New Minister for Cities welcomed

New Minister for Cities welcomed

Posted on Monday, September 21 2015 at 1:34 PM

New Prime Minister Malcolm Turnbull’s appointment of Jamie Briggs as Minister for Cities and the Built Environment should lead to a greater focus on funding urban infrastructure, according to Urban Taskforce Australia.

Urban Taskforce

CEO Chris Johnson points out that Turnbull “clearly has an interest in cities

and how growth is managed”, adding: “It is therefore pleasing to see the

appointment.

“The major role

the federal government has in cities is in relation to the funding of urban

infrastructure projects.

“It’s important

that the federal government doesn’t confuse the key role that state governments

have in planning and managing cities and their growth,” Johnson says. “As the

major collector of taxes, however, the federal government should allocate funds

based on pro-growth policies of state and local government.”

Urban Taskforce’s

position is that with Australian cities becoming more urban, with a big swing

to apartment living, there’s a need to ensure public transport systems and

other amenities can support the urban growth.

“Without adequate

funding for urban infrastructure, communities will be reluctant to support

urban density, which could lead to greater government costs through our cities

spreading vast distances,” Johnson says.

“The Urban

Taskforce is keen to work with Minister Briggs as a continuation of discussions

held with him a few months ago so that input from the development industry can

help inform policy.

“With the slowdown

in the minerals sector it is the property development sector that is leading

employment activity in Australia and the continuation of this momentum is

important for future prosperity.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

New Minister for Cities welcomed

Debate rages around NSW strata reform

Calls for housing completions not approvals to be focus of commitments

Annual rental rate drops to record low 0.7%

Investor new-build demand remains high

Qld tipped for nation-leading growth

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/pMj1LjtuoE4/new-minister-for-cities-welcomed

Debate rages around NSW strata reform

Debate rages around NSW strata reform

Posted on Wednesday, September 16 2015 at 3:06 PM

The New South Wales chapter of the Urban Development Institute of Australia (UDIA) says scare tactics and misinformation are being used to argue against strata reform in the state.

The public

consultation period has passed for the draft strata reform bills released in

July this year, and the NSW Department of Fair Trading is now reviewing the

comments.

Among the

legislation is a controversial proposal whereby only 75 per cent of a body

corporate need agree to redevelop a strata property.

Concerns that

dissenting residents will be “thrown onto the streets” are unfounded, according

to UDIA NSW chief executive Stephen Albin.

“One thing

people need to be aware of is this strata reform is not retrospective,” he

says.

“It will

apply only to existing strata committees if they choose to sign on to it, and

it will apply to strata committees that are established post the introduction

of the reforms.”

Albin also

argues that the collective sale of a strata building would take years to

achieve, and there’ll be occasion for residents to appeal.

“The sale

would have to go through courts and those in opposition will have the

opportunity to argue their case.”

However,

his comments are unlikely to have allayed the fears of groups such as the

Council on the Ageing (COTA) NSW.

Ian Day,

the CEO of COTA NSW, says it’s not just property owners that should be

concerned.

“While Fair

Trading assure us they will provide support to owners who are in effect ‘forced

to move’, these bills – if passed – will have negative unintended consequences

for renters, who number about 50 per cent of occupants in older strata title

dwellings.

“The strata

title unit blocks likely to be affected by these laws are among the few

remaining affordable housing options in Sydney, the world’s third most

expensive housing market.

“One in

five pensioners rent.

“It seems

that the government has given no thought to what will become of them once these

bills hasten the process of selling old unit blocks to developers for renewal.”

COTA NSW has

called on the state government to appoint a Minister for Housing to take charge

of the issue.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Debate rages around NSW strata reform

Calls for housing completions not approvals to be focus of commitments

Annual rental rate drops to record low 0.7%

Investor new-build demand remains high

Qld tipped for nation-leading growth

Property listings across Australia down

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/25iJMawbwu0/debate-rages-around-nsw-strata-reform

Calls for housing completions not approvals to be focus of commitments

Posted on Tuesday, September 15 2015 at 9:52 AM

The Urban Development Institute of Australia (UDIA) NSW has welcomed the New South Wales state Premier Mike Baird’s commitment to making infrastructure delivery and housing approvals top government priorities.

UDIA NSW chief executive Stephen

Albin says housing approvals need to be fast-tracked to keep up with demand,

and a commitment to determine most approvals within 40 days is a good start.

“The industry is highly supportive

of any initiatives that help increase residential development application turnaround

periods,” he says, but add that the Premier’s priority to deliver 50,000

development approvals per year should be based on housing completions instead.

“Housing approvals don’t necessarily

translate into completions as land can sit dormant until the landowner decides

to develop,” he says.

“What we’d really like to see is a

strong commitment to seeing homes built on the ground through boosting

completions.”

Albin says that to seriously address

housing delivery issues in NSW, the government also needs to look at combining

these commitments with action on already announced policy.

“The state government needs to continue to

work towards simplifying the planning system to remove issues such as

duplications in approvals processes.

“It also needs to extend its housing diversity

package to outside of growth areas to ensure people at all stages of their

lives, with all levels of income, can buy the homes they want.

“The Housing Acceleration Fund was

extended in the budget but we have yet to see where that money will be spent.

“By making the allocation of that

infrastructure funding a priority, the government will boost investment

confidence, and ultimately turn the supply tap on sooner in some areas,” he

concludes.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Calls for housing completions not approvals to be focus of commitments

Annual rental rate drops to record low 0.7%

Investor new-build demand remains high

Qld tipped for nation-leading growth

Property listings across Australia down

Housing affordability improves

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/9oRM5L7-y8o/calls-for-housing-completions-not-approvals-to-be-focus-of-commitments

Annual rental rate drops to record low 0.7%

Annual rental rate drops to record low 0.7%

Posted on Friday, September 11 2015 at 12:58 PM

A sharp rise in home values in two of Australia’s largest capital cities hasn’t flowed through to rental rates according to the latest CoreLogic RP Data rental review, which reveals that rental increases are now at their slowest pace on record, at 0.7% over the year.

Based on the August analysis:

- Weekly rents fell by a further -0.4 per cent over the month of August

- Rental growth across the combined capital cities dropped to a new

record low of 0.7 per cent over the year. - Sydney rents rose just 2.3 per cent over the year.

- Rents have fallen over the past year in Adelaide, Perth and Darwin.

- Combined capital city rental rates are recorded as $487/week for

houses and $462/week for units.

CoreLogic RP Data research analyst Cameron Kusher is anticipating that

the rate of rental growth will continue to slow over the coming months due to

increased housing and rental stock supply, and slower migration rates.

“Based on year-to-date data results, rental growth conditions have

softened during 2015,” he says.

“The 0.7 per cent rise in rental rates over the past year is the slowest

rate of rental growth on record based on data that goes back as far as December

1995.

“The reasons behind this lacklustre result for the rental market can be

attributed to the extent of the current construction boom across the capital

cities and slowing population growth.

“Added to this is the surge in investor participation in the housing

market, which is contributing to weaker rental growth by adding to the rental

stock,” Kusher says.

The three cities to experience the largest ramp-up in new housing supply

and investor activity over recent years, and the only three cities to record

annual rental growth, are Sydney, Melbourne and Brisbane. It should be noted

that these three cities have still seen a fairly sharp slowdown in rental

growth.

Over the past month, weekly rents have moved lower across every capital

city except Sydney and over the past three months rents are lower in all cities

except for Melbourne, where they’re unchanged.

According to Kusher, the gap in the cost of rentals remains

significantly lower than the actual purchase cost of a house relative to a

unit.

- Over the past month, house rents have fallen by 0.5 per cent while

unit rental rates were unchanged. - Combined capital city house rents were recorded at $487 per week in

August 2015 and unit rents were $462 per week. - Over the three months to August 2015, rental rates for houses are down

1.0 per cent, while for units they have increased by 0.2 per cent.

The rental data points show that the recent rate of rental growth has

started to slow even further. Over the past year, house rents have increased by

0.5 per cent while units have recorded a greater 1.6 per cent annual rise.

Kusher says annual rental growth is crawling along at its slowest pace

on record, and well below its 10-year average levels. The 10-year annual rate

of rental growth is currently higher than growth over the past year across each

capital city.

“Additional accommodation being provided by the current building boom

along with record high levels of investment purchasing is adding substantial

new dwelling supply to the market at a time where the rate of population growth

is slowing,” he explains.

“At the same time… the rise in home values is pushing rental yields

lower. Across the combined capital cities, gross rental yields sit at record

lows of 3.4 per cent for houses and 4.3 per cent for units.

“The ongoing decline in yields is largely being driven by Sydney and

Melbourne, where rental growth is sluggish and value growth is strong. As a

result both cities currently have record low rental yields.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/VjN-EknLY2M/annual-rental-rate-drops-to-record-low-0.7

Investor new-build demand remains high

Investor new-build demand remains high

Posted on Wednesday, September 09 2015 at 4:15 PM

Recent ABS housing finance data shows investors remain keen on new-builds but the full effect of tighter lending guidelines is yet to be felt, according to the Housing Industry Association (HIA).

Lending to investors constructing new homes increased 11.7 per

cent in July to reach a new all-time high.

“Investors have played a major role in the current new home

building cycle, contributing a larger share of new housing supply than has

historically been the case,” HIA economist Diwa Hopkins says.

Conversely, the total number of loans to owner-occupiers

purchasing or constructing new homes remained relatively unchanged in the month,

and was 9.4 per cent lower than its peak in September 2014.

Hopkins also warns that the impact of tighter investor

guidelines introduced by the Australian Prudential Regulation Authority (APRA)

are yet to be felt.

“We maintain our concern about recent APRA interventions –

there is a risk of disruption to new home building activity.”

According to the ABS,

New South Wales and the Australian Capital Territory were the only jurisdictions

to record increases in the owner-occupier result, at 0.7 per cent and 4.8 per

cent respectively.

Declines of

between 6.6 per cent (South Australia) and 29.7 per cent (Darwin) were recorded

across all other states and territories.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Investor new-build demand remains high

Qld tipped for nation-leading growth

Property listings across Australia down

Housing affordability improves

Cash rate held for another month

Sydney houses surpass $1 million median with 7.58% three-month jump

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/lAdUkAxCM50/investor-new-build-demand-remains-high

Qld tipped for nation-leading growth

Qld tipped for nation-leading growth

Posted on Monday, September 07 2015 at 11:02 AM

In news that will be music to the ears of investors eyeing up the sunshine state, Queensland is said to be poised for nation-leading economic growth according to independent forecaster Deloitte Access Economics.

Speaking from

Hong Kong, where he’s undertaking an international investor roadshow, Treasurer

Curtis Pitt welcomes Deloitte’s upbeat assessment in its Queensland Business Outlook report for September 2015, released last

week.

“According to

Deloitte, the outlook for the Queensland economy over the next five years is

positive,” he says.

“They’ve

identified tourism, agriculture and housing as some of our strengths, along

with growing LNG exports.

“This has led

Deloitte to predict Queensland will outstrip all the other states and territories

in economic growth over the next two financial years.

“Deloitte is

forecasting the Queensland economy will grow by 4.5 per cent this financial

year and by 4.0 per cent in 2016-17.

“This is broadly

in line with Queensland Treasury’s own growth forecasts, which show the state

economy picking up over the next two years.”

Pitt says

Queensland has one of the most diverse economies in Australia.

“That’s a key

reason why our economic growth is forecast to be stronger than Australia’s

national growth over the next four years, and stronger than any other state or territory

in the country,” he says.

“The Deloitte

report acknowledges Queensland has a natural competitive advantage in a number

of industries, which will provide a future platform for economic growth.

“These industries

include agribusiness, international education, wealth management, tourism and

gas.

“Queensland’s

tourism sector has particularly bright prospects for growth.

“Deloitte

forecasts international visitors to Queensland will grow by 4.9 per cent each

year over the next three years

“Domestic

overnight trips are forecast to grow at 2.7 per cent a year, in line with the

national outlook.”

Pitt says the

Palaszczuk government will continue to work with business and industry to

promote jobs, growth and investment in the state.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/wdxjFcibqYo/qld-tipped-for-nation-leading-growth

Property listings across Australia down

Property listings across Australia down

Posted on Friday, September 04 2015 at 10:58 AM

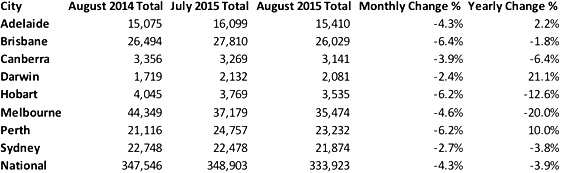

The number of residential property sale listings fell in all capital cities during the month of August according to SQM Research.

Nationally,

the number of listed properties dropped to 333,923 in August 2015, decreasing

4.3 per cent from July 2015, with the number of sale listings down 3.9 per cent

from a year earlier. A monthly fall in sale listings for August was expected

due to abnormally high sale listings for the month of July 2015.

Year-on-year

results indicate that Melbourne and Hobart experienced excessive yearly falls.

Melbourne recorded the biggest yearly change, with listings falling by 20 per

cent, reducing the number of properties for sale to 35,474. Hobart soon

followed with records indicating a yearly change of 12.6 per cent.

Within

the last 12 months sale listings for Darwin and to a lesser extent Perth have

recorded high yearly growth. Darwin experienced a yearly growth of 10 per cent,

with sale listings climbing from 1,719 to 2,081. Sale listings in Perth

increased from 21,116 this time last year to 23,232 (August 2015), a total

yearly growth of 10 per cent.

Managing director

of SQM Research Louis Christopher says: “It’s another surprise result and a reversal of the

surge in listings during July. Normally listings start to rise in August ahead

of the spring selling season. We’ll wait until the September reading before

drawing too many new conclusions on the market.”

Asking

prices for Sydney houses continued to climb over July, with a total monthly

rise of 1.2 per cent for houses and 0.7 per cent for units. The median asking

price for a unit has now reached $630,300, while the median house asking price

in Sydney is $1,124,500, according to SQM Research’s figures.

In

contrast, median asking house prices in Canberra recorded yearly falls, with a

year-on-year comparison showing a 12-month decline of 4.8 per cent for houses,

and 1.4 per cent for units. Perth median asking prices continue to record

yearly falls – in particular asking prices for houses are down 4.6 per cent

over the last 12 months and 1.2 per cent for units.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/_SG7a0zts_Q/property-listings-across-australia-down

Cash rate held for another month

Cash rate held for another month

Posted on Tuesday, September 01 2015 at 2:43 PM

The Reserve Bank of Australia (RBA) left the cash rate on hold once again this afternoon, at 2 per cent, which came as little surprise to most, with the finder.com.au survey finding that 31 of the 32 experts asked had expected as much.

Money Expert at

finder.com.au Michelle Hutchison says that

while the record low rates have been welcomed by many borrowers, they’re not

here to stay.

“The finder.com.au Reserve Bank Survey has found that it’s

not a matter of ‘if’ the cash rate will rise but, rather, ‘when’.

“However, there’s no

need to panic and borrowers should use this time to do their research and scan

the market to ensure they’re getting the best rate possible. Also, now’s the

time to prepare for future rate hikes by making extra repayments while you can.

“With the national

average auction clearance rate increasing by approximately 10 per cent over the

past 12 months, and the start of mortgage season just days away, we can expect

the property market to remain competitive in the coming months.”

The survey found that

19 experts (59 per cent) expect auction clearance rates to stabilise at the

current level, while one expert – Peter Boehm of onthehouse.com.au – believes

auction clearance rates will boost even higher this mortgage season.

“However, more than

one in three experts (11 experts or 34 per cent) expect auction clearance rates

to fall, despite mortgage season being traditionally billed as the hottest time

to buy and sell,” Hutchison says, adding that buyers who are planning to wait

until the property market settles may want to think again.

CoreLogic RP Data’s August housing market data along

with recent data on investor credit growth would have been welcome news to the board

when they were deliberating on the rate setting.

Head of research Tim Lawless says: “The rate of

capital gain apparently eased across the housing market in August. After

capital city dwelling values increased by more than two per cent in both June

and July, capital city dwelling values grew by a much more sustainable 0.3 per

cent in August.

“Additionally, recent credit data released by the RBA

shows the annual pace of growth in investment credit slipped from a recent

annual high of 11.1 per cent to reduce back to 10.8 per cent in July.

“The slower month of housing data may indicate that

the housing boom in Sydney and Melbourne is starting to slow and investment

lending is starting to moderate in line with APRA guidelines.

“While the Sydney and Melbourne housing markets don’t

need any further stimulus, other capital cities as well as regional markets

have recorded much more sustainable growth rates. In fact, dwelling values

declined across four of the eight capital cities over the month of August and

three capital cities – Perth, Darwin and Canberra – have recorded a decline in

dwelling values over the past 12 months.

“Home owners and prospective buyers across Australia

will welcome the sustained low interest rate setting, which will continue to

spur buyer demand and help offset the effects of softer economic conditions

outside Sydney and Melbourne.”

Hutchison has a message for buyers: “Regardless of when you’re buying, ditch emotion and

consider what the future holds for the cash rate.

“When doing your

calculations, allow a two to three per cent buffer for future rate rises.

Remember, these record lows won’t stick around forever.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/PqZj8M7AXX8/cash-rate-held-for-another-month

Sydney houses surpass $1 million median with 7.58% three-month jump

Posted on Monday, August 31 2015 at 3:14 PM

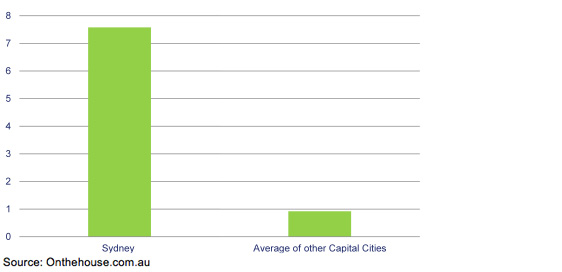

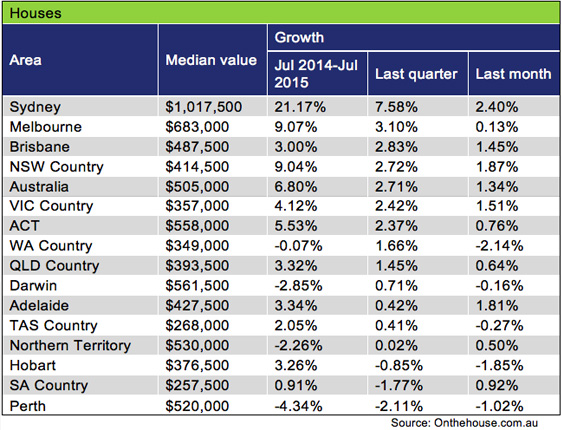

Research released today by Onthehouse.com.au has revealed that Sydney’s housing market has surpassed even its own average quarterly growth rate of 3.05 per cent, recording an astonishing 7.58 per cent in the three-month period ending July 2015.

The average

quarterly growth rate of all other capital city housing markets was just 0.92

per cent.

This huge increase

in value has pushed Sydney’s housing market through the million-dollar benchmark,

with the median house now valued at $1,017,500.

The following

graph demonstrates the July 2015 quarter capital growth rates for houses in

Sydney and other capital cities:

Market analyst at

Onthehouse.com.au Eliza Owen says: “As the growth in Sydney continues to

accelerate, there is insufficient evidence attributing foreign investment and

tax structures to this surge. However, there is another force to consider –

population convergence, a theory utilised by urban studies theorist Richard

Florida in 2005.

“Florida found

that population and economic activity were converging to a few large cities

around the world and evidence suggests that Sydney could be one of these

cities. If this is indeed the case, it signals that the growth is likely to

continue in the same way we’ve seen values and rents skyrocket in other cities

over the last few decades, including Singapore, New York, London and Tokyo.

“Assuming Florida

is correct in his theory of population convergence, Sydney could see strong

house value increases over the next few quarters before stabilising at a level

that even the most wealthy and mobile will find excessive,” Owen says.

Melbourne and

Brisbane were the only other capital city housing markets that documented a

steady quarterly growth performance, recording 3.10 per cent and 2.83 per cent

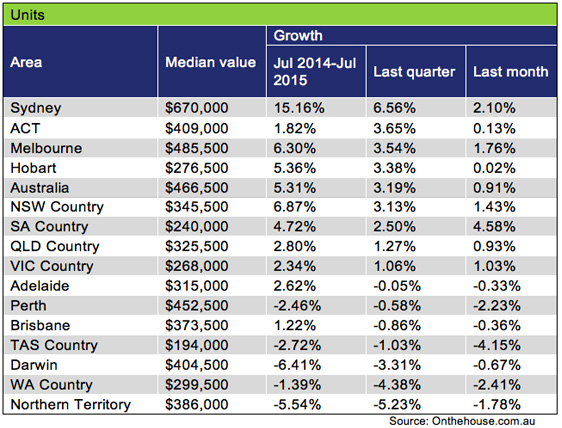

growth respectively. However, an overhang of stock in the Brisbane unit market

saw values drop by 0.86 per cent during the same period.

The worst

performing regions in the quarter to July were once again the resource states,

as Perth houses contracted 2.11 per cent (-4.34 per cent annually) and Darwin

unit values fell by 3.31 per cent (-6.41 per cent annually).

The following

table demonstrates the July market performance for houses across Australia,

ranked in order of quarterly growth:

The following

table demonstrates the July market performance for units across Australia,

ranked in order of quarterly growth:

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/xqmR_yxtkK4/sydney-houses-surpass-$1-million-median-with-7.58-three-month-jump

UDIA: Time to depoliticise council planning

UDIA: Time to depoliticise council planning

Posted on Friday, August 28 2015 at 10:42 AM

The state government’s decision to disallow those with a pecuniary interest to vote on council matters is a good first step but more needs to be done to depoliticise council planning decisions, according to the Urban Development Institute of Australia (UDIA) NSW.

UDIA NSW chief executive

Stephen Albin says any number of councillors could be considered to have “pecuniary

interests”.

“In reality, who

doesn’t have a pecuniary interest in decisions about development approvals in a

local area?” he asks.

“What about the councillors

that are keen to stop growth and reduce the supply of housing and see their own

property values rise on the back of this – is this not a pecuniary interest in

a decision?”

Albin says that

in order to support the reversal of the Act amendment, independent hearings and

assessment panels, made up of experts that are truly independent, should be

engaged to review the decisions of planners within councils.

“The whole

planning system needs to be depoliticised and quickly. Identifying pecuniary

interest is so fraught we should consider leaving it to the experts.”

Albin says councils

spend hundreds of millions of dollars annually to employ urban planners to

process approvals and prepare strategic development controls, and too often the

decisions of these staff are overturned by councils with a political agenda.

“The good thing

about this debate is it could lead to sensible policy approaches,” he says.

“The most

sensible approach is to let anyone that’s a fit and proper person become a

local councillor – including those with an understanding of real estate and

planning controls – and take the politics out of planning by introducing

independent panels to properly consider development applications.

“Only then will

we get a fair system that looks after the communities’ long-term interests and takes

the politics out of planning.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

UDIA: Time to depoliticise council planning

Are Brisbane auctions going the way of Sydney?

Sydney vacancy rates fall

Renovations rule, not holidays or weddings

Home reno costs are down in Queensland

Better news from the West, with Albany on top

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/My4hz1V_5I8/udia-time-to-depoliticise-council-planning