Sydney facing its own oversupply

Many Sydney suburbs are facing property oversupply according to a new study by national property market researcher Propertyology.

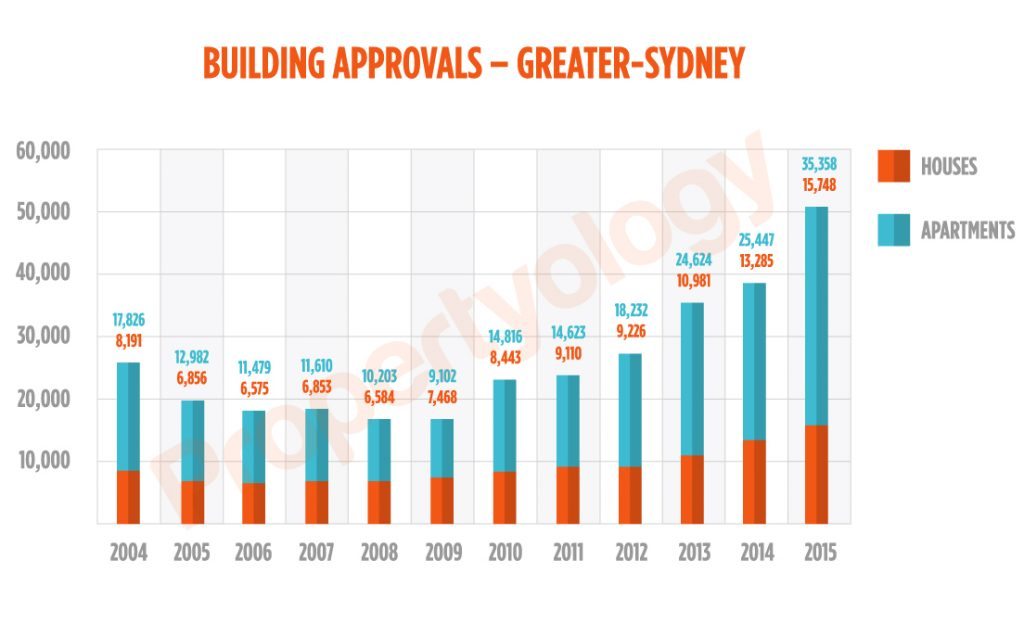

Building approval volumes have never been higher in Sydney than the last three consecutive calendar years according to Propertyology market analyst Simon Pressley.

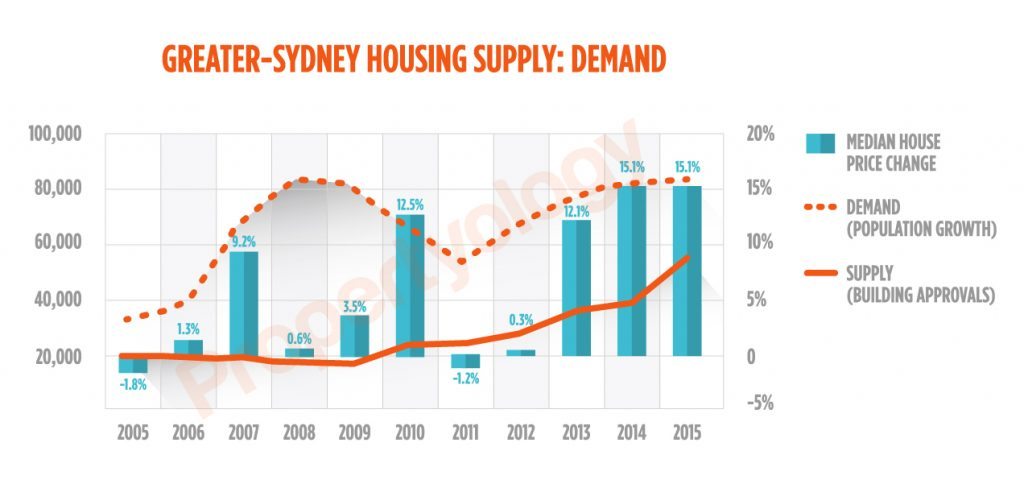

“Sydney is about to enter new territory. Its average annual population growth rate has consistently hovered around 1.6 per cent but supply is really ramping up; things are out of sync.”

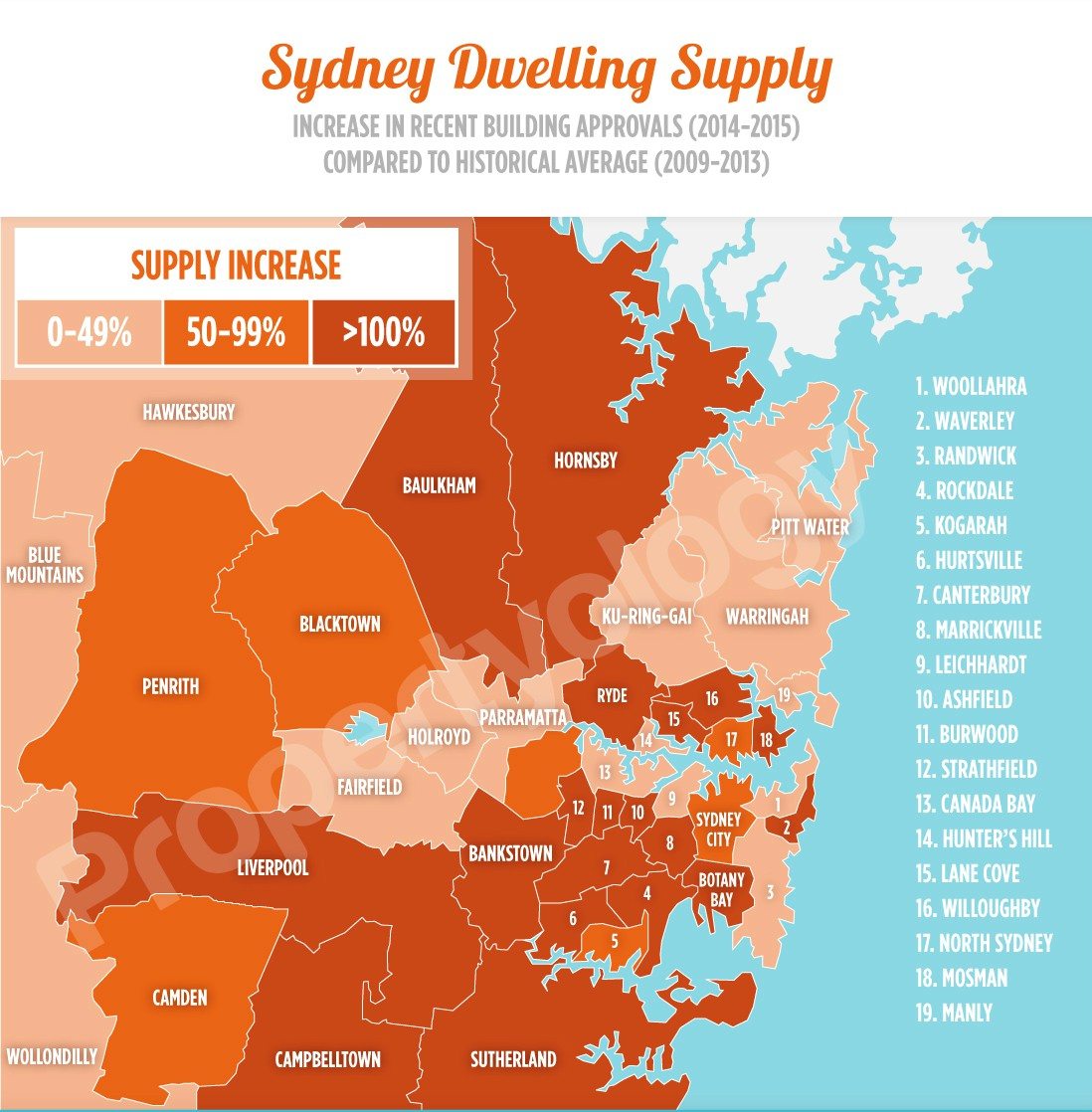

Property supply in 18 of Sydney’s 43 local government authorities (LGAs) is 100 per cent higher than historical averages. Supply in a further 10 LGAs has 50 per cent more than normal in its pipeline.

The research shows the average number of new dwellings approved in Greater Sydney each year for the 10 years ending 2011 was 22,555. The annual average dwelling approvals for the following four years between 2012 and 2015 was significantly higher at 38,225.

“The trend is not abating either. A further 51,106 dwellings were approved in 2015,” Pressley says.

“The official data analysed by Propertyology leaves us in no doubt that several pockets of Sydney will become oversupplied.”

Where?

According to the study, the following city councils are at risk of oversupply in the short-term due to double the amount of normal supply being rolled out in the next couple of years:

- Mid-north – Hornsby and The Hills

- Lower north – Lane Cove, Ryde and Willoughby

- Inner south – Rockdale and HurstvilleMid-South Canterbury and Bankstown

- Outer south – Camden, Campbelltown and Liverpool

- Inner west – Ashfield, Burwood and Strathfield

- Outer west – Penrith

Market forecast

Propertyology anticipates that property price growth will be moderate.

“Sydney’s economy is likely to remain strong, providing a solid floor under its property market generally, but that’s not to say there aren’t a few cracks. Several pockets may well see price declines,” Pressley says.

Sydney rental yields are already amongst the lowest in the country and Pressley believes there’ll be some easing of rents over the next few years.

Foreign investment

While Sydney’s economy remains strong, partly due to its substantial infrastructure program, its property market also remains sensitive to demand reductions from local and foreign investors as well as settlement risks from off-the-plan buyers.

“The significant increase in property holdings to Asian investors does pose some risk if significant destabilisation in Asian economies were to occur,” Pressley says.

“Some off-the-plan buyers with settlements due in 2017 and 2018 also risk losing their deposit as a result of tighter credit policies subsequent to the initial exchange of contracts or lower valuations in some of the potentially oversupplied pockets of Sydney.”

While not on the economic radar yet, Pressley says future interest rates rises will mean property pain for Sydney in the years ahead.

“In a market where many households are managing a mortgage of about $800,000, it wouldn’t take many interest rate rises to put the Sydney property market back on its knees,” he says.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/S_M7nJ1lIPk/

5 tips to pay off your mortgage sooner

Every Australian family wants to pay off their mortgage sooner. Do they actually do it? The ball and chain of a mortgage is a heavy one to carry around, especially for decades. Some people just accept their mortgage for what it is, make the minimum repayments and wait, wait, wait for the sum to be paid off and wish they could hurry things up. But there are ways of speeding up the process.

If you’re interested in paying off your mortgage sooner rather than later, we present five of the tried and true methods that help you get a real edge over your mortgage.

1. Make repayments according to your pay cycle

One sure fire tip is to make mortgage repayments when you get paid. If you get paid fortnightly, make your mortgage payments according to the same schedule. This cuts down on interest payable – you make 26 individual payments per year instead of just 12. These seem insignificant on paper, but they all add up.

2. Use an offset account

An offset account is a transaction account that reduces the amount you pay in interest on your home loan. If you have a $300,000 loan and $100,000 in savings, your bank or lender only charges interest on the $200,000. The more you save on your offset, the less interest you have to pay. This can shave years off the life of your mortgage.

3. Have your salary paid into your offset

Interest in offset accounts are calculated daily – so having your salary sit untouched in your offset account for a few days a year can actually have a profound effect on your mortgage. This might save you a few extra hundred dollars per year. Every little bit helps!

4. Refinance your mortgage

If you’ve had a home loan for a few years now, you should consider refinancing your mortgage. Refinancing – especially when interest rates are at record lows now (May 2016) – can save you thousands in interest, fees and other charges. In many cases, the home loan product you originally took out may not even exist anymore. The market for your home loan is bigger than ever before. Take advantage of competition and lock in a refinanced mortgage that saves you more in the long run.

5. Use lump sum payments

If you get your tax return or a bonus at work, consider depositing the lump sum into your mortgage. These large payments can shave years off your home loan.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/qLoVmBf3rMQ/

DIY sale time tips

Do-it-yourself real estate expert Daniel Baxter, cofounder of Your Hot Property, is a strong advocate of people selling their own home and believes in using the power of social media to do it.

With up to 86 per cent of buyers searching online for their next property, social media is increasingly becoming integrated into a home owner’s selling strategy, but if agents aren’t using it effectively, Baxter asks, why not take over and do it yourself?

“These days, when selling a property, a social media strategy is no longer seen as a luxury, it’s a necessity.

“It’s a hard point to argue against, especially when Facebook’s data scientists estimate people check the platform about 14 times a day.”

Baxter has seven tips for using Facebook to sell your property:

1. Create a Facebook Property Page.

2. Share images and information about your property.

3. Get friends and family to like and share your page.

4. Work out who you think will purchase your property and what they would be interested in. Understand your buyer.

5. Post interesting images and information about your property, answer questions and engage with people who are commenting on, liking and sharing your posts.

6. Share information about the local area, upcoming events and what’s so great about living there.

7. Find your ideal buyers using advertising. Show your property to the people that are likely to buy it with highly targeted Facebook advertising, eg. a young family or an older couple looking to downsize.

Styling

Before your property hits your newly formed social media page, it has to be in top form.

If you’re looking to spruce up your home or investment property before this weekend’s open home, director and principal stylist of Vault Interiors Justine Stedman says styling for less than $50 can be as simple as adding five quick and easy items.

“There are several different aspects to consider when styling, with affordability being a high priority for many, as well as the return on investment,” she says.

“It’s 100 per cent possible to achieve rewarding results, even on a small budget.”

Her top five styling tips for under $50?

1. Artwork

This can have a huge impact yet is easy on the wallet. Consider framing your favourite photos by creating a gallery wall for your hallway or above a console table. Varying sizes keeps it interesting, while a mix of black and white photos can also look very graphic.

2. Floor and table lamps

A great way to create ambience and change the feeling of your room. Justine loves gold numbers, although all metallics are on trend – plus an easy way to add instant glamour.

3. Plants

Add a bit of life to your home or investment property using nature. Plants instantly brighten up a room. Justine recommends small pots placed on dining or coffee tables. Try succulents, as they’re very low maintenance, and a tall palm or fern works well on the floor next to an entertainment unit.

4. Cushions and throws

Every stylist’s go-to trick! Changing up scatter cushions or throws will alter the effect in an instant. Justine recommends bright citrus poppy tones in summer and deeper tones for winter.

5. Rugs

Floor coverings can anchor a space and create defined zones, effective for adding texture or to uplift a space.

For basement bargains on any of these items, don’t be afraid to check out local thrift shops, where you can find vintage frames, unique furniture pieces and other surprises.

You’ll be surprised, too, at what you can find on roadsides in the lead up to roadside collection days, another goldmine for many renovators keeping to a budget.

Of course, online shopping is also huge these days, with sites such as Gumtree offering potential bargains on pretty much any household item you might think of or need.

When selling, you want to get the best price for your property, so the bottom line is it’s all about keeping dollars in your pocket and not someone else’s.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Pp3Hvk3Zp3Y/

Support for first-time homebuyers at the top end

The Northern Territory Government has announced its budget will include a stamp duty concession for first-time homebuyers seeking to purchase existing property.

The 2016 budget delivers a 50 per cent stamp duty discount for first homebuyers of established homes valued up to $450,000 and capped at $10,000 thereafter.

The concession will apply from May 24, 2016 until June 30, 2017 and will be reviewed in the second quarter of 2017 to determine if it should be extended.

For homes valued above $450,000, first-time buyers will be entitled to the maximum stamp duty discount of $10,000.

The Real Estate Institute of the Northern Territory (REINT) has welcomed the news. REINT chief executive Quentin Kilian believes the measures will help stimulate the market and provide assistance to first homebuyers, though he adds that there’s still further advocating to be done.

“While this is a very positive step and certainly will help to stimulate this portion of the market, we feel a greater level of assistance could have been applied to first homebuyers and we will be continuing to speak with government with regard to the review in 2017 with the aim of having the thresholds increased substantially,” Kilian says.

Kilian believes the stamp duty concession for existing property purchases by first homebuyers will be particularly important in regional areas.

“[Areas] such as Katherine, Tennant Creek and Alice Springs where no or very little new building activity is occurring,” he says.

“It will mean that a first homebuyer seeking to purchase an existing property will need to save up to $10,000 less to get into the property market and have their own home.

“This can only be a positive move and the REINT will continue to ensure that first homebuyers get the best deal possible and every opportunity to save when they purchase their first property.”

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/1ORhyeU94Ic/

7 secret tips to building a property portfolio

A property portfolio doesn’t happen overnight – it requires planning and ongoing review of your circumstances. The younger you start out as a property investor the earlier you’ll become financially independent, according to Roy Sanderson.

Roy is the Managing Director of R J Sanderson Associates Pty Ltd. The firm was voted Accountant of the year for 2015 in Victoria under the People’s Choice Awards. The accounting and taxation consultancy firm are very proud of the award and according to Roy, “the award is the result of our very dedicated team who genuinely care about our client’s future and financial stability”.

Roy worked as an accountant with AV Jennings Homes for six years at the start of his career, followed up by a further six years with a commercial builder in Victoria.

With twelve years in the property industry, he opened an accounting practice which specialises in property-related tax returns for individuals, companies, trusts and Self-Managed Super Funds. This accounting practice now boasts over 45,000 clients and nine offices, mostly in Victoria, although the firm works with clients anywhere in Australia.

“My property background and experience is shared at our monthly full-day training sessions which all accountants attend,” says Roy. “Our staff are not only dedicated but determined to be the best in the business to advise clients on all sorts of tax matters. Taxation issues for property investors can be complex and I believe it’s quite important for investors to have an accountant who has a passion for – and a thorough understanding of – property investing.”

Roy noted that it’s vital for investors to build a team of well-qualified professionals to advise them, regardless of whether they’re just starting out or they already have a substantial portfolio. A property-savvy accountant is a key member of this team. While most accountants have a general knowledge of the taxation issues relating to property investment, a firm that specialises in property investment can provide huge advantages to clients in maximising the value of their investments, claiming all available deductions and advising on complex structuring questions.

Apart from building a successful accounting and taxation advisory business, Roy has also amassed an extensive property portfolio. His first property purchase was a family home at 24 years and he has continued to purchase more property as his equity, income and rents have increased. “I recall my first home when I borrowed that absolute maximum I could, based on my income and borrowing capacity. Over the years I borrowed the maximum a couple of times to allow me to continue to buy property.”

Roy’s property portfolio includes investments in which he’s a joint venture owner or partner with another person or number of people. Some of his holdings include:

The cost price on all properties (Roy’s share) is $6,266,433 but the market valuation is approximately $11,380,000. His interest or part-interest in these 29 properties has allowed his wealth and equity to grow as the properties have increased in value. Roy’s clients benefit greatly from his combination of accounting knowledge plus real-world experience in property investing, both residential and commercial.

Roy Sanderson has offered 7 Secret Tips to increasing your property portfolio

1. Start Young Somewhere

The younger you are when you take that big step to buy your first property, the better off you’ll be in the future. So many clients get close to retirement and say “if only I had bought something earlier.” Take little steps as it doesn’t happen overnight. As equity, income and rents increase then you can look at another investment some years later.

2. Assess Your Borrowing Capacity

Every person has a limit as to what they can borrow based on their income, expenses and assets. Get your finance broker to assess first so you know what your limits are when you go shopping.

3. Buyers Advocate

Consider using a buyers advocate to locate a good property investment. Roy says his last 12 properties were purchased with the assistance of a Buyers Advocate.

4. Property Manager

The property manager is crucial to having a property portfolio which has minimal problems. My preference is to use someone local to the area of the property, but be sure they do thorough reference checks.

5. Increase Rent

Even if the rent increase is only $5 per week, every year you should increase rent. Only weak property managers will suggest the rent does not increase (unless there are unusual market circumstances leading to a softer rental market.)

6. Joint Ventures

Consider joint ventures with people you know who may be in a similar position of not quite having enough to buy an investment property. But it’s crucial to outline the plan and document it so there’s no misunderstanding down the track. Seek advice for any agreement and run this by your accountant. API magazine covers joint ventures and small private syndicates on a regular basis.

7. Ownership Structure

The most important is maybe the last! A good accountant will review your circumstances and consider if the investment should be in a personal name, joint name, an investment trust or a Self-Managed Super Fund (SMSF). This is your starting point before you sign the contract, which should always be signed as “your name and / or nominee”.

R J Sanderson Associates Pty Ltd consult to clients all over Australia either by phone, email or on the website www.rjsanderson.com.au or roy@rjsanderson.com.au. The firm welcomes enquiries from API readers anywhere in the country.

Roy notes that travel to see your accountant is generally tax deductible.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/_KJlWInvnb4/

Sydney’s residential vacancy rates remained at 1.7 per cent for a third month in a row, according to data released by the Real Estate Institute of New South Wales (REINSW).

REINSW president John Cunningham says the April 2016 REINSW Vacancy Rate Survey again saw inner-Sydney rental accommodation unchanged at 1.3 per cent.

“Middle Sydney was down 0.3 per cent at 1.6 per cent, while outer Sydney rose 0.1 per cent to 1.9 per cent,” Cunningham says.

“Low vacancy rates highlight the shortage of properties in high-demand areas. This trend is expected to continue into the winter months.”

In the Hunter, vacancy rates rose 0.2 per cent to 2.5 per cent, while Newcastle experienced a fall of 0.8 per cent.

“Properties are leasing well and in quick timeframes in Newcastle,” Cunningham says.

In the Illawarra, vacancy rates rose 0.4 per cent to 1.7 per cent, led by Wollongong which was up 0.7 per cent to 1.7 per cent.

Across regional areas, availability in Albury was down 0.7 per cent at 2.9 per cent, the Riverina was down 1.2 per cent at 3.1 per cent and New England was steady at 3.6 per cent.

The central coast was up 1.0 per cent to 3.0 per cent and the south coast rose 0.3 per cent to 2.5 per cent.

*Suburbs included in ‘inner’, ‘middle’ and ‘outer’ Sydney are those falling within the Sydney Statistical Division as per the Australian Standard Geographic Classification of the Australian Bureau of Statistics.

Perth’s rental market

Meanwhile, Perth’s vacancy rate sits at 5.6 per cent for the March quarter, according to the data.

It seems tenants are taking advantage of improved affordability in the rental market, as leasing activity has spiked and reiwa.com analysis shows a surge in the leasing of one- to three-bedroom properties.

Real Estate Institute of Western Australia president Hayden Groves says one-bedroom leased properties increased by 50 per cent in the March quarter, while two- and three-bedroom properties had increased by 18 per cent.

“There was a significant amount of leasing activity in the one- to three-bedroom market over the quarter, while four- and five-bedroom properties experienced a small decline.

“In the three months to March 31, 2016, the total volume of leased properties in the Perth metro area increased by 17 per cent on the December 2015 quarter,” he adds.

“While rental listings in Perth remain above the long-term average, the number of properties leased in the March quarter has soared well above the growth of listings, which is a real positive for the market.

“This has caused the vacancy rate to come down to 5.6 per cent in the March quarter from six per cent in the December quarter as tenants have soaked up stock,” Groves says.

At a sub-regional level, nearly half of Perth’s sub-regions maintained a stable overall median rent in the March quarter, while there were mixed results for average leasing days across the metro area.

“The biggest improvement in average leasing days was felt in the Perth City, Fremantle and Western Suburbs sub-regions, while on average it took longer to lease a property in Joondalup South, Wanneroo North West and Wanneroo South in the March quarter than it did in the December 2015 quarter.”

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/ukQHvTU2ibY/

Subdivision fee savings for Victorians

The Victorian Urban Development Institute of Australia (UDIA) has secured a decision on the Metropolitan Planning Levy (MPL) that will mean significant savings in subdivision fees.

The Minister for Planning signed off on the MPL Planning Practice Note this month, which has been welcomed by Victorian institute chief executive Danni Addison.

“It’s gratifying to get to this result after a tireless advocacy campaign by the institute and its members.

“Based on average development sizes and development costs for greenfield projects, this will amount to a saving of over $50,000 for applicants proposing a standard 500-lot subdivision,” Addison says.

In calculating the “estimated cost of development”, the practice note states:

“For all leviable types of development, including subdivision, only the works requiring a permit should be included in the calculation of costs.”

Since the MPL’s introduction on July 1, 2015, the institute has been persistent in seeking a practice note to confirm the applicability of the MPL.

The UDIA held the position that the calculation of “estimated cost of development” does not include works exempt from a planning permit, and the release of the practice note confirms this position.

This means that for many works associated with a subdivision, their costs are not included within the application’s “estimated cost of development”.

For more detail on the types of works, you can access Clause 62 of the Victorian Planning Provisions.

Refunds?

For applicants that were required to incorrectly include the cost of all works associated with a subdivision, this news comes as some relief. Under refunds and exemptions, the practice note states:

“If an applicant has previously incorrectly calculated the estimated cost of development, based on costs of works associated with a subdivision but not in themselves requiring a planning permit, a request for a refund can be made in writing to the State Revenue Office.”

The SRO contact details are:

State Revenue Office

GPO Box 1641

Melbourne, VIC 3001

The Victorian UDIA and the Property Council have joined efforts to get a fairer and more equitable deal on infrastructure charges. The Department of Environment, Land, Water and Planning (DELWP) are more thoroughly analysing existing Development Control Plans (DCPs). If all or some of their recommendations for the methodology is adopted, this could mean significant savings.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/kniZbNhAmEs/

Building industry forecasts released

Building and construction industry forecasts released today document the passing of two booms – mining and residential – and the impact of that on this sector of the Australian economy.

The Australian Construction Industry Forum (ACIF) today released the latest ACIF Forecasts, revealing how the sector is coping with another double-digit fall in engineering construction plus the impending peak of residential building.

“The May 2016 ACIF Forecasts re-chart the course of building and construction industry as it surfs the downside of tsunami-sized waves of investment,” chief economist for ACIF Kerry Barwise says.

“The building and construction industry is playing a key role in the transition of our economy away from resources towards a more diversified economy.

“The industry has ramped up residential building following the once-in-a-lifetime mining boom, but that too is now coming to an end.”

The May 2016 ACIF Forecasts reveal a second consecutive 5 per cent annual fall in aggregate activity, reducing 2015-16 total construction activity by $12 billion to $212 billion.

These forecasts have also ground $5-10 billion off the level of construction activity that was projected in each year over the next three years, largely reflecting a more stringent downgrade to the outlook in engineering construction following the mining boom and the expected dip in residential building. Residential builders are still working through an enlarged construction pipeline and building work is expected to top $91 billion in real terms in 2016-17 before falling.

However, despite the sweeping changes and challenges, these forecasts also identify areas of construction activity that should help an economy in transition.

Wherever activity is in support of the shift towards the new economy, innovation, creativity and the provision of key services, non-residential building work is growing, especially in the areas of health and aged care, accommodation and retail/wholesale trade.

These conflicting trends are projected to turn around the modest contraction forecast in non-residential building activity for this year into a small uptick next year and more extensive growth – close to 3 per cent per annum – by 2017-18.

These forecasts have also taken into account a fundamental shift in the composition of engineering construction activity. Many of the largest new infrastructure projects are in areas that will enhance the delivery of key services and improve the mobility and liveability in Australia’s cities, enhancing their role as major drivers of economic growth.

The ACIF’s Construction Forecasting Council chair Adrian Harrington says:

“The building and construction sector contributes around 8 per cent to GDP… with technology continuing to emerge at an unprecedented scale, our population growing and aging, and the economy transitioning from the biggest resources boom in over a century, it’s more important now than ever before that the industry has a relevant and credible ‘compass’ for the next 10 years.

“These Forecasts outline the upcoming demand for work across the three key sectors – residential and non-residential building plus engineering construction, and the 20 sub-sectors they include, as well as what’s happening with construction costs and labour requirements.”

Another recent report reveals that Australia’s building sector can deliver up to 28 per cent of Australia’s 2030 emissions reduction target, save $20 billion and create healthier, more productive cities if a suite of targeted policies are introduced, according to the Australian Sustainable Built Environment Council (ASBEC).

ASBEC president Prof Ken Maher says: “Buildings account for almost a quarter of Australia’s emissions. This sector must be a strong focus if Australia is to meet its international obligations under the Paris Climate Change Agreement.

“Over the last decade, market leaders in the building sector have shown that rapid improvements are possible, and this report demonstrates just how much more opportunity exists.”

The report’s modelling found that without further action, buildings would consume almost half of Australia’s total national carbon budget.

“This is not an option,” Maher says.

“The good news is that major improvements are possible with the right public policies.”

Buildings can achieve zero carbon by 2050 using existing technologies

in addition to $20 billion in energy savings. Buildings can deliver one quarter of the national emissions target and over half of the national energy productivity target by 2030.

Property Council of Australia chief executive and chair of the ASBEC’s Energy Efficiency and Emissions Task Group Ken Morrison says the report is a blueprint for government action.

“Major emissions reduction gains can be made with the property industry, but it requires a focused plan that includes regulation, strong incentives, energy market reform and market information to support transformation.

“When we’re talking about the built environment, we’re talking about literally millions of individual home owners as well as thousands of businesses across the property supply chain. That’s a level of complexity which requires a nuanced approach.”

Chief executive officer of the Green Building Council of Australia Romilly Madew adds: “This report makes a clear business case that the residential and commercial building sector can punch well above its weight to help Australia achieve a goal of net zero emissions before 2050.”

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/06DFx4VnPhE/

Queensland outlook slumps

Confidence in the Queensland economy and building industry has halted, dropping into negative territory for the first time in more than three years.

Master Builders Australia’s deputy executive director Paul Bidwell says the results of the latest survey of industry conditions for the March 2016 quarter exposed the easing of recent building approvals, which have moved off their peak.

“Much of the state has experienced a slowdown but encouragingly the survey results show that most respondents expect the economic outlook to remain stable for the coming 12 months,” Bidwell says.

“However there is a growing number of respondents who hold a more pessimistic outlook for the future, with nearly one in three respondents who expect the economic outlook to deteriorate.

“Low levels of demand are the most critical constraint on business growth. This is in line with falls in building approvals over the same period and the concentrated nature of the demand, which has failed to reach many regions and sectors of the industry.”

Builders will be looking closely at the Queensland Budget, due to be handed down in a month, for measures that will help make new housing affordable and provide spending commitment for catalytic infrastructure.

On a national level, Real Estate Institute of Australia (REIA) president Neville Sanders says the 2016 Federal Budget has recognised that the housing and construction sector have a role to play as the Australian economy transitions away from a decade-long reliance on mining for growth.

“Investment in dwellings is forecast to grow at eight per cent in 2016-17 and peak in 2017-18 with a record number of completions,” he says.

Further Qld findings

The Gold and Sunshine coasts now stand alone in maintaining a strong performance. As the Gold Coast prepares for the Commonwealth Games in two years it seems that, already, the positive effects for the property market have begun to filter through.

Central Queensland had an improved quarter, moving off a low base, and far north Queensland continues as the standout among the regions.

Greater Brisbane has come off its high as the demand for new unit construction begins to peak.

North Queensland and Wide Bay have slumped and joined Darling Downs and southwest Queensland and Mackay and Whitsunday in a struggle to find sufficient demand.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Da4KLFBOcwQ/

‘It’s not property investors’ fault!’

Targeting property investors, as well as “the root of all evil” negative gearing, in the current housing affordability debate, is wrong according to Performance Property Advisory associate director Heath Bedford.

“The problem has more to do with our continued strong population growth (second strongest population growth in the OECD behind Luxemburg), a chronic shortage of appropriate housing, all-time-low interest rates and an undue focus on developing our capital cities.

“Restrictive planning policies have locked up a lot of our inner- to middle-ring suburbs from appropriate medium-density development, skewing our construction pipeline to high-rise development in our CBDs, inner-city fringe and house and land packages on the urban fringe.

“If you take a look at Melbourne and Sydney for example, where all the media attention has been focused due to strong capital growth over the past five years, there’s a real disconnect with the current new dwelling supply and what homebuyers are looking for. The priority for a large portion of this so-called ‘next-time’ homebuying sector is a well-located two-, three- or four-bedroom property on 250 to 450 square metres of land, with a short commute by car or public transport to the CBD.

“However, there are few suitable alternatives in these established suburbs, with villas/duplexes/townhouses and small-scale apartment buildings effectively restricted to only small pockets or not permitted at all.

“This is resulting in a lack of suitable housing development, with homebuyers having no alternative but to pay inflated prices for existing stock, further reducing affordability.”

Bedford says poor regional development has also played a role in inflating prices in our capital cities.

“Slow land release in regional areas is a significant impediment to the supply of land for new housing and, coupled with the mismatch between buyer demand and the type of land released, this has been especially problematic.

“Governments need to focus on developing our key regional areas, which could be greater hubs for employment and education, dispersing demand more evenly.”

Bedford says another issue rarely reported in the mainstream media is that owner-occupiers – the so-called “next-time” homebuyers – make up the largest proportion of the established residential market (approximately 43 per cent) while investors (resident in Australia) account for just 28 per cent of this market. (The investor group is also made up of first homebuyer investors – people who choose to rent out the property.) Foreign investors make up around 8 per cent of the established residential housing market and 15 per cent of new housing market.

The remainder of the established residential housing market is made of first-time buyers.

“What this clearly demonstrates is that our current price growth is largely driven by owner-occupiers looking to upgrade the family home or cashed-up downsizers. They’re generally financially secure, highly motivated and will often pay whatever it takes to secure the property they want because they’ve invested in it emotionally.

“They’re the ones driving the market.”

Investors, on the other hand, are all about financial returns, Bedford says.

“An investment purchase must make financial sense and be supported by key fundamentals, and if the financial numbers don’t stack up, [investors] walk away and move on to the next opportunity.”

It’s important to note, he adds, that following key APRA (the Australian Prudential Regulation Authority) changes since July, investment activity has slowed by as much as 10-15 per cent.

“The changes include higher interest rates for investment loans, lower LVRs (loan to value ratios) – 80 per cent for investors and 70 per cent for SMSFs – and greater ‘stress testing’ on loan serviceability calculations.

“In other words, the changes are designed to curb speculative borrowing and investment in this ultra low interest rate environment.”

Bedford says the Victorian Government has also cracked down on foreign investors by doubling their stamp duty surcharges from 3 per cent to 7 per cent and tripling the surcharge on “absentee landholders” from 0.5 per cent to 1.5 per cent, effective from the 2017 land tax year.

“This will most certainly put a dampener on foreign investor activity and result in easing of demand and some pricing pressure.”

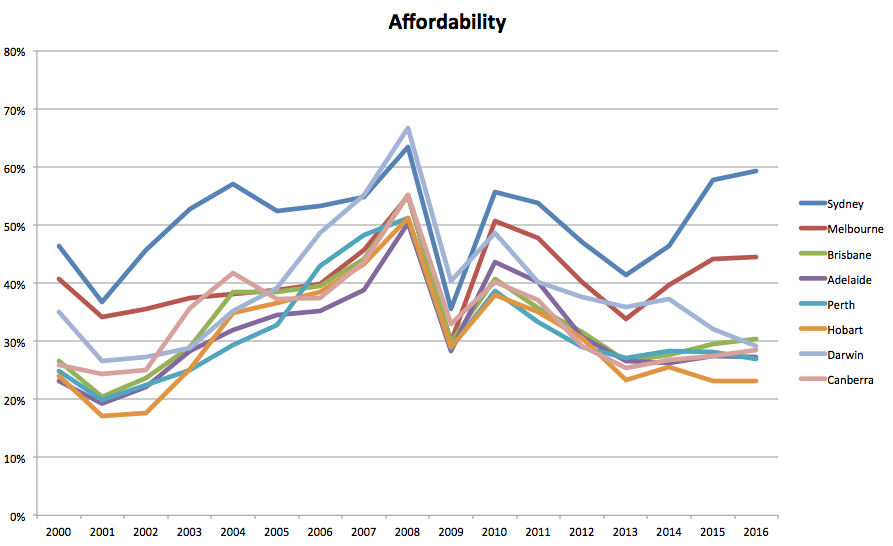

Affordability – not a nationwide problem

Bedford says it is vital the buying public, media and politicians get to grips with the fundamentals that drive the Australian residential property market and don’t overreact unnecessarily.

“The concept that the Australian residential property market moves in cycles is well known,” he says.

“Prices rise, fall, stabilise and then rise once more. Eventually, affordability constraints will lead to prices peaking, before undergoing a correction to bring them back from their peaks.

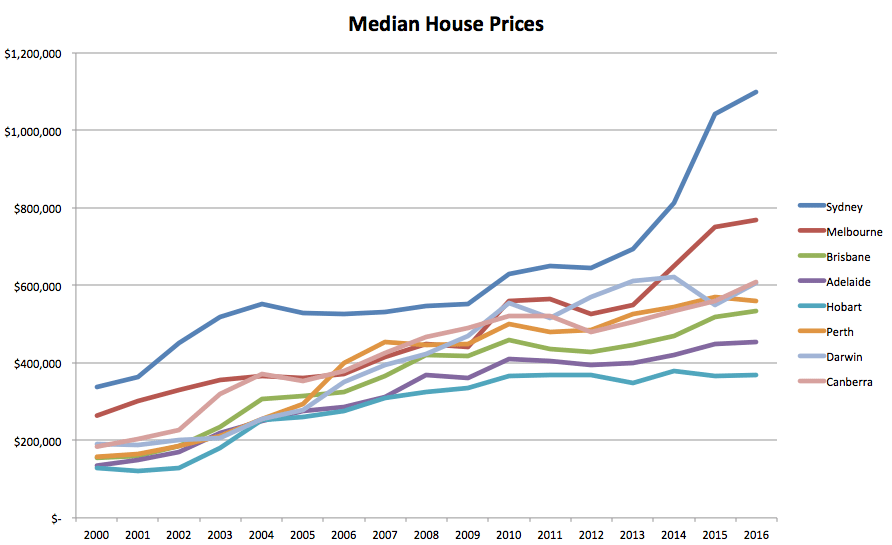

“It just happens that Melbourne and Sydney are peaking, or very close to peaking, and this is where the mainstream media attention is focused.”

He adds that over the past few years Sydney has been “making up” for the protracted period of price stagnation between 2004 and 2012, when the median house price increased by a little as 23 per cent in eight years.

Since 2012 it has sky-rocketed by more than 60 per cent.

“While apparently boom-like conditions, the market is in fact making up for lost time,” Bedford says.

“This has been compounded by a chronic undersupply of housing supply over this period, strong population growth and falling interest rate environment.”

The Affordability Index (AI) is calculated using the median price, median income, an LVR of 80%, and the current interest rate. The lower the AI, the more affordable the location.

He says price increases have very much been about a “tale of two cities”.

“Melbourne and Sydney are unaffordable at present but the other capital cities are still very affordable based on their long-term affordability index measure. In fact, they’re the most affordable they have been since the very early 2000s.

“In some cities we’re likely to see affordability improve: Perth, for example, is experiencing and will continue to see prices decline after a strong 10-year growth period.”

Bedford is confident that as prices peak in Melbourne and Sydney, they’ll drop or stagnate and we will begin seeing some significant wage growth.

“When this occurs there will be much less discussion around lack of affordability.”

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/VA69qfE5T6Q/