By Joe Hurley, RMIT University; Ebadat Parmehr, RMIT University; Kath Phelan, RMIT University; Marco Amati, RMIT University, and Stephen Livesley, University of Melbourne

Greater recognition of the benefits of urban forests is focusing efforts from all levels of government to defend and improve them.

Perhaps the most iconic of these efforts is New York City’s Million Trees Program. Other initiatives of note include the City of Melbourne’s and the City of Sydney’s.

Earlier this year, federal Environment Minister Greg Hunt declared:

Green cities – cities with high levels of trees, foliage and green spaces – provide enormous benefits to their residents.

Hunt pledged to develop:

… decade-by-decade goals out to 2050 for increased overall tree coverage.

But achieving green cities will need more than just canopy cover targets and central city strategies. In contested urban environments, it will require new approaches to urban planning and development.

Urban development and the urban forest

As cities grow, pressure for urban consolidation increases. Planning policies that enable compact city development, along with increased market demand for smaller, well-located dwellings, contribute to this pressure.

Urban consolidation is an important policy goal to improve cities. While not uncontested, consolidation slows cities’ outward expansion. This can reduce the loss of agricultural and ecologically significant land and provide a more efficient urban form.

Yet, as cities become denser and the traditional suburban “house and garden” is redeveloped, buildings are replacing trees. How is it possible to reconcile urban consolidation with urban greening and increased canopy cover?

A critical first step is to measure the urban forest and assess the impact of redevelopment and consolidation on canopy cover. This should inform strategies to best meet compact city goals while enabling a rich and extensive urban forest. This agenda forms part of the work of the National Environmental Science Program’s Clean Air and Urban Landscapes Hub.

A case study of the Melbourne suburb of Williamstown illustrates the potential conflict between consolidation and the urban forest.

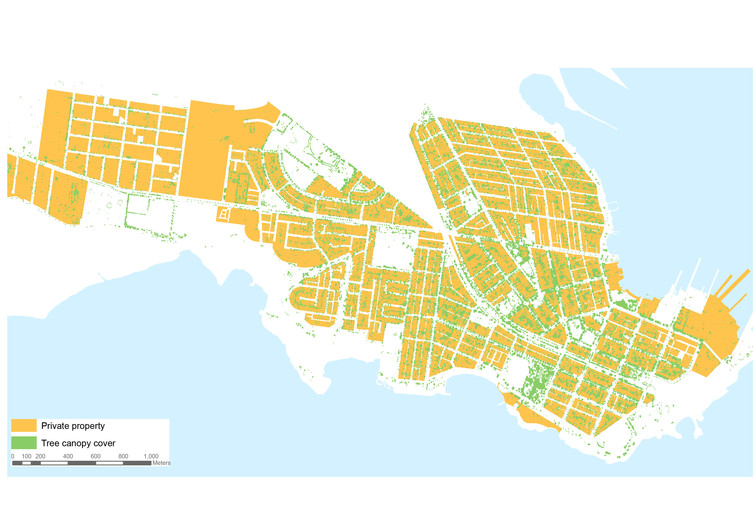

The map below brings together tree canopy cover derived from remote sensing with analysis of land use and zoning. It shows tree canopy cover on both private and public land.

Tree canopy cover and the public/private realm in Williamstown. Author provided

Some 55% of the canopy is over private land. Urban forest policies, which typically focus on the public realm, are at best tackling only half the picture. Urban consolidation policies also rarely note the impact of redevelopment on the urban forest.

Urban deforestation

Tiny backyards in new fringe areas and boundary-to-boundary development in existing suburbs often eliminate private land’s potential contribution to the urban forest. This puts incredible pressure on the public realm to provide the urban forest.

Current land-use policies support dispersed piecemeal redevelopment of individual lots in existing suburbs, which produces relatively few new homes (as below). At the same time, replacing an existing home with a larger house or with several townhouses typically results in all existing vegetation being stripped from the site.

These Preston townhouses are an examples of dispersed, low-yield consolidation. Joe Hurley

Meeting future housing needs in this way would require redevelopment of a vast number of these lots. This would have a significant impact on the urban forest.

Higher-density modes of consolidation also typically eliminate vegetation. However, their greater housing contribution means this form of consolidation’s cumulative impact on the urban forest is significantly less than that of low-density redevelopment (as below).

This apartment building in Hawthorn, Victoria, is an example of higher-density consolidation. Kath Phelan

An urban forest, not a concrete jungle

Compact city land-use policies and urban forest policies need to work together to ensure that cities have high-quality built environments and extensive tree cover. These policies must set the overall goals and outline strategies to deliver on them for both public and private land.

Cities urgently need more strategic identification of small and large lots that are suitable for more intensified development, particularly to reduce the need for the widespread low-level consolidation that threatens tree cover.

Land-use regulation should ensure that both low-yield and higher-density redevelopment maintains the contribution of private land to the urban forest. Existing and new approaches to achieving this outcome need to be considered – whether through local rules, government programs or incentive schemes.

An early leader in this space is Brimbank City Council, which has made modest but important planning scheme changes to require trees in the front yards of two-lot subdivisions.

Rapid urban consolidation will change urban landscapes significantly over the next few decades. The right decisions need to be made now to ensure the consolidation of cities maximises the benefits of redevelopment while also protecting one of their most critical functional, cultural and environmental assets.

![]()

Joe Hurley, Senior Lecturer, Sustainability and Urban Planning, RMIT University; Ebadat Parmehr, Research Officer, School of Global, Urban and Social Studies, RMIT University; Kath Phelan, Research Fellow, School of Global, Urban Social Studies, RMIT University; Marco Amati, Associate Professor of International Planning, Centre for Urban Research, RMIT University, and Stephen Livesley, Senior Lecturer in Urban Biogeochemistry, University of Melbourne

This article was originally published on The Conversation. Read the original article.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/J6MRqcMBRPE/

Has housing construction passed its peak?

Warning signs in new data suggest that housing construction has started to slow.

The Australian Bureau of Statistics data on building activity shows a 5.1 per cent fall in commencements in the December quarter, and a fall of 2.3 per cent on completions.

Numbers show the commencements and completions over the past 12 months remain at record highs – but the fall in starts and completions in the last quarter is revealing.

Building commencements throughout 2015 reached a record 220,887. However, in the December quarter commencements fell from 56,612 to 53,727.

Property Council’s chief of policy and housing Glenn Byres says there’s a real risk in these numbers that housing commencements and completions have peaked and could turn south.

“It’s the last thing we need at a time when housing construction is crucial to economic prosperity and we’ve got chronic undersupply in our major capital cities,” he says.

“While Australia’s largest state, New South Wales, had the largest increase in commencements throughout 2015 (up 19.1 per cent for the year), the 14.0 per cent fall in the December quarter is a marker for concern. It’s a reminder that NSW needs to get cracking and fix up its planning system, which is still the most dysfunctional in the nation.

“We need policy solutions in place that reduce the time, cost and red tape on projects and make it easier to deliver a sustained period of strong supply. Stronger supply will improve affordability, which is vital for homebuyers.

“This data is a reminder about the important role property construction plays throughout the economy. It’s why we are so concerned about dramatic changes to negative gearing and capital gains tax.

“These changes are not just a risk to housing construction; they are a risk to jobs and growth.”

Latest building figures from Master Builders show building approvals up almost 10 per cent in Queensland, an improvement on the previous two months.

Master Builders deputy executive director Paul Bidwell says the February increase was due almost entirely to approvals in the southeast of the state.

“Building approvals are still up across the past 12 months and I’m confident that detached housing will continue to grow long-term, but believe the investor-led boom in unit approvals is waning,” Bidwell says.

Month-on-month in the regions, Brisbane was up 38 per cent, the Sunshine Coast rose 45.7 per cent and the Gold Coast increased by five per cent.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/fYVU0v80tdo/

Why Real Estate Investing Suits So Many

Experts are always trying to tell us when it’s the right time to take action. There’s always a right time to work out, eat, shop, and sleep. And, of course, there’s also always a right time to invest in real estate and to purchase a home.

You’ve been hearing for years that it’s a great time to buy real estate. Ultimately, it comes down to not only the real estate market, but also your personal situation and where you are at in life

So is now a good time to get into the real estate market?

For the first time in decades, real estate is over taking mining to become Australia most profitable industry. Real estate produced $8.6 Billion of taxable profit in a quarter, mining at $3.6 Billion.

Take a look at the latest line up of Forbes Billionaires List. A total of 135 property tycoons now make up the world’s wealthiest list with 14 property billionaires joining the ranks this year alone, boosted by surging property values around the world.

Now for the average person, below are 10 reasons why investing in property is attractive and can be tailored to everyone.

Ten Reason Why

- Stable investment that has a long history of growth.

- Other people can pay for your investment.

- Demand is higher than supply.

- Melbourne’s real estate market has buyers from all over the globe.

- You can use your SUPER to buy it.

- TAX benefits, negative gearing and deprecation.

- Choose an investment that suits your budget.

- Flexible: you can renovate, subdivide or rebuild.

- You can leverage equity to purchase more property.

- Easier than researching the stock market.

If you do decide to invest, meet with a trusted local real estate buyers agents who can help you navigate the ever changing landscape of the real estate market. They often know when properties are about to go on the market and may have a lead on a short sale property that can be a great buy.

Happy house hunting!

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/qmPVh6wUYTk/

By Ryan Van den Nouwelant, UNSW Australia and Laura Crommelin, UNSW Australia

Watch any tourism or branding campaign for an Australian city, and chances are you’ll see plenty of appealing imagery of amenities in and around the CBD – be it restaurants, nightclubs, parks or galleries. It is a common mantra in urban planning that good “amenity” is valuable to the economy both in its own right, particularly to attract tourism, and for attracting a productive workforce that boosts the economy more generally.

But in a recent research project, we found that hospitality businesses – including restaurants, bars and hotels – are facing some headwinds in our CBDs. These stem from what economists call a thin labour market. This roughly boils down to businesses struggling to find good workers.

In a series of interviews in Sydney, we found instances of employers experiencing problems with recruitment, reliability and retention of lower-paid workers in particular. These all have the potential to undermine the viability of the CBD hospitality sector.

Why hospitality is vulnerable

From our analysis of census data, the CBD hospitality sector is typically the biggest employer of lower-paid CBD workers – it represents around one-in-five such workers. And it is the CBD sector most dependent on lower-paid workers. Around two-thirds of hospitality workers in the CBD are in the lower pay range.

Census and housing market analysis revealed these lower-paid workers are making a lot more housing compromises to work in the CBD, compared with lower-paid workers elsewhere in the broader metro area. This includes: being more likely to rent; more likely to share with unrelated adults; more likely to forgo extra space (spare rooms or backyards); and more likely to face a longer commute. All else being equal, these compromises are going to discourage the lower-paid workers from working in the CBD.

Lower-income CBD workers must put up with either housing compromises or a long commute. AAP/Joel Carrett

Most industries that employ large numbers of lower-paid workers – like retail or manufacturing – also tend to be more distributed across the metro area, closer to where workers live. This doesn’t help CBD hospitality, though. It’s tethered to the galleries and convention centres in the CBD that attract the visitors.

To be sure, these problems were not a universal experience among hospitality businesses. There were often other mitigating factors, which ensured they could attract good workers.

CBDs are usually the hub for public transport systems, which helps overcome much of the additional distance people travel. And, somewhat ironically, many lower-paid workers like working in the CBD because it offers such good amenities and lifestyle.

In some instances, hospitality jobs also seemed to be a good fit with available sources of lower-paid workers. Seasonal jobs and evening jobs attracted international workers and university students, who brought skills and experience that hospitality jobs might not usually attract.

Heed the warning signs

The sky is not falling in. However, businesses and industry groups we spoke with were increasingly aware of the challenging housing circumstances many of their workers faced.

It’s important to recognise that high housing costs aren’t just making life difficult for lower-income households, but can have broader economic impacts too. There is also a concern that this represents a thin end of the wedge – as housing affordability around the CBD deteriorates further, there’s every possibility it will leave other CBD industries seeing their lower-income labour market thinning out.

We also found governments are not well positioned to respond to this issue, which crosses a number of policy “silos”. So housing agencies hope planning agencies will distribute jobs to where the workers live; planning agencies hope transport agencies will connect distant labour markets to the CBD jobs; and transport agencies hope housing agencies will deliver more housing where the jobs are.

In the meantime, our market-led housing strategies leave lower-paid workers struggling with longer commutes and poorer living circumstances, and CBD businesses at risk of thinning labour markets.

![]()

Ryan Van den Nouwelant, Senior Research Officer – City Futures Research Centre, UNSW Australia and Laura Crommelin, Research Associate, City Futures Research Centre, UNSW Australia

This article was originally published on The Conversation. Read the original article.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/VrylUicb07k/

Calls for scrapping of stamp duty grow louder

There are calls for the abolition of stamp duty to be a central part of the future debate over federal state financial relations, though the Property Council of Australia warns that a swap to land tax is unlikely to be the answer.

“By scrapping stamp duty and replacing it with efficient taxes we could boost Australia’s GDP by $3.3 billion and increase real consumption by $9.7 billion,” Property Council chief executive Ken Morrison says.

The Urban Taskforce agrees, with CEO Chris Johnson advocating for its replacement with a broad land tax.

““State governments have become comfortable with the large income they get from stamp duty on the purchase of homes but they must look at better, more efficient ways to raise funds,” he says.

“Sydney’s housing is among the most expensive in the world and this is partly driven by the various taxes and levies required by governments.

“A broad based land tax would spread the income base across all land owners rather than only focusing on the sale of homes.”

Morrison describes stamp duty as a tax that “costs jobs, hurts the economy, makes our cities less efficient and is an unpredictable tax base for state governments”.

“Deloitte Access Economics has calculated there’s a real benefit to households with replacing this inefficient tax with an efficient one,” Morrison says.

“The benefit equates to an extra $20 per week per household on average – which is more than half of what households spend on fuel and power.

“We all know that state government reliance on stamp duties increase with each year.

“A typical home in Sydney now incurs a $35,100 stamp duty. In Melbourne it’s $32,300, in Canberra it’s $20,200… and in Adelaide it’s $17,300.

“One of the consequences of stamp duty is that it makes moving costs inordinately high. Families and couples hold on to homes long after they’ve outgrown them, or long after the children have left.

“Scrapping stamp duty will result in an acceleration of housing turnover – with the current average of 13 years falling to eight years.”

Recent media discussion has advocated for the end of stamp duty, to be replaced with an ongoing annual land tax, a move that’s gained support from business groups, social service advocates and the development industry.

Many economists, including the Prime Minister and Ken Henry, author of the 2010 Henry Tax Review, have stated that a broad based land tax is the most equitable and fairest way to tax property owners and developers.

Unlike stamp duty, which imposes a huge up-front financial burden on home buyers, a broad-based land tax, paid annually and spread over a wider base of people, provides a steady income stream to government to fund infrastructure and shouldn’t hurt homebuyers the way stamp duty does.

Broad based land taxes are simple to administer and encourage urban consolidation as the tax paid is based on the size of the land, according to Johnson.

“This tax encourages a more environmentally sustainable urban form,” he adds.

While the Property Council holds different views on the alternatives, its views on the need for change echo those of the Urban Taskforce.

“In putting the case for reform, we also have to look at what is politically feasible,” Morrison says.

“We appreciate the motivation of those who argue that the states should simply replace an inefficient stamp duty with a new land tax.

“The reality is that businesses already pay very high levels of land tax and there’s a political limit to what homeowners are likely to accept.

“Adding a new $16 billion annual land tax on the family home is not likely to pass the pub test.

“There are very strong reasons for abolishing stamp duty, but we have to be realists in this debate – replacing stamp duty with a new broad-based land tax on every family home is unlikely to be politically palatable.

“As well, the commercial sector already pays significant land taxes and we question if businesses across the economy can absorb a higher land tax. A shift to higher land taxes will simply increase this burden – and significantly reduce the economic benefits of moving away from stamp duty.

“Every economic analysis shows that Australia would be better off without stamp duty, but to achieve this we will need a more holistic reform effort.”

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/oA8cTtAuTOc/

Cash rate kept on hold once more

The Reserve Bank of Australia (RBA) has decided to keep the cash rate unchanged at 2 per cent. At today’s meeting, RBA governor Glenn Stevens said the board judged there to be reasonable prospects for continued growth in the economy, with inflation close to target.

“Recent information suggests that the global economy is continuing to grow, though at a slightly lower pace than earlier expected,” Stevens says.

The last time the RBA cut the cash rate was in May 2015.

Bessie Hassan, consumer advocate at finder.com.au, says the RBA will be watching the Aussie dollar closely.

“Central banks often favour a depreciating currency to stimulate inflation and boost activity,” she says.

“With interest rates at record lows, fewer borrowers are opting for interest-only home loans as mortgage repayments become more affordable.”

Figures from the Australian Bureau of Statistics and the Australian Prudential Regulatory Authority (APRA) reveal the percentage market share of interest-only loans fell from 45.8 per cent in the June 2015 quarter to 37 per cent by December 2015.

“The value of new interest-only loans approved in Australia also dropped from $44 billion in the June quarter to $36 billion by December 2015 – the first time such a drop has been observed since the GFC,” Hassan says.

If the Australian dollar moves even higher, she adds, experts predict the Reserve Bank will feel obliged to step in.

Tim Lawless, CoreLogic RP Data head of research, also suspects there may be interest rate cuts later in the year.

“With some of the heat coming out of the housing market and inflation remaining low, the Reserve Bank has room to cut the cash rate later this year if they see a requirement to do so,” he says.

“If we do see a lower cash rate later this year, chances are we won’t see the full rate cut passed on to mortgage rates due to the higher funding costs facing Australian lenders.”

“Arguably, a cash rate cut wouldn’t have the same stimulatory effect on the housing market as what we saw from previous rate cuts in February and May last year.”

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/2fd1BttWLoE/

Building design a boon for staff

In a new design concept that could change the style of both office and residential buildings for ever, employees sliding their way to post-work freedom is the ambitious plan for Flight Centre Travel Group’s new global headquarters, which today submitted revised plans to the local council to append a 15-storey slide to the exterior of its property in Brisbane.

The slide is one of several proposed additions to a building that already boasts meeting rooms in the shell of planes, trains and cruise ships in the confirmed design.

Flight Centre’s Tom Walley says the new building in Brisbane’s South Bank is due for completion in September and is a physical representation of the company’s ethos.

“We work for an amazing company selling the best product in the world, so why not have a head office that reflects that?”

Efficiency of movement into, out of and within Flight Centre’s new HQ is a key design element, with innovative solutions integrated into the existing and amended building plans

“Our people have been telling us for a while that stairs and lifts are too conventional for their tastes, so we’ve decided to install large-scale trampolines on each level for people to propel themselves up, floor by floor.

“It will take a bit of re-jigging of the floorplan to make it work, but we see it as a necessary addition for workplace happiness, although health and safety regulations state we can’t allow people to use the trampolines when descending between floors,” Walley says.

Similar solutions for efficient movement include personal hover boards for each employee and a new, fast-tracked means of entering the building via a high-velocity, all-glass, outward facing lift directly from the train platform beneath.

“The building straddles South Bank train station and as we have a lot of employees who commute in each day, we wanted a way to ease their transition into work.

“The revised plan means they can step off the train and into the lift to be at their desk in record time.”

Walley confirms officials have indicated early approval of the new design, which will cast a unique shadow on the city skyline.

“The new building is set to be an icon and the added features only enhance the statement it makes, so we’re happy the powers that be are on board with the new design concepts,” he says.

Other additions include airport check-in facilities for first class customers and a helipad on the roof with a Flight Centre helicopter to ferry these customers to the airport, while Level 15 is set to become Brisbane’s hottest rooftop bar.

“We’ll definitely have the cream of the crop of Brisbane’s after-work watering holes with our Level 15 club zone complete with dance floor, booth seating and huge balcony sunlounge with sweeping city views.

“Our people are really into BMX at the moment, so we’re going to reserve the back half of Level 15 for a BMX ramp to host an annual Flight Centre freestyle competition, as well as regular team brainstorm sessions atop our brand new fleet of wheels from 99 Bikes.”

The building is part of the Southpoint development located at the corner of Grey and Vulture Streets in South Bank, Brisbane.

• If you hadn’t already guessed, this rather far-fetched story is actually an April Fool! Happy April 1!!

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/CzZEaXzW3oA/

By Hera Antoniades, University of Technology Sydney

Consumers lose out when a real estate agent acts fraudulently. This includes actions such as false and misleading advertising, deceptive conduct and misappropriation of trust funds.

So what is behind the increase in white-collar crime and fraudulent behaviour? And are there are any preventative measures that could be implemented to reduce the impact on consumers?

The scale of the problem

There are various property agency laws and codes of ethics that set out appropriate standards of behaviour for property agents.

In New South Wales, occupational licensing for property agents and certificates of registration are mandatory if working in the property industry. Occupational licensing for this category is managed under the auspices of individual state and territory Fair Trading offices.

My research concluded that education plays a pivotal role, coupled with industry experience, in combating white-collar crime in the property industry.

From 2003, the NSW regulator diminished the existing higher educational requirements and abolished the need for industry experience. This has been followed by significant increases in consumer and trader complaints in real-estate transactions.

These complaints include non-disclosure of a vested interest, misrepresentation, unethical conduct and fraud.

The table above indicates an increase in complaints from 1756 to 3754 in a decade.

In 2012-13 Fair Trading reported only 1,444 complaints, which represented a decrease of 17.77%. However, there does appear to be an anomaly with the following year, which reported an increase of 113.78%. Therefore, it is possible that the complaints for 2012-13 could have been partly accounted for in the following financial year – hence the disparity.

If this is the situation, then an average calculation would indicate that complaints increased in 2012-13 and 2013-14 by an average of 48% for each year. This appears more in line with trends during the earlier years.

My 2013 study identified ten randomly selected court cases from 2010 to 2013 that related to trust accounting fraud. Of these, five cases disclosed the amounts misappropriated – which totalled A$2,107,261.

I undertook further research on five court cases that occurred during the 2013-14 financial year. The misappropriation of trust funds ranged from $813,936.00 to $1,434,111.43. The penalties ranged from jail sentences, extending from a bond for good behaviour to 18 months’ imprisonment, to disqualification from holding a licence or certificate and working in the property industry.

The way forward

Consumer complaints and trust accounting fraud continue to increase. Over the last decade, the property industry has continuously lobbied the regulator for an improvement in the educational requirements for the certificate of registration and licence categories.

My research developed a model of occupational corruption. Based on this, it recommends the following preventative measures be implemented:

- A major overview of the educational course curriculum and associated mandated qualifications. All certificate of registration holders should complete a Certificate IV qualification. All licensed holders should complete a diploma qualification, both within the property services training package and the relevant category of employment.

- An increase in the mandated units and training hours required before starting work in the property industry. The previous industry experience of a minimum of two years should be reintroduced.

- A points system where agents must submit their business and personal financial details to Fair Trading in order to obtain or renew their property licence. This will identify the agents whose businesses are not trading profitably and who might be considered high risk in trust accounting ethics and processes. The issuing of the licence should be linked back to obtaining a nominated minimum point score that reflects the financial viability of the licence holder or business.

- An interview system, where agents applying for their licence are required to undertake an oral examination. In Australia, the Australian Property Institute and the Royal Institution of Chartered Surveyors have for decades successfully applied this method of assessment to the valuation profession.

![]()

Hera Antoniades, Senior lecturer, School of Built Environment, University of Technology Sydney

This article was originally published on The Conversation. Read the original article.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/nEj3f84WMOA/

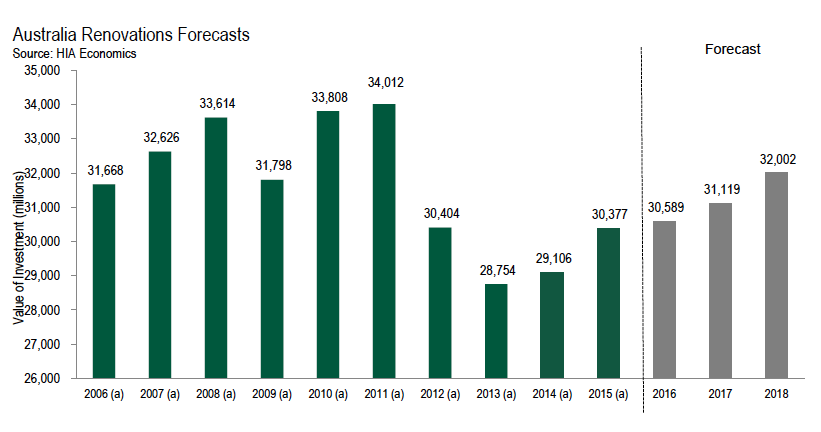

Renovations activity grew again in 2015

The Housing Industry Association (HIA) has released the latest edition of its Renovations Roundup report, which offers a comprehensive quarterly analysis of the home renovations market in each of the eight states and territories, as well as outlining forecasts for future renovations activity.

Renovations Roundup also provides results of the HIA Renovations Survey undertaken in February, in which more than 900 businesses and individuals participated.

“The HIA Renovations Survey provides a comprehensive update on conditions within the sector,” HIA senior economist Shane Garrett explains.

“Repairs and maintenance are the most popular type of job, followed by kitchen and bathroom renovations.”

“A significant 24 per cent of renovation jobs fall within the value range of $12,000 to $40,000.

“The survey also found that 13 per cent of renovation jobs fell in the range of $200,000 to $400,000. This reflects demand for comprehensive renovation work that covers a large part of the footprint of an existing house and is an area of the renovations market that should gather momentum in coming years.”

According to Garrett, total renovations activity grew for a second consecutive year in 2015, rising by 4.4 per cent.

“However, the recovery remains quite fragile and there is considerable geographic variation to activity,” he explains.

“Several markets are benefitting from the improving labour market along with stronger dwelling price growth.

“In other places, weak earnings growth, relatively low turnover of established houses and tighter credit conditions are holding activity back.”

The Renovations Roundup projects that renovations activity will increase by 0.7 per cent this year with growth of 1.7 per cent forecast for 2017.

HIA says that it projects that activity will grow by 2.8 per cent in 2018 followed by a 3.2 per cent increase in 2019, bringing the total volume of renovations activity to $33.02 billion.

![]()

View all articles by Angela Young »

<!–

–>

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/D7HxtUffuvU/

Approvals for medium-density housing have overtaken standalone homes for the first time according to new research by Bankwest. In its Housing Density Report it shows that in the year to October 2015 there were 117, 552 building approvals for medium-density housing compared with 115,634 for freestanding homes.

Greg Caust, Bankwest general manager, says the results reflect a long-term shift towards medium-density, which shows no signs of abating.

“That 12-month period to October was a record breaker… I have no doubt medium-density approvals will shortly exceed approvals for standalone homes – not just occasionally, but on an ongoing basis,” he says.

“Half the approvals in the 12 months to November 2015 were for medium-density housing – up from 43.1 per cent the previous year and well ahead of the average 34.4 per cent over the past 20 years.”

So, are these trends a reflection of the times? Property lecturer Peter Koulizos says there’s a reason why medium-density housing is becoming more and popular in Australia.

“People aren’t looking for big backyards anymore as they don’t need all that outdoor space; they just need enough yard for a barbecue and entertaining friends,” he says.

“Medium-density housing is generally on smaller blocks of land, which makes it more affordable than low-density housing.”

Caust believes the increase in medium-density is largely driven by strong approval rates in Australia’s capital cities.

“Higher density housing trends may be developing due to affordability issues, however they also mean society is moving toward more sustainable living.”

National medium density trends

NSW – tops nation in medium-density housing approvals.

QLD – the nation’s fastest growth in medium-density housing.

SA – medium-density housing hits record high.

Victoria – higher density housing approvals increase at four times the rate of standalone.

WA – resilience in higher density housing.

The report highlights a clear long-term trend towards medium-density homes in Australia.

- The number of new approvals for medium-density housing is near a 20-year high, with 115,731 approvals in the 12 months to November 2015, up 33.9 per cent from 86,430 in the 12 months to November 2014. On the other hand, growth in approvals for standalone homes over the same period was a sluggish 1.5 per cent.

- Half of dwelling approvals in the 12 months to November 2015 were for medium-density housing, up from 43.1 per cent in the 12 months to November 2014 and well ahead of the 20-year average of 34.4 per cent.

- While New South Wales has the highest number of medium-density dwelling approvals, Queensland leads the nation in the growth of medium-density approvals, with the number of approvals in the 12 months to November 2015 growing by a whopping 53.1 per cent.

- Medium-density housing remains much more prevalent in the capital cities than in regional areas. In the 12 months to November 2015, more than half (57.4 per cent) of approvals in capital cities were for medium-density dwellings, compared to only 23.1 per cent in regional areas.

- More than two thirds of local areas nationally (225 out of 330 or 68.2 per cent) have seen an increase in medium-density housing as a proportion of total housing stock.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/uJStuxMRqZ4/