Apartment concessions for South Australia

The South Australian Government has recently announced it will extend and expand stamp duty concessions for off-the-plan apartments as part of the 2016-17 state budget.

The concession of up to $15,500 was due to expire at the end of this month. It previously only applied to properties in the CBD and inner-city suburbs but will now be available across the state.

This comes as welcome news to the Urban Development Institute of Australia (UDIA – SA).

Executive director Pat Gerace says the UDIA has been urging the government to continue stamp duty concessions for off-the-plan apartments, which will now be extended by 12 months until June 30 next year.

“We’ve been pushing the state government to extend stamp duty concessions to outside of the CBD, so we’re pleased with this announcement,” Gerace says.

“These stamp duty concessions will make apartment properties more affordable and help more homebuyers into the market.

“Importantly, it will also allow more choice for those who are downsizing or trying to get into the market but don’t want to live in the city.”

The UDIA called for the continuation of off-the-plan apartment concessions in its submission to the SA Government ahead of the July 7 budget.

It has also requested the government remove land tax on undeveloped residential land, which would reduce the land tax impost that is ultimately applied to pricing when the land is eventually ready for purchase by homebuyers.

The UDIA is also calling on the government to provide funding to establish proposed infrastructure schemes and an e-planning system by mid-2018 – as outlined in the recently passed Planning, Development and Infrastructure Bill 2015.

“There’s been good progress in recent times to reform the state’s planning system, so it’s important the government provides the necessary funding to establish new initiatives such as infrastructure schemes and an e-planning system to help unlock new investment and generate economic growth,” Gerace says.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/caYojANMvO0/

The second release of Australia’s first ever Rental Affordability Index (RAI) reveals the lowest-income households in Australia are paying up to 85 per cent of their income on rent, while rental unaffordability is extending to professionals.

Under current market conditions, the RAI reveals low-income households typically need to pay 50 to 85 per cent of their income on rent. It’s generally accepted that a household is in housing stress if it pays more than 30 per cent of its income on rent.

Adrian Pisarski, executive officer of National Shelter, says the latest index highlights many rental households are falling into poverty and are being pushed to suburban fringes due to high rents.

“Australia’s lowest income households – those on around $500 a week – are paying up to 85 per cent of their income on rents. Middle-income households are also falling into housing stress as high rents chew up incomes that aren’t keeping pace with rising housing costs. It’s clear that rental unaffordability is dividing Australia,” Pisarski says.

City-by-city breakdown

Under the capital city data, low-income households continue to experience severe unaffordability:

Sydney

- Greater Sydney is the least affordable metropolitan area in Australia in recent years, with an RAI of 109 in the last two quarters of 2015.

- However, affordability levels have stabilised in Sydney in recent years.

- Near the city centre, there has been no relief for the average household in meeting housing costs, though some areas in the west have experienced slight improvements in affordability.

Brisbane

- With an RAI of 116, rental affordability in Greater Brisbane has decreased over the past two years; it’s the only city to have recorded such a trend of the metro areas studied. This is due to a declining income growth rate in Brisbane. Over the past two years, household income has declined by 0.2 per cent, while rents have increased overall by 2.5 per cent. Median household rents have fluctuated between $390 and $406 per week.

- Some areas in the inner city, south of the Brisbane River (i.e. West End, South Brisbane and East Brisbane) have experienced improvements in rental affordability, probably as a result of localised growth in apartment supply.

Perth

- Greater Perth has an RAI of 126, meaning rents are acceptable. With a score of 108 (moderately unaffordable) in December 2013, affordability has increased significantly over the past two years.

- The increase in affordability has been more significant in regional WA compared to the metro area, away from moderately unaffordable rents to acceptable rents, possibly in part due to the mining downturn.

Adelaide

- Greater Adelaide has an RAI of 117, meaning rents are moderately unaffordable. There has been a moderately positive trend in rental affordability over the last two years. Since the November 2015 release, the RAI score has risen by three points.

- This is a result of household incomes rising faster than rents in recent years. Over the past three years, household income rose 7.5 per cent while rents rose 1.7 per cent.

Hobart

- Greater Hobart has an RAI of 111, meaning the city remains moderately unaffordable.

- After Sydney, Greater Hobart is the least affordable city, due to relatively lower incomes and high rental yields.

- Unaffordability has increased slightly, as the RAI score dropped by one point.

- Pockets at the fringes of Greater Hobart have become more affordable.

Economist Saul Eslake notes that in 1991-92, first homebuyers each accounted for about 17 per cent of the total housing market, with the remainder going to “repeat buyers”.

“By the current financial year, however, the share of total housing lending going to first-time buyers is just 11 per cent, while the share going to investors rose to 46 per cent,” Eslake says.

The index includes data from the September and December 2015 quarters as well as historical data dating back to 1996. Data was not available for Victoria.

About the Rental Affordability Index

The RAI has been created by National Shelter, Community Sector Banking and SGS Economics Planning, which undertook the research. The report gives an account of rental affordability in Australia’s capital cities. The higher the number of the RAI, the greater the affordability.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/KwSFr51Mwu0/

Investors now are younger than ever

Property investors are getting younger – that’s what new data released by mortgage company Mortgage Choice reveals.

According to the 2016 Investor Survey, 50.8 per cent of investors were 34 years of age or younger when they purchased their first investment property.

By comparison, in 2013, just 33.8 per cent of investors were under the age of 34 when they bought their first investment.

Mortgage Choice chief executive officer John Flavell says he’s surprised to see an increase in the number of younger property investors.

“With property price growth outpacing wage growth over the last few years, saving a deposit and buying property has become very difficult for a lot of younger Australians.

“Furthermore, the recent spate of investment lending changes has made it tougher – in some instances – for younger Australians to obtain finance to buy property,” he adds.

Flavell says it’s clear from the data that Australians clearly understood the value of owning property and younger Australians are keen to get their foot into the market sooner rather than later.

“Property prices have risen significantly across most markets over the past few years, which is great news for property owners.

“Data from CoreLogic shows property values have risen by 10 per cent across the combined capital cities over the last 12 months to June.

“This level of price growth ensures property owners – specifically property investors – see a great return on their investment.

“In fact, looking at the survey data, the number one reason why Australians bought an investment property was for financial gain.”

According to the data, 29.6 per cent of respondents said they bought an investment property to “set themselves up financially for the future”.

“Australians understand the benefit of investing their money in property,” Flavell continues.

“Provided they take a long-term approach to property investment, investors should be able to see a good return on their investment.

“With interest rates currently sitting at historical lows, making the cost of borrowing more affordable than ever before, there’s never been a better time to be a property investor.”

Of course, for those Australians thinking of buying an investment property in the not-too-distant future, whatever their age, Flavell points out that it’s important for investors to do their due diligence.

“Before buying an investment property, it is important to do your research and get a good understanding of the current property market.

“In your research, look for suburbs that perform better than others in terms of rental yields and capital growth,” he adds.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/HXAyMpviDXE/

Qld Gov’s Budget a ‘roll of the dice’

The Queensland Government released its State Budget yesterday, with Treasurer Curtis Pitt saying that it sets out a clear economic plan for the state’s future focused on three priorities: job creating innovation; investment; and infrastructure.

For the year 2016-17 the government has a $10.7 billion capital works program, which will support 31,000 jobs and provide transport, health, education, energy and water infrastructure.

“More importantly this is part of a four-year $40 billion investment in infrastructure which includes capital expenditure, capital grants and public-private partnerships to drive jobs and growth in Queensland,” Pitt says.

In the realm of the property industry, The Property Council of Australia has reacted to the Budget by pointing out that it has reinforced just how critical the property industry is to the Queensland economy, and describing the Treasurer as “rolling the dice”.

Queensland executive director of the Property Council Chris Mountford says the Treasurer is expecting stamp duty to grow by 5.6 per cent and land tax to grow by 7.3 per cent in 2016-17.

“Clearly the Treasurer’s budget bottom line has been strengthened by activity and growth in the property sector over the past 12 months, and he is banking on it continuing,” Mountford says.

“This is the role the property industry wants to play in the Queensland economy – generating jobs, affordable housing and prosperity for Queenslanders.

“We know that over the past 18 months much of this has been driven by strong residential development activity, particularly in apartments in southeast Queensland.

“And this is the part of the market where foreign investment has played such a powerful role in providing funding certainty and the presales required to get projects out of the ground.

“This is also the part of the market which is already cooling, and will continue to do so over the next couple of years as this additional supply moderates further demand.

“It beggars belief that the government is willing to risk making it even more difficult for the apartment market by slugging it with an additional stamp duty surcharge.

“It also appears likely that many developers – including house and land developers – are likely to be slugged with this tax as the Treasurer has indicated a 50 per cent foreign-owned threshold test.

“In reality, tax is a cost like any other in the development process. It’s no different to concrete, bricks or drainage – it has to be passed on to the end consumer if the project is going to stack up and proceed.

“So, today’s budget delivers a tax that not only risks investment and jobs in the construction sector, but also risks driving up the cost of housing for Queenslanders across our cities and our suburbs.”

While Mountford concedes that the first home-owners grant increase also included in the Budget is a positive step, he believes could potentially be undone for many first homebuyers.

“They will need to dig into their pockets to pay this tax as part of the cost of building their new home.”

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/VYeJQGztroo/

Mohsen Kalantari, University of Melbourne

The New South Wales Government is set to privatise its land-titling services. This decision may provide the impetus for other states and territories in Australia to go down the same path.

But what are the implications of privatising the operation of title offices for the Australian public?

What are title offices and why do they matter?

Title offices maintain a registry that defines the ownership and boundaries of private and public properties and keeps records of changes to the properties as they happen.

Details of various changes affecting the land – such as mortgages, restrictions, leases and rights of way – are also recorded in the registry.

So, if you are about to commit hundreds of thousands of dollars to buy a property, you or your solicitor need to search the registry and make sure the seller is not a pretend owner, and the dimensions of the property are the same as what the registry says.

Similarly, if you want to subdivide your backyard to sell or build a new dwelling, it is necessary to look into the registry about what you can and can’t do in your backyard.

Australians may do business with a title office only a couple of times in their lives, but they do provide services to many people every day. For example, in NSW, about 900,000 land dealings (like transfers of title or mortgage discharges) were lodged and almost 53,000 new titles registered in the 2014-15 financial year.

Australia’s stable and reliable property market is a key contributor to the country’s economy. From buying and selling to financing property, title offices underpin billions of dollars of economic activity every year. The robust titling systems in Australia’s states and territories are one of the reasons the country was among the least affected by the global financial crisis.

Australia’s system is a simplified land registration method that guarantees the ownership of a property if it is recorded in the title office. Although there is always room for improvement, this system of registration is one of the best and most efficient in the world.

In Victoria, if you have all the necessary documentation you could transfer the ownership of property in 24 hours. Many countries around the world – including the US – cannot even dream of such efficiency.

But what might privatisation lead to?

Uncharted territory

Title offices usually do not cost the government; they generate revenue through the provision of land-related services and selling land and property information.

But, if privatising title offices is being done with the aim of improving its performance, does any provider in Australia already have a better service in place to do the job more efficiently than it is being done now?

Impact on individuals

Apart from the economic significance of land and property, arguably a property could be the most valuable asset an average person could own in their life.

Although the announcement emphasises that the government will continue guaranteeing titles, the for-profit philosophy of privatisation can lay the groundwork for the private sector to negotiate more profitable alternatives such as the insurance-based titling system that operates in the US. So this may well be the starting point of moving away from guaranteeing Australian land titles.

Impact on the public

Land information that is created in the process of titling is accurate, assured and authoritative.

When you subdivide the backyard of your million-dollar property, a new title is to be created. In this process, a licensed surveyor prepares a plan, which is lodged and registered with the title office. Before being registered, the title office staff examine the plan to ensure the ownership boundaries on the plan correspond with the boundaries as marked on the ground.

Land information generated and maintained in title offices has a documented and legally valid audit trail. This is not only key to the property market and land development, but is critical to many public services such as infrastructure engineering, emergency management, or disaster responses. Any compromise on the private sector’s part will have significant consequences, which could go beyond the properties we own.

Privatisation has its advantages. But Australia’s title offices may not necessarily be the right government businesses to be privatised.

![]()

Mohsen Kalantari, Senior Lecturer in Geomatics, University of Melbourne

This article was originally published on The Conversation. Read the original article.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/NNOXpibJOhk/

WA capital sees improved rental activity

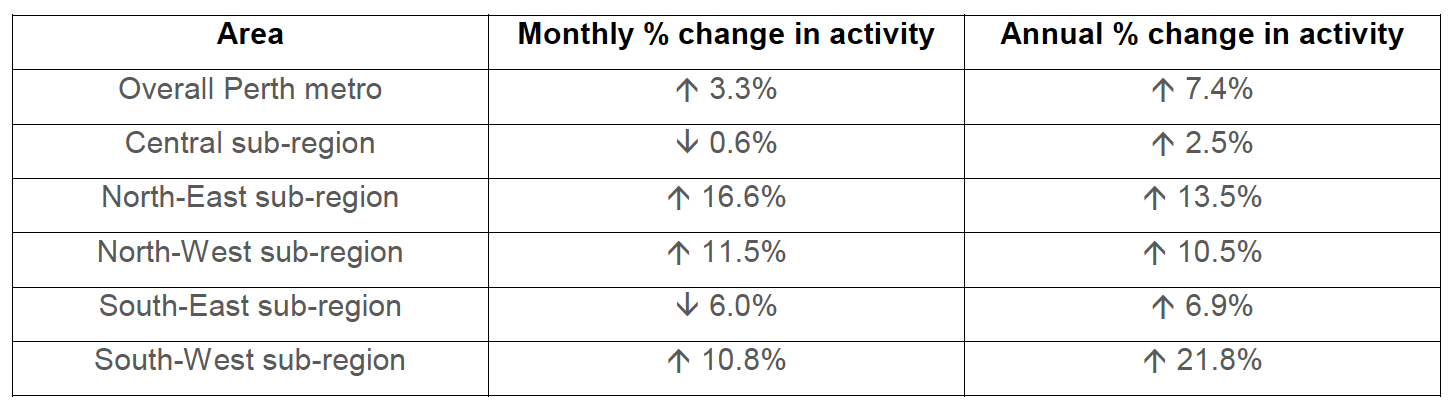

Perth’s rental market saw increased activity in May, with reiwa.com data showing that the volume of properties leased during the month was up 3.3 per cent on April 2016 and 7.4 per cent when compared to May 2015.

Real Estate Institute of Western Australia (REIWA) president Hayden Groves says the analysis shows that Perth tenants are taking advantage of improved choice in the market to secure a lease at a more affordable price.

“It’s pleasing to see that although rental listings remain above long-term averages, there’s still plenty of movement in the market with leasing figures on the rise across the metropolitan area,” he says.

“With a healthy supply of stock on the market and moderating rent prices, tenants have a good opportunity to improve their living situation.”

The spike in leasing activity during the month was felt across all but two of the sub-regions.

“The northeast sub-region was the standout performer in May, lifting 16.6 per cent on April, followed by the northwest sub-region, which saw an 11.5 per cent increase,” Groves says.

“When compared to May 2015, the southwest sub-region saw the most notable lift in listings – up 21.8 per cent on last year, followed by the northeast sub-region up 13.5 per cent.”

REIWA data shows that the central sub-region and the southeast sub-region were the only submarkets to experience a decline over the month, but when compared to May 2015 leasing activity was up 2.5 and 6.9 per cent respectively.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/PZi4OysBZdw/

Rachel Ong, Curtin University; Alan Duncan, Curtin University, and Steven Rowley, Curtin University

Australia’s housing stock is not meeting the demands of older Australians, according to a new report released today by the Bankwest Curtin Economics Centre (BCEC).

The report features findings from a BCEC Housing Affordability Survey, which captures the housing experiences and affordability perceptions of more than 4,300 people across New South Wales, Western Australia and Queensland.

Older householders aged 55 years or over were asked a series of questions relating to downsizing, including motivations and barriers.

Around 16% of those aged 55 to 64 and one-quarter of those aged 64 or over reported they had already downsized.

The most commonly cited reasons for downsizing, as shown in the figure below, were to live in a smaller house that is easier to maintain and to reduce housing costs.

Older Australians want options that allow them to downsize in areas that suit their lifestyle. This includes being close to family and friends while having access to quality amenities.

Main reasons for downsizing

A growing mismatch between housing stock and demand

Among those aged 55 years or over who had not downsized, more than 80% said they would certainly do so in the future. However, around 40% of those who had not downsized felt there weren’t enough suitable or affordable housing options in the areas where they would choose to downsize.

Perceived barriers to downsizing

This identifies a mismatch between demand and existing housing stock. And it’s likely to get worse, with the proportion of older and lone-person households set to increase significantly over the next 20 years.

Most of Australia’s dwelling stock is made up of separate houses with at least three bedrooms. Small dwellings with one or two bedrooms are still relatively scarce.

According to the 2011 Census, three-quarters of the nation’s dwelling stock is made up of separate houses, compared to just 14% flats, units or apartments. There are, however, some stark differences across cities.

Census data show that more than 25% of Sydney’s housing stock is made up of flats, units and apartments. Other cities lag behind. In Melbourne, only 15% of the housing stock are flats, units and apartments, in Brisbane 12% and in Perth only 9%.

Semi-detached, row or terraced houses provide smaller alternatives to the detached house. Yet, with the exception of Perth, the proportion of such dwellings is even lower than flats, units and apartments.

The lack of housing diversity compels older Australians to continue living in larger dwellings than they would prefer, and often for longer than they would prefer.

In Western Australia, where four out of every five dwellings are separate houses, more than one-quarter of households aged 55 years or over live in dwellings with three or more spare bedrooms.

So, what housing solutions are possible?

As population ageing drives a long-run demand for smaller dwellings, the mismatch between preferences and housing supply will grow unless a significant shift in the diversity of dwellings happens across the country.

This does not simply mean delivering more one-bedroom apartments. Increasing dwelling diversity takes time, planning and commitment. Strategic planning documents across the country recognise the need for change, yet the housing market in its current form appears unable to deliver diverse, affordable housing options on anything close to a sufficient scale.

The lack of suitable homes is not the only factor that discourages older Australians from downsizing. The BCEC Housing Affordability Survey shows that 58% of would-be older downsizers thought the costs of downsizing – such as stamp duty and real estate agent fees – were simply too high to make downsizing worthwhile.

Making downsizing less costly is likely to be “doubly beneficial”. This is because it would free up existing housing stock for younger families, thus revitalising an ageing housing stock, while allowing older households to reduce their housing costs. Stamp duty reforms targeted at older Australians, such as those already implemented in Victoria and the ACT, would remove a significant barrier to downsizing and potentially deliver benefits to the economy.

However, tax reforms must be accompanied by flexible housing solutions. These need to increase the supply of diverse housing forms, not just in terms of house type but also tenure, in the locations where older people want to live.

Older Australians want innovative solutions that offer more than traditional retirement housing options. Vertical villages, which offer activated internal corridors, flexible living spaces and areas to entertain the grandchildren, are starting to appear.

Alternative tenure options such as the “land rent” model create housing solutions in which costs are reduced because the occupant does not need to buy the land.

Such models represent forward thinking, but existing policy settings present major challenges to such innovation.

Governments need to work with industry to deliver solutions that meet the housing needs of older Australians. These solutions are required now more than ever.

The authors would like to thank Amity James, of Curtin University, for her contributions to the administration and analysis of the BCEC Housing Affordability Survey.

![]()

Rachel Ong, Deputy Director, Bankwest Curtin Economics Centre, Curtin University; Alan Duncan, Director, Bankwest Curtin Economics Centre and Bankwest Research Chair in Economic Policy, Curtin University, and Steven Rowley, Director – Australian Housing and Urban Research Institute – Curtin Research Centre, Curtin University

This article was originally published on The Conversation. Read the original article.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/mwoF3MSV_iY/

Dwelling approvals on the up again

Despite ongoing fears of oversupply in Melbourne, Brisbane and even Sydney, it seems approvals for multi-unit dwellings are on the climb again.

The total number of all dwellings approved rose 1.2 per cent in April 2016, in trend terms, and has risen for five months, according to data released by the Australian Bureau of Statistics (ABS).

Dwelling approvals increased in April in the Australian Capital Territory (6.7 per cent), Queensland (2.9 per cent), South Australia (2.2 per cent), Tasmania (1.9 per cent) and New South Wales (1.4 per cent), though they decreased in the Northern Territory (15.2 per cent) and Western Australia (0.1 per cent) in trend terms, and were flat in Victoria.

“Approvals for multi-unit dwellings provided the impetus for the headline growth in April, with approvals in this part of the market growing by 8.1 per cent during the month,” Housing Industry Association economist Geordan Murray says.

“The growth in multi-unit approvals was driven by the eastern seaboard states, where we saw multi-unit approvals jump by 20 per cent in Queensland, 19 per cent in NSW, and 7 per cent in Victoria. South Australia also posted an increase of 3 per cent.

“In contrast to the situation with multi-unit approvals, the number of detached house approvals fell across the eastern seaboard states, while all other states and territories posted improvements,” he adds.

“It’s pleasing to see the likes of South Australia post the strongest month of detached house approvals in more than two years.”

Urban Taskforce CEO Chris Johnson says the approval numbers for April indicate that apartments are still booming in NSW.

“The jump in approvals is in contrast to Victoria, where on a trend basis apartment approvals dropped to 2538 in April, indicating a cooling of the Victorian market,” he says.

“This is reinforced by aggressive marketing of Melbourne apartments into the Sydney market.

“House approvals in Victoria are still very strong, with 3128 in April compared to 2263 house approvals in NSW.”

While monitoring housing approvals is useful to assess trends, Johnson points out that not all approvals lead to completions of real homes.

“It would seem in NSW that there’s a significant gap between approvals and completions due to the staging of large projects and to excessive conditions to approvals that can make projects unviable,” he says.

“With a shortfall of almost 6000 new homes last financial year compared to government projections, it’s vital that the supply of new houses and of new apartments continues at a strong level in Sydney.”

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/cnE9oPvTLxI/

Many investors think that having their home loan, investment loans, credit cards and savings accounts with the one bank is a good thing.

I’ve had people tell me what a great benefit it is, as they get fee waivers and special discounts for having all their accounts with the one bank. They may even have their very own ‘personal relationship manager’. Don’t they feel special!

What the unsuspecting investor doesn’t realise is what is really going on here – which is the fact that everything is geared in favour of the bank.

Let me lay it on the line and explain some of the risks of this situation:

Risk 1: The bank knows your entire spending history and habits

The bank can see if you pay your loans on time and whether you pay extra or just the minimum repayment. That’s fairly stock standard.

But, then there are your credit cards; the bank can see whether you pay the balance off in full each month, or just make the minimum repayment. It can also see all of your spending habits. It can see where you like to shop – Kmart or upmarket boutiques? – where you like to dine out or where you shop for groceries.

Data-crunching software is incredibly sophisticated these days, to the point where some banks are using information you post on social media to help them ascertain your ‘risk’. Do you really want your bank having that much information and power at their disposal?

Risk 2: The bank knows how much you have saved

Next, there is the savings account that most people generally have their pay deposited into. Now your bank knows how much you earn (down to the last cent) and how much you have left at the end of each pay period. It also knows when you receive a pay rise, as your regular pay income into your savings account will increase.

With all of this information at their disposal, the bank knows if you are a saver or a spender. In fact, it has a complete picture of your financial spending habits, including where you shop, how much you spend, how much you save and how much you pay on your loans.

Risk 3: The bank can take pre-emptive action to protect themselves

What happens if something goes wrong? Let’s say you lose your job. You decide not to pay off your credit card balance in full this month, like you usually do. Instead you pay the bare minimum so you can save your pennies until you find another job.

Unfortunately, you have difficulty finding another job, so for a period of several months there is no regular income going into your savings account as expected.

How much power does the bank have now?

It can see that your savings account is drying up and that you’re making lower payments on your bills. The clauses in your mortgage contract protect the bank in this regard, so that if it feels a little nervous about your financial position and you miss or default on a payment, no matter how small, it may decide to call you in on one or all of your loans.

In short, because the bank is aware of your entire financial situation, you are totally exposed – and they have all the power.

I know of a builder who wanted to subdivide his home and build two units in his backyard. He obtained approval for a development application (DA) for the units and decided to construct them himself as an owner-builder. He had ample existing equity and cash, as he had other good investments.

As an owner-builder, he needed to stop working to focus on this new project. All of his accounts were with the one bank. He explained to the bank what his intentions were, but unfortunately for him, the bank became nervous and decided to issue him with a 30-day notice to pay up all his loans. It resulted in the project falling over, and him and his family being kicked out of their home.

The best way to avoid this situation is to spread your risk by not putting all your eggs in the one basket. Have your credit cards with one bank, your savings and every day accounts with another bank, and your investment loans and PPOR mortgage with several different financiers.

With a personal financial risk mitigation strategy you can take some power back from the banks, as it makes it a little more difficult for any one bank to have a complete financial history of how you manage your financial affairs.

Helen Collier-Kogtevs

Property Educator and Best Selling Author

Real Wealth Australia

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/FPZVEGm2feY/

The top 5 home buyer myths busted

When it comes to buying a home, there is a lot of superstition among buyers. A lot of old wives’ tales, misinformation and downright wrong assumptions float around people’s heads when they’re preparing to buy a home. In this post, we bust five of the largest myths about home buying.

1. I need a 20% deposit before I can even consider buying a house

Not true. For some markets, a 20% deposit may run you as high as $150,000. Not many of us have that kind of cash on hand, even if we’ve been saving as hard as we can since childhood. Most lenders will lend up to 90% of your house’s value – some as high as 97%. 10% is more realistic, but there’s no hard and fast rule about having a 20% deposit.

2. Lenders won’t touch single people and the self-employed

This is another big myth. If you are single and can come up with a deposit and satisfy your lenders’ requirements, most lenders will be happy to approve your mortgage application. The same applies to small business owners. About one third of Australian private industries are small businesses. That substantial market is impossible to ignore. Usually, showing your lender or broker two years of good financial statements is a good start. Lenders are interested in what your future holds, not what your past looks like.

3. Lenders will flat out reject people with bad credit

If you’ve had bad credit and you’re afraid of even stepping foot inside a brokerage or lender’s office – don’t be. Gaining approval for a home loan with bad credit is somewhat more difficult, but not impossible. Sometimes people may have to wait a couple of years until their credit improves before applying for a home loan. Other times, people have errors or discrepancies on their credit histories that you can fix and explain. Lenders understand this, and are always eager to help.

4. I can’t buy an investment property

Untrue. Many first homebuyers are buying investment properties instead of dwellings. This could be due to lifestyle choices. Others buy to get a foothold in the property market while earning money from their purchase. If you’re buying an investment property, the choices are endless as you’re buying to make a return, not to live in it. It could make your loan smaller and your repayments more affordable.

5. Lenders Mortgage Insurance protects me against default or hardship

This is the opposite – lender’s mortgage insurance (LMI) protects your financial institution if you default, not you. First home buyers must pay LMI if they’re borrowing more than 80% of the home’s value. This is a necessity if you’re looking to buy without that mythical 20% deposit – it’s what allows many homebuyers to do so. LMI can be amortised or paid back over the life of the loan, so it need not come out of your deposit amount, which is a plus.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/UG9auXIC-pw/