Are Brisbane auctions going the way of Sydney?

Are Brisbane auctions going the way of Sydney?

Posted on Monday, August 24 2015 at 12:16 PM

A weekend auction in Brisbane’s Dutton Park points to Queensland’s capital pushing past reserves in much the same way Sydney and Melbourne have been doing for some time.

There’s been much talk – for at least two years now – of the Queensland

market taking over the mantle from Victoria and New South Wales, after those

markets reach boiling point. While that point has yet to be reached, it does

seem as though they’re slowing, and the evidence from the weekend would suggest

that the market in Brisbane is extremely hot.

The auction for 50 Deighton Road attracted a large amount of interest,

not only because of the site’s position just 2.5 kilometres from the CBD, but

also the tragic state of the building that still stands (just!) at the address.

The house itself is in such a state of disrepair that it’s uninhabitable

– indeed, it’s structurally unsafe to enter – but that didn’t stop it realising

$168,000 over its reserve, fetching an impressive $668,000.

That surprising price, however, is still considerably less than the

suburb’s median house price, currently $757,000.

The buyer is said to be an investor with intentions of building a dream

home on the plot where the dilapidated 1946 Queenslander currently stands.

According to Gunther Behrendt, of Ray White Stones Corner, who managed

the sale, there were 25 registered bidders for the auction, though many more

people turned up to view the spectacle.

The agent says he has seen definite evidence of an increasingly hot

market in Brisbane, with two of his recent sales advancing way over the

reserve. Added to this weekend’s success, Behrendt says, his recent sale of 32

Ross Street in Woolloongabba means his last two sales went $800,000 over

reserve.

“We could sell a whole street over with the amount of interest we have

at the moment,” he says, adding, “it might sound like a cheesy estate agent

line, but my advice to Brisbane homeowners thinking of selling is to make hay

while the sun shines.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/rRoKodjPY5I/are-brisbane-auctions-going-the-way-of-sydney

Popularity of depreciation schedules rising

Popularity of depreciation schedules rising

Posted on Wednesday, July 15 2015 at 2:39 PM

The number of investors relying on tax depreciation schedules to maximise investment property returns is increasing, according to one firm.

BMT quantity surveyors say they’ve had a 15 per

cent increase in depreciation schedule business in the 2014/15 financial year

compared to 2013/14.

Brad Beer, CEO of BMT, says the amount of time between a property

acquisition and the ordering of a schedule has dramatically decreased as well.

“The data suggests that an increasing number of investors are becoming

more sophisticated in terms of understanding the tactics available to them to

increase their yields.”

During the 2013/14 financial year, BMT found that it took investors an

average of 281 days to order a tax depreciation schedule after purchasing their

property.

By May 2015, this figure dropped nearly 13 per cent to 245 days.

Quantity surveyors are able to create schedules that detail the

depreciation deductions available for items in an investment property over

varying time frames.

The Australian Taxation Office (ATO) allows investors to claim this

depreciation as a tax deduction against income received from the property.

“If an investor has not claimed depreciation on an investment property

in the past they are able to claim for some of the years that they missed out

on and this might result in savings of up to tens of thousands of dollars,”

Beer says.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Sydney vacancy rates fall

Renovations rule, not holidays or weddings

Home reno costs are down in Queensland

Better news from the West, with Albany on top

Renters could feel APRA backlash

Cash rate unmoved for another month

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Va9HUcO0tcM/popularity-of-depreciation-schedules-rising

Sydney median breaks $1m mark

Sydney median breaks $1m mark

Posted on Wednesday, July 22 2015 at 3:49 PM

The June House Price Report from Domain.com.au has today revealed that house prices in Sydney have surged 22.9 per cent over the last 12 months – double the national median house price growth of 11.7 per cent – to $1 million.

In doing so, the harbour city has emerged as a

significant player in the international property market. The median house price

has now surpassed that of London and is fast approaching New York, though it

remains well behind the property prices of Paris.

The key findings of the report show:

- Sydney

market reports remarkable growth over June quarter - Melbourne

market continues strong recent revival - Brisbane

price growth resumes but remains modest - Perth

house prices still falling as confidence wanes - Canberra

market clearly strengthening with buyer activity on the rise - National

median house price is up 4.3 per cent over the quarter and 11.7 per cent year on

year.

Commenting on the report, Domain senior economist Dr

Andrew Wilson says:

“The Sydney housing market has been the standout performer

of all the capitals over this quarter, recording a phenomenal 22.9 per cent

price growth year on year.

“Other capital cities reported steady growth, with the

Perth and Darwin property markets the only ones to see a drop in median house

price value over the quarter.

“Nationally, the median house price jumped 4.3 per

cent over the quarter – an increase of 11.7 per cent over the year.

“Sydney’s strong growth is expected to continue for

the foreseeable future, while solid buyer activity and interest is expected to

continue to drive steady growth in the Melbourne and Canberra markets.”

JUNE QUARTER PERFORMANCE

SUMMARY

Sydney

Median house price increased by 8.4 per cent to

$1,000,616, according to Domain data. Sydney unit prices also surged over the

quarter, by 6.6 per cent to $656,078 – again the strongest local growth rate of

the modern era.

The main catalyst is thought to have been low mortgage

rates – the lowest since the mid-1960s. It’s “a perfect storm of local supply

and demand factors generating price growth”.

Melbourne

The housing market continued its strong revival,

recording an increase of 3.5 per cent in the median house price to set a new

record at $668,030. Melbourne’s median unit price also increased strongly by

3.2 per cent over the quarter, to a new record $443,549. The median house

price in Melbourne increased by 10.3 per cent over the 2014-15 financial year

with the median unit price up by 4.5 per cent over the same period.

Strong price growth over the last 12 months is thought

to have been generated primarily by aspirational buyers, particularly in

Melbourne’s eastern suburban regions. Rising buyer activity in suburbs west and

north of the city also contributed to the house price growth.

Brisbane

While positive, the market continued to produce

results slightly below the predicted price growth for 2015. The median house

price increased by just 0.6 per cent over the June quarter to $490,855 with

unit prices up by 1.0 per cent to $371,508. House prices in Brisbane have

increased marginally by 1.9 per cent over the past year, while unit prices have

fallen by 3.2 per cent.

Underperformance by the local economy and fragile

buyer sentiment continues to impede buyer activity, according to Wilson.

Adelaide

The report reveals a modest increase in the Adelaide

housing market, with a slight increase in the median house price over the June

quarter. After a strong result over the March quarter, median house prices

increased by just 0.2 per cent to $479,285, while Adelaide unit prices fell by

2.7 per cent over the quarter to $292,399. The median house price for

Adelaide has increased by 3.3 per cent over the 2014-15 financial year, with

the median unit price up by just 0.6 per cent over the same period.

“Prospects of a solid recovery in buyer activity for

the Adelaide market have lessened with recent results,” Wilson says, adding

that remains the most affordable mainland capital city with relatively high

yields and low vacancy rates likely to attract increasing numbers of investors.

Perth

The median house price fell by 0.9 per cent to

$605,089, while Perth unit prices dropped 2.1 per cent to $405,417. Over the

last 12 months, Perth’s median house price has fallen by 1.4 per cent, while

unit prices are down by 2.1 per cent.

Modest buyer activity and weakening house price growth

is said to be expected for the remainder of 2015.

Hobart

Median house prices in Hobart were steady, after a

drop in the March quarter. Hobart’s median house price remained at $325,972, an

increase of just 0.6 per cent over the last financial year. Hobart unit prices

also recorded a flat result over the June quarter with a median of $272,932,

down by 1.6 per cent over the year.

Increased investor activity and higher numbers of

first homebuyers are set to support the market over the remainder of 2015.

Canberra

Strong growth in buyer activity over the June quarter,

continuing the significant momentum experienced over the last 12 months.

Canberra’s median house price increased by 1.5 per cent to $616,313, an

increase of 5.4 per cent over the 2014-15 financial year, which was second only

behind Sydney and Melbourne for annual prices growth.

While house prices are

performing well, unit prices did fall sharply over the quarter, down by 6.3 per

cent to $382,350 and down by 6.8 per cent year on year.

Recent high levels of apartment construction continue

to push supply ahead of demand with downward pressure on prices growth.

Darwin

House prices rebounded sharply, following a flat

result over the previous quarter. The Darwin median house price increased by

1.6 per cent to $654,270. Although this was an increase of 1.8 per cent

over the 2014-15 financial year, Darwin’s median house price still remains

below the peak $680,337 recorded over the December quarter 2013.

Unit prices fell by 3.4 per cent over the

June quarter to $471,789 but were up by 3.3 per cent over the year ending June.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/6svwcdALFDs/sydney-median-breaks-$1m-mark

Sydney vacancy rates fall

Sydney vacancy rates fall

Posted on Tuesday, August 18 2015 at 2:30 PM

A tightening in Sydney’s vacancy rate shows supply is meeting demand, according to the Real estate Institute of New South Wales (REINSW).

The July 2015 REINSW Vacancy Rate Survey reveals the

number of properties for rent across Sydney fell 0.2 per cent to 1.9 per cent.

Malcolm Gunning, president of the REINSW, says the

supply of available rentals is strong, and is being taken up by tenants.

“Vacancy rates remain close to 2.0 per cent which

shows that supply is starting to meet demand.

“Despite the 0.2 per cent decline month on month we

still we think it is a good result and shows a strong

stream of property on the market starting to feed the migration into Sydney.”

Inner Sydney tightened by 0.5 per cent to 2.1 per

cent, while Middle Sydney saw falls in availability of 0.2 per cent at 1.7 per

cent.

“Outer Sydney has hit levels last seen in December

2014,” Gunning says.

Hi comments are based on a drop in the vacancy figure

of 0.1 per cent to 1.6 per cent Outer Sydney.

In locations further afield, the Hunter region saw

availability rise 0.2 per cent to 3.7 per cent.

The region with greatest availability was New England,

which jumped 1.2 per cent at 4.6 per cent.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Sydney vacancy rates fall

Renovations rule, not holidays or weddings

Home reno costs are down in Queensland

Better news from the West, with Albany on top

Renters could feel APRA backlash

Cash rate unmoved for another month

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/k0Qu4bHOONE/sydney-vacancy-rates-fall

Another big lender makes investor loan changes

Another big lender makes investor loan changes

Posted on Wednesday, July 29 2015 at 1:17 PM

AMP Bank will not be accepting new or assessing existing investor property lending applications from today, it has announced. This is expected to last until later in 2015, depending on market conditions.

The

lender is also set to increase variable rates on all existing investor property

loans by 0.47 per cent per annum from September 7, 2015, in response to

regulator guidelines to limit growth in investor property lending across the

market to 10 per cent,.

All

investor property loan applications that have been approved will be subject to

the 0.47 per cent increase on settlement.

“We

appreciate the position this puts our customers in and will be working with our

distribution network to actively communicate with them,” AMP Bank managing director

Michael Lawrence says, adding that the lending facility remains committed to

helping Australians own their homes.

“Australia’s

property market is experiencing high levels of investor property lending growth

and we are supportive of the regulator’s intention to slow this growth to

appropriate levels,” he says.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Renovations rule, not holidays or weddings

Home reno costs are down in Queensland

Better news from the West, with Albany on top

Renters could feel APRA backlash

Cash rate unmoved for another month

Property investment body calls for balanced approach

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/zaQ5FcKJhBE/another-big-lender-makes-investor-loan-changes

Renovations rule, not holidays or weddings

Renovations rule, not holidays or weddings

Posted on Friday, August 14 2015 at 12:01 PM

Aussies are more likely to take out a loan for home improvements than they are to borrow money for an exotic overseas holiday or wedding, according to new data from customer-owned lender CUA.

More than one in 10 personal loans issued by CUA

during the 12 months to June 30, 2015, were for home improvements or household

goods, the company says. Home renovators borrowed a little more than $15,000 on

average, while personal loans taken out to purchase household goods averaged

around $8,900.

“Customers see any money they put into their home –

including renovations and home improvements – as being an investment in their

future,” CUA head of customer insights Chris Malcolm says.

“Improvements to the family home, like an extension

or a new entertaining area, can create extra space or comfort for the family to

enjoy today, as well as potentially adding value to what is, for most people,

their biggest asset.”

Comparatively, just over five per cent of personal

loans taken out by CUA customers were for holidays, with people borrowing an

average $10,000. Weddings accounted for less than one per cent of new personal

loans issued during the past year, with soon-to-be-newlyweds or their families

borrowing an average of nearly $15,000 to help pay for their big day.

Boats, caravans/campers, motorcycles and scooters

were also well down the list when it came to personal lending.

“The figures reinforce the findings of our recent

CUA National Mortgage Survey, which showed

homeowners are more likely to put extra cash towards paying off their home loan

than they are to splurge on luxuries and holidays,” Malcolm says.

Personal loans remained popular with customers

wanting to consolidate their personal finances or debts, while around one in

three CUA personal loans during the year were for new or second-hand cars.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/CLo2jFlwMaI/renovations-rule-not-holidays-or-weddings

Property investment body calls for balanced approach

Property investment body calls for balanced approach

Posted on Monday, August 03 2015 at 11:03 AM

The Property Investment Professionals of Australia (PIPA) has questioned the move by lenders to increase interest rates to both new and existing property investors, urging regulators and government to take a more balanced approach in working to encourage a sustainable and flourishing property market.

PIPA chair Ben Kingsley

says increasing interest rates for existing investors appears to be an

opportunistic move by banks that could have potentially harmful flow-on effects

to the broader property market.

“Increasing

borrowing costs for investors, and in some cases owner-occupiers, who bought

into the market some time ago seems unfair and detracts from what should be the

common goal of creating a balanced property market,” Kingsley says.

PIPA believes more

targeted measures to slow new investor lending, such as decreasing and

restricting borrowing power for new investors in locations where the market is

particularly heated, could be a better approach.

“Above all, the

industry needs to be united in slowing investor activity in some markets. While

PIPA fully supports responsible lending, we believe going forward APRA [the

Australian Prudential Regulation Authority] should take a more transparent

approach, rather than continue its current closed-door tactics.”

According to

Kingsley, APRA’s pressure tactics to force individual lenders to lock out

investors, or increase interest rates, have raised both concerns and question

marks for the industry.

“While real estate

can absolutely be a powerful investment class, people must recognise that not

every property in every market will deliver appropriate returns, and in a

heated market, the odds are really against you.

“PIPA is urging the

government and regulators to join forces and open this debate to the broader

industry. Let us all contribute to this discussion and invest in measures that

will create a more balanced property market for the long-term, and strengthen

this invaluable component of our economy,” he says.

As the peak body for

the property investment industry, PIPA has long campaigned for greater

education around property investment as well as regulation of property

investment advice.

“PIPA remains dedicated to supporting a healthy, sustainable property

investment industry, where education and appropriate regulation come together

to support good outcomes for all stakeholders involved,” Kingsley concludes.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Y1xbmKw1SGk/property-investment-body-calls-for-balanced-approach

Home reno costs are down in Queensland

Home reno costs are down in Queensland

Posted on Monday, August 10 2015 at 4:05 PM

The cost of renovating your home in Queensland has dropped one per cent so that it’s now the most affordable state in which to renovate, according to a new report.

The Renovation

Consumer Price Index (RCPI) is a quarterly report released by

ServiceSeeking.com.au analysing 52,000 quotes submitted by tradesmen on the

website. The latest RCPI compares the cost of renovating in the fourth quarter

of FY15 versus the previous year.

To support the release, ServiceSeeking.com.au has

created an interactive map that plots price changes across 10 popular

renovation services in Queensland year on year.

“The interactive map shows the cost of renovating a

home in the sunny state has dropped by one per cent quarter-on-quarter,” CEO

Jeremy Levitt says, while the national average has risen 3.9 per cent.

“In the past, Queensland’s been Australia’s most

expensive state to renovate so the news comes as a pleasant surprise for many

homeowners,” he adds.

Prices in Queensland were overwhelmingly cheaper than

those around the rest of the country, particularly in Western Australia and

Victoria, where costs skyrocketed by more than 6 per cent.

Tiling and paving (up 8.9 per cent) and plastering (up

4.5 per cent) were the only industries that saw significant price increases,

with all other renovation sectors affording great value.

The findings suggest that demand is finally being

matched by strong local supply of skilled tradesmen. However, homeowners are

warned to take advantage of the savings ahead of the state government’s recent

stimulus package, which is set to boost Queensland’s infrastructure and perhaps

put another strain on supply.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Home reno costs are down in Queensland

Better news from the West, with Albany on top

Renters could feel APRA backlash

Cash rate unmoved for another month

Property investment body calls for balanced approach

Loans to investors still high – but investors should take care

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/wqv5OT-eEbA/home-reno-costs-are-down-in-queensland

Better news from the West, with Albany on top

Better news from the West, with Albany on top

Posted on Friday, August 07 2015 at 12:16 PM

The area of Albany has emerged as the best performing regional centre for West Australian property over the last financial year, according to the Real Estate Institute of Western Australia (REIWA).

Data released this week by REIWA shows the Albany Urban Area had 5.3 per

cent growth in median house price over the last year, lifting it to $389,750.

The regional city saw 456 house sales, 42 unit sales and 200 land sales

over the last year.

Better performing suburbs included Bayonet Head, up 8.8 per cent to a

median of $397,000, Mount Melville, up 5 per cent to $380,000 and Spencer Park,

up 4.9 per cent to $350,000.

The suburb with the greatest number of house sales was Yakamia, where 52

properties changed hands at a median price of $388,750, but which was a drop of

almost 6 per cent in price on the previous year.

REIWA’s branch chairman for Albany, Barry Panizza, says that while any

growth is good it must be seen in context.

“The lift in median price over the last year really only brings us back

to where we were five years ago because the market has been weak for that long,”

he says.

“However, it’s encouraging to think that we might now be returning to a

better position of forward growth and it gives buyers and sellers a bit more

confidence.

“Turnover, however, was down 10 per cent on last year, which could be

attributed to fewer properties on the market and this also helped with price

growth.”

Panizza believes the growth should hold as the available land in some

areas is being taken up quickly with no new subdivisions on the horizon in some

residential suburbs.

“I also think there may have been some renewed interest in Albany

following the hugely attended ANZAC commemorations over the last 12 months.

Thousands of people from all over Australia got to see and experience Albany

last October and again in April this year, and it wouldn’t surprise me if that

resulted in a few people relocating here or acquiring an investment holiday

home for the future,” he says.

The second best performing regional centre was the Busselton Urban Area,

which experienced 3.4 per cent growth over the financial year, following on

from positive growth in previous years. Its best performing suburb was Abbey

with a median price of $625,000, up by 15.7 per cent over the year and

averaging almost 4 per cent growth each year over the last five years.

In third place was Goldfields/Esperance with 3.1 per cent growth,

although the suburb of Esperance itself did well with 4.3 per cent growth based

on 25 sales and a median price of $365.000.

The suburb of Kalgoorlie enjoyed 7.6 per cent growth to $317,500, while

Piccadilly had very good growth of 20.2 per cent to $375,000.

Several regional centres had zero growth or very modest fluctuations,

such as Mandurah and Bunbury, while many others went backwards.

Hardest hit was the Pilbara region, still suffering from the downturn in

the mining-construction sector.

Karratha dropped by an exceptional 32.3 per cent to a median price of

$440,000. Port Hedland dropped 12 per cent but still had a significant median

price of $880,000, while South Hedland had a modest drop of 4.6 per cent to

$711,000.

Around the state several smaller towns and villages had some reasonable

stand-alone results, including Pinjarra with 19 per cent growth to $362,500,

Harvey up 11 per cent to $310,000, Margaret River up 8.1 per cent to $465,000,

Merredin up 10.6 per cent to $177,000, Narrogin up 9.6 per cent to $216,000 and

Wagin up 39.2 per cent to $181,000.

Across the regions as a whole, price growth was just under one per cent,

lifting the country median house price to $383,000.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/ooWDeixOPDY/better-news-from-the-west-with-albany-on-top

Renters could feel APRA backlash

Renters could feel APRA backlash

Posted on Wednesday, August 05 2015 at 10:53 AM

While it had been fully expected that the Reserve Bank of Australia (RBA) would keep the cash rate on hold at yesterday’s board meeting, all eyes are on investment lending as new research by comparison website finder.com.au shows rents are expected to rise by 2.8 per cent.

The finder.com.au

monthly Reserve Bank Survey found all 31 leading

economists and experts unanimously predicted the cash rate would hold at 2.00

per cent, with many saying they felt the last two cash rate cuts in February

and May need more time to filter through the economy.

The survey also found that almost one in

five of the experts are forecasting another cash rate cut this year. Despite

this, the majority surveyed are expecting property prices will keep rising this

year.

Michelle Hutchison, money expert at finder.com.au, says

renters won’t be immune to higher housing costs.

“For the

majority of households who don’t have a mortgage (about five million households

or about two in three – two million of which are renters), it’s not looking

good for many of them either as new research by finder.com.au suggests monthly

rents could be set to increase by nearly 3 per cent nationally as Australian

banks increase rates on some of their investment loans.

“The big four

banks announced increases to some of their investment home loans following new

APRA guidelines.

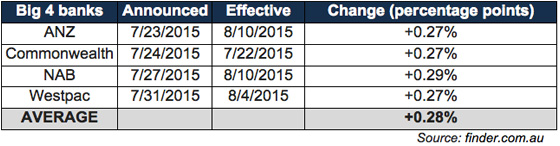

“ANZ, Commonwealth

Bank and Westpac all announced 0.27 percentage point increases to their

investment standard variable rates while NAB is increasing its investment line

of credit and interest-only loans.

“With the big

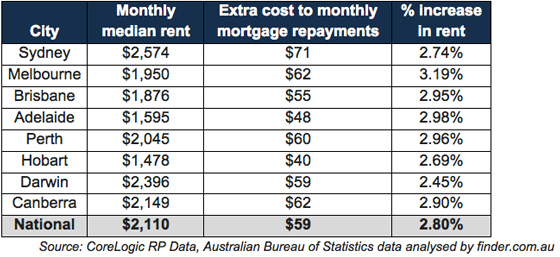

four banks holding the majority of the market, national monthly rents could be

set to increase by 2.80 per cent or $59 in higher rent per month if landlords

pass on the full cost of the new interest rates on investor loans (based on the

average home loan of $343,000 over 30 years),”

she says.

“For low income

households with one person on the minimum wage, this increase could account for

2 per cent of annual income (based on the national minimum annual salary of

$34,158.80/$656.90 per week).”

Melbourne renters are

expected to be hit the hardest, Hutchison adds, with a 3.19 per cent increase

($62 per month), followed by Adelaide with a 2.98 per cent increase ($48 per

month). Sydney will see the biggest jump in cost of $71 per month.

“Whether you’re a mortgage holder, renter or prospective first

homebuyer, watch out for higher costs on the way and make sure you’re prepared

by keeping some savings aside before it’s too late,” Hutchison says.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/AEdurVzx2as/renters-could-feel-apra-backlash