By Saul Eslake, University of Tasmania

Australia’s federal government clearly sees its program of annual reductions in the company tax rate as the core element in its plan for “jobs and growth”.

There is now a large – though by no means uncontested – body of evidence to support the contention that reductions in company tax rates can support faster rates of GDP growth and higher wages. It does this by stimulating higher levels of investment and hence higher levels of labour productivity.

But there is very little evidence supporting the favouring of small businesses over large in this regard. The significant preference which both this budget and its predecessor have extended to small businesses appears to owe much more to a desire to bow before small business than to any unambiguous economic rationale.

Small businesses have accounted for only 18 per cent of the increase in employment over the most recent five years for which data are available, while firms with more than 200 employees – which the ABS defines as “large” – have accounted for 52 per cent of the increase in total employment over the past five years, despite accounting for less than 32 per cent of total employment. And large businesses are more likely to engage in “innovative activities” than small ones, especially ones with four or fewer employees.

In other words, if the government wanted to cut company taxes in a way that was most likely to result in increased job creation or higher levels of innovation (assuming that cutting company taxes would have that effect), it should have cut company taxes for large companies ahead of small ones. But that would have been exceedingly difficult, politically, in the current climate.

Mixed messages

The other key element of the government’s ten year enterprise tax plan is the increase in the tax threshold for the second-top marginal rate from $80,000 to $87,000. The government says this will prevent “average full time wage earners … from moving into the second highest tax bracket”. But when you consider the difference between gross and taxable incomes, and that most people use deductions to reduce their taxable income, $87,000 is far from average.

The budget seems to be saying to people with taxable incomes of less than $80,000 – if you want to pay less tax, get yourself a negatively-geared property investment.

The budget is also arguably saying the same thing to people with taxable incomes of more than $250,000, people who have already contributed $500,000 to superannuation over the course of their lifetimes, or people who already have at least $1.6mn in their superannuation accounts. The message is if you put any more into superannuation, we are going to tax you more, but if you put it into a negatively-geared property investment, we won’t touch you, because (in the words of the Treasurer’s Budget Speech), “that would increase the tax burden on Australians just trying to invest and provide a future for their families”.

I am quite comfortable with the budget’s proposed changes to superannuation arrangements. But I can’t see why people – even wealthy people – who are “just trying to invest” through superannuation should be singled out for less generous tax treatment, while people who are doing exactly the same thing through negatively geared property (or other) investments should remain unscathed.

The Treasurer reportedly toyed with the idea of limiting “excesses and abuses” of negative gearing, with caps on claims. This would have more or less exactly paralleled what the budget seeks to do with regard to superannuation.

The decision not to go down that path was reportedly “a political – and not an economic – move”.

But it has, and will have, economic consequences.

Combined with the Reserve Bank’s latest cut in official interest rates, the budget’s decisions and non-decisions with regard to income tax cuts, superannuation and negative gearing are likely to encourage more Australians to borrow more money in order to invest in the property market. At a time when Australia has one of the developed world’s highest ratios of household debt to GDP or personal income, and amongst the developed world’s most expensive residential real estate.

This is a condensed version of a longer essay on the 2016 federal budget.

![]()

Saul Eslake, Vice-Chancellor’s Fellow, University of Tasmania

This article was originally published on The Conversation. Read the original article.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/CmtapFK4yUY/

Beware the march of the termites

Homeowners, it seems, have been inviting termites in to eat up their properties, providing expensive meals that cost thousands of dollars without even realising it according to Archicentre, the building design and advisory service of the Australian Institute of Architects.

Archicentre director Guy Williams says termites can work away silently, with the damage sometimes only being revealed when the head of the vacuum cleaner hitting the skirting board causes it to crumble to dust.

Archicentre termite inspectors and architects have also reported incidents of houses with dangerous structural damage caused by termites.

Williams says typically warm, wet weather around Australia will see swarms of young termite “alates” – taking flight to search for new locations in which to establish colonies in trees, stumps, fallen logs, and fences, with many attracted to houses.

Some homeowners are making their homes attractive to termites by:

- Stagnant sub-floor spaces – remedy this by improving sub-floor ventilation so air can move freely through the space.

- Storing timber off-cuts beneath the house – clean them out!

- Firewood stacked up against the side of the building – simply relocate it.

- Dampness under or around a home – install an effective surface drainage system.

- A “bridged” damp-proof course, usually caused by landscaping or paving being placed too high – lower it.

“Regular inspections are also a must, at least once every year,” Williams says.

“Whilst it can be difficult to prevent a termite attack, the damage bill can be minimised if their presence is detected early.

“With the average treatment and repair cost estimated to be in the order of $10,000, it’s vital to limit the damage that termites can cause.”

Williams adds that if you find termites (or insects you think might be termites), leave them alone and get expert advice as soon as possible.

Disturbing termites will result in them beating a hasty retreat to establish a new colony elsewhere on the property, thereby increasing the likely treatment and repair cost.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/4pIjhmJOzWE/

Interest rate cut to 1.75%

The decision by the RBA to cut rates to a record low of 1.75 per cent marks the first change since May last year.

The historic new low decided today was likely a hotly debated discussion according to Tim Lawless, head of research at CoreLogic RP Data.

“On one hand we have economic growth tracking at three per cent per annum, a housing market where the pace of capital gains is moderating in a controlled fashion and relatively strong labour market conditions.

“The big question relevant to the housing market is how much of the lower cash rate will be passed on to mortgage rates?

“The spread between the cash rate and standard discounted mortgage rate has been widening since 2008 when there was 1.8 percentage points difference between the two rates.

“By April 2016 the spread has doubled to be 3.65 percentage points and is likely to widen further if the full rate cut isn’t passed on by lenders to mortgage rates.”

Dr Andrew Wilson, Domain chief economist, says change to the rate indicates the RBA is acting to stimulate an under-performing economy.

“Although the recent tightening of bank lending conditions has contributed to weakening property price growth, low interest rates are continuing to support housing market activity, and remain a real positive for the property market,” he says.

“All eyes will be on the federal budget announcement this week, with housing markets sensitive to outcomes with regards to spending initiatives or possible public service job and service cuts, and changes to taxation policy.

“Lower official interest rates, if passed on by banks, is positive news for mortgage holders and prospective home buyers. ”

Mortgage Choice chief executive officer John Flavell says a spate of “less than impressive” economic data ultimately provided the RBA with the incentive it needed to cut the cash rate.

“Data from the Australian Bureau of Statistics found CPI fell 0.2 per cent over the March quarter, pushing core inflation down to 1.6 per cent – well below the Reserve Bank’s target range of 2-3 per cent,” he said.

“This was the first time since 2008 that we’ve actually seen a quarterly deflation result.

“Furthermore, the 0.2 per cent drop in CPI was a far cry from the 0.2 per cent rise that economists were expecting.”

Flavell says the sudden and surprising drop in CPI combined with the fall in consumer sentiment ultimately forced the Reserve Bank’s hand.

“According to the latest Westpac-Melbourne Institute of Consumer Sentiment, confidence fell 4 per cent to the point where pessimists now significantly outnumber optimists,” he says.

“Knowing this, it seemed the Reserve Bank had no choice but to cut the cash rate.”

What does this mean for you?

Borrowers are being warned to keep a close eye on rate cuts that are set to filter into the market as a result of the Reserve Bank’s surprise decision this afternoon.

Bessie Hassan, money expert at finder.com.au, says the new cash rate can pave the way for further savings, if you’re willing to do your homework.

“New figures show that inflation has dramatically slowed, growing by just 1.3 per cent annually, its lowest rate since the Reserve Bank began its inflation targeting activities,” she says.

“Even a small reduction on your home loan rate can save you thousands of dollars. Based on the average national home loan size of $357,200, a 0.20 per cent reduction from the average standard variable rate of 5.12 per cent to 4.92 per cent could save you approximately $500 per year or over $15,000 over the life of your loan.”

Currently on Canstar’s database the average standard variable mortgage rate is 4.77 per cent, says Canstar editor-in-chief Justine Davies. Considering the RBA’s reduction, and if the banks are to follow suit and cut home loan rates accordingly, the average standard variable home loan rate would drop to 4.52 per cent.

On a 25-year home loan, that would potentially make the following difference to monthly repayments:

Source: Canstar. Approximate calculation based on 25-year loan term.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/8NiIwDSjris/

Sydney drops below million-dollar median

House prices fell in every capital city except Melbourne and Hobart this quarter, while unit prices also fell across the board following a record number of apartments being built in most capitals – according to the March Quarter Domain House Price Report.

Domain chief economist Andrew Wilson attributes weakening economic activity and growing uncertainty to affecting fragile consumer and investment sentiment, leading to falling house and unit prices in most capital cities.

“The outlook for house prices remains subdued, with capital city growth likely to continue to track at best just above the inflation rate for the remainder of 2016,” he says.

“The prospect of weaker house price growth, however, will be welcomed by prospective first homebuyers still struggling to get into the market.

“The national median has now fallen over two consecutive quarters for the first time since June 2011 as the general housing market correction consolidates.”

Onthehouse.com.au’s Eliza Owen believes the outlook for 2016 will see most of our major markets move into downswing, “whether that’s in the form of lower rates of positive growth, or negative growth”.

“Historically, housing market cycles have followed Sydney but at a slight lag,” she says. “Sydney has been in a cyclical upswing since late 2012, and peaked in late 2015, so it’s no surprise that after such exorbitant house price increases, Sydney should be moving into downswing.

“Markets that are still going up at the moment are probably doing so because they lag behind the Sydney market.

“Smaller markets, such as Canberra, Hobart and Darwin, may be more responsive to economic shocks this year simply because of their size and lack of economic diversity.

“Things such as LNG prices, government public service provisions and tourism are such factors that could influence these markets.”

The key findings in the March Quarter Domain House Price Report are:

- Sydney’s median house price drops below $1 million as unit medians also fall.

- Melbourne house prices still rising with the strongest result over the year

- House and unit prices are down in Sydney, Brisbane, Perth, Canberra and Darwin.

- Adelaide was the only capital not to record a decline in unit prices across the quarter.

- Hobart house prices continue to surge but remain the most affordable Australian capital city.

Capital city overview

Sydney’s median house price fell again over the March quarter, recording a 1.5 per cent drop down to $995,804. Sydney’s unit prices also fell for the second consecutive quarter, down by 0.7 per cent to $656,166.

Despite both experiencing declines over the March quarter, Sydney house prices increased by 6.9 per cent over the year while unit prices rose by 5.8 per cent.

Wilson warns that “any price growth [is] unlikely before spring”.

Melbourne was the only mainland capital to buck the trend of falling house prices, recording an increase of 1.2 per cent over the March quarter, reaching a median of $726,962. Melbourne house prices increased by 11.8 per cent over the year ending March, the strongest result of all the capitals.

Melbourne unit prices fell by 1.7 per cent over the March quarter to $444,370 for an annual increase of 3.8 per cent.

“Melbourne has now overtaken Sydney as the fastest growing capital city housing market in Australia… [and] has recorded 14 consecutive quarters of house price growth, the longest sequence since June 2008,” Wilson says.

Brisbane house prices fell marginally over the March quarter for the first decrease since the September quarter 2014, with a median price of $512,809. Brisbane unit prices were also down over the quarter, falling by 0.8 per cent to $367,058. Across the year, Brisbane house prices increased by 4.1 per cent with unit prices falling by 3.2 per cent.

Adelaide’s housing market reversed its consistent growth performance of last year with the median house price falling by 0.5 per cent to $491,422. Unit prices were steady over the March quarter with a median of $303,537, making Adelaide the only capital not to experience a decline this quarter. Unit prices increased by 2.2 per cent over the year with house prices up by 3.4 per cent.

Perth – the revival of Perth’s house prices was short lived, with the median falling by 1.3 per cent over the March quarter to $579,914. The weaker result followed an increase over the previous December quarter, which was the first rise in a year. Perth house prices fell by 4.7 per cent over the year ending the March quarter, which was the strongest decline of all the capitals. Unit prices decreased by 3.7 per cent to $379,975 and have fallen by 5.1 per cent over the past year – the sharpest annual decline since December 2011.

Hobart house prices continue to rise strongly, with the median increasing by 4.3 per cent over the March quarter to $360,212. The March result follows the 3.5 per cent increase recorded over the previous December quarter, with annual prices now up by 7.6 per cent – the second best performance of all the capitals. Hobart unit prices fell sharply by 6.2 per cent over the March quarter to $251,633 for a fall of 3.3 per cent over the year.

“Despite further likely rises, Hobart remains the most affordable Australian capital city,” Wilson says.

Canberra house prices fell over the March quarter following five consecutive quarters of growth. The median house price decreased by 1.4 per cent to $638,696 but has increased by 4.8 per cent over the past year. Canberra unit prices reversed the rise of the previous quarter, falling by 2.8 per cent to $400,637 for an annual decrease of 4.7 per cent.

“An oversupply of new apartments is affecting unit prices in Canberra. A rebound in Canberra house prices will be dependent on the performance of the local economy with all eyes as usual on the upcoming federal budget,” Wilson says.

Darwin house prices fell sharply over the March quarter, down by 4.9 per cent to $610,305 and the third consecutive quarter of falling house prices. Unit prices were also down over the quarter, decreasing by 4.1 per cent to $448,416. House prices have declined by 3.3 per cent over the past year with unit prices down by 8.3 per cent – the weakest performance of all the capitals.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/7U-_0YHfZHE/

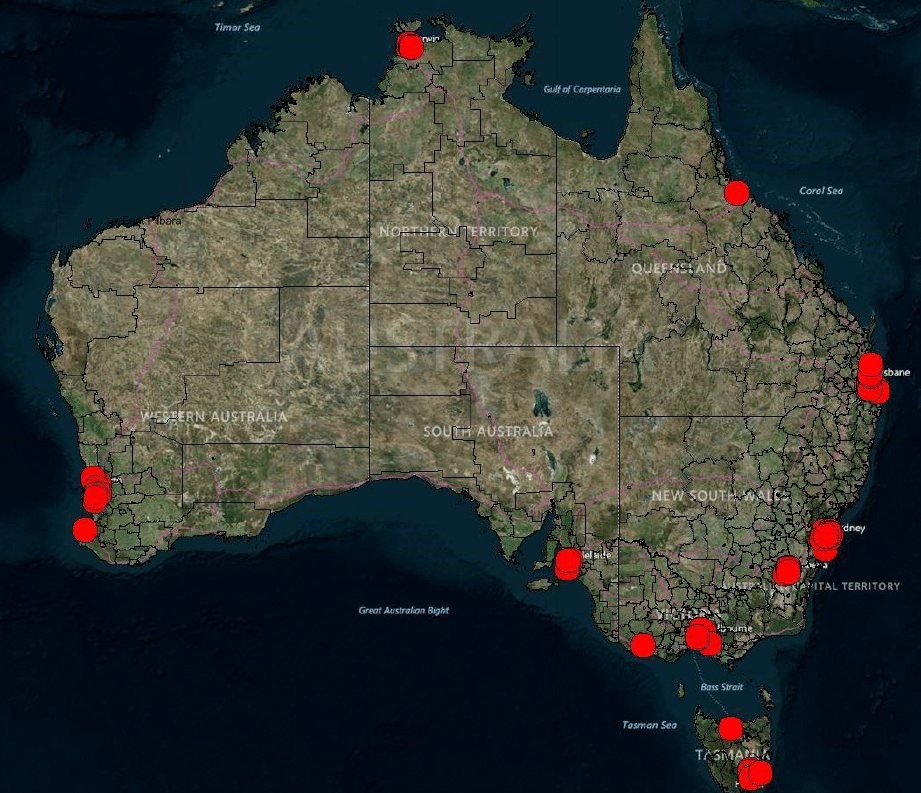

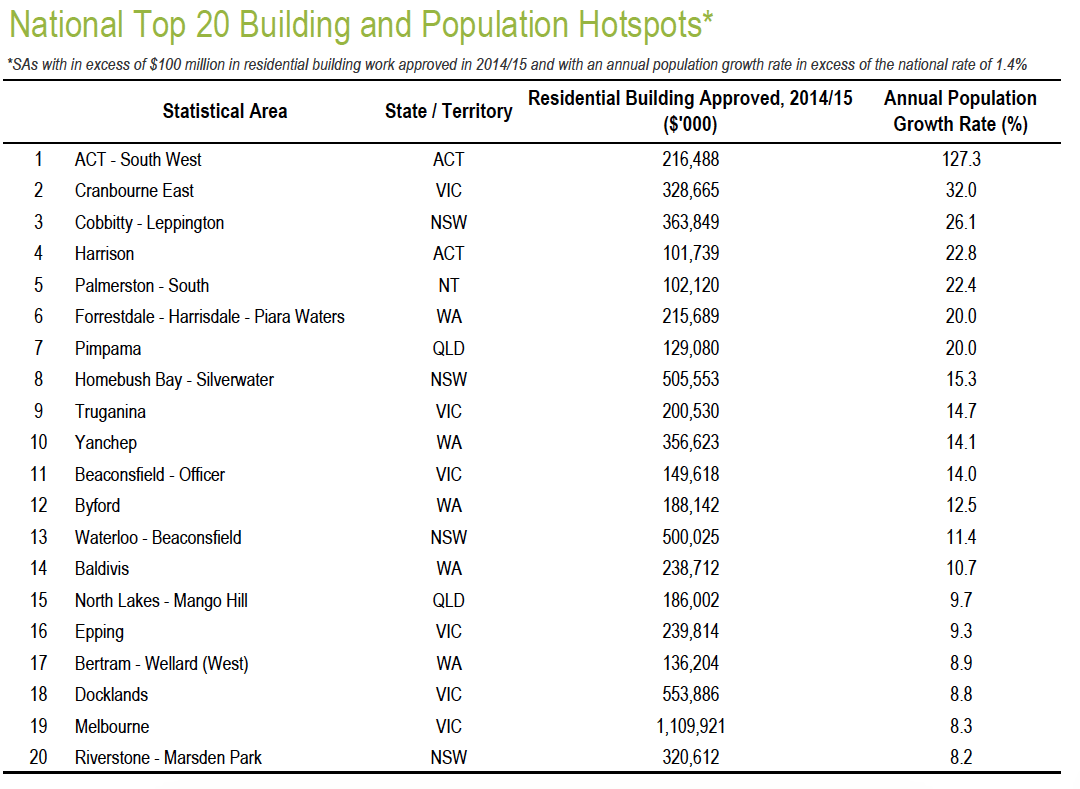

Australia’s strongest performing markets for new home building and population growth have been revealed in the latest Housing Industry Association (HIA) Population and Residential Building Hotspots report.

“More than 220,000 new dwellings were commenced last year, so it’s no surprise there was a strong performance among housing hotspots across Australia,” HIA economist Diwa Hopkins says.

“Today’s report identifies a total of 602 hotspots spread right across Australia’s eight states and territories.

“Nearly all jurisdictions were represented amongst the National Top 20 Hotspots,” she adds.All jurisdictions apart from Tasmania and South Australia appear at least once in the national Housing Hotspots Top 20 league table:

6 top 20 hotspots are in Victoria

Western Australia contains 5 hotspots

4 are in New South Wales

Queensland and the ACT each contain 2 hotspots

1 is in the Northern Territory.

Nationally, a “hotspot” is defined as a local area where population growth exceeds the national average and where the value of residential building work approved is in excess of $100 million.

The final ranking of the hotspots is determined by their respective population growth rates.

Based on its performance during 2014/15, ACT’s South West area was the country’s number one hotspot again, with $216.5 million worth of new residential building approved and its population more than doubling.

In second place was Cranbourne East in Melbourne’s southeast, where the population increased by 32 per cent and some $328.7 million worth of new residential building was approved.

Rounding off the national top 3 was Cobbitty-Leppington in the southwest of Sydney.

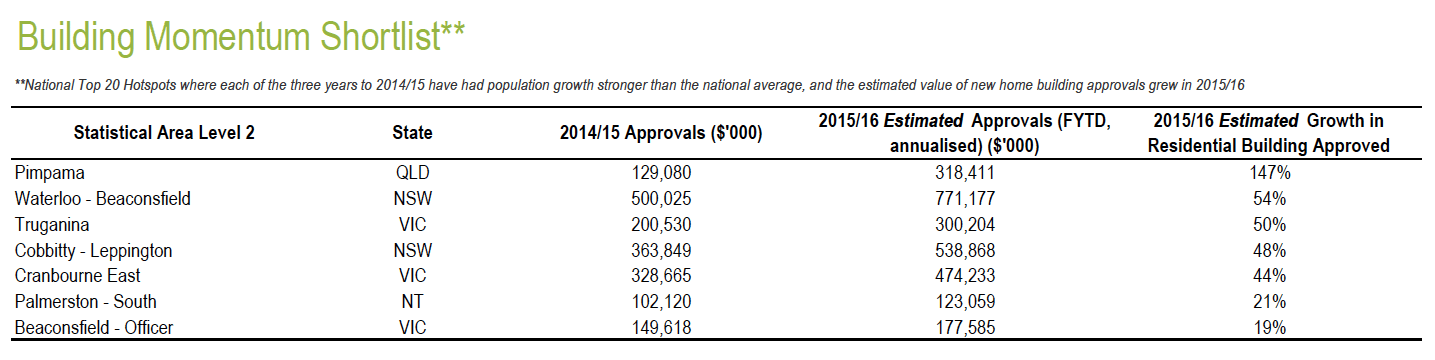

This year’s Hotspots report again identifies a set of areas where momentum remains very strong according to latest data.

These areas are likely to perform well in next year’s rankings if the pattern of this year is anything to go by.

“In the final analysis, the fact that 10 of the top 20 hotspots are located in NSW and Victoria speaks volumes,” Hopkins says.

“These two states have been the engines of the strong upturn in new home building over the last few years.

“It’s also encouraging to see WA still perform strongly this time at the national level, considering the difficulties arising from the natural resources downturn.”

![]()

View all articles by Angela Young »

<!–

–>

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/NBtequFUmAU/

Negative gearing to remain unchanged

The government’s decision to leave negative gearing untouched is a win for both property owners and renters according to Momentum Wealth managing director Damian Collins.

“Negative gearing allows average Australians to grow their nest eggs through property investment, and also works as a rent subsidiary for low-income earners and those not yet ready to purchase a house,” he says.

“Tinkering with negative gearing puts the financial future of millions of Australians, and the broader economy, at risk, which is why it’s crucial to leave the existing structure as is.”

Housing Industry Association (HIA) chief executive industry policy and media Graham Wolfe says negative gearing is not the domain of so-called “wealthy investors”.

“Australian Tax Office data confirms that nearly eight of every 10 taxpayers with a rental property declare a taxable income of less than $100,000, while 70 per cent earn less than $80,000,” he says.

“With an ageing workforce and mounting pressure on publicly funded services, retaining negative gearing will support the delivery of a larger stock of rental accommodation, increasing access to shelter, while promoting wealth creation and self-sufficiency in retirement for hundreds of thousands of ‘mum and dad’ investors.”

Research conducted by Independent Economics on behalf of the HIA confirmed that restricting access to negative gearing for residential property would reduce investment in housing and put upward pressure on rents.

Research confirms that negative gearing also provides a positive force for the Australian economy and Australian living standards.

Housing affordability?

Collins says neither political party directly addressed housing affordability, reiterating his calls for all levels of government to take action on the issue.

“If governments were serious about improving housing affordability, they could immediately start by taking three simple steps,” Collins says.

“Firstly, governments could remove taxes on land developers and buyers, secondly they could allow more medium- and high-density housing options in established suburbs and finally they could address the high cost of land development for new housing estates.

“By taking these steps, housing affordability will dramatically improve allowing countless more Australians to obtain home ownership.”

The Urban Taskforce agrees that the decision to leave negative gearing alone is positive news for the housing market, saying: “The new housing market is currently slowing down through restrictions on lending by banks and it’s essential that investor confidence in new housing, particularly in apartments, is maintained.

“Australia, as one of the most urbanised countries in the world, is moving more towards a stronger rental market as other major cities in the world currently have.

“A stronger rental market comes with urban density with apartments close to public transport nodes and this rental market clearly needs investors to deliver new apartments.

“Australia’s economic support of investment in rental housing through negative gearing and attractive capital gains is essential to maintain the necessary stock of rental housing.”

CEO of LJ Hooker Grant Harrod reveals that a poll of 1,700 investors with properties managed by LJ Hooker showed 37 per cent of investors earned a combined household income under $100,000, while 67 per cent had a household income of $150,000 or less.

The poll also found 31 per cent of investors would sell some or all their portfolio if negative gearing was abolished or restricted, revealing that property investment is central to an individual’s, couple’s or family’s wealth accumulation.

“The residential real estate market – including construction, sales and rentals and related services – is one of the Australian economy’s largest sectors both in value and employment,” Harrod says.

“Changing negative gearing legislation will lead to a structural change of the real estate market.”

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/gb1UNvBcR5E/

Luxury residential property in Sydney is approximately twice as affordable as Monaco, Hong Kong and London, according to property consultancy Knight Frank’s latest report, the Australian Prime Residential Property Market Insight – April 2016.

Using the results of Knight Frank’s Prime International Residential Index (PIRI), a study is undertaken each year that determines the amount of luxury property, in square metres, $US1 million will buy around the world.

The report found that Monaco is tightest, covering only 17 square metres, followed by Hong Kong at 20 square metres and London with 22 square metres. In Sydney, close to double this size can be purchased, at 40 square metres (down from 41 square metres in 2014). Melbourne is larger again, covering an area close to 116 square metres.

According to Knight Frank’s director of residential research Australia Michelle Ciesielski, the value of prime (luxury) global residential property markets globally rose on average by 1.8 per cent in 2015.

“This was similar to the 2 per cent growth recorded a year earlier,” she says. “However, in 2015 over 66 per cent of the PIRI 100 locations recorded flat or positive price growth, compared with 62 per cent in 2014.”

Ranking the top 25 cities in the PIRI 100, Vancouver leads the rankings by some margin, with prices accelerating 24.5 per cent in 2015.

“Sydney follows in second place, with growth of 14.8 per cent,” Ciesielski says. “Many comparisons can be drawn between the two cities – a lack of prime supply, coupled with foreign demand, spurred on by a weaker Canadian (and Australian) dollar are all factors explaining both cities’ stellar performances.”

Ciesielski says prime residential property prices in Sydney rose 14.8 per cent in 2015, while Melbourne prime property prices grew 11.9 per cent.

“Knight Frank correctly predicted the Sydney and Melbourne prime residential property markets would outperform other global cities in 2015.

“Price growth in the Sydney and Melbourne prime residential markets, although lagged, have generally followed an upward trajectory in the Australian share market, when indexed to December 2008.

“Post the Lehman’s collapse to December 2015, coming off a lower base, the Melbourne prime market recorded cumulative growth of 31 per cent while prime Sydney prices grew by 30 per cent.”

Ciesielski says that when isolating performance since June 2012, Sydney prime prices grew 33 per cent, compared to 27 per cent in Melbourne.

“Since this time, the upswing in the share market, along with other stimulus such as favourable business conditions – and more recently a stable political environment – has renewed the confidence in the prime end of the market.

“Despite this vast capital growth in both prime markets over the seven-year period to December 2015, the broader mainstream market in Sydney and Melbourne significantly outperformed at 80 per cent and 52 per cent respectively.”

Back on the subject of prime property, Ciesielski says: “Across the past decade there has been limited new supply of prime residential properties built by global standard; especially within close proximity of the Sydney CBD and with uninterrupted harbour views.

“However, over the next 10 years, there are potentially three prime residential towers in the revamped Circular Quay precinct; within close proximity of the renovated Circular Quay wharves and the new Sydney Light Rail Terminal. There are another four towers in Barangaroo proposed, including part of the new Crown Casino.

“In the pipeline for Melbourne city, One Queensbridge will accommodate high-end luxury with the most expensive apartments Melbourne has yet to experience, as well as Australia 108, which is now under construction. Both are well-positioned for vantage points along the Yarra River and enjoy views of the CBD.”

There continues to be limited new stock available at the high end of the market in prime locations – especially in Sydney – yet there’s continued demand from foreign buyers not meeting the investment migrants’ criteria of the Significant and Premium Investment Visas.

“These foreign buyers must buy a ‘new’ property in order to comply with the federal government’s foreign investment regulation,” Ciesielski explains.

“This demand for foreign buyers comes at a time when the purchasing power of the lower Australian dollar has been much stronger, notwithstanding a recent rally.

“Many foreign buyers have already seen success in other global cities after buying into new projects where new life has emerged in once obsolete inner-city areas; these buyers are now in a position to add a Sydney or Melbourne property to their global portfolio.

“In fact, of the most important global cities to UHNWIs [ultra high net worth individuals] – for where to live, invest, educate their children, grow their business, network and spend their leisure time – Sydney enters the top 10 list at eighth place in The Wealth Report Attitudes Survey, up from 14th place in 2015,” Ciesielski says.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/qRIREqV8NzQ/

By Sendy Chung

The property market in Sydney has long been a heated topic among families, investors, agents, and even Gen Y-ers themselves.

The endless debates about the impossibility of owning their own home, whether there actually is a housing bubble, and whether that bubble may burst soon is perhaps the most talked about aspects of Australian life.

The record Sydney home prices – which have jumped 50 percent in just the past 3 years – have hit some so hard, they are afraid to set their foot in the property market.

However, there are some identified areas where properties have actually gone backwards, including Cabramatta, Guildford and Alexandria. Felix Taing from buyers’ agency Cohen Handler provides insights for April’s edition of Your Investment Property Magazine’s story on distressed suburbs in Sydney.

Cabramatta, 30km south-west of Sydney’s CBD, is a large suburb with promising growth and popularity, growing an astonishing 53% over the past 3 years. This is partly due to its proximity to the city and universities, enticing younger tenants who are drawn towards units, apartments and townhouses. Felix Taing notes that its

“consistent growth in housing values and relatively low rental return of around 3.7% is putting pressure on investors.”

The result is a surplus of townhouse listings, representing a good opportunity for investors.

Guildford is also an appealing place for young professionals and couples. Located 25km west of the city centre near Sydney’s second largest business precinct, Parramatta, it has sustained a 66% growth over the past 3 years. Housing values have increased significantly with little sign of slowing, with median house prices rising from $480,000 to the mid-$700,000’s. Felix says this is in part

“due to its location, and rental prices haven’t been able to keep up with inflated prices”

recommending investors look toward discounted houses as an opportunity for renovation.

Alexandria, the closest distressed suburb to the Sydney CBD, has high rental demand and increased supplies of accessible and identical housing. This inner-ring suburb of Sydney located 4km from the CBD has grown only 25% in the past 3 years but will hold its property values.

“Signs of saturation means investors should look for discounts towards the top end of the suburb closest to the city” according to Felix, “preferably one with a point of difference such as an extra study room to ensure a stronger resale in the future.”

For those wanting to buy property in Sydney, don’t be fooled by thinking it’s not possible. Don’t rule out leaving Sydney like so many do – you may just find a silver lining with the right team on board. Contact buyers’ agency Cohen Handler today for advice about buying property in Sydney.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/CqlYod2CIxQ/

Banks pull back on mortgage lending

Data from the Australian Bureau of Statistics shows the size of home loans are falling across the country, with the national average home loan size now $357,200. This equates to a slide of 4.08 per cent in February 2016 compared to the previous month.

The national home loan size has declined by 7.71 per cent in total in the past three months to February 2016, or $29,100 – the biggest three-month drop since May-July 2000, when the national average declined 7.74 per cent.

Bessie Hassan, money expert at finder.com.au, says the impact of tougher bank lending policies introduced during mid-2015 is finally being felt.

“A cooling property market has led to shrinking maximum loan sizes following the Australian Prudential Regulatory Authority’s changes to investment lending,” she says.

“Banks are scrutinising new loan applications more closely, taking a tougher line when assessing a borrower’s income.”

Latest figures from CoreLogic show the rate of house price growth is slowing year-on-year – March data reveals that median capital city prices rose just 0.2 per cent.

Data from credit reporting bureau Veda also shows the demand for mortgages slowed significantly in the last quarter of 2015, with growth in mortgage applications decreasing by 2.9 per cent compared to December quarter 2014. This is the second quarterly decline in a row.

Hassan believes the effect of this will put the home loan market under pressure, and banks will be eager to secure new customers.

“This could lead to an increase in housing affordability with interest rates declining even further,” she says.

Jessica Darnbrough of Mortgage Choice Limited says potential borrowers should speak to a professional to get the best information for their situation.

“Be it their local banker or a broker. A finance professional can let them know exactly what their borrowing capacity is and help them find the right product for their needs,” she says.

“In addition, potential borrowers should make a list of things they want and need from their mortgage.

“If they want interest rate security for example, they may choose to take on a fixed rate home loan.

“Alternatively, if they’re looking home loan flexibility, they may decide to go with a variable rate mortgage with an offset account attached.

“Knowing what you want from your mortgage will make it easier to find the right product.”

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Xjy8f5N_940/

More than six out of 10 Australian first homebuyers (66 per cent) have joined forces with their partner, family or friend to purchase their first property, according to new research by St.George Bank.

The survey of 1,003 first homebuyers revealed that 74 per cent of respondents have found the property they wanted and those who didn’t had to compromise on the location (50 per cent), price (46 per cent) and overall space and size (45 per cent).

Evaluating which properties provide good value was ranked the most difficult process for first timers (57 per cent), followed by choosing a suburb (47 per cent) and working out affordability (42 per cent).

St.George Retail Banking general manager Ross Miller says the results show that first homebuyers are adapting to new ways to achieve the great Australian dream of buying a home.

“Two incomes are better than one so it seems logical for buyers to team up with others if affordability’s an issue,” he says.

“By purchasing with your partner, family or friend, you can make buying a house a lot more affordable and share the costs, including stamp duty and valuation fees.”

The research indicates that 76 per cent of respondents took six months or less to find a home compared to 8 per cent for whom it took more than 12 months.

Forty two per cent of respondents plan to live in their property for as long as they can compared to 5 per cent who plan to live it for just one or two years, while 60 per cent funded the majority of their deposit through a dedicated savings plan. The top saving strategies used were: being frugal with household expenses (60 per cent), cutting back on eating out/entertainment/shopping and holidays (55 per cent), and living with family (29 per cent).

In other research, conducted for housing lender ME, results have revealed high support among Aussies for action on housing affordability, including among property investors.

The survey of 1,500 households took place in December 2015 and results were compared with an earlier survey in June 2015.

Of households canvassed in the December survey, 76 per cent agreed the federal government should be taking action to make housing more affordable for first homebuyers, an increase of three points from the June 2015 survey.

Support for action was broadly based across all states and generations as well as by those looking to buy property in the next 12 months (81 per cent) and property investors (70 per cent).

In terms of actions to fix affordability, more than three quarters agreed the government should encourage more new developments of lower priced housing, and 61 per cent agreed the government should reform the tax system to provide less support to investment property buyers, including, perhaps surprisingly, 42 per cent of property investors.

More households on lower incomes than on higher incomes supported winding back tax concessions for property investors: 63 per cent of those earning $40,001 to $75,000 supported the idea, compared to 59 per cent of those earning $75,001 to $100,000 and 59 per cent of those earning over $100,000.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/-JMTphOnu7s/