertised at $615,400.

In contrast, median asking house prices in Darwin continue to fall with

year-on-year comparison showing a 12-month decline of 2.4 per cent for houses

and 8.4 per cent for units. Perth also recorded yearly falls, with asking

prices for houses down 3.6 per cent and 1.0 per cent for units.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/nqJPXBnp7kk/excessive-yearly-falls-in-sales-listings

RBA keeps cash rate at same level

RBA keeps cash rate at same level

Posted on Tuesday, July 07 2015 at 2:38 PM

Just as predicted by the 33 experts and economists surveyed by finder.com.au, the Reserve Bank of Australia (RBA) announced this afternoon that the cash rate will be staying at two per cent for at least another month.

Governor Glenn Stevens said

in his announcement: “The Board today judged that leaving the cash rate unchanged was

appropriate. Information on economic and financial conditions to be received

over the period ahead will inform the Board’s assessment of the outlook and

hence whether the current stance of policy will most effectively foster

sustainable growth and inflation consistent with the target.”

Domain senior economist

Andrew Wilson was unsurprised by the announcement. He said: “House price growth, particularly in Sydney

and Melbourne, will continue to be fuelled by the lowest mortgage rates since

the mid-1960s. Low bank deposit rates will also continue to activate investment

in residential property chasing both higher yields and capital gains.”

According to the

finder.com.au survey, many of the experts surveyed cited reasons for a rate pause including the RBA continuing to maintain a

‘wait and see’ approach as the recent rate cut in May has had little impact as

yet on the economy.

The improved unemployment

rate, higher housing costs as well as financial pressures from overseas were said

to be other factors associated with the decision.

However, almost two out of

five of the experts surveyed (38 percent or 12 experts) are expecting the cash

rate to fall by the end of the year, which could be as early as next month. Of

the 12 who expect the cash rate will fall this year, five are expecting a drop

in August or September while the remaining seven are expecting to see the cash

rate fall in the last quarter of 2015.

Two experts are forecasting

the cash rate will rise this year – Peter Boehm from onthehouse.com.au and Mark

Crosby of the Melbourne Business School.

Griffith University’s Mark Brimble said before the decision: “The Reserve Bank is between a rock

and a hard place on this now, with a weak economy and property prices starting

to bubble in some areas. Ideally, it needs the currency to do the work for it,

but this is remaining stubbornly strong.

“This continued uncertainty in Europe and Asia and expectations of a

rate rise in the US later this calendar year, the Reserve Bank is likely to sit

on its hands. Regarding house prices, the property market will continue to

behave unevenly across the country. Some areas will continue to rise, while

others will fall dramatically as employment (and thus demand) shifts.”

Michelle Hutchison, money

expert at finder.com.au, says

first homebuyers will see greater pressure to enter the market if interest

rates fall further this year.

“The latest global economic

uncertainty has thrown a spanner in the works for our local economy, as the

Reserve Bank could now look to minimise the impact by reducing the cash rate

this year.

“This could lead to further

pressure on the housing market, as lower interest rates could fuel further

demand for investors and refinancers, leaving first homebuyers behind.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/PuOWxsqcafA/rba-keeps-cash-rate-at-same-level

‘Property Value’ tool hits the market

‘Property Value’ tool hits the market

Posted on Friday, July 03 2015 at 12:47 PM

As announced in this month’s Australian Property Investor magazine (which is on sale now, folks!), property data and research company CoreLogic RP Data has today launched its new consumer property information website Property Value (www.propertyvalue.com.au).

Described as an “all-you-can-eat

data buffet”, it’s set to help homebuyers, sellers and investors achieve an

active reading of a property’s performance as well as deliver updates on

current market conditions prior to a purchase or sale.

The website and tool, which

comprises both free and subscription-based elements, was created in response to

an increasing demand from everyday buyers and investors.

“It’s our hope Property Value

will help Australians make more informed and better property decisions and

ultimately put them in a better financial position,” CoreLogic RP Data head of

solutions Greg Dickason says.

The site provides extensive data

coverage and decision-making tools and also works on mobile. Every day buyers

and sellers can estimate the sale value of a property and take a much deeper

dive into data before deciding on which property to buy and where, by using the

benchmarking option, and analyse comparable properties for sale, for rent and

recently sold. Users can even look back over 30 years to see what the property

has previously sold for, how long it’s generally taken to sell and whether it’s

been rented.

Investors are also provided with

a unique estimated rent and yield for individual properties in addition to “Investor

Scores”, which score a property and its surrounding suburb in relation to cash

flow, capital growth and lower risk investment strategies.

It’s not just about individual

property, though. Each street and suburb has its own profile – giving further

insight into the surrounding areas. If a buyer’s considering a couple of

suburbs, these can be compared side-by-side using the “compare” function. Users

can also check out the make-up of the street they’re interested in, including

how many units and houses there are and whether they’re likely to be rented or

owner-occupied.

In a nutshell, then, Property

Value helps investors to:

- Understand what a property

might be worth by comparing its estimated market value with comparable recent

sales - Perform due diligence on

investment opportunities - Locate capital growth

information for states, cities, suburbs, streets and individual houses - Easily find auction clearance

rates - Identify vendor discount rates,

rental yields, vacancy rates and demographic information.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

‘Property Value’ tool hits the market

Calls for commission to consider retirees

Renters in the north, movers in the south

NSW Gov promises $400m boost to help housing affordability

Government’s looking to the north

Study shows FHB investors least well off

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/k7O7C3HPAu8/property-value-tool-hits-the-market

Calls for commission to consider retirees

Calls for commission to consider retirees

Posted on Wednesday, July 01 2015 at 11:21 AM

Calls have been made by executive chairman of Raine Horne Angus Raine for the Greater Sydney Commission (established in last week’s NSW Budget) to help promote more suitable housing for retirees, such as low-density apartment blocks and villas, in order to help address the city’s real estate affordability issues.

The NSW Government will invest $20.9 million

over four years to launch the Greater Sydney Commission, which has been given

the task of overseeing the delivery of new housing, infrastructure and

services, across the metropolitan area.

To help meet its target of 664,000 dwellings in

Greater Sydney by 2031, the state government has allocated $400 million to

support new housing supply in infill and greenfield areas, as well as $89.1

million to help cut council red tape.

“The Greater Sydney Commission is an excellent

initiative but it must find ways to deliver suitable housing to retirees still

living in oversized family homes across the metropolitan area,” Raine says, adding

that he believes Sydney requires more medium-density housing and villas, where

land prices make this a feasible alternative for developers.

“There’s been plenty of news about the massive

growth in apartment developments across Sydney, but the majority of this stock

isn’t suitable for retirees, who are already hampered by the prospect of paying

stamp duty to downsize.

“If the commission can help encourage more

Sydney empty-nesters to downsize out of bigger family homes, it will go some

way towards helping to address the city’s affordability issues,” he says.

Raine also urges the NSW Government to do more

to promote the benefits of downsizing to a bigger population centre such as

Newcastle, Bathurst, Wagga, Tamworth, Dubbo and Orange.

“These centres offer all the amenities and

facilities that retirees have come to expect in the city, yet real estate

prices are significantly more affordable,” he says.

In the St George and Sutherland Shire region,

Ray Fadel, principal of Raine Horne Sans Souci, agrees that the explosion

of high-rise apartment towers in his region is not really addressing the

housing needs of empty-nesters.

“Older Australians want to live in villas or

three-bedroom apartments in smaller blocks that have views and are within

walking distance of shops and transport,” he says.

“There’s not much stock like that in our region

apart from Cronulla, Ramsgate and Brighton.

“The majority of the new developments in the St

George/Sutherland region offer two-bedroom apartments, located in high-rise

towers where owners must share the space with hundreds of other occupants.

“Even though they all have lift access, the high-rise

towers are not for retirees in many cases.”

Older three-bedroom villas worth around $1

million are proving popular with retirees, although they’re also in short

supply, according to Fadel.

“The trouble is that the three-bedroom villas

were selling for about $700,000 a few years ago. They’re now up above $1

million, which doesn’t free up much cash for retirees considering a downsizing

strategy,” he says.

On the North Shore, Hugh Macfarlan, principal of Raine Horne

Chatswood/Willoughby, says the cost of land generally prohibits the development

of villas.

“Ku-ring-gai

Municipality, which covers off suburbs between Wahroonga in the north and

Roseville in the south, has responded with plenty of new low-rise apartment

blocks that offer stylish three-bedroom apartments with generous floor plans

and lifts, which are suitable for downsizers,” he says.

“These

apartments are more manageable than large houses on big blocks with tennis

courts and pools, that many on the Upper North Shore continue to live in because

of a shortage of suitable options.

“Stamp

duty is already a problem and this is keeping many older North Shore residents

in bigger homes, so it would be great to see the new Greater Sydney Commission

consider ways to address housing affordability issues – and this probably means

encouraging the development of larger quality apartments close to good

amenities that would suit downsizers very well.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/9ZChbg_GJlk/calls-for-commission-to-consider-retirees

Renters in the north, movers in the south

Renters in the north, movers in the south

Posted on Friday, June 26 2015 at 1:59 PM

While a third of Australians are currently renting property, a new Nielsen report from Domain.com.au has revealed that the Northern Territory has the highest percentage of renters in the country (43 per cent), followed by Queensland (37 per cent).

Though the Sydney and Melbourne property markets are

the most talked-about in the country, the percentage of people renting in these

states is significantly lower, with more renters in NSW (33 per cent) than in

Victoria (28 per cent). Tasmania has the lowest percentage of renters in the

country, with just a fifth (20 per cent) of the state currently

renting.

The Domain data suggests that renting is a temporary

state, highlighting that 47 per cent of Australians have lived in their current

rental property for less than two years. Only 27 per cent of Australians have

been in their rental property for more than five years.

The “great Australian dream” of homeownership is

seemingly distant for some states, with 62 per cent of NT residents indicating

they believe that owning their own home is no longer attainable. More than

half (51 per cent) of NSW and Vic (52 per cent) residents are also negative about

the attainability of property ownership.

Domain senior economist Andrew Wilson says the high

number of renters in the NT reflects low homeownership rates.

“High housing costs in the NT remain a significant

barrier to home ownership resulting in the highest proportion of renters to

total households of all Australian states.

“Darwin house prices are behind only Sydney of all the

state capitals, and although Territory incomes are the among the country’s

highest, local rents are clearly the highest, providing another significant

barrier to home ownership for those saving for a deposit.

“That said, the number of recent new developments in

the NT means we may see a shift in the future. Supply is slowly catching up to

demand and we may see a gradual increase in the rate of homeownership.”

Meanwhile, the state of Victoria has recorded its

highest net interstate migration in more than 40 years, figures released by the

Australian Bureau of Statistics

(ABS) have revealed. Denise Carlton from the ABS says

the latest figures

from Australian Demographic Statistics, December Quarter

2014, reflect

an ongoing trend of increasing population growth for

Victoria.

“Victoria has experienced increasing population growth

since 2011, with a net gain of 9,300 people from the rest of Australia in the

last year alone.

“Most of this increase for Victoria can be attributed

to people moving from NSW (2,700 movers), with South Australia (2,100), Western

Australia (1,400) and Queensland (1,100) the next largest contributors.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/TDCPb4Dd7JQ/renters-in-the-north-movers-in-the-south

NSW Gov promises $400m boost to help housing affordability

Posted on Monday, June 22 2015 at 10:32 AM

Last week’s New South Wales State Budget will inject a record $400 million into the Housing Acceleration Fund (HAF) in order to speed up the delivery of more housing and put downward pressure on home prices, according to a government spokesperson.

Visiting a site for new homes in Sydney’s northwest,

NSW Premier Mike Baird, Treasurer Gladys Berejiklian and Minister for Planning

Rob Stokes said the largest-ever single contribution to the HAF will ensure

faster land releases across Sydney.

“This record investment will help put the dream of

home ownership within reach of more young families,” Baird said.

“One of the most important things we can do to

improve housing affordability is to increase housing supply.

“We’ve increased housing supply to the highest

levels in two decades – and we’re delivering the vital infrastructure needed to

support this new housing.”

The $400 million boost will take total HAF funding

to $966 million since 2012.

So far the HAF has been allocated for

infrastructure projects supporting 161,000 new dwellings and 1,200 hectares of

employment lands and it’s expected this new funding will at least double that

number.

This round of the HAF will include a focus on

projects that enable and facilitate increased housing in existing areas, and

will include projects that help facilitate new housing investment while

improving the infrastructure and amenity of existing areas.

The HAF has already funded key infrastructure

projects supporting new housing including upgrades to Camden Valley Way,

Richmond Road and Schofields Road in Western Sydney.

So far this financial year, about 7,750 of the NSW

Government’s First Home Owner Grants have been issued – an increase of 9.2 per

cent over the corresponding period last year.

Berejiklian said: “We know that housing

affordability is a very big issue for a lot of

people, and this record funding will help to put

downward pressure on prices.

“The grants we’ve issued to first homebuyers are

working to assist people across our community to get the keys to their new

home.”

Stokes said: “The Cudgegong

Road Station precinct… will be a thriving new community in close proximity to

the first station on Sydney’s new modern, world-class metro rail system.

“On top of being a terrific place to live and

having great public transport services, the precinct will also feature parks,

sporting fields and retail space for new shops, restaurants and cafes.”

The new station precinct is being prepared for

construction of more than 4,500 new homes. People will be able to buy into the

area within two years.

It sits directly opposite The Ponds, which will

have more than 4,200 dwellings when the final home is completed at the end of

the year.

Sydney’s northwest is forecast to have more than

70,000 homes built within the next three decades.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/2bRsep80xso/nsw-gov-promises-$400m-boost-to-help-housing-affordability

Government’s looking to the north

Government’s looking to the north

Posted on Friday, June 19 2015 at 4:40 PM

The Australian Government yesterday released its White Paper on Developing Northern Australia: Our North, Our Future, the country’s first White Paper on developing northern Australia, describing it as “an essential part of our plan for a strong, prosperous economy and a safe, secure Australia”.

With a land mass covering more than three million

square kilometres and a population of more than one million people, the north

has been largely ignored in the past, despite being home to some of Australia’s

most treasured icons, such as the Great Barrier Reef, Uluru and Kakadu.

The paper sets out a long-term reform agenda up to

2035, delivering an initial investment of $1.2 billion (in addition to the $5

billion Northern Australia Infrastructure Facility).

Measures to unlock the north’s potential across six

key areas include: simpler land arrangements to support investment; developing

the north’s water resources; growing the north as a business, trade and

investment gateway; investing in infrastructure to lower business and household

costs; reducing barriers to employing people; and improving governance.

The government says it is supporting simpler and

more secure land arrangements in the north, by investing:

- $20.4 million to support native title bodies to

realise their potential and negotiate more efficiently with business; - $17 million to support secure property rights for

cadastral surveys, area mapping and township leases; - $10.6 million for pilot land tenure reforms to

help fund ‘next steps’ for projects that demonstrate the benefits of tenure

reform, particularly on pastoral leases.

It will also work with the Council of Australian Governments

(COAG) to:

- reduce native title costs and delays – the

Government wants all existing native title claims settled in the next 10 years;

and - allow Indigenous Australians to borrow against or

lease out exclusive native title land.

A $200 million Water Infrastructure Development

Fund is set to be established, which will provide up to $5 million for a

feasibility analysis for the Nullinga Dam near Cairns, and up to $5 million for

a detailed examination of land-use suitability for Ord Stage 3.

In order to help attract more investors to the

north, the government plans to:

- host a major northern investment forum in Darwin

in late 2015 to bring together international investors, supported by the new

investment prospectus: “Northern Australia emerging opportunities in an

advanced economy” - set up a new $75 million Cooperative Research

Centre on Developing Northern Australia; - invest $15.3 million to position the north as a

global leader in tropical health; - provide $12.4 million for Indigenous Ranger

groups to expand biosecurity surveillance; - help business enter new markets and supply chains

by increasing access to the Entrepreneurs’ Infrastructure Programme and

Industry Skills Fund.

The government also says it will focus on funding

high priority infrastructure through a $5 billion Northern Australia

Infrastructure Facility; a new $600 million roads package; and a $100 million

beef roads fund, which will help improve cattle supply chains. Plans are also

afoot to invest $5 million in rail freight analyses, starting with a

pre-feasibility analyses of the Mount Isa to Tennant Creek railway and an

upgrade of the Townsville to Mount Isa line.

The Northern Australia Strategic Partnership — the

biannual gathering of First Ministers from the Commonwealth and northern

jurisdictions — will also be made permanent.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Government’s looking to the north

Study shows FHB investors least well off

Brisbane’s softer median mostly seasonal

WA: sales are stable but rents still falling

Calls for more investor education and less lending restrictions

RBA announcement: cash rate to stay at 2%

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/H9U4jP2BclU/governments-looking-to-the-north

Study shows FHB investors least well off

Study shows FHB investors least well off

Posted on Tuesday, June 16 2015 at 2:00 PM

A new study by comparison website Finder.com.au has found that first homebuyer investors are the least well off in the Australian property market despite being in a better financial position.

The survey of more than 1,100 Australians

found that 14 per cent of recent or prospective first homebuyers (FHBs) are

buying their first home as an investment. Generation Y (aged 18-34) are more

likely to be FHB investors than any other age group, with 64 per cent of FHB investors

from that category, followed by gen-X (aged 35-54) with 33 per cent.

These FHB investors are more likely to

have a bigger household income than owner-occupier FHB – almost double the

proportion have a household income of more than $200,000 (17 per cent) compared

to FHB owner-occupiers (9 per cent). More than half of first-time buyer

investors (59 per cent) have a household income of $100,000 or more, compared

to 46 per cent of FHB owner-occupiers.

The study found that purchase budgets are

also bigger for FHB investors, as 52 per cent are spending more than $500,000

compared to just 35 per cent of FHB owner-occupiers. More FHB investors have a

budget higher than $1 million compared to FHB owner-occupiers, too.

First homebuyer investors are less likely

to buy their first property in the same city in which they live (79 per cent)

compared with FHB owner-occupiers (91 per cent). Forty-eight per cent of FHB investors

are likely to buy apartments, townhouses and villas compared to just 36 per

cent of owner-occupiers.

Michelle Hutchison, money expert at finder.com.au,

said despite deeper pockets than owner-occupied FHB, FHB investors are finding

it the toughest in the property market.

“First homebuyers are among the lowest

levels we’ve ever seen, currently at just over 15 per cent of all home loans

financed, and it has been steadily declining for over a year.

“Government grants for FHBs have declined

while property prices have grown considerably over the past few years. And now

with some lenders pulling back on their attractive rates to investors, first-time

buyer investors are the worst off.

“However, this is good news for FHB

owner-occupiers, who are the majority of FHBs, as it could help alleviate the

property market heat, which is being pushed by investors and refinancers.

“Whether you’re buying your first home to

live in or as an investment, prospective borrowers need to be careful with

over-stretching themselves as it’s not worth the financial risk if you can’t

afford to jump into the market. Work out how much you can afford to repay with

a buffer for rising interest rates and stick to a budget or face financial

stress down the track.”

Capital city results

- Sydney has the highest number of FHB

investors, followed by Melbourne and Perth, while Adelaide has the least - Sydney FHB investors are more

likely to have a budget over $500,000 than FHB investors in other capital

cities, while Adelaide were the least likely - Perth and Brisbane FHBs are the

least likely to have a budget over $1 million, while Sydney and Melbourne were

the only cities to have FHB investors with property budgets of over $1 million - Sydney FHB investors

were more likely to have a household income of more than $100,000, followed by

Melbourne, than Perth. The least likely is Adelaide.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/1paqLeE7hZI/study-shows-fhb-investors-least-well-off

Brisbane’s softer median mostly seasonal

Brisbane’s softer median mostly seasonal

Posted on Wednesday, June 10 2015 at 4:39 PM

A 3.3 per cent fall in Brisbane’s median house value was seasonal and expected according to the Real Estate Institute of Queensland’s (REIQ).

The group’s Queensland Market Monitor reveals the median house

price fell to $580,000 in March Quarter 2015.

Antonia Mercorella, CEO of the REIQ, says this result reflects a quieter

quarter in prestige property rather than a general fall in the overall market.

Mercorella says that the seasonally strong December Quarter 2014, which

saw the median reach $600,000, has also played a part in the results.

“March is historically the quietest quarter of the year, and after such

robust trading in December 2014 this dip was not unexpected.”

The report says data for the year ending March 2015 should boost

confidence, with house prices up 7.2 per cent compared to last year.

“Looking at the 12-month trend to March 2015, the median house price is

at $587,000 and this is an even more accurate reflection of what sales prices

are doing.”

The soft quarterly result was also countered by rising sales activity,

particularly for attached housing in outer suburbs with

new infrastructure.

“The Moreton Bay suburbs of Griffin, Petrie and Kallangur are benefiting

from the new rail line which will improve transport options for those

residents,

“The relative affordability of units and townhouses in the Redcliffe

region, with a median price of around $305,000, is a good entry point for

investors and owner occupiers who can’t afford to buy closer in,” Mercorella

says.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Brisbane’s softer median mostly seasonal

WA: sales are stable but rents still falling

Calls for more investor education and less lending restrictions

RBA announcement: cash rate to stay at 2%

New home sales show another lift

First timers grant changes cause confusion

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/RcDD_2Ompzo/brisbanes-softer-median-mostly-seasonal

RBA announcement: cash rate to stay at 2%

RBA announcement: cash rate to stay at 2%

Posted on Tuesday, June 02 2015 at 2:45 PM

The Reserve Bank of Australia’s governor Glenn Stevens announced today that the cash rate will remain at two per cent for at least another month.

In his

statement, he said: “In Australia, the available information suggests the

economy has continued to grow, but at a rate somewhat below its longer-term

average,” adding that “low interest rates are acting to support borrowing and

spending”.

“Having

eased monetary policy last month,” Stevens said, “the board today judged that

leaving the cash rate unchanged was appropriate at this meeting. Information on

economic and financial conditions to be received over the period ahead will

inform the Board’s assessment of the outlook and hence whether the current

stance of policy will most effectively foster sustainable growth and inflation

consistent with the target.”

The recent finder.com.au

Reserve Bank survey found that all 34 respondents were agreed that the cash

rate would stay on hold for June. Most of the experts felt that the RBA would

be conducting a “wait and see” approach, after last month’s cut.

BIS

Shrapnel’s Richard Robinson said: “They’ll

wait for a time when the rate cut will help engineer a fall in the dollar.

Residential markets are still too buoyant.”

Last

month’s decision to deliver a 25 basis point cut did help create a late autumn

property rush in Queensland, according to Raine Horne Beenleigh

co-principal Dennis Wey.

“Up

until early May the market in Logan City had been stuttering and the February

rate cut hadn’t been much help,” he says.

“But

when the RBA slashed rates to a record low of two per cent, the autumn property

market took off.

“The

enquiry level jumped immediately and was ferocious, with investors from Sydney

leading the charge.

“The

Sydney investors have recognised that there is plenty of value in our region

and we expect the May rate hike will provide the fuel that gets the Beenleigh

market motoring.”

In

the Moreton Bay region, the May rate cut helped drive up demand in suburbs such

as Burpengary, Narangba, Morayfield and Caboolture, according to local agent

Gina Wells.

“We

had a record month in April, doubling our sales averages,” she says.

Apart

from lower interest rates, Wells confirms there has been a significant surge in

Sydney investors, which is driving the Moreton Bay market.

“This

autumn market has been better than a traditional spring market, and we’re

getting back to boom levels with prices starting to rise,” she adds.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/FtnXEif0wu8/rba-announcement-cash-rate-to-stay-at-2