Home loan rates are on the move

Home loan rates are on the move

Posted on Wednesday, October 14 2015 at 11:59 AM

As one of the big four banks – Westpac – announces its variable home loan rate rise, borrowers are being warned to be prepared for further hikes, with other lenders expected to follow.

Westpac has announced an increase to its variable home loan rates of 0.20 percentage points, effective as of November 20.

Michelle Hutchison, money expert at comparison website finder.com.au, says there have actually been many out-of-cycle home loan rate changes since the last cash rate cut in May.

“It’s interesting to see so much movement in the variable home loans market, particularly when it’s outside the Reserve Bank cash rate cycle.”

Hutchison says the finder.com.au database reveals that 407 variable home loans have changed their rates out of cycle since June this year, 352 of which decreased.

“With low funding costs and record high household deposits, it seems unusual for banks to be lifting variable rates out of cycle right now,” she says. “However, Westpac could be preparing early for APRA’s capital requirements of the average risk weight on Australian residential mortgage exposures to increase from 16 per cent to at least 25 per cent by July 2016.

“Total household bank deposits is at a record high of $737.3 billion, according to the latest APRA data analysed by finder.com.au,” Hutchison adds. “Westpac’s household deposits is also sitting at its highest level, at almost $171 billion, as at August 2015.

“The biggest concern is that Westpac’s rate rise could open the floodgates for the other big banks and the rest of the home loan market to follow, so we’re expecting to see more variable home loans rise in the coming months.

“Westpac holds 23 per cent of the owner-occupied home loan market share out of all banks monitored by APRA, while the big four banks hold a combined 82 per cent. They set the benchmark for the entire mortgage industry.

“We’re clearly seeing banks respond to APRA’s crackdown, and expect to see further movement… so watch this space,” Hutchison warns. “For borrowers, it’s definitely the time to do your research when shopping around for a home loan to ensure you’re getting the best possible deal for your situation as competition looks set to get tighter.”

Extra cost per month for different home loan sizes

Source: finder.com.au/home-loans

Based on current average variable home loan rate of 5.1%

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/eMi2V2LJv2E/home-loan-rates-are-on-the-move

Even more sellers now in Sydney’s market

Even more sellers now in Sydney’s market

Posted on Tuesday, October 06 2015 at 12:05 PM

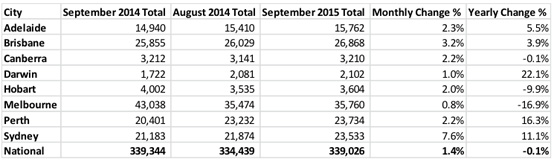

SQM Research reports that Sydney residential property listings rose 7.6 per cent during the month of September to stand at 23,533 listings.

Year on year, Sydney listings have

risen 11.1 per cent, suggesting there are now more residential property sellers

in the market than a year ago.

Nationally, the number of listed

properties climbed to 339,026 in September 2015, increasing 1.4 per cent from

August 2015, with the number of sale listings remaining largely unchanged to

this time last year. A monthly rise in sale listings for September was expected

due to the normal spring seasonality historically recorded at this time of

year.

Within the last 12 months sale

listings for Darwin and to a lesser extent Perth have recorded high yearly

growth. Darwin experienced a yearly growth of 22.1 per cent, with sale listings

climbing from 1,719 to 2,081. Sale listings in Perth increased from 20,401 this

time last year to 23,232 in August 2015, a total yearly growth of 16.3 per cent.

In contrast, year-on-year results

indicate that Melbourne and to a lesser extent Hobart experienced excessive

yearly falls. Melbourne recorded the biggest yearly change, with listings

falling by 16.9 per cent, reducing the number of properties for sale to 35,760.

Hobart also recorded yearly falls with records indicating a yearly change of

9.9 per cent.

Managing director of SQM Research

Louis Christopher says: “The Sydney surge in listings is another indicator

suggesting that the Sydney housing market’s slowing. Buyers should now find

there is a little more choice out there compared to earlier this year. Yet, I

note that asking prices are still higher. I suspect vendors are not quite

registering that conditions have changed somewhat since the white-hot market of

autumn.

“The Melbourne result is also interesting in that there was barely any

movement at all in listings in September and that stock for sale is well down

on this time last year. This is suggestive of a strong housing market that

isn’t slowing down at all.”

Source: www.sqmresearch.com.au

While listings in Sydney surged,

asking prices for Sydney dwellings continued to climb over September, with a

total monthly rise of 1.6 per cent for houses and 0.9 per cent for units. The

median asking price for a unit has now reached $636,100, while the median house

asking price in Sydney is $1,143,300, according to SQM Research.

In contrast, median asking house

prices in Canberra recorded yearly falls, with a year-on-year comparison

showing a 12-month decline of 2.5 per cent for houses and 0.3 per cent for

units. Perth median asking prices continue to record yearly falls – in

particular asking prices for houses are down 5.3 per cent over the last 12 months

and 1.7 per cent for units.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/jB0qq4poxY0/even-more-sellers-now-in-sydneys-market

Home loan numbers high but investors’ loans drop

Home loan numbers high but investors’ loans drop

Posted on Friday, October 09 2015 at 2:16 PM

Australians’ appetite for property shows no signs of slowing, with the value of new home loans surging in August 2015 to a fresh high of $34.6 billion, according to a report released today.

Owner-occupiers make up the huge gains over the month, according to the head of new banking business act. Amanda Watt, who welcomed a rise in the proportion of first homebuyers in the market.

Over the month, the value of new home loans taken for owner-occupier housing surged 6.1 per cent to a record $20.8 billion, while the value of investment housing loans showed a drop of 0.4 per cent to $13.6 billion, taking the total value of home loans written in the month to a fresh record of $34.6 billion – up 3.5 per cent according to Australian Bureau Statistics (ABS) housing finance data.

In original terms, the number of first homebuyer commitments as a percentage of total owner-occupied housing finance commitments rose to 15.7 per cent in August from 15.4 per cent in July, boosted by two official interest rates cuts earlier in the year.

Fixed-rate loans, as a proportion of all new home loans, fell to 9.6 per cent, their lowest level in around four years, as investors took advantage of record low variable interest rates.

act.’s Amanda Watt says the push into property could reflect some Australians’ love affair with the security of bricks and mortar and the gains it offers, at a time when many investors fear putting their money into stocks.

“Not only is property seen as a good hedge against inflation, it’s seen as an all-round wealth builder over the long term.

“There’s more perceived certainty that returns from property will be positive and with a huge level of volatility in share markets in recent months and talk of a correction, Australians are probably holding back from share investments and instead putting their savings into property, from which they can enjoy solid capital gains over the long term and even spectacular gains over the shorter term, as we’ve seen in Sydney.

“Investors, too, can enjoy a regular income stream from rent,” Watt adds.

“With all the current uncertainty in markets in Australia and around the globe, this is expected to maintain a high level of interest in the property market and will continue to support growth in real estate values, and propel even higher the number of home loans being taken by Australians in coming months, with interest rates at historically low levels, which has helped to make the servicing of home loans more affordable,” Watt says.

CommSec economist Savanth Sebastian says the latest housing finance statistics make for interesting reading.

“Not only is the size of the average home loan holding at a record high, but it’s growing at the fastest pace in 12 years,” he says.

“Over the past year the average home loan grew by 15.4 per cent and is showing no signs of slowing down.”

Sebastian suggests policymakers will be encouraged by the lift in owner-occupied loans at the expense of investor finance.

“The value of investment loans has now fallen for three out of the past four months. Overall the housing finance statistics don’t suggest a huge pullback in home lending, although there are signs activity levels are starting to ease.

“Over the next few months the tighter bank lending standards will filter through to the housing statistics.”

He adds: “There’s no doubt the pullback in investor loans is a positive, and will help to cool property prices, but housing is all about demand and supply. Encouragingly, loans to build new homes lifted after falling for the prior three months. If there is a substantial pullback in new construction it could be more of a detriment in the longer-term.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/E79vgvmpIJU/home-loan-numbers-high-but-investors-loans-drop

Statistics confirm Perth downturn

Statistics confirm Perth downturn

Posted on Wednesday, October 07 2015 at 11:23 AM

The latest statistics on Perth confirm the property market is softening.

Figures released

by the Real Estate Institute of Western Australia (REIWA) reveal the city’s

median house price fell by 2.7 per cent in the September quarter 2015 to reach $535,000.

There’s been a 14

per cent fall in sales turnover on the back of listings rising by nine per cent

for the quarter.

That means

listing numbers are now up 44 per cent on last year’s result.

Hayden Groves,

president of REIWA, says he’s not surprised by the figures.

“Currently we have almost 15,000 listings on the Perth market, which is

up by about 3,000 on what we would consider normal.”

Only a handful of areas saw an increase in turnover for the quarter,

including Fremantle, Gosnells, Cockburn and Armadale.

The slowdown continued into the rental market, with vacancy rates rising

to 5.4 per cent.

Groves says this reflects the fact that there are nearly 50 per cent

more rental properties compared to the same time last year.

“As a consequence, the overall median rent has dropped to $410 per week

across Perth, and is now typically around $420 for a house and $395 for a unit,

apartment or villa,” he explains.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Statistics confirm Perth downturn

RBA announces rates to hold once more

Even more sellers now in Sydney’s market

Detached house new home sales remain high

Capital city auction report describes national softening

Slight shift to favour sellers in property market

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/5_pUBoLysQ4/statistics-confirm-perth-downturn

RBA announces rates to hold once more

RBA announces rates to hold once more

Posted on Tuesday, October 06 2015 at 2:03 PM

As predicted by the recent finder.com.au Reserve Bank Survey, which found experts were unanimous in expecting no movement to the cash rate at the October meeting, governor Glenn Stevens announced today that the rate will remain at 2.0 per cent for at least another month.

In his statement he said: “The available information suggests that moderate expansion in the

economy continues.”

CoreLogic

RP Data’s head of research Tim Lawless says: “The flat rate of growth across the

Sydney housing market last month, together with a slowdown in investment

related mortgage activity wasn’t enough to sway the RBA into another interest

rate cut this month.

“We

saw the rate of capital gain flatten out across the Sydney housing market during

September, however the trend rate of growth remains very strong, with Sydney

values almost 17 per cent higher over the past 12 months and 4.6 per cent

higher over the September quarter.

“In

contrast, Australia’s second largest housing market has gathered some momentum

over the past quarter, outperforming Sydney with a 2.4 per cent rise in

dwelling values last month and a 7.4 per cent shift over the quarter. Other

housing market data is suggesting that conditions may be slowing,” Lawless

says.

“With

the Aussie dollar holding around the US71c mark, inflation remaining low and

labour market conditions relatively steady, the RBA is in a good position to

keep interest rates at their record lows.

“With

interest rates remaining on hold, borrowers are still enjoying historically low

mortgage rates, which should continue to drive demand for housing,” he adds.

Onthehouse.com.au

market analyst Eliza Owen says: “Underperformance in the Australian economy

has led to this decision, with further rate cuts anticipated by the end of

2016.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

RBA announces rates to hold once more

Even more sellers now in Sydney’s market

Detached house new home sales remain high

Capital city auction report describes national softening

Slight shift to favour sellers in property market

Population growth figures not looking too good

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/eglPYqJszaE/rba-announces-rates-to-hold-once-more

Capital city auction report describes national softening

Posted on Thursday, October 01 2015 at 9:06 AM

The Domain Australian Home Auction Report indicates an overall slowdown in home auction markets across the nation, with mixed prospects for the remainder of the spring sales season.

Dr Andrew Wilson, chief economist at Domain, says clearance

rates have fallen in most capitals due to a record numbers of early spring

listings.

All major capitals, except Adelaide, reported

decreases in clearance rates over the month.

“September home auction activity is now generally

tracking below last year’s September levels.”

Wilson says while clearance rates may be down, auction

prices have either risen or remained steady across the cities, reflecting the

seasonal effects of higher-priced auction sales.

“Record-high volumes of auctions will continue to test

capital city markets for the remainder of the year, providing greater

competition among sellers and more choice for buyers.

“This is likely to continue putting downward pressure

on clearance rates – particularly in Sydney, and to a lesser degree Melbourne.”

Sydney

Sydney’s auction clearance rate is 69.8 per cent for September 2015,

down more than five per cent from the August result and well below the May 2015

record of 83.3 per cent.

Wilson says listing numbers are affecting Sydney auction clearances.

“September alone recorded a record average of 859

weekend auctions. This is well ahead of the August average of 738 weekend

auctions and the 590 conducted over September 2014.”

While the city’s median year-on-year auction price had

increased from $1.09 million to $1.151 million, the year-on-year price growth

rate comparisons have fallen solidly over the past four months.

Melbourne

Melbourne’s clearance rate fell only two per cent for the month to

record 73.2 per cent in September, which is more or less on par with last year.

Wilson says lower clearance rates in the Victorian capital

reflect the influence of a record surge in early spring listings.

“With a remarkable number of auctions – nearly 1,000

per weekend over the month of September – Melbourne’s auction market is well

ahead of where it was last year,” he says.

“The city averaged 977 auction listings every weekend

over September, up from the average of 830 over August and significantly higher

than the average of 640 over September last year.”

Melbourne’s median auction price increased 13.1 per

cent year-on-year to reach $820,000 in September.

Brisbane

The Queensland capital saw auction clearance rates

fall in September to 46.2 per cent from 57.4 per cent in August.

Wilson notes auctions have been gaining in popularity in

the city.

“Brisbane averaged 123 auctions per weekend over

September – a significant increase from the average of 106 auctions per

weekend in August.

“This was well ahead of the 99 averaged over September

last year.”

The city’s median auction price remained steady during

September at $700,000, just 1.1 per cent lower than at the same time last year.

Adelaide

Adelaide reversed the negative results from other

capitals, albeit marginally, seeing an auction clearance of 65.3 per cent for

September, which is 0.1 per cent higher than August.

Wilson says the city’s result reflects a steady

improvement in confidence for the South Australian capital.

“Not only was there an increase in Adelaide’s

clearance rates over September, but there was also a significant increase in

auction volumes.

“This reflects the growing confidence of sellers in the

local market conditions.”

Adelaide’s auction median of $597,000 for September

was 12.5 per cent higher than the August figure – a substantial gain.

Canberra

After a strong August result, Canberra’s auction

clearance retracted 6.4 per cent in September to record a figure of 64.3 per

cent, well ahead of the 56.3 per cent from September 2014.

Wilson says the August 2015 figure of 70.7 was the

highest monthly result for more than five years, so the fall in September isn’t

as dramatic as it first appears.

“The underlying growth trend for the auction market

remains encouraging and indicates the consolidation of solid housing market

activity generally in Canberra this year.”

Canberra’s median auction price fell by a marginal

$10,000 to record $675,000 for September.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/BOcOvnymKe0/capital-city-auction-report-describes-national-softening

Detached house new home sales remain high

Detached house new home sales remain high

Posted on Friday, October 02 2015 at 11:40 AM

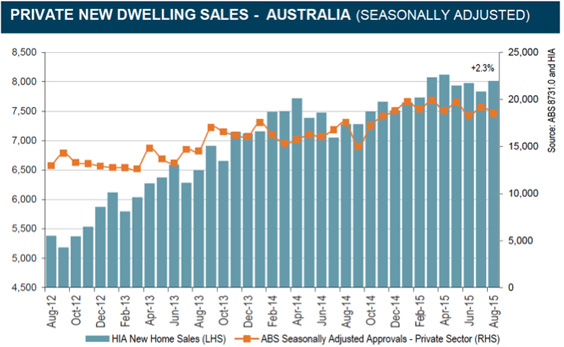

The Housing Industry Association (HIA) New Home Sales Report, a survey of Australia’s largest volume builders, recorded an increase in August 2015, with the level of activity only just short of the high reached in April this year.

“Total seasonally adjusted new home sales increased by 2.3

per cent in August this year, driven by a 3.5 per cent rise in detached house

sales,” HIA economist Diwa Hopkins says. “Multi-unit sales, however, declined

by 1.7 per cent.

“It’s becoming increasingly apparent that total sales

activity has already peaked this year, but today’s update shows that sales are

remaining elevated.”

The overall developments in both HIA New Home Sales and the

equivalent ABS measure, building approvals, are consistent with the HIA’s

outlook for actual new home building activity in 2015/16, according to Hopkins.

“We’re forecasting total dwelling commencements to ease back

from what we expect to have been the peak level in the financial year just

passed, but still remain elevated.”

Detached house sales increased by 3.5 per cent in August

2015, but were 5.1 per cent below the monthly peak that occurred back in April

2014.

For multi-units it’s May 2015 that is shaping up to

represent a peak in monthly sales, with declines occurring in each of the

subsequent months. Multi-unit sales in August this year were down from the May

level by 8.5 per cent.

In the month of August detached house sales increased in

four out of the five mainland states.

Detached house sales increased by 10.2 per cent in South

Australia, 7.0 per cent in Queensland, 3.2 per cent in New South Wales and 3.4

per cent in Victoria. In Western Australia, detached house sales declined by

1.4 per cent.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Detached house new home sales remain high

Capital city auction report describes national softening

Slight shift to favour sellers in property market

Population growth figures not looking too good

Capital city average home price exceeds $600,000

New Minister for Cities welcomed

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/ShX-J1mE_7g/detached-house-new-home-sales-remain-high

Slight shift to favour sellers in property market

Slight shift to favour sellers in property market

Posted on Monday, September 28 2015 at 11:58 AM

The national property market remains balanced, while Sydney and Melbourne have shifted further in favour of sellers, according to the latest Commonwealth Bank CoreLogic RP Data Home Buyers Index (HBI).

The HBI is based on the ratio of properties available for sale compared

with the number of housing loans that are being committed to by Commonwealth

Bank.

The latest report shows there was a slight shift towards sellers between

May and July 2015, although at a national level the housing market remained

relatively balanced for both buyers and sellers.

The top five best buyers’ markets in Australia are:

- Far

West, NSW. - Upper

Green Southern, WA. - Wide

Bay-Burnett, Qld. - South

West, Qld. - Northern,

SA.

The top five best sellers’ markets in Australia are:

- Sydney,

NSW. - Melbourne,

Vic. - Central

Highlands, Vic. - Canberra,

ACT. - Ovens-Murray,

Vic.

Commonwealth Bank’s executive general manager home buying Dan Huggins says:

“At a national level we’re seeing a relatively balanced housing market, however

conditions continue to vary across the different states, territories and

capital cities.

“Although Sydney and Melbourne remain skewed towards sellers, there are

favourable conditions for prospective buyers in state capitals like Hobart and

Darwin, as well as more regional areas across the states.

“It’s important to have the right information when looking to purchase a

property. I would encourage all homebuyers to do thorough research and speak

with a home lending specialist to help make a more informed decision about

where to buy.”

According to the HBI, market conditions in Queensland, Western

Australia, Tasmania and the Northern Territory were skewed towards buyers,

whereas Victoria and the Australian Capital Territory favoured sellers. New

South Wales and South Australia remained neutral.

Market conditions in capital cities were typically either balanced or in

favour of sellers this quarter. Sydney and Melbourne experienced high buyer

demand, creating further competition in the market. Inner West Sydney,

Boroondara City and Eastern Middle Melbourne saw the sharpest swing to favour

sellers. Elsewhere, Gosford-Wyong in Sydney and Mornington Peninsula Shire in

Melbourne experienced balanced conditions.

Adelaide and Canberra experienced a shift further in favour of sellers,

with listed properties outnumbering people actively looking to purchase.

For buyers, the most favourable conditions among the state capitals were

Hobart and Darwin, while Brisbane and Perth remained balanced between buyers

and sellers.

CoreLogic RP Data’s senior research analyst Cameron Kusher says: “While

we’re seeing strong selling conditions in Sydney and Melbourne, the latest

report shows that on a national level the real estate market remains balanced.

“Regional areas continue to offer the best opportunities for would-be

homeowners, while sellers are still benefiting from increased demand in

metropolitan areas.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/J1yfqb8jM2E/slight-shift-to-favour-sellers-in-property-market

Population growth figures not looking too good

Population growth figures not looking too good

Posted on Friday, September 25 2015 at 11:48 AM

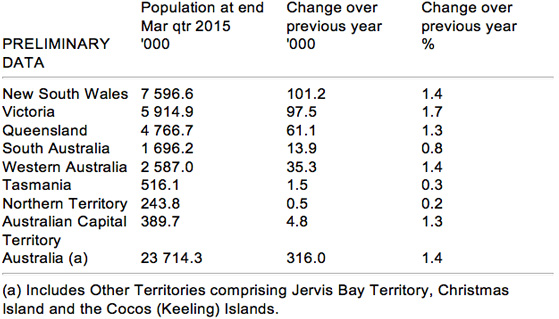

Australia’s population growth rate has slowed to a rate last seen nearly 10 years ago, according to the Australian Bureau of Statistics (ABS).

“In the year to March 2015, Australia’s population growth rate continued

to slow from its peak in 2008-09 and is now just below the 20-year average

growth rate,” Denise Carlton from the ABS says.

“The Northern Territory recorded its lowest growth rate in 11 years, at

0.2 per cent for the year ending March 2015. This is 80 per cent lower than

that of March 2014.

“Net interstate migration losses were the greatest contributor to this

slower growth, with the territory recording its largest ever interstate

migration loss in the year to March 2015,” she adds.

“Western Australia also recorded slower growth. In the past two years, net

overseas migration to the state has dropped by 71 per cent, while net

interstate migration has dropped to the point where the state has seen a net

interstate loss.

This has not been seen in over 10 years in this state.

“Victoria and Queensland were the only states recording a net gain from

interstate migration,” Carlton says.

Australia’s population grew by 316,000 people (1.4 per cent) to reach 23.7

million by the end of March 2015.

Net overseas migration contributed 173,100 people to the population, which is a

rather worrying 16 per cent lower than the previous year, and accounted for 55

per cent of Australia’s total population growth.

Victoria continues to have the fastest population growth rate in the country,

growing by 1.7 per cent (97,500 people).

Over the year, natural increase contributed 142,900 people to Australia’s

population, made up of 298,400 births (3 per cent lower than the previous year)

and 155,500 deaths (4 per cent higher than the previous year).

You can see the latest demography

video here.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/TtWJmWGGVnU/population-growth-figures-not-looking-too-good

Capital city average home price exceeds $600,000

Capital city average home price exceeds $600,000

Posted on Wednesday, September 23 2015 at 4:23 PM

You’ll need more in your budget if buying in the nation’s capitals according to Australian Bureau of Statistics (ABS) data – and you can thank our two largest cities.

The

average price for a home in Australia’s capital cities rose 9.8 per cent across

the board over the last year, reaching $604,700.

The

ABS numbers reveal property prices in our eight major cities rose 4.7 per cent

over the three months to the end of June.

In

dollar terms, the figure is up $26,000 in the June quarter 2015.

Sydney

saw prices surge 8.9 per cent in the June quarter, with a rise of 18.9 per cent

over the 2014/15 financial year.

Melbourne

won silver with price growth of 4.2 per cent in the latest quarter, and an

annual rise of 7.8 per cent.

Beyond

the two big capitals, price gains were relatively flat, with all other cities

having less than one per cent gain over the quarter, and less than three per

cent for the year.

Perth

and Darwin actually recorded annual price retractions of 1.2 per cent and 1.8

per cent respectively.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Capital city average home price exceeds $600,000

New Minister for Cities welcomed

Debate rages around NSW strata reform

Calls for housing completions not approvals to be focus of commitments

Annual rental rate drops to record low 0.7%

Investor new-build demand remains high

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/JxUGij73oxs/capital-city-average-home-price-exceeds-$600000