Change in the air for NSW

Change in the air for NSW

Posted on Monday, November 02 2015 at 4:14 PM

At the same time as the New South Wales Parliament passes new strata laws, buyers purchasing off-the-plan in the state are set to have greater protections, too, thanks to changes announced by Minister for Innovation and Better Regulation Victor Dominello.

Real

Estate Institute of NSW president Malcolm Gunning described the new strata laws

as “a step forward to those who live in apartments”, adding that they were “in

dire need of reform”.

Meanwhile,

the state government will be introducing new laws later this month to make

developers justify any sunset clause termination of an off-the-plan sale.

“The NSW Government has listened to the concerns of its citizens and is

taking action,” Dominello says. “We are committed to ensuring certainty in the

property market and to protecting the rights of those who purchase off-the-plan

properties.”

Some NSW consumers

have reportedly had their contracts rescinded by a developer using the sunset

clause, only for the land or apartment to be re-sold the same day for a higher

price.

The proposed

legislation will apply not only to contracts made after the law comes into

effect, but will also apply to contracts that are still in operation.

“The NSW Government

is putting developers on notice that from this day forward if they use a sunset

clause for no other reason than to reap a windfall profit at the expense of the

purchaser, then they do so at their own peril,” Dominello adds.

“The overwhelming

majority of developers are reputable and do the right thing, and their industry

makes an important contribution to our state’s economy.”

A spokesperson for the Owners Corporation Network of Australia (OCN)

says the organisation is “delighted that off-the-plan purchasers in NSW will

soon be afforded protection against profiteering developers”, adding: “OCN commends the Minister…

for taking swift action to reign in these rogue developers when the media

recently exposed a number of them rescinding longstanding contracts to re-sell

at a much higher price.

“OCN

is particularly pleased that the new legislation will apply to contracts which

haven’t yet reached the ‘sunset clause’.

“Developers

will have to justify any sunset clause termination of an off-the-plan sale.

This protects the purchaser whilst providing reputable developers a get-out clause

for legitimate reasons, such as planning permission or unavoidable building

delays.

“For

too long, off-the-plan purchasers have been the brunt of an off-the-plan

purchase system weighted heavily against them. Thick, complex contracts that

heavily favour the developer are common. Substantial changes to the floor plan

occur regularly.

“Some

contracts have even required the purchaser to give their proxy vote to the

developer. This is fraught with danger when the building is likely to have

defects requiring urgent attention, and a developer less than willing to

address them.”

A total of 639 people responded to the three-week public consultation,

which closed on October 14. Industry groups were also consulted.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Nxg-BXuTQjI/change-in-the-air-for-nsw

Australian cities top global price growth list

Australian cities top global price growth list

Posted on Thursday, November 05 2015 at 3:59 PM

Two Australian cities have made the top five in Knight Frank’s Prime Global Cities Index for the year to September 2015.

The index has Sydney coming

in second, with an annual price gain of 13.7 per cent for the year – one of

only three international cities to record double-digit growth.

Melbourne filled out the top

five with a 9.4 per cent increase in values.

Michelle Ciesielski, a

director at Knight Frank, says their appearance isn’t surprising.

“One factor is the lower

Australian dollar, which has influenced the number of ex-pats buying back in

Sydney and Melbourne, taking advantage of buying a prime property in these

ideal conditions – ready for when they eventually return to Australia.”

Ciesielski says there’s also

been increased interest from overseas buyers looking to secure a trophy asset either

on the waterfront or in one of the cities’ more exclusive suburbs.

She believes growth is also

being driven by the limited supply of quality stock in sought-after positions

such as along the harbour, too.

“However, we are expecting

more higher-density prime stock to come to the market in Sydney with the

completion of Barangaroo and the Circular Quay redevelopment.”

The Knight Frank Prime Global Cities

Index reflects the top five per cent of housing in the wider market

in each city.

The highest gains globally were in

Vancouver, Canada, with a rise of 20.4 per cent for the year.

Shanghai was the other big mover at

10.7 per cent, while Jakarta reflected the same result as Melbourne with 9.4

per cent.

The overall results reflect a

slowing in growth among prime markets according to Kate Everett-Allen, a

partner in residential research at Knight Frank.

“The index’s annual rate of growth

has slowed significantly from seven per cent two years ago to 1.9 per cent.”

Seventy-three per cent of cities recorded

positive annual price growth in the year to September, down from 91 per cent

two years ago.

Singapore was the weakest performing prime

market tracked by the index for the seventh consecutive quarter, but the rate

of annual decline has slowed from -15.2 per cent at the end of Q2 to -7.9 per

cent this quarter.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Australian cities top global price growth list

RBA holds cash rate once more

Change in the air for NSW

Rate pain not over yet, investors warned

Investors ignore financial hurdles

How the states are stacking up

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/NJ4cIqxcYvM/australian-cities-top-global-price-growth-list

RBA holds cash rate once more

RBA holds cash rate once more

Posted on Tuesday, November 03 2015 at 2:48 PM

The Reserve Bank of Australia (RBA) has announced that it is holding the cash rate at 2.0 per cent for another month.

In his statement, governor Glenn Stevens said: “At today’s meeting the board judged that the prospects for an improvement in economic conditions had firmed a little over recent months and that leaving the cash rate unchanged was appropriate at this meeting. Members also observed that the outlook for inflation may afford scope for further easing of policy, should that be appropriate to lend support to demand.”

CoreLogic RP Data’s Tim Lawless was unsurprised by the announcement.

“With the cash rate remaining on hold, and considering the recent 15 to 20 basis point lift to mortgage rates, the average discounted variable mortgage rate is likely to remain around the 4.8 to 4.85 per cent mark for owner-occupier mortgages, which is close to historic lows.

“This should continue to provide a reasonable level of stimulus to the housing market.

“While interest rates are important to the housing market, other factors are also at play in the recent abatement in the rate of capital growth. Investors are now paying close to a 30 basis point premium on their mortgages, rental yields have slipped to new record lows, housing supply is moving through record peaks and affordability challenges are very much apparent in Sydney and to a lesser extent Melbourne,” he adds.

Peter Esho, chief market analyst with brokerage firm Invast Australia, expects the RBA to cut interest rates before the year’s end.

“I think if the Aussie dollar does move towards the mid US70 cent range (where there is resistance), the RBA will step in and go another 25 basis points,” he says.

“They need to maintain an element of surprise and even though the recent minutes didn’t indicate an imminent cut, a November cut probably has a higher chance than the market is signalling and I would be a seller of the Aussie dollar anywhere above the US73 cent range.”

Domain’s Andrew Wilson also believes the year could still see another cut, saying: “Prospects are increasing for a near-term rate cut.”

Real Estate Institute of New South Wales president Malcolm Gunning sys: “Sale prices have flattened out and we’re seeing a change in the market, which favours buyers rather than sellers,” adding: “We expect this to continue to the end of the year and beyond.”

The official cash rate has fallen 275 basis points since November 2011, with the RBA cutting interest rates twice in 2013 in May and August and at its February and May meetings this year.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/7gEI7Ayb_VU/rba-holds-cash-rate-once-more

Investors ignore financial hurdles

Investors ignore financial hurdles

Posted on Thursday, October 29 2015 at 9:42 AM

A survey by the industry group Property Investment Professionals of Australia (PIPA) reveals investors have not been put off by new lending restrictions.

The PIPA 2015 Property Investor Sentiment Survey questioned more than 1,000 property investors, with 32 per cent saying tighter lending policies, introduced by the Australian Prudential Regulation Authority, have affected them.

Despite this, 63 per cent of respondents believe now is a good time to invest in property while 60 per cent are looking to purchase a property in the next six to 12 months.

In addition, only 20 per cent of respondents say concerns over a property bubble have put their investment plans on hold.

Ben Kingsley, chairperson at PIPA, says the outcome confirms investors are both sophisticated and buying for the long haul.

“Property investors are looking past the noise and remaining focused on the long-term investment rewards that well-selected property can deliver.

“Kingsley says beyond much-hyped Sydney real estate, there are affordable capital city markets full of opportunities.

“And with interest rates still low by historical standards, it’s still a good time to invest in the housing market, if you’re doing your due diligence and seeking advice from professionals.

“According to PIPA’s survey, an overwhelming majority of investors (74 per cent) consider metropolitan markets the most appealing place to buy right now, with Brisbane identified by 58 per cent as being the capital that offers the best investment prospects.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Rate pain not over yet, investors warned

Investors ignore financial hurdles

How the states are stacking up

Home loans rising across the board

Softer September quarter signals end of southeast’s boom

Slow rises forecast for 2016

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/mtrwKA_c7Zc/investors-ignore-financial-hurdles

Rate pain not over yet, investors warned

Rate pain not over yet, investors warned

Posted on Friday, October 30 2015 at 2:27 PM

As the Australian Prudential Regulation Authority (APRA) crackdown takes effect, investors are being warned they should prepare for further rate pain.

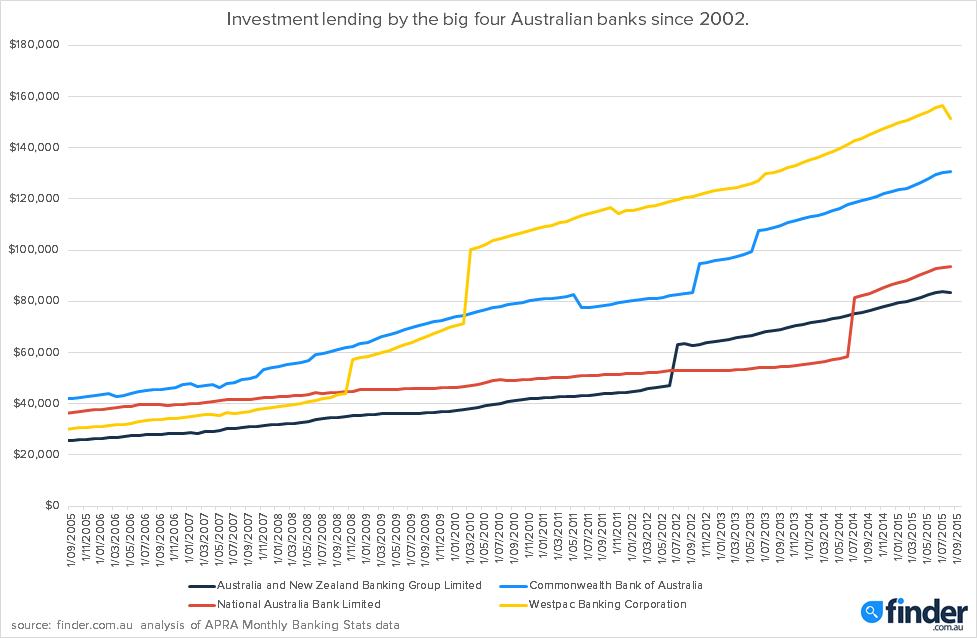

Insights analyst at finder.com.au Graham Cooke says the company’s analysis reveals investment lending has definitely softened on the back of APRA’s July movements.

“In just released figures from APRA, the average investment growth across all banks year on year to September 2015, excluding those with no investment lending, is 10.3 per cent,” he says, “still higher than APRA’s recommended 10 per cent but effectively showing that APRA’s new guidelines are filtering through to the market.

“Of the big four banks, NAB is leading in growing is investment lending the most in the last year from September 2014 to September 2015, increasing by 13.1 per cent from $83 billion to $94 billion. ANZ takes second place, increasing its investment lending by 10.1 per cent from $83 billion to $94 billion.”

Interestingly, the figures show a drop in investment lending at Westpac of -4.2 per cent since the guidelines were issued in July.

“Despite this,” Cooke says, “Westpac has seen significant investment lending growth in the last decade, overtaking NAB in 2008, and then overtaking Commonwealth Bank in 2010.

“Westpac remains the biggest lender in the country with a total of $149 billion in investment loans, 17 per cent bigger than its nearest rival, Commonwealth Bank.

“While 80 per cent of leading economists and experts in the finder.com.au Reserve Bank Survey expect rates to hold at 2.0 per cent this Melbourne Cup day,” he adds, “we’re tipping more out-of-cycle rate rises for owner-occupier and investment loans alike.”

Cooke warns that rising investment rates, along with a cooling property market (highlighted by recent auction clearance rates) continues to cause concern for investors as they try to assess how much of an impact these factors will have in capital growth.

“That said, property is still widely viewed as a strong investment and there’s no sign of this general consensus changing any time soon. Rather, with rate rises hitting the market – and all signs pointing to further rate rises – it’s up to investors to look more closely at where and how they can get the best value for their investments.”

He advises undertaking plenty of market research, and the sooner the better.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/m85UPQeejv0/rate-pain-not-over-yet-investors-warned

How the states are stacking up

How the states are stacking up

Posted on Monday, October 26 2015 at 11:57 AM

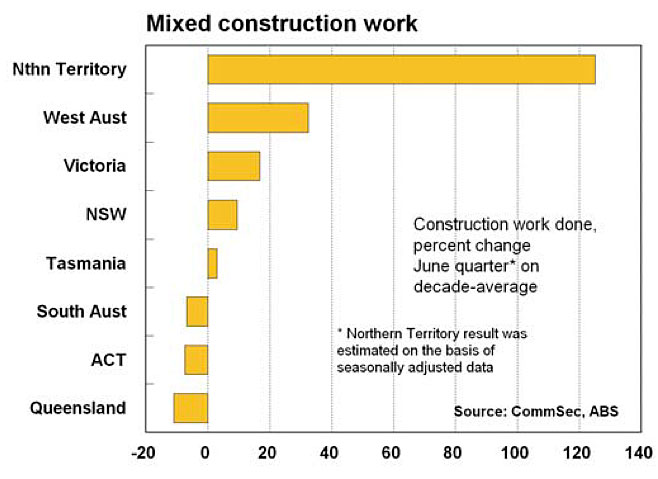

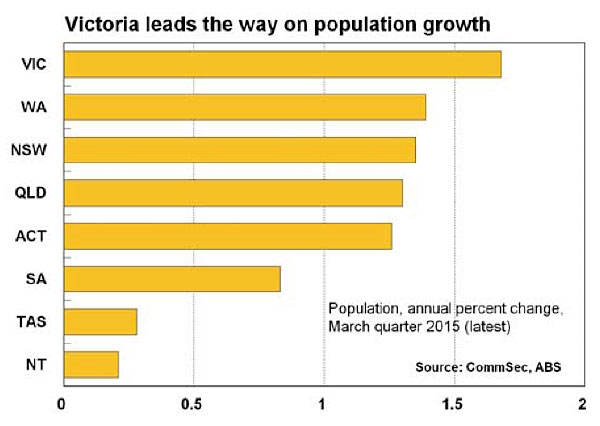

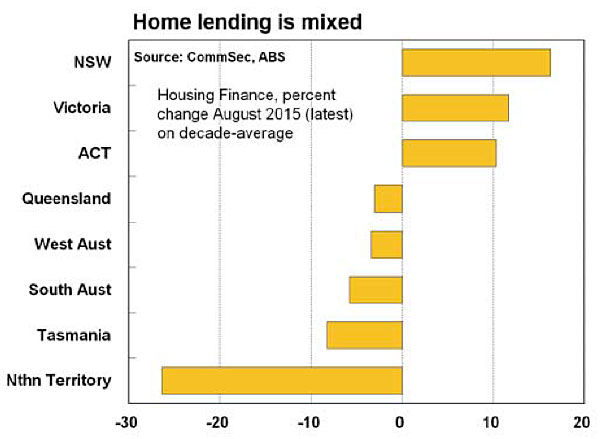

Commonwealth Bank of Australia’s research department has released its latest State of the States report, which gives a snapshot of what’s going on in the states’ economies across Australia by examining the indicators of economic growth, retail spending, equipment investment, unemployment, construction work done, population growth, housing finance and dwelling commencements.

The report shows there’s been little change in the rankings, with New South Wales retaining the top spot and Victoria in second. Both states have pushed further ahead of all the other states.

NSW has retained its top rankings on population growth, retail trade and dwelling starts, but now also adds housing finance to the list.

Victoria’s main strengths are population growth, housing finance and dwelling starts (second ranked on each indicator.)

The Northern Territory remains the third ranked economy, but has fallen further behind Victoria and now shares the third ranking with Western Australia. Northern Territory is top ranked on economic growth, business investment and construction work done, but the “top end” economy is last ranked on population growth, housing finance and dwelling starts.

Western Australia is second on retail trade, economic growth and construction work, but higher unemployment (eighth ranked) has affected housing activity.

Queensland retains fifth position on the economic performance table but it’s clear that it’s now in a third grouping of economies with the ACT, South Australia and Tasmania. Queensland is middle-ranked on most indicators.

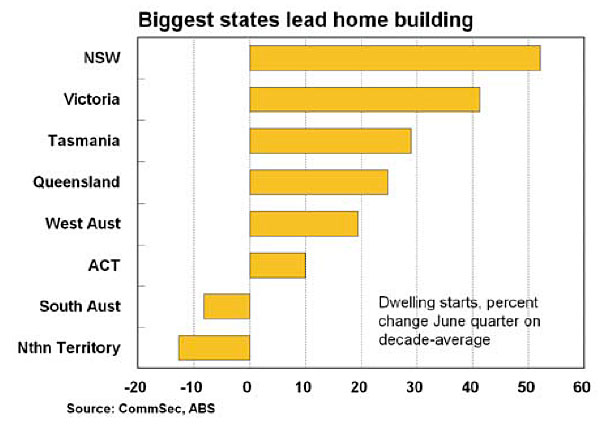

In the area of construction work, five of the states and territories were showing higher than decade averages.

NSW is fourth ranked with construction work 9.4 per cent above decade averages, while Tasmania is fifth ranked at 2.9 per cent above “normal” levels. In Queensland, overall new construction work completed is now 11 per cent below the decade average after being up 0.5 per cent on its decade average in the March quarter.

In the sphere of population growth, just one state now has population growth above long-term averages (NSW).

Victoria continues to record the strongest annual population growth and is still second on the differential with the decade-average rate. Victoria’s population is 1.68 per cent higher than a year ago although this growth rate is 2.9 per cent below than the ‘normal’ or decade average level.

In three of the states and territories – NSW, Victoria and ACT – trend housing finance commitments are above decade averages. And in six of the eight economies, trend commitments in August were above year-ago levels – all except Northern Territory and Western Australia.

NSW has now taken top spot for housing finance, with the number of commitments 16.3 per cent above the long-term average. Next strongest was Victoria, up 11.7 per cent on the decade-average.

The ACT has slipped from first to third spot on housing finance, but still up 10.3 per cent on the decade average, followed by Queensland (down 3.0 per cent).

When it comes to dwelling starts, the report shows a mixed outlook for housing.

While dwelling starts are above decade averages in six of the states and territories, starts are above levels of a year ago in only half of the states and territories.

NSW retains the mantle of the strongest in the nation for new home construction, with starts just over 52 per cent above decade averages. In addition, in the June quarter the number of dwellings started was 11.4 per cent higher than a year earlier.

Victoria holds second spot, with starts 41.2 per cent above decade averages, followed by Tasmania with starts up 29 per cent on decade averages and Queensland, up 24.8 per cent.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/hH6T5oPFSTo/how-the-states-are-stacking-up

Softer September quarter signals end of southeast’s boom

Posted on Thursday, October 22 2015 at 9:55 AM

Property portal Domain.com.au claims recent price growth results confirm property activity is slowing in the nation’s hottest markets, leading them to claim that the “boom is over”.

Domain says its September Quarter House Price Report reveals a sharp decline in the rate of price growth in both Sydney and Melbourne, with more moderate softening in other capitals.

According to Domain, the general outlook for housing markets across Australia is moderate to modest growth over the remainder of 2015 and into 2016.

Dr Andrew Wilson, senior economist at Domain, says low interest rates are losing their impact in driving Sydney and Melbourne.

“With rates steady over five consecutive months and income growth remaining subdued, the capacity for house price increases is moderating.

“Local factors continue to drive capital city house price growth, with resource states – Queensland, Western Australia and the Northern Territory – the clear underperformers as a consequence of weakening economies,” he says.

Domain’s findings on a city-by-city basis are:

Sydney

The great Sydney house price boom has ended, with house price growth tracking back sharply over the September quarter.

While the median house price still grew 3.2 per cent in the quarter to reach $1,032,433, this was the lowest quarterly rate of growth reported since March 2014.

“The extraordinary house price growth Sydney has recorded over the last three years is now clearly receding, although price growth remains relatively strong and well ahead of all other capitals, except Melbourne,” Wilson says.

“Sydney’s house prices have increased by a remarkable 21.7 per cent over the year ending September.”

Melbourne

The report shows Melbourne’s median house price increased by 2.8 per cent over the September quarter to reach $707,415.

While a strong result, Melbourne’s house price growth was well below the six per cent recorded in the previous June quarter.

“Despite the retreat in the rate of house price growth over the September quarter, Melbourne’s median house price increased by 15.6 per cent over the year, which was the highest annual result recorded since June 2010.”

Brisbane

Brisbane’s housing market reported another modest result for house price growth over the September quarter, with the median price increasing by just 0.8 per cent to $497,143.

Brisbane unit prices fell by 0.6 per cent during the period to $362,737, a drop year-on-year of 5.6 per cent.

“This was the fifth consecutive quarter of falling unit prices in Brisbane. With high levels of new apartment construction entering the market over the past year, supply has pushed well ahead of demand.”

Adelaide

Adelaide’s housing market remained flat, with the median figure increasing 0.3 per cent to record a figure of $485,873.

“Despite a subdued September quarter of growth, Adelaide’s house prices are still likely to increase at a faster rate this year than the 3.3 per cent recorded over 2014.”

Perth

Perth housing continued to decline over the September quarter, recording its sharpest fall in house prices since June 2011 – a drop of 2.4 per cent to $589,100.

“Perth house prices have now fallen by 3.2 per cent over the past year, with only Darwin recording a lower rate of annual house price growth. The sharp deterioration in the local economy and significant increases in jobless numbers has affected buyer and seller confidence,” Wilson says.

Hobart

Hobart’s median house price of $346,360 reflects a marginal increase of 0.9 per cent over the September quarter.

“Despite the modest increase in house prices over the quarter, strong growth earlier in the year has Hobart’s house prices up by 6.5 per cent year-on-year and are on track to increase over 2015 at a significantly higher rate than the 1.3 per cent recorded last year.”

Canberra

Median house prices in Canberra have reached $625,092 after rising 2.3 per cent during the quarter.

Domain says house prices have now increased by 7.8 per cent over the past year, representing a rate of growth behind only Sydney and Melbourne of all the Australian capitals.

“Canberra’s annual house price growth rate is the highest recorded by the local market since September 2010, with prices growth this year set to clearly exceed the 3.1 per cent recorded over 2014.

“The strong result recorded by the Canberra housing market over the September quarter is reflective of rising buyer confidence, which has been restored after a subdued period of buyer activity.”

Darwin

Darwin’s median house price fell by 2.3 per cent during the quarter and now sits at $639,042.

“The Darwin median house price has fallen by 5.1 per cent over the past year, which reflects reduced demand from interstate job seekers and an associated weakening of local economic activity,” Wilson says.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/2vhtBZMpNZU/softer-september-quarter-signals-end-of-southeasts-boom

Home loans rising across the board

Home loans rising across the board

Posted on Friday, October 23 2015 at 1:54 PM

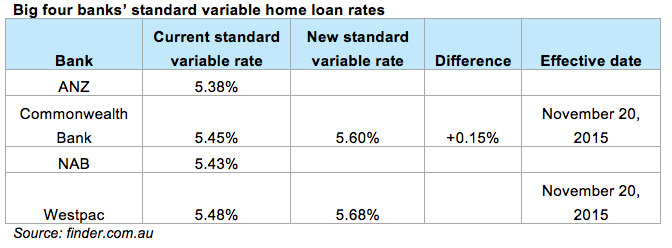

Westpac’s announcement last week that it’s increasing its variable home loan rate by 0.2 per cent prompted the predicted similar movements by the other Big 4 banks, with Commonwealth Bank announcing its 0.15 per cent raise yesterday and the National Australia Bank (NAB) and ANZ saying today that their variable rates will rise by 17 and 18 basis points respectively.

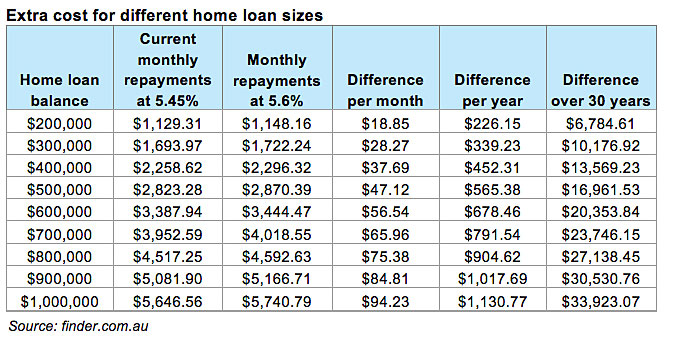

Money expert at comparison website finder.com.au Michelle Hutchison expressed little surprise at the announcements, saying: “Commonwealth Bank announced it will increase its standard variable home loan rate by 0.15 percentage points, effective November 20, the same day as Westpac’s 0.20 percentage point rate rise… this will cost a mortgage holder with a $300,000 home loan an extra $28 per month, $339 per year or potentially $10,177 over the life of a 30-year loan.

“Commonwealth Bank is the biggest home loan lender in Australia, with over $239 billion of home loans financed to households across the country (according to the latest APRA data). This increase will potentially be an extra $22.5 million per month, over $270.5 million in 12 months or over $8.1 billion over 30 years.

“However, despite Commonwealth Bank’s bigger household mortgage book,” she adds, “Westpac’s higher standard variable rate and larger rate increase means it’s expected to make a bigger return on the latest rate rise than Commonwealth Bank.”

In fact, according to finder.com.au, it’s likely Westpac will make an extra $23.9 million per month or potentially $8.6 billion over 30 years.

“It’s likely… other lenders will increase their variable home loan rates out of cycle,” Hutchison adds, “so it’s important for borrowers to watch their rates and compare their home loan to other lenders in the market.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Home loans rising across the board

Softer September quarter signals end of southeast’s boom

Slow rises forecast for 2016

Underquoting in NSW tackled as bill passes

Home loan rates are on the move

Home loan numbers high but investors’ loans drop

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/aLPvf0q6UEA/home-loans-rising-across-the-board

Slow rises forecast for 2016

Slow rises forecast for 2016

Posted on Monday, October 19 2015 at 11:51 AM

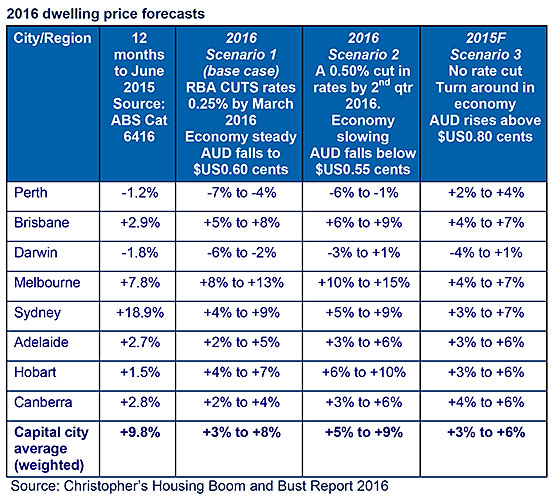

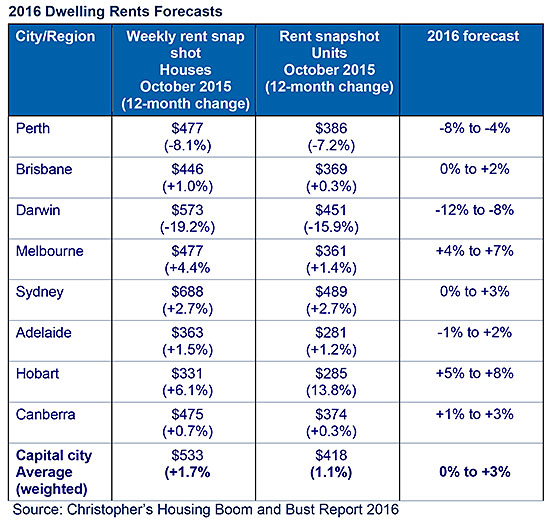

Australian dwelling prices are forecast to rise next year at the slowest pace recorded since 2012. SQM Research has today released its 2016 Housing Boom and Bust Report, which predicts that average capital city dwelling prices will rise between 3 per cent and 8 per cent for the full calendar year. That’s is down from the current 9.8 per cent recorded for the 12 months to June 2015.

The slowdown will occur predominantly as a result of a slowing Sydney property market, which is forecast to rise between 4 per cent and 9 per cent. Melbourne is forecast to overtake Sydney and be the best outperforming capital city in 2016, with a predicted rise in dwelling prices of between 8 and 13 per cent

Other contributing factors to this slowdown include:

- An ongoing housing market correction in the resources-exposed capital cities of Perth and Darwin.

- The APRA actions (announced mid-2015) of restricting credit growth.

- A slower Australian economy, with nominal GDP forecast to rise between 1.2 per cent and 1.7 per cent.

- The recent announcement by a leading major bank that it’s lifting variable home loan rates out of sync with the current cash rate.

On the plus side, SQM Research believes it’s highly unlikely that an across-the-board correction will occur next year, based on the following factors:

- The Australian dollar is likely to stay at current low levels and indeed may fall further, thereby providing a buffer to the economy and the housing market.

- An ongoing low interest rate environment and the possibility of a rate cut in early 2016.

- An ongoing robust Melbourne housing market, which is forecast to rise by 8 to 13 per cent.

Nationally, the rental market is likely to see a continued flat market with expected rental changes of between 0 and 3 per cent. Darwin is tipped to record another year of significant declines in rents of -12 per cent to -8 per cent, while Hobart’s tipped to record the fastest rental growth of all capital cities at between 5 and 8 per cent.

Speaking of the new forecasts for 2016, SQM Research managing director Louis Christopher says: “We forecast the national residential housing market will slowdown in 2016, predominantly as a result of a slowing Sydney housing market. However, we do not believe the market will record a fall in prices for the year. There might be one quarter, perhaps, where Sydney records a marginal decline, but that should be it.

“Perth and Darwin will record falls again next year, however we believe by the end of the year, both those cities may reach the bottom of their four-year downturn.

“We believe that Melbourne will be the outperformer of the year followed by the Gold Coast and Hobart. Each of these respective cities are benefiting from the lower Australian dollar.”

Christopher goes on to say: “One of the key risks to the housing market over the medium- to long-term is the looming threat of global deflation and this is quite a danger to our markets here, given the level of debt in the housing market right now, which we note has risen again against incomes over the course of 2014/2015 to be at all-time highs.

“This threat became all too apparent this week when Westpac lifted its variable home loan lending rate. In a global deflationary environment the risk premiums banks would require on their lending book would most likely skyrocket due to the greater threat of defaults and falling asset prices.

“For 2016 we believe the RBA has some ammunition to offset this looming risk, however we are concerned about their ability to handle the issue over the medium- to long-term.

“This year, it has become quite apparent that rents have slowed, possibly as a result of the lower inflationary environment. We believe there’s evidence that rents will slow further in 2016.

“We believe the threat of a massive oversupply in Melbourne has been overstated. Indeed, our vacancy rates for that city have fallen for the year as population growth and housing formation have quickly absorbed the new stock being completed.”

Capital city forecasts

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Wl4vAXs61aI/slow-rises-forecast-for-2016

Underquoting in NSW tackled as bill passes

Underquoting in NSW tackled as bill passes

Posted on Friday, October 16 2015 at 2:28 PM

An overhaul of underquoting laws will come into effect on January 1, 2016, after a bill passed the NSW Parliament on Tuesday that will help clarify how agents should market properties, according to the Real Estate Institute of NSW (REINSW).

REINSW president Malcolm Gunning says the reforms were important for consumers and real estate agencies and ensure that professional standards of the industry are met.

“The reforms bring clarity and surety to the real estate industry. We support this legislation that will require agents to be much more accountable in the determination of current market value and provides transparency to those seeking to make a purchase.

“These reforms are a step forward for the real estate industry and are in line with our goal of stamping out poor agency practice.

“We are working with NSW Fair Trading to prepare real estate agents for the new laws and information sessions across the state commenced [on Wednesday],” Gunning adds.

Under amendments to the Property Stock and Business Agents Act 2002, agents will be required to provide written evidence of their estimated selling price to the vendor and this estimate must be stated in the agency agreement.

When marketing a property, an agent must not quote a figure less than their estimated selling price provided in the agency agreement. The estimated selling price can be a single figure or a price range. If a price range is used, the highest price must not be more than 10 per cent higher than the lowest price.

The amendments will see the prohibition of advertisements and representations that say “offers over” or “offers above” or any similar statement. Agents will also be required to keep a written record of every statement of price they make to buyers, prospective buyers, vendors and prospective vendors.

Agents found guilty of underquoting will now be liable to forfeiture of any commission or fees from the sale in addition to the existing penalty of $22,000.

Minister for Innovation and Better Regulation Victor Dominello recognised the need for the changes in a statement.

“There have been no successful prosecutions related to underquoting made under this Act in 13 years, so this reform is long overdue.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Underquoting in NSW tackled as bill passes

Home loan rates are on the move

Home loan numbers high but investors’ loans drop

Statistics confirm Perth downturn

RBA announces rates to hold once more

Even more sellers now in Sydney’s market

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/E9UY-OtUosg/underquoting-in-nsw-tackled-as-bill-passes