Cash rate unmoved for another month

Cash rate unmoved for another month

Posted on Tuesday, August 04 2015 at 2:41 PM

In a move that had been widely predicted, the Reserve Bank of Australia announced today that the cash rate will remain at 2.0 per cent. It came down to that level on May 6, 2015, and has remained there ever since.

Governor Glenn Stevens said in his statement:

“Low interest rates are acting to support borrowing and spending. Credit is

recording moderate growth overall, with growth in lending to the housing market

broadly steady over recent months.

“Dwelling prices

continue to rise strongly in Sydney, though trends have been more varied in a

number of other cities. The Bank is working with other regulators to assess and

contain risks that may arise from the housing market.

“The Board today judged that leaving the cash

rate unchanged was appropriate at this meeting. Further information on economic

and financial conditions to be received over the period ahead will inform the

Board’s ongoing assessment of the outlook and hence whether the current stance

of policy will most effectively foster sustainable growth and inflation

consistent with the target.”

CoreLogic RP Data head of

research Tim Lawless says: “With dwelling values continuing their stellar run

of growth through July, the housing market was likely to be a key topic of

conversation for the Reserve Bank when they deliberated the cash rate today.

“Australian regulators,

including the RBA and APRA, were probably hoping to see value growth in the

housing market decelerating during the winter months, however the opposite has

been true in Sydney and Melbourne.

“Last month, Sydney’s

annual rate of capital gain reached its highest level since 2002, with dwelling

values tracking 18.4 per cent higher over the year, while Melbourne values were

11.4 per cent higher.

“While growth conditions

remain exceptionally strong in Sydney and Melbourne, the other capital city

housing markets are seeing much more benign rates of capital gain, highlighting

the fact that low interest rates aren’t having as strong a stimulatory effect

on housing market conditions outside Sydney and Melbourne.

“The third highest rate of

annual capital gain across the capital cities was Brisbane, where dwelling

values have increased by only 3.9 per cent over the past 12 months, and values

are falling in Darwin and Perth.

“We are expecting investor

demand will start to moderate as investment loans are both more difficult and

costly to obtain. Additionally, the cumulative effect of low rental yields,

worsening affordability, record levels of new dwelling construction and the

maturity of the growth cycle are likely to act as a disincentive to any further

acceleration in investment demand across Sydney and Melbourne, despite the

steady interest rate environment.”

Real Estate Institute of

New South Wales president Malcolm Gunning said low interest rates were

continuing to help boost the property market.

“There has been great

activity across Sydney and NSW since interest rates were cut earlier this year.

Property buyers are using these record lows to their advantage and as long as

they factor in future interest rate rises, now is a great time to upgrade,

enter the market or invest.”

The official cash rate has

fallen 275 basis points since November 2011, with the RBA cutting interest

rates twice in 2013 in May and August and at its February and May meetings this

year.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/XiyJ1VFzAcg/cash-rate-unmoved-for-another-month

Loans to investors still high – but investors should take care

Posted on Friday, July 31 2015 at 4:13 PM

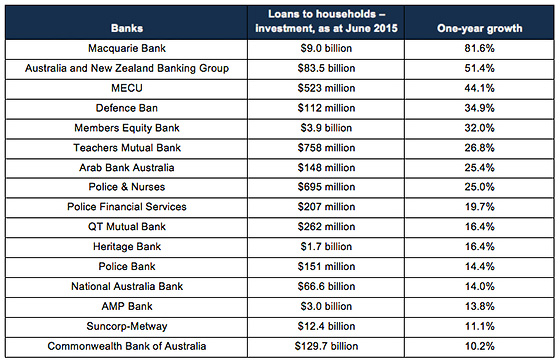

Property investors are being warned to watch their home loan interest rates, while new investors will face a tougher time securing an investment loan, following new research into home loan market lending growth by comparison website finder.com.au.

The finder.com.au analysis of data from the

Australian Prudential Regulation Authority (APRA) shows that 16 banks have

grown their investment home loan lending by more than 10 per cent in the past

year to June 2015, including three of the four major banks: ANZ, Commonwealth

Bank and NAB.

Banks have collectively grown their

investment lending by 16.5 per cent in June 2015 compared to June 2014. Total

investment loans by the 73 banks monitored by APRA has grown from $435.7 billion

in June 2014 to $507.4 billion in June 2015.

Investment lending in the past year has grown more than

three times that of their owner-occupied lending. These banks have collectively

grown their owner-occupied books by just 4.5 per cent (compared to 16.5 per

cent for investment loans), from $829.9 billion in June 2014 to $866.8 billion

in June 2015.

Money expert at finder.com.au Michelle

Hutchison says APRA’s move to curb investment lending has done little to ease

growth.

“While APRA has

implemented measures to curb investment lending growth, many banks have clearly

not responded as their lending has continued to rise.

“In fact, 16

banks have increased their investment lending by more than APRA’s recommended

10 per cent growth rate in the past year, including some of our biggest banks.”

The biggest

increase in investment lending growth was by Macquarie Bank by 81.6 per cent to

$9.0 billion, largely due to acquiring loans books from other institutions.

The third-largest

investment home loan lender in Australia – ANZ – saw the second-biggest spike

in investment home loan growth, of 51.4 per cent year-on-year to $83.5 billion.

In contrast, the biggest investment lender in Australia –

Westpac – grew its investment lending by just 9.9 per cent in the past year to

June 2015, to $152.5 billion.

Growth over the past two years to

June 2015 saw investment lending by these banks increase by 28.6 per cent.

Compared to owner-occupied lending, it grew by 12.2 per cent.

Taiwan Business Bank saw the

biggest growth in

investment lending of 300 per cent over the past two years, while Macquarie

Bank also had the biggest growth for owner-occupied home loans since June 2013

of 155.7 per cent.

“Borrowers need to be mindful that

some lenders may pull back on investment lending harder than others, by

following the lead of AMP earlier this week and ceasing offering investment

loans, or increasing rates or tightening down on lending criteria,” Hutchison

says.

“In this turbulent market, it’s

vital to do your research and compare providers and their offerings, weigh up

the pros and cons, and ensure you’re getting the best possible deal for your

personal situation.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/_t_HshAUaxM/loans-to-investors-still-high-but-investors-should-take-care

Affordability index sees fall in June quarter

Affordability index sees fall in June quarter

Posted on Friday, July 31 2015 at 12:03 PM

The Housing Industry Association (HIA) Affordability Index fell in the June 2015 quarter, signalling a deterioration in affordability conditions.

“The

positive impact of a second interest rate cut for the year in May was

overwhelmed by an increase in the CoreLogic RP Data median dwelling price and

the persistence of sluggish earnings growth,” HIA chief economist Dr Harley Dale says. “The net negative impact of these

factors saw the national HIA Affordability Index fall by 2.9 per cent to 79.7

in the June 2015 quarter.

“The

national affordability result masks wide variations around the country, an

unsurprising finding given the lack of geographical consistency to the current

residential cycle,” he adds.

During

the June 2015 quarter, affordability deteriorated by 3.6 per cent in capital

city markets, driven by Sydney and Melbourne. This was in stark contrast to a 2.7

per cent improvement for regional Australia. Compared with the June quarter

last year, capital city affordability worsened by 0.6 per cent, while in

regional Australia affordability saw a 5.2 per cent improvement.

“The

large differences in the results for the capital city Affordability Index and

its regional counterpart, together with the variation in outcomes between

capital cities, exposes the folly of sweeping generalisations that refer to an

Australian housing boom,” Dale says. “That is simply not what is occurring – in

many parts of Australia the extremely low interest rate environment is

delivering historically favourable affordability conditions.

“It’s

against this backdrop that authorities have escalated their requirements for

the rationing of credit to residential investors. The risk is that this will

obstruct new housing supply, aggravating affordability conditions in markets

around Australia,” he concludes.

ABS figures

released earlier this week show that total new home building approvals fell in June 2015, due to a

sharp decline in approvals for non-detached housing. Approvals for detached

housing continued an 18-month trend of relatively strong and steady levels.

In June

2015, the number of new home building approvals declined by 8.2 per cent to

17,868 in seasonally-adjusted terms. During the June 2015 quarter, approvals

totalled 56,351, 4.8 per cent lower than in the previous quarter.

“Both the

monthly and quarterly declines in new home building approvals were driven by

falls in non-detached housing approvals,” HIA economist Diwa Hopkins says.

“It

certainly looks like this segment of approvals has peaked, with each of the

last three months of activity falling well short of the record-high level

reached in March this year.

“In

contrast, detached house approvals have been tracking fairly steadily at

relatively strong levels for the past 18 months. Approvals in this segment of

the market have maintained an average of 9,650 per month since January 2014.

The last time such levels were similarly maintained was over a decade ago.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/05dWbjbiSxE/affordability-index-sees-fall-in-june-quarter

50% of investors plan to buy in next year

50% of investors plan to buy in next year

Posted on Monday, July 27 2015 at 10:11 AM

Recent research by property investment experts MRD Partners has revealed that more than half of property investors would like to buy a property over the next 12 months, and also that Queensland is the state of choice for property investors looking to buy.

More than half of

respondents to MRD’s Australian Property

Investor Survey indicated the Sunshine State was where their next

investment would be.

Queensland outstripped its

rival states of New South Wales, Victoria and Western Australia in popularity

by four to one, South Australia by six to one, Tasmania by 32 to one, and the

Northern Territory and the Australian Capital Territory by 48 to one.

WA was the second choice

behind Queensland, but it was a distant second, with only 13.61 per cent of

respondents indicating the state was their preferred investment location.

Nick Lockhart, MRD Partners’

managing director, says it was no surprise Queensland was the focus for

investors going forward, explaining that there had been plenty of speculation

over the past 18 months pointing to southeast Queensland in particular as the

place to invest, largely because it was long overdue for an upturn.

“Investors know all markets

go through what we call a ‘property cycle’, where there is typically a boom,

followed by a flat market and some price correction before it lifts again, and

Brisbane is the only capital not to have experienced a substantial lift since

the GFC,” Lockhart says.

“The Brisbane market has

moved from recovery to growth but has not yet entered what we could call a

‘boom’ market, so there’s plenty of opportunity for people to get in now and

buy before that growth comes.”

Survey respondents indicated they believed the Queensland market was “on

the comeback”, along with the ACT, SA and Tasmania. New South Wales and

Victoria were considered to be at the top of the cycle, while the property

market in WA and the NT were labelled as “in a slump”.

Lockhart notes that the WA

market has recently stagnated – or fallen in some instances – due to the

slowdown in mining, which is creating opportunities in the state for investors.

But he also notes the

majority of investors who indicated a desire to buy in WA were those from the

state, which was evidence of a preference to buy “in their own backyard”.

“Alongside WA, NSW and

Victoria were also high on the shopping list for investors, which was to be

expected,” he adds.

“Even though these states

have experienced significant growth recently, they will always be popular

markets as they have a history of strong growth.”

The survey found the

majority of property investors were positive about the market, with more than

51 per cent of respondents indicating they would buy over the coming year and

50 per cent indicating they believed negative gearing would remain despite

recent political debate about its possible removal.

Investors from the ACT

expressed the highest sentiment, with 89 per cent wanting to buy in the next

year, followed by those from NSW at 66 per cent.

WA, SA and Tasmania were the

only states where the majority of investors indicated they did not want to buy

over the next 12 months.

“Now is an amazing time to

invest due to the historically low interest rates on offer – but only in

certain markets,” Lockhart says.

“Investors should focus on

those markets that are in the recovery stage or entering the growth phase of

the cycle and should avoid markets that are at – or near – the top of a recent

growth phase.

“One of the exciting things about the Australian property market is that

it has markets within it at varying stages of the growth phase at any one time.

In that sense, there’s usually an attractive place for investors to invest, and

at this time the most attractive would have to be Brisbane and southeast

Queensland.”

The MRD survey results

dispel the common belief that property investors are “rich”, with nearly 87 per

cent of respondents identifying as being from a low-(23.71 per cent) or

middle-income (62.89 per cent) household.

Investors surveyed preferred

to buy a house and land (62.8 per cent) as opposed to townhouses (15.46 per

cent) and units/apartments (14.01 per cent), and were almost equally split on

whether they preferred to buy in the inner city (47.34 per cent) or in areas

further from CBDs (45.41 per cent).

“People still believe the

value of a property investment is in the land,” Lockhart says.

“In the past two decades master-planned housing estates have

sprung up making housing further from our CBDs more appealing. With them comes

a mixture of retail and commercial facilities, as well as residential housing,

usually with lakes, parks, community facilities, schools, hospitals and

bikeways.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/VNUS1xmGJhk/50-of-investors-plan-to-buy-in-next-year

ANZ increases investor loan rates

ANZ increases investor loan rates

Posted on Thursday, July 23 2015 at 3:13 PM

ANZ today announced interest rates for residential investment property loans will increase to manage investor lending growth targets and in response to changing market conditions.

ANZ said there was no change to other variable lending rates

including the standard variable rate for owner-occupied home loans or for

business lending. Fixed rates for new owner-occupied home lending will be

reduced by up to 0.40 per cent.

Effective Monday, 10 August 2015, ANZ’s variable residential investment property

loan (RIPL) index rate will rise by 0.27 per cent to 5.65 per cent.

Fixed rates for new residential investment lending will also increase by up to

0.30 per cent.

“Although interest rates for residential property investors are at

very low levels historically, the decision to raise interest rates for residential

investment lending has been difficult but necessary in the current environment,”

ANZ CEO Australia Mark Whelan says.

“It allows us to balance the mix of our lending between

owner-occupied and investment lending as well as the impact of changing market

conditions. This includes a decision to cut fixed rates for new owner-occupied

home lending.

“This is a considered decision that takes into account our

customers’ position and the criteria we look at when setting rates including

our competitive position, our regulatory obligations and the state of the

residential property market.”

ANZ has also introduced a series of other measures recently to

improve the mix between investor and owner-occupied lending. For residential

investment lending, these include reducing interest rate discounts, increasing

the deposit required to at least 10 per cent and increasing interest rate

sensitivity buffers.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Most still feel now’s a good time to buy

ANZ increases investor loan rates

Sydney median breaks $1m mark

Massive home building boom set to move into oversupply

States shout louder for stamp duty changes

Popularity of depreciation schedules rising

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/D2qyzeRmVvg/anz-increases-investor-loan-rates

Most still feel now’s a good time to buy

Most still feel now’s a good time to buy

Posted on Friday, July 24 2015 at 1:51 PM

A majority of survey respondents think it’s a good time to buy property despite rising capital city home values over the past three years according to the CoreLogic RP Data Nine Rewards Consumer sentiment survey, released today.

Over the June 2015 quarter, 60 per cent of

respondents agreed that now was a good time to buy a property or home, though

this proportion fell from 71 per cent of respondents at the same time a year

ago, and is down from 80 per cent over the second quarter of 2013.

CoreLogic RP Data research director Tim Lawless says

a majority of respondents still feel that it’s a good

time to buy property.

“With the current growth period having run for

so long it isn’t a surprise to see a fall in the proportion of respondents who

think now’s a good time to buy, particularly in the hottest market – Sydney.”

The regions where survey respondents were most

optimistic about buying conditions were in Tasmania, regional South Australia,

Brisbane and in regional Queensland.

This comes as no surprise to Lawless, who says

these regions are yet to see a substantial run up in prices.

Conversely, he says, “Sydney and regional New South

Wales-based respondents were the least optimistic about buying conditions,

which can probably be attributed to the high rates of capital that have been

recorded over the past few years.”

Sixty-five per cent of respondents thought it

was a good time to sell; the highest reading in the history of the survey,

which began in the first quarter of 2013.

Sydney and Melbourne-based respondents were the

most optimistic about selling conditions. Given the strength of the housing

market in these cities.

“Perceptions around selling conditions in the

Northern Territory and Perth, where property values are now in decline and

listing numbers are rising, were more subdued,” Lawless says.

The survey also asked respondents about their

expectations for capital growth over the next six and 12 months. Forty-eight

per cent of respondents expect home prices to rise over the next six months,

while 45 per cent are expecting prices to rise over the next 12 months. Only 14

per cent of respondents expect prices to fall over the coming year.

Respondents in Tasmania were the most optimistic

about the likelihood of capital growth for their state, with 60 per cent

expecting prices to rise over the coming year.

Lawless believes this result confirms an

improvement in local sentiment across Tasmania, where the market’s previously

recorded weak conditions but has recently started to show some capital gain.

Sydney and Melbourne also saw more than half the

respondents indicating that they expected further growth in property prices

over the next 12 months.

Across the country, respondents from regional

Western Australia were the most pessimistic about local housing market

conditions, with only 14 per cent of respondents indicating they expect prices

to rise over the next 12 months.

Lawless says: “With attitudes around future

capital growth broadly still strong, it’s interesting to note that when

respondents were asked whether Australia’s housing market was vulnerable to a

significant correction, three quarters of respondents felt that it was. This

was the highest reading we’ve received for this question, which suggests that

despite a perception that prices will still rise, more Australians are becoming

concerned about a correction in the housing market.

“Respondents based in regional Western

Australia, the Northern Territory and Sydney were the most wary about the

market’s vulnerability, with 86 per cent, 80 per cent and 79 per cent of

respondents respectively indicating they were concerned values could fall

significantly.”

Another aspect of the market surveyed in June

was respondents’ perceptions around foreign buying. When asked if they thought

foreign buyers were making it more difficult for those living in Australia to

own their home, 73 per cent responded yes.

The effect of foreign buying was perceived to be

most evident in Sydney, regional New South Wales, Melbourne and Tasmania, where

are least 79 per cent of respondents thought foreign buyers were making it more

difficult for Australian residents to purchase their own home.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/U7ACFq2U2wI/most-still-feel-nows-a-good-time-to-buy

States shout louder for stamp duty changes

States shout louder for stamp duty changes

Posted on Friday, July 17 2015 at 2:29 PM

Several states across the country are calling for more action on the subject of stamp duty and, particularly, the scrapping of it.

The presidents of the Real Estate Institutes of Western Australia and NSW, David Airey and Malcolm Gunning, have called for a wider and “more mature” debate around property tax reform and specifically the role negative gearing plays in the provision of rental housing.

The Reserve Bank of Australia (RBA) this week expressed concern about the high use of negative gearing around the nation, estimated to cost taxpayers $12 billion annually.

Airey says negative gearing provides much needed rental accommodation across the nation and helps moderate rental prices through the tax breaks to investment property owners.

“It should be remembered that negative gearing is not a specific tax break but in fact is a tax provision for earning income on assets,” he says.

“It’s too simplistic just to target negative gearing as an issue for review without looking at the wider housing system and the clumsy patchwork of property taxes across the country.”

Gunning says the REINSW has been highlighting the inefficiencies of stamp duty for too long without action from the state’s government.

“Stamp duty clearly distorts prices and adversely effects property transactions,” he says.

“We have to stop the talk and start to see action. The state has got to put its own self-interest aside for the benefit of the broader economy.

“While we’re calling for an abolition of stamp duty, a first step, as a revenue neutral initiative, is to address the stamp duty brackets, which haven’t been adjusted for 30 years.

“This will have no impact on the state because there is clear evidence that a reduction in stamp duty rates will generate additional sales.”

Gunning says that the REINSW recognises that ultimately, if stamp duty is going to be abolished, an increase in GST will be necessary, which will take involvement from the federal government.

“However, it’s time for the NSW Government to stop hiding behind the Commonwealth and start making real decisions for the future of our great state. Something can and should be done now.”

Airey says that a recent report independently commissioned by the Real Estate Institute of Australia and conducted by ACIL Allen, debunked the myth that negative gearing was a sop to the rich.

“The report found that two-thirds of property investors earned a taxable income of less than $80,000 per year and that 73 per cent of those who negatively geared owned just one property.

“Too many people are quick to jump on the negative gearing bandwagon with unsubstantiated claims that it adds to overall house prices and doesn’t add to new stock.

“There is no credible evidence for this and it distracts people from the real issues that contribute to affordability, including stamp duty,” Airey says.

In its recent pre-budget submission to the state government, the REIWA reiterated its call for reform of property taxes.

“Stamp duty’s the biggest hurdle to the ingoing costs of a new home. It is a huge sum of money and it can also be prohibitive to retirees looking to downsize.

“We need a mature debate about abolishing this inefficient and outdated tax and replacing it with a modest land tax across all owners. This will help greatly with affordability and assist state governments with a more predictable revenue stream,” Airey says, adding that the current federal tax system review is a good opportunity for a mature discussion on taxes, the GST and particularly property taxes.

“I encourage the Barnett Government to commit to a review of state taxes in the lead-up to the next state election. For too long discussion around property taxes has been ill informed and ad hoc. We really need to pull it all together and thrash out the issues properly in an integrated way rather than focus on isolated bits of what is quite a complex housing system.

“The problem with property taxes is not negative gearing, it’s negative discussion,” Airey concludes.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/bieayf_91dc/states-shout-louder-for-stamp-duty-changes

Massive home building boom set to move into oversupply

Posted on Monday, July 20 2015 at 10:56 AM

According to economic forecaster BIS Shrapnel, the record-beating residential building boom has already reached its peak and will soon begin to run out of steam.

The

company’s Building in Australia 2015-2030

report says that national dwelling commencements are estimated to have reached

their peak over 2014/15 and will begin to gradually decline from this level in

coming years.

“After

recording strong growth over the past few years, we estimate that total dwelling

starts reached just over 210,000 in 2014/15, an all-time record high,” associate

director Dr Kim Hawtrey says. “From this level, national activity is then

forecast to begin trending down over the following three years, with the

currently high-flying apartments sector leading the way down.”

While

a sizeable dwelling stock deficiency coupled with record-low interest rates drove

building activity to its current highs, Hawtrey warns that the national market will

shift into a mild oversupply by 2018.

“Low

interest rates have unlocked significant pent-up demand and underpinned the current

boom in activity,” he says, “but as population growth slows while construction

activity remains strong, new supply will begin to outpace demand.

“This

will see the national deficiency of dwellings gradually eroded and some key

markets will begin to display signs of oversupply.”

In

the company’s latest forecasts, net overseas migration is expected to continue

its recent downwards trend and gradually ease in response to softer employment

and economic growth, resulting in a weaker outlook for population growth.

However, residential building activity has continued to grow and new dwelling

completions are estimated to have pushed above the underlying demand for

dwellings in 2014/15 for the first time since 2011.

Based

on BIS Shrapnel assumptions about household formation per thousand head of

population, the Building in Australia

2015-2030 report estimates the national dwelling stock deficiency reached a

peak of around 108,000 dwellings by June 2014.

After

a strong 2014/15 this has slipped back to approximately 85,000 as at June 2015.

“After

a sustained period of underbuilding, new dwelling supply is now exceeding demand,”

Hawtrey explains. “With investors and upgrader/downsizers providing enough

momentum to sustain activity at historically strong levels, we estimate that

the national deficiency will have been largely satisfied by 2018, although the

outlook will vary significantly between markets.”

Importantly,

the research shows that despite reaching its peak in 2014/15, new dwelling

starts will continue to track at historically high levels over the coming

years. Low interest rates will continue to support demand, with investors and upgrader/downsizers

expected to remain the driving force across the national market.

“While

we are forecasting a fall in activity from its current peak, this will mostly

be felt in the higher density segment of the market,” Hawtrey says. “After

climbing to nearly 100,000 starts, there will be an inevitable adjustment in

the other dwellings sector as they move back to more sustainable levels.

Detached houses – the late bloomer in this cycle – will prove more resilient,

holding up in 2015/16 before beginning a more subdued decline beyond that.”

Residential building

outlook

According

to the report, housing starts are estimated to have grown by 16 per cent in

2014/15 to reach a record high of 210,000. The stellar result was underpinned

by 24 per cent growth in the other dwellings sector, which is estimated to have

peaked at 95,500, while detached houses delivered a solid

result of 114,600 new starts.

From

this level, BIS Shrapnel expects to see activity begin to fall in 2015/16 (-5

per cent) as pressure is gradually alleviated in some markets. The decline will

be led by the other dwellings sector as it falls back from its unsustainable

high, while detached house starts will remain flat. Affordability concerns will

begin to emerge in the key Sydney and Melbourne markets, which will limit

demand despite interest rates remaining at record-low levels.

New

South Wales, Victoria and Queensland led the way in 2014/15, but only New South

Wales is expected to maintain growth into 2015/16 off the back of a strengthening

economy and a persistent deficiency of dwellings. Queensland will remain relatively

flat around a strong level as its market moves towards balance, while Victoria

will experience the most significant reversal of the three eastern states (-7

per cent). Off such a sustained period of strength, Victoria has been

over-building relative to demand and is estimated to see areas of the Melbourne

market move into oversupply.

Western

Australia will experience the sharpest decline of the five major states (-13 per

cent) as its economy slows in the wake of the mining boom and population growth

softens sharply. This will see a significant stock deficiency quickly

evaporate, and with vastly reduced pressure in housing demand in the key Perth

market, subsequently building activity will soften considerably.

Over the medium term, activity will slow

steadily to 163,800 new starts in 2017/18, with modest increases in interest

rates in late-2016 combining with softening pressure in key markets to limit

new development. From this level a new, more modest upturn will begin as rates

are cut once more and population growth begins to pick up.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/3AGLBXBGhFE/massive-home-building-boom-set-to-move-into-oversupply

Aussies think stamp duty is “most unfair tax”

Aussies think stamp duty is “most unfair tax”

Posted on Monday, July 13 2015 at 11:57 AM

According to new research, there has been a significant shift in community attitudes toward tax reform in Australia. Stamp duty on property purchases ranks as the least fair and most punitive, with a majority of Australians wanting it abolished and strong support for increasing GST to retire stamp duty. In contrast, GST is considered the fairest of all current taxes.

A report from Newgate

Research, Community Attitudes Towards Tax Reform, commissioned by the

Property Council of Australia, finds that nine out of 10 Australians surveyed

support tax reform that makes the system simpler and fairer.

Almost three quarters (72

per cent) of Aussies believe it’s inevitable that GST will rise over the next

decade, while only two per cent believe it definitely won’t.

Most believe the GST is a

fair tax because it’s one that can’t be dodged.

Stamp duty, on the other

hand, is considered the most unfair tax, with most Australians agreeing that it’s

now a major barrier to buying a home.

More than two-thirds (68 per

cent) of Australians have been personally affected by stamp duty and it has

made it harder for around half (54 per cent) to afford a home.

The research also reveals that

housing affordability ranks as a key concern, with 86 per cent of those

surveyed claiming they’re concerned about housing affordability to some degree and

nearly two thirds (63 per cent) either “extremely concerned” or “very

concerned”. Seventy per cent believe it is “extremely” or “very important” for

the government to take action on this issue.

Three-quarters of

Australians also agree that stamp duty is driving up home prices and making it

unaffordable for young people to own their own home. More than two thirds of

the community support the idea of abolishing stamp duty.

Reducing the level of tax on

people’s homes is considered a higher priority than reducing the rate of

personal income tax.

Almost half (47 per cent) of

Australians support abolishing stamp duty in exchange for removing current GST

exemptions: a further 21 per cent are undecided and only 32 per cent oppose

this reform proposal.

A similar proportion (46 per

cent) support abolishing stamp duty in exchange for keeping GST exemptions in

place and increasing the GST to 12.5 per cent: 22 per cent are undecided on

this and 32 per cent oppose it.

Property Council chief executive

Ken Morrison says the research shows Australians support fair reforms to the

tax system.

“Broadening or increasing

the rate of GST has long been considered political poison, but that no longer

reflects the attitude of the community,” Morrison says.

“Australians clearly

understand the need for tax reform and as the research makes clear, they want a

tax system that is fairer and simpler.

“Changes to the GST need to

be taken out of the too-hard basket.

“Governments know stamp

duty distorts the economy, hurts housing affordability and is a rollercoaster

source of revenue.

“National tax reform

needs to replace our most distortionary taxes with more efficient revenue

sources.”

(The research is based on

the answers of 1,957 respondents surveyed nationwide in May and June 2015.)

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/GWrXQuElvr8/aussies-think-stamp-dutys-most-unfair-tax

SA unemployment rate sounds alarm bells

SA unemployment rate sounds alarm bells

Posted on Friday, July 10 2015 at 3:02 PM

The peak body for Australia’s $680 billion property industry says it’s time to get serious about creating “the best state to do business” in South Australia.

Australian

Bureau of Statistics (ABS) data released yesterday reveals that South

Australia’s unemployment rate has hit 7.8 per cent in trend terms or 8.2 per

cent in seasonally adjusted terms.

SA

executive director of the Property Council Daniel Gannon says this month’s

unemployment figures are startling and should be a call to action for the state

government.

“We

need to get serious about implementing the Premier’s vision as ‘the best place

to do business’,” he says. “That involves cutting red tape and creating a

taxation and business environment that’s internationally competitive.

“We

shouldn’t lose sight of the fact that South Australia is in competition with

the world when it comes to attracting investment.

“South

Australian businesses struggle with antiquated shop trading regulation, high

land tax rates, high penalty rates and a sluggish local government-based

planning system,” Gannon says.

“We

need lower costs associated with owning and developing land in South Australia,

cheaper utilities and regulation that doesn’t get in the way of creating jobs.

“We

need to create compelling reasons for interstate and international businesses

to invest here, and give young job-seeking South Australians a reason to not

increase our brain drain exodus.

“That’s

why last month’s announcement to phase out stamp duty on non-residential

property transfers was strongly endorsed by the property sector. Following [this]

jobs data, there is a strong case to fast-track this policy to create an

immediate incentive to invest.

“We

also need to think about infrastructure as a jobs driver. The state government

just released its Integrated Transport

and Land Use plan; however, funding hasn’t been locked in for initiatives

like extending the tram line.

“Let’s

create a plan for moving forward with public-private partnerships on

infrastructure. There are models out there globally, like the UK’s City Deals

infrastructure policy, that have some lessons for policymakers here in our

state.

“The

jurisdictions with the most competitive tax environments and the most liveable

cities will win the contest for skilled immigration and investment globally.

“With

more job losses on the horizon, the property sector has concerns for our

industry’s workforce – a workforce that accounts for 168,000 jobs and generates

almost 26 per cent of wages and salaries paid to South Australians.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

SA unemployment rate sounds alarm bells

RBA keeps cash rate at same level

Excessive yearly falls in sales listings

‘Property Value’ tool hits the market

Calls for commission to consider retirees

Renters in the north, movers in the south

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/EOb-JK-rAC8/sa-unemployment-rate-sounds-alarm-bells