Landlords urged to keep eye on New Year’s Eve parties

Posted on Friday, December 11 2015 at 11:54 AM

’Tis the season to be jolly, but landlords are being warned to make sure the ensuing folly doesn’t hit them in the pocket.

New Year’s Eve rental property

parties can leave an expensive financial hangover for unsuspecting landlords

warns landlord insurance specialist Terri Scheer Insurance.

Executive manager Carolyn

Parrella says New Year’s Eve parties are a source of stress for many landlords.

“While tenants should be

responsible for the rental property, invited party guests, who often have no

attachment to the property, may not treat it with the same respect as they

would their own home.

“New Year’s Eve parties that

get out of hand can leave landlords susceptible to costly damage and clean-up

bills.”

She does say, however, that

there are a number of steps for landlords to “New Year’s Eve-proof” their

properties.

Screen tenants

“Prevention is often better

than the cure,” Parrella says. “Tenants are entitled to enjoy their time at the

property, however it must be done with respect and consideration for the

landlord.

“Including lifestyle questions

on the lease application can help to identify and minimise future issues. Does

the applicant have regular visitors or guests? What type of activities will be

undertaken at the rental property? Landlords can use such questions to help

filter potentially troublesome tenants.

“Renter history checks can also

identify any past issues of accidental damage that may be attributed to

out-of-control partying.”

Enforce lease agreement

“Setting the ground rules

upfront and in writing can help avoid future headaches,” she says.

“A rental agreement may allow

landlords to enforce noise restrictions, such as no loud music after 10pm, and

a maximum number of guests at the property at any one time.

“It’s a common oversight by

landlords not to use the formal rental contract as a way to outline a tenant’s

responsibilities. This can help prevent the likelihood of parties and trouble

arising on New Year’s Eve. As the holiday season approaches, it’s also an

opportunity to remind tenants of their obligation set out in the rental

agreement.”

Maintain relationships and communication

“Maintaining a positive, open

and transparent relationship with tenants will help put landlords in good stead

ahead of New Year’s Eve festivities,” Parrella explains.

“Responding quickly to queries

and concerns can help build a good rapport with tenants, making them more inclined

to treat the property as though it were their own.”

Conduct property inspections

“Property inspections should be

non-negotiable and should be scheduled both before and after the holiday

season.

“Regular inspections can

provide early indications of a tenant that may fail to fulfill their rental

agreement obligations if accidental or malicious damage is identified.

Likewise, post-New Year’s Eve inspections can help identify any accidental

damage incurred during the holiday season.

“This also shows the tenant

that the landlord has an active interest in the care taken with their property

and helps reinforce the conditions under which the tenant has leased the

property.”

Review insurance coverage

“The holiday season is a time

that can carry a heightened risk of accidental damage to investment properties,

making a specialised landlord insurance policy all the more important,”

Parrella continues.

“Too often property investors

overlook risk management until after a tenant has moved in or when something has

gone wrong.

“Maintaining

a specialised landlord insurance policy can protect investors from the many

risks associated with owning a rental property and provide peace of mind if the

unforeseen should occur.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/2CdqiN6XcUo/landlords-urged-to-keep-eye-on-new-years-eve-parties

Melbourne vacancies defy affordability pressures

Melbourne vacancies defy affordability pressures

Posted on Wednesday, December 09 2015 at 1:26 PM

Melbourne-based non-government organisation Prosper Australia has released a report indicating more than 80,000 habitable properties could be vacant across Greater Melbourne.

Prosper Australia’s 2015 Speculative Vacancies Report suggests that

up to 18.9 per cent of investor-owned property is vacant, with the speculative

vacancy rate increasing by 22 per cent in 2014.

The annual report looks at

abnormally low water consumption over 12 months as a proxy for vacancy when

determining its speculative vacancy figures.

Karl Fitzgerald, project director at

Prosper Australia, says there are incentives for investors to keep investments

out of the rental pool.

“The findings prove we do not have a

housing supply crisis, we are literally locked out.”

Fitzgerald says capital gains

accelerated in 2014 and this saw the number of vacant properties held for

speculative investment rise.

The results were determined by identifying

households using less than 50 litres of water per day.

“According to our most conservative

measure, those using zero litres of water increased by a concerning 70 per

cent,” Fitzgerald says.

“Up to 18.9 per cent of all

investment properties lie empty.

“This report demonstrates over eight

years that hoarding is magnified in periods of increased speculation.”

Fitzgerald has called on the government

to look at the demand and supply imbalance and pursue policies to address the

issue.

“When there are three times as many

empty houses as there are homeless people, we know the policy focus is just

wrong.”

Fitzgerald says the report only

covers Greater Melbourne, and believes the research should be applied

nationally.

“This key economic data simply must

be collected by government and we call on PM Malcolm Turnbull to fund the ABS

to officially measure speculative vacancies.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Melbourne vacancies defy affordability pressures

Business confidence influencing property markets

Affordability’s improving in Perth

NSW goes digital with rental bonds

No cut, as RBA leaves rate unchanged

Study shows property prices unaffected by flight path

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/1RI9UB6i7M4/melbourne-vacancies-defy-affordability-pressures

Affordability’s improving in Perth

Affordability’s improving in Perth

Posted on Friday, December 04 2015 at 4:23 PM

Housing affordability has further improved in Perth according to the Real Estate Institute of Western Australia (REIWA), with the latest preliminary data showing that Perth’s median house price is at $535,000 for the three months to November 30.

REIWA president

Hayden Groves says the median house price was consistent with the Real Estate

Institute of Australia/Adelaide Bank Housing

Affordability Report, released yesterday, which showed that housing

affordability in WA had improved across the September quarter and also the

year, with the proportion of income required to meet loan repayments now at

23.8 per cent.

“Perth hasn’t

been this affordable for homebuyers for several years, with our latest

preliminary data for the three months to November 30 showing that 42 per cent

of sellers are adjusting their selling price in order to sell.

“Further analysis

also shows us that the most significant adjustments across price ranges in the

Perth metro area for the rolling three months to November 2015 is happening in

the $360,000 to $500,000 range, which is traditionally the first homebuyer

market, and in the over-$725,000 range, which is consistent with what REIWA

members have reported in the current market,” Groves says.

The official

abolishment of the First Home Owner Grant (FHOG) for established homes in

October has predictably had a direct impact on sales volumes for the three

months to November, which came in at 1,768 – a drop of 13 per cent over the

last three months.

The total number

of listings for sale in Perth as at November 30 came in at 16,475, but peaked

during the month of November at 17,078.

“This is up 18

per cent over the three months to November and up 23 per cent on the year to

November 2014 but the recent fall in listings could indicate that listing

levels have peaked,” Groves says.

Rental market

Rental

affordability in Perth has continued to improve over the last three months too,

with the latest reiwa.com data showing rents at more affordable levels.

“The overall

median rent price for the three months to November 30 now sits at $395 per

week, a minor adjustment of $5 over the last month but a significant $45 on the

same time last year,” Groves says.

The median house

rent is now $400 per week, while rent prices for units sit at $375 per week.

“These current

weekly rent prices are also consistent with the results of the Housing Affordability Report, which

found that rental affordability in WA had improved in the September quarter,

with tenants now spending around 21.5 per cent of their income on rent,” Groves

says.

Rental listings

in the Perth metro area have increased 16 per cent over the last three months,

to 9,448, providing tenants ample choice.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/jXgvNDndclM/affordabilitys-improving-in-perth

NSW goes digital with rental bonds

NSW goes digital with rental bonds

Posted on Wednesday, December 02 2015 at 2:23 PM

The New South Wales Government has launched an electronic system for the lodgement and refund of rental bonds.

Victor Dominello, NSW Minister for Innovation and Better

Regulation, says bringing the process into the digital age provides enormous

efficiencies.

“Each year NSW Fair Trading processes around 540,000

paper-based applications for the deposit and refund of residential bond monies.

“We are doing away with this cumbersome process by cutting out

the middle man and enabling tenants to lodge their bond directly to NSW Fair

Trading through an electronic transfer system.”

NSW’s Rental Bonds Online is the only scheme in Australia

where tenant bond money is deposited directly to the government, according to

Dominello.

“The new scheme provides tenants with greater confidence that

their bond money is securely held in trust, from the moment the payment leaves

their account.”

A pilot of the scheme began in July this year. Since then, more

than 2,000 real estate agencies and private landlords have signed up to the new

service, with more than 7,000 active accounts established and more than $5

million worth of bond money lodged.

Electronic lodgement is voluntary, with tenants able to choose

paper lodgement if they wish.

The service also allows tenants to record and save their bond

history online, which they can opt to use to support future tenancy

applications.

“Rental Bonds Online is expected to reduce red tape for

tenants, private landlords and real estate agents by approximately $20 million

per year,” Dominello says.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

NSW goes digital with rental bonds

No cut, as RBA leaves rate unchanged

Study shows property prices unaffected by flight path

Perth tenants in the rental driver’s seat

Ducted air con and solar power best for depreciation

Rental rates showing little signs of increasing

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/YJAZMFcd8ts/nsw-goes-digital-with-rental-bonds

No cut, as RBA leaves rate unchanged

No cut, as RBA leaves rate unchanged

Posted on Tuesday, December 01 2015 at 1:41 PM

Once again, the Reserve Bank of Australia has chosen to leave the cash rate at 2.0 per cent, meaning no more rises for 2015.

Governor Glenn

Stevens said in his message: “At today’s meeting,

the Board again judged that the prospects for an improvement in economic

conditions had firmed a little over recent months and that leaving the cash

rate unchanged was appropriate. Members also observed that the outlook for

inflation may afford scope for further easing of policy, should that be

appropriate to lend support to demand.”

He added: “The

available information suggests that moderate expansion in the economy continues

in the face of a large decline in capital spending in the mining sector.

“While GDP growth

has been somewhat below longer-term averages for some time, business surveys

suggest a gradual improvement in conditions in non-mining sectors over the past

year. This has been accompanied by stronger growth in employment and a steady

rate of unemployment.

“Inflation is low

and should remain so, with the economy likely to have a degree of spare

capacity for some time yet. Inflation is forecast to be consistent with the

target over the next one to two years.

“In such

circumstances, monetary policy needs to be accommodative.”

Stevens also mentioned that growth in

lending to investors in the housing market has eased and that supervisory

measures are helping to contain risks that may arise from the housing market.

The topic had been predicted by CoreLogic RP Data, which reported a 1.5 per cent fall

in capital city dwelling values over the month of November and a 0.5 per cent

fall over in values over the past three months.

While

the cash rate remained on hold, a less buoyant housing market is likely to

provide the RBA with a greater degree of flexibility in adjusting interest

rates without as much risk of over stimulating the housing market as they’ve

faced over previous months, a spokesperson says, adding that while the Reserve

Bank is likely to welcome a slowdown in the rate of home value appreciation,

the overriding objective would be to avoid a significant downturn in the

housing market, which would act as a weight on economic growth and potentially

affect financial system stability.

Despite

the stable rate setting, mortgage rates remain close to record lows, which

should continue to act as an incentive for homebuyers and investors considering

a property purchase.

The

first Reserve Bank board meeting of 2016 will take place in February.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

No cut, as RBA leaves rate unchanged

Study shows property prices unaffected by flight path

Perth tenants in the rental driver’s seat

Ducted air con and solar power best for depreciation

Rental rates showing little signs of increasing

Tasmanian town planning laws to be simplified

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/PRHdlEt7lWo/no-cut-as-rba-leaves-rate-unchanged

Study shows property prices unaffected by flight path

Posted on Monday, November 23 2015 at 12:15 PM

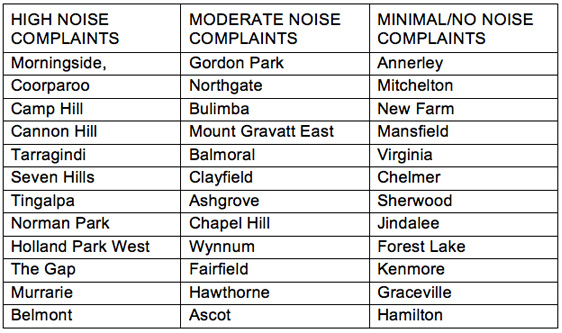

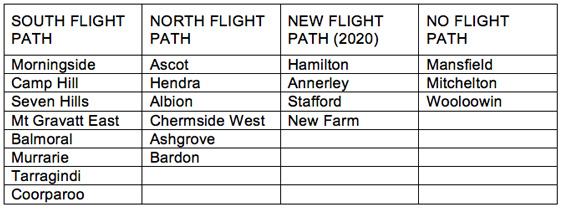

Aircraft noise has had minimal if any impact on property prices in suburbs near or under the flight paths to Brisbane Airport, a Queensland University of Technology (QUT) analysis of 26 years of property sales, rental and investment performance has found.

In fact, the study, commissioned by Brisbane Airport

Corporation, found property prices in some high-value suburbs with high noise

complaints increased at a greater rate than other similar suburbs unaffected by

aircraft noise.

Property economist

Professor Chris Eves and Andrea Blake from QUT’s School of Civil Engineering

and Built Environment and the QUT Air Transport Innovation Centre analysed

price, saleability, investment performance and capital growth from 1988 to 2014

of residential properties in 40 Brisbane suburbs either near the airport or

under a flight path.

“It is the most detailed and comprehensive analysis of

the impact of aircraft noise ever undertaken in Australia,” Eves says.

“In total we looked at more than 180,000 sales

transactions in 40 suburbs ranging from those whose residents recorded the

highest number of noise complaints to those which reported minimal or no

aircraft noise.

“Our findings suggest that factors such as proximity

to transport, the Brisbane CBD, schools, recreation facilities, the airport and

other services, far outweigh any negative impact experienced as a consequence

of being under a flight path or from aircraft noise.”

Eves explains the suburbs were classified by the

number of aircraft noise complaints recorded by Air Services Australia over the

past five years. These suburbs were classified as having high, moderate or

minimal/no noise complaints.

“Our analysis shows very little difference in growth

of house prices across high-value suburbs regardless of where they were

situated or their exposure to aircraft noise.

“For example, Bulimba, which is under an existing

flight path and records moderate noise complaints, has capital returns slightly

higher than New Farm, which isn’t subject to any noise complaints.

“The capital returns for Ascot and Balmoral, which are

currently not under a flight path, are less than the capital returns for

Bulimba.”

Eves says units and townhouses under Brisbane flight

paths also showed no impact on investment performance from aircraft noise.

“Rental properties under the existing main southern

flight path, which attracts the highest level of noise complaints, have a

rental market increasing at the same percentage as properties not located under

an existing flight path,” he says.

“In fact, over the 26 years, units and townhouses in

the high noise complaint suburbs showed an average annual capital return of

7.66 per cent, which is higher than the capital returns in the moderate noise

complaint suburbs of 7.40 per cent, but slightly lower than capital return for

no noise complaint suburbs.

“In higher value, middle socioeconomic suburbs, two of

the highest average annual capital returns for the 26-year period for houses

were achieved by Camp Hill (9.52 per cent) and Cannon Hill (9.72 per cent).

“Each of these suburbs is under the main southern

flight path and subject to high noise complaints. In contrast, Bardon, with

minimal/no noise complaints, achieved 9.02 per cent.”

Eves says Hendra, another higher value middle

socioeconomic suburb, adjoining the airport, had recorded moderate noise

complaints but outdid them all and achieved an average annual capital return of

10.9 per cent.

“Hendra is not currently under a flight path but will

be when the New Parallel Runway opens in 2020,” he says.

“Even when we looked at the only two lower-value,

middle socioeconomic suburbs in the study, we found similar effects.

“Mount Gravatt East, which records moderate noise

complaints under the existing flight path, had, at 7.93 per cent, a higher

average annual capital return than the Brisbane median of 7.72 per cent.

“In contrast, Chermside West, which has minimal/no

noise complaints under the existing flight path, had below the median growth of

6.46 per cent.

“Overall the study found that the value and price of

housing and units in Brisbane located under flight paths are determined by a

range of factors other than aircraft noise.”

Eves says that when the new proposed flight paths open

in 2020 there would be many suburbs that had less noise because aircraft

movements would be shared.

Brisbane Airport Corporation (BAC) corporate relations

head Rachel Crowley says the potential negative impact on property values was a

cause of concern for people living near an airport or under a flight path.

“We’re pleased that this study may provide some

comfort to people who may be anxious about whether or not their property value

is constrained by their location under a flight path,” she says.

“We also hope this study may convince property

developers, vendors and real estate agents that being open and transparent

about the presence of a flight path should not negatively impact sale price.

“Airports are essential national infrastructure and

the importance of their ability to operate unencumbered cannot be over-stated.

“Queensland is in the fortunate position of having its

major gateway airport both well-located and well-protected by a

significant buffer of industrial land, which protects residents from the worst

aircraft noise experienced in cities that have residential development far

closer to the airport.”

Suburbs

in the study

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/65JW69Up5l8/study-shows-property-prices-unaffected-by-flight-path

Ducted air con and solar power best for depreciation

Ducted air con and solar power best for depreciation

Posted on Monday, November 16 2015 at 3:55 PM

Analysis by BMT Tax Depreciation has shown that ducted air conditioners, floating timber floors and solar power systems are the assets that generally have the highest depreciable value for property investors.

“Based

on our experience preparing thousands of property depreciation schedules, we’ve

found that these assets will average a combined depreciable value of

approximately $27,000 in a residential property,” BMT CEO Bradley Beer says.

“In

the first financial year alone, these three items could result in about $3,400

in deductions for the owner.”

While

these assets generally result in the highest depreciation deductions for

property owners, there are other items that BMT finds more frequently.

“The

three depreciable assets we find most often during a site inspection are hot

water systems, split-system air conditioners and bathroom accessories,” Beer

says.

“We

find that these assets have a combined average depreciable value of around

$5,000.

“For

an investor, these three items could result in a first financial year deduction

of $1,100 and a cumulative deduction of around $3,500 over five years.”

There

are also a number of assets investors easily miss and fail to maximise

depreciation deductions for, including smoke alarms, garbage bins and exhaust

fans.

“The

depreciable value of these items will usually total $1,200 and as these smaller

ticket items are often valued less than $300 each, they could also entitle

their owner to claim the full amount as an immediate write-off in the first

financial year,” Beer explains.

“The

deductions for assets found in an investment property add up and it pays for an

investor to understand how depreciation works and which items can be

depreciated.

“When

preparing a depreciation schedule for a property investor, specialist quantity surveyors

will complete a detailed site inspection to ensure no assets are missed,” Beer

adds.

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/msjIOjwtjwo/ducted-air-con-and-solar-power-best-for-depreciation

Perth tenants in the rental driver’s seat

Perth tenants in the rental driver’s seat

Posted on Wednesday, November 18 2015 at 1:40 PM

The latest Real Estate Institute of Western Australia (REIWA) analysis shows rents in metro suburbs fell again during the third quarter 2015.

Damian Collins, president of

REIWA, says Perth’s overall median rent price of $400 reflects a fall of $20

over the quarter and $50 for the year to September.

“When we break this down

further we see that the median house rent price is $420 per week, a drop of $10

over the quarter and $30 for the year to September, while the median unit rent

price is $395 per week, which is a decline of $5 over the quarter and $35 when

compared to the year to September.”

The biggest drops were seen

in Wanneroo South, Belmont and Stirling East.

While this isn’t great news

for landlords, improved affordability is a positive for tenants, Collins says.

He predicts softening to

continue in the near future, but is more bullish about the city’s long-term

prospects.

“As more large scale

multi-residential developments come onto the market, we will see an increase of

rental stock in the short-term providing tenants with plenty of choice, however

over the long term, with population trends forecast to increase, the Perth

rental market should adjust.”

Collins recommends landlords take time to assess their portfolio to ensure

their holdings are attractive to tenants.

“REIWA members are reporting

that while overall enquiries had dropped off, well-presented properties at

realistic prices are still being leased.

“They also reported that

properties that offer better amenities like air conditioning are in a better

position to find good tenants.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Perth tenants in the rental driver’s seat

Ducted air con and solar power best for depreciation

Rental rates showing little signs of increasing

Tasmanian town planning laws to be simplified

Australian cities top global price growth list

RBA holds cash rate once more

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Js4VdLjgzjg/perth-tenants-in-the-rental-drivers-seat

Rental rates showing little signs of increasing

Rental rates showing little signs of increasing

Posted on Friday, November 13 2015 at 2:48 PM

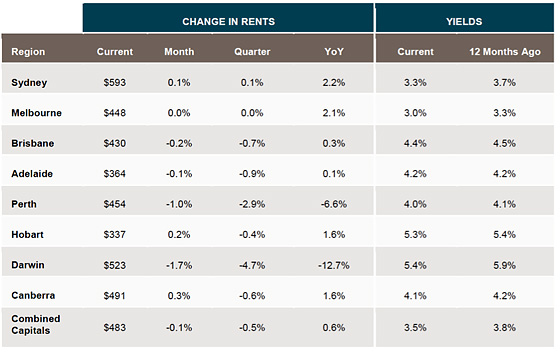

Rents can be a key indicator for property market conditions across Australia’s capital cities.

The

CoreLogic RP Data rental review, distributed each month and released recently covering

October’s rental market activity, provides a deep-dive analysis into the impact

rental rates may or may not be having on capital city property markets.

The October

analysis shows rents across the combined capitals were virtually unchanged in

October, down by -0.1 per cent over the month, with rents lower in four of the

eight capital cities. The annual rate of change has increased slightly from 0.5

per cent in September to 0.6 per cent in October.

CoreLogic RP

Data research analyst Cameron Kusher says: “The data points to an ongoing

softening of rental growth, particularly throughout this year. With just two

months remaining to year’s end, it seems that rental growth will be very soft

over 2015.”

Kusher points

out that the construction boom across the capital cities, coupled with slowing

population growth, low mortgage rates and the recent heightened level of

activity from investors, are the major contributing factors to the slowing

rental growth.

“Sydney,

Melbourne and Brisbane continued to record rental rises over the past year,

however each city is seeing a slowing in the pace of rental growth relative to

12 months ago,” he says. “Clearly, the increase in investment stock is

providing landlords with little scope to lift rental rates while the low

mortgage rate environment provides little incentive to push yields higher.”

National overview:

- Dwelling rental rates across the combined capital cities

are recorded at $483 per week and they have increased by just 0.2 per cent over

the first 10 months of the year while they’ve risen by 0.6 per cent over the

past 12 months. - Weekly rents across the combined capital city measure fell

by -0.1 per cent in October, but on an annual basis they recorded a slight rise,

taking annual rental growth to 0.6 per cent. - Only Sydney and Melbourne have recorded rental increases

greater than 2 per cent over the year. - Rents have fallen over the year in Perth and Darwin, while

the remaining capitals have seen rents rise by less than 2 per cent over the

year. - Currently combined capital city rental rates are $487/week

for houses and $463/week for units. - It’s anticipated that the

rate of rental growth will continue to slow over the coming months due to

increased supply of housing and rental stock and slower migration rates.

Looking

across the individual capital cities, over the past year Sydney and Melbourne

have recorded the greatest increases in weekly rents. Over the past month,

weekly rents have moved lower across every capital city except Sydney, Hobart

and Canberra, where they rose, and in Melbourne where they were unchanged. Over

the past three months rents are lower in all capital cities except for Sydney

and Melbourne.

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Rental rates showing little signs of increasing

Tasmanian town planning laws to be simplified

Australian cities top global price growth list

RBA holds cash rate once more

Change in the air for NSW

Rate pain not over yet, investors warned

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/JIPjKrmPpIw/rental-rates-showing-little-signs-of-increasing

Tasmanian town planning laws to be simplified

Tasmanian town planning laws to be simplified

Posted on Wednesday, November 11 2015 at 5:09 PM

The Tasmanian Government is introducing legislation to simplify the state’s planning process.

Peter Gutwein,

Tasmania’s Minister for Planning and Local Government, says new laws will

ensure 80 per cent state-wide consistency across its Local Government Areas.

At present,

there’s only 15 per cent consistency across Tasmania’s 29 councils, a system

Gutwein describes as a “nightmare”.

“The [new] planning

system will be faster, fairer, simpler and cheaper, which will encourage more

confidence for those looking to invest and expand,” he says.

Mary Massina,

executive chair of the Tasmanian Planning Reform Taskforce, says the changes

have been a long time coming.

A single state-wide

planning scheme will remove what Massina calls the “single biggest barrier to

investment and job creation”.

“The creation of

a single set of planning rules will take Tasmania from the worst to first,” she

says.

Brian Wightman,

Tasmanain executive director of the Property Council, says the state had been

ranked last in his organisation’s Development

Assessment Report Card 2015, but the new reforms should change next year’s

result.

The reforms will

deliver consistency, drive improvement and “lead to the state moving off the

bottom rung of the planning ladder”, Wightman says.

“The property

sector is a major player in the state’s economy, contributing $2 billion in

Gross State Product, employing seven per cent of the workforce and driving a

significant resurgence of activity across Tasmania.”

Follow us on Twitter.

Was this article helpful? Place a link to it from your website, or share it using the button below.

Recent articles:

Tasmanian town planning laws to be simplified

Australian cities top global price growth list

RBA holds cash rate once more

Change in the air for NSW

Rate pain not over yet, investors warned

Investors ignore financial hurdles

Leave a comment

Comments

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/0Ip9PNJawXk/tasmanian-town-planning-laws-to-be-simplified