Sydney city plans released, amid some concerns

The City of Sydney has revealed its strategic vision for Sydney’s future skyline, with potential building heights in excess of 300 metres – 80 metres taller than Governor Phillip Tower – while still protecting sun access to important public places and parks.

In the most comprehensive urban planning strategy for central Sydney in 45 years, opportunities have been identified to unlock up to 2.9 million square metres of additional floor space for retail, hotel, cultural and office needs to meet long-term targets for the city centre’s growth.

A key move of the draft Central Sydney Planning Strategy is the identification of concentrated “tower cluster” areas where there’s potential for 300-metre-tall commercial buildings that would be subject to federal airport approval.

It’s suggested that this will allow the city centre to grow while still retaining essential solar access planes to Hyde Park and other important public areas such as the Royal Botanic Gardens, Martin Place and Wynyard Park.

Lord Mayor Clover Moore says the strategy provides certainty, consistency and continuity of planning to help the city more effectively encourage economic and employment growth over the next two decades.

“Past planning strategies have successfully increased the number of residential buildings in the city centre, but now we need to protect and increase the amount of productive floor space to maintain Sydney’s economic vitality and resilience,” she says.

“Ensuring infrastructure keeps pace with growth, in terms of transport, cultural and social institutions and affordable housing, will help keep our community strong and maintain our standards of living.

“We need to preserve and maintain what is positive and unique about our city, while reshaping its other attributes to meet the needs of tomorrow’s central Sydney.”

The 20-year strategy proposes to update previous planning controls and is the first comprehensive plan since the City of Sydney Strategic Plan in 1971 by George Clark, which set the skyline and character of the city as it is today.

The new Central Sydney Planning Strategy includes 10 key moves and nine aims for business and residential development, balanced with the changing needs of the growing number of workers, residents and visitors.

The 10 key moves include:

- The expansion of Central Sydney to reabsorb The Rocks, Darling Harbour, Ultimo (The Goods Line, Central Park and UTS) and Central Railway to Cleveland Street. Having a single consent authority and framework will make planning more consistent and reduce red tape and hurdles;

- The prioritisation of business floor space employment by expanding the city’s commercial core west to Barangaroo and south to Belmore Park;

- The management of small sites to consider wind, sunlight, public views and setbacks. The City wants to encourage owners of city buildings to talk to their neighbours about their combined development potential;

- Progressing plans for three new squares along George Street – at Circular Quay, Town Hall and Railway Square – to provide precincts that improve the liveability of the city centre;

- The strengthening of public open space, accessibility and connections to make moving around the city easier and more enjoyable for workers, residents and visitors;

- The promotion of design excellence by requiring all towers and major developments to go through a design competition process;

- Ensuring transport and social infrastructure keeps pace with growth, and that Sydney is inclusive of all members of society by the introduction of an affordable housing levy; and

- A move toward zero net energy for all buildings through sustainability incentives for floor space ratio bonuses and minimum NABERs standards for new office buildings.

Central Sydney helps generate $108 billion of economic activity annually – nearly eight per cent of the national economy. It has the highest concentration of top 500 companies, banking institutions and mainstream artistic and cultural institutions, and is the largest retail centre in Australia.

It is also home to 25,000 residents and accommodates close to 300,000 workers and a large proportion of the city’s 610,000 domestic and international visitors every day.

Reacting to the strategy release, Urban Taskforce CEO Chris Johnson says: “The Urban Taskforce has been calling for taller towers in the Sydney CBD so we’re supportive of the increase in height to 310 metres. We are, however, concerned that to achieve the increased heights, developments must share the value of the uplift with the city council.

“The Central Sydney Planning Strategy is establishing a planning framework where most projects will be negotiated outcomes through planning proposals. The report outlining the strategy calls for a streamlining of the Gateway process undertaken by the Department of Planning, which can take many months.

“The Sydney CBD strategy continues a trend with Sydney councils to set height limits but to then trade off extra heights for financial contributions to infrastructure. Value Capture has become the new buzz word but every council has different rules. It will be important for the New South Wales Government, through the Greater Sydney Commission and the Department of Planning, to establish clear policies about a flexible planning system based on trading floor space.

“The Urban Taskforce is concerned that the City of Sydney seems to be discouraging residential development in its strategy,” Johnson adds.

“The strong preference is for commercial towers. Residential-only towers are not allowed. This approach will have an impact on the physical shape of the city, with fatter commercial towers rather than slim residential towers.”

The Urban Taskforce believes the state government will need to interact with the city on the future balance of residential and commercial space in the city. “It’s important that the city has a good amount of residential accommodation where people can walk to work and the city can be alive all day and through the week,” Johnson says.

“The new strategy is very detailed and it will take some time for the industry to fully understand the implications of the changes to policy.

“If there are too many levies and affordable housing contributions then projects may not go ahead.”

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/rY8vlT8swjY/

Explainer: how the paperless property market works

Lynden Griggs, University of Tasmania and Rouhshi Low, Queensland University of Technology

Paperless house sales are now a reality but it might be some time before we’ll all be buying and selling property online. The electronic system, Property Exchange Australia or PEXA, set up by financial institutions and a number of state governments, changes conveyancing of real estate in a way not seen since the introduction of title by registration in the mid-1800s.

What this transition achieves is a remote electronic based system for the buying and selling of land. The new process from contract to settlement can be paperless. The only physical aspect of the transaction involved the vendor moving out, the purchaser moving in, and the stakeholders, such as mortgagees and conveyancing agents entering keystrokes on a remotely maintained work space.

How PEXA works

Once the parties enter into a contract for the sale of real estate, an online work space is created through PEXA, whereby relevant information is populated by all stakeholders who retain password verified access to the site.

Instead of the buyer and seller signing forms to be lodged at land titles offices, agents on behalf of these parties (such as conveyancing agents) will digitally sign on their behalf. Overseeing this is the Australian Registrars National Electronic Conveyancing Council a regulatory agency providing guidance and oversight through operating and participation rules.

These rules govern the relationship between the PEXA operator and the land title registry, as well as the electronic lodgement operator and direct participants such as conveyancing agents and financial institutions.

At the moment only conveyancing agents and other subscribers such as financial institutions can lodge online and have direct access to PEXA. To facilitate the use of the system, some land contracts now require that the conveyancing be done through PEXA.

In the foreseeable future its unlikely that the consumers will be able to use PEXA themselves. The cost and impediments to obtaining access are only feasible for someone engaging in transactions on a routine basis.

In theory, the system should reduce costs and unintentional errors through embedding checks in the process of lodging these forms. Currently the paper-based system is arguably more prone to human error, though computer systems depend greatly on the security that sits behind them and the mistakes potentially made by the keystroke operators.

From the point of the real estate industry, it increases productivity and can provide simpler and easier access to real-time data in relation to the property and to the state of the transaction.

Because money is transferred electronically within moments of the settlement occurring, it reduces the current gap that occurs between settlement and registration within paper-based systems. The new system should streamline the complex legal problems that can sometimes occur in transactions.

It should help resolve a category of irreconcilable legal decisions around the priority between two unregistered interests, where there’s one interest in a property and a second interest is also created in the period between settlement and registration. At the moment, judicial bodies resolve these on a case by case basis, but with PEXA reducing the gap between settlement and registration, the opportunity for these sorts of conflicts should disappear.

Risks of paperless property exchange

The first sale using PEXA has already occurred with the five largest states already using the system.

But with any development comes risks. At its heart conveyancing requires that a purchaser be able to identify the vendor, verify that the vendor is indeed the owner of the land, and finally, confirm that this vendor has the right to deal with that land and is not constrained by others (such as a mortgagee). These requirements are key to preventing identity fraud.

PEXA’s response has been to impose significant identity verification requirements that can exceed the well-known 100 point requirements to open a bank account. Purchases by overseas parties have had significantly greater requirements for identity verification imposed upon them.

However identity fraud will continue to pose a threat in the PEXA environment if users are not vigilant in complying with these enhanced identity requirements. There may also be risks in the movement of funds at settlement. Because this occurs electronically, the capacity to cancel cheques paid in settlement before these cheques are cashed will disappear.

The risk of a person accessing the computer system fraudulently and altering multiple records is palpable.

At its heart, what this new era does is reallocate risk. Lawyers, conveyancing agents, mortgagees, assurance funds and land title registries have for close to 150 years of private law jurisprudence on title by registration developed a complex series of rules governing this allocation.

The new dawn of electronic conveyancing will inevitably provoke new jurisprudence with the stakeholders jousting for position. Whoever emerges with the least amount of risk attached to them will be a powerful player in this new paperless property market.

![]()

Lynden Griggs, Senior Lecturer, Faculty of Law, University of Tasmania and Rouhshi Low, Lecturer, QUT Business School, Queensland University of Technology

This article was originally published on The Conversation. Read the original article.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Lh9ORyxqW1s/

Creating suntrepreneurs

By ANNA WARWICK

In Australia’s deregulated energy market with energy companies increasing prices year-on-year and tenants crying “energy poverty”, there’s a new product in the market that allows landlords to incentivise tenants and generate an additional income stream from selling cheaper, cleaner solar power.

Riding a new wave of innovation sweeping through the energy market, an innovative win/win service offered by Australian tech company Matter answers the dilemma facing landlords and tenants with regards to installing a solar system on a rental property, namely that tenants would be lucky to break even from the investment, while landlords would see no returns.

Says Matter Co-Founder Simon Barnes, “Solar energy has reached a cost point where it’s cheaper to produce electricity where you use it than to access it after it’s been transmitted through the grid.”

Matter’s metering technology and online solar sharing platform has introduced a peer-to-peer relationship model (similar to airbnb) to the energy market. Brokered by Matter, landlords and tenants agree on a fixed price for solar power which is less than the tenant’s current energy rate. The landlord pays for installation of the panels and the tenant pays the landlord for energy consumed during daylight hours when solar power is being produced.

Through Matter, landlords receive an increased income of 15% or more per annum. And in the long term, solar panels can add in excess of $35,000 to the value of an investment property.

Tenants face Energy Crisis

Australian residents are more disgruntled, confused and crippled by power bills than ever before.

The Australian Energy Market Commission has warned that 24 per cent of all households find it difficult to pay their gas and electricity bills, with thousands facing disconnection or on energy hardship programs. Nevertheless, on July 1st 2016, at least two major energy retailers’ raised power charges yet again by a reported average of 10 per cent.

These price rises have been principally driven by over investment, often called “gold-plating” by the energy networks that distribute power to our homes. The end result are peak electricity rates that hit us hardest when we use power most, like the heat of the day when air conditioners, swimming pools and refrigerators are in use.

While solar only produces power during the day it is perfect for saving money during peak demand times, with the sunniest time of day generating the highest levels of electricity.

Educate and Empower Your Tenant

Energy customers are ready to make a change. The AEMC’s 2016 customer survey found that around half of Australian customers have not switched electricity retailers in the last five years, meaning consumers are missing out on savings. AEMC Chairman John Pierce said “many consumers find new technologies appealing, but there are significant gaps in consumer access to information about what these technologies could deliver for them,” he said.

Matter hands landlords the ability to offer tenants a set rate for daytime electricity and a new, transparent way of consuming energy with 24/7 digital information on their electricity usage at their fingertips, through an online tenant dashboard.

With a Matter solar service, renters keep their grid energy service for night-time use and supplement solar during the day, but gain a clear picture of how to shift their peak energy usage to lower cost, daytime solar power instead of evening grid energy, reducing overall energy costs.

Get Started as a Solar Energy Provider

Set up Costs

“Setting up a solar service at a residential investment property will set you back about $5k all up including panels, inverter, Matter monitoring hardware and installation” says Barnes.

Matter’s ongoing management of the solar service costs $9.90 (Incl. GST) per month and covers everything. Matter will onboard your tenant, negotiate the solar rate and bill them monthly, paying you directly. Tenant contracts are aligned to their leases and automatically renewed in-line with leases.

Rebates and Tax Deductions

Says Barnes “Yes, rebates are available for the next 15 years to help reduce the cost of solar systems. Where tax is concerned, investors will need to consult their tax advisor but yes, the investment can be written off as any other investment in your property would be.”

Turnaround on Investment

“For typical sites, both residential and commercial, payback on the initial investment is usually four to six years,” says Barnes.

Income can vary depending on a few key factors, Barnes explains. “The first is the tenant’s location, as this affects the amount of sunshine available, which determines the amount of solar electricity produced. A second factor is the tenant’s grid electricity tariff which impacts the value created.” he says.

The Payoffs

Revenue is easy to track. Matter also provides landlords with an online login dashboard with real time monitoring of solar energy production at the property, as well as solar usage, grid usage and any excess sold back to the grid.

According to early sales figures, Matter customers are already seeing income increases on residential properties in excess of $1000 per annum.

In the long term, Barnes says “property investors have the asset for its lifetime (about 25 years) since they own the system.”

This increases the overall value of the property. “For residential properties, we’re seeing increases in capital value in excess of $35k-45k,” says Barnes. “Obviously commercial properties vary greatly in size but are considerably higher” he adds.

Will it work for your property?

Matter’s services are currently focused on single tenant properties and property portfolios, however a multi-tenant product is set to be launched in the near future, Barnes confirms.

Fill out Matter’s online form for an assessment as to your suitability for solar and the rewards you can expect from joining the next wave of the solar revolution.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/SrOZXmNB0Vo/

Conveyancers and property professionals are disappointed with the South Australian Government’s announcement to privatise the state’s Lands Titles Office (LTO).

CEO of the Australian Institute of Conveyancers SA division (AICSA) Rebecca Hayes says the LTO is a service that performs a pivotal role in the South Australian economy.

“We are obviously disappointed and concerned about the privatisation of the Lands Titles Office,” Hayes says.

“Given the figure touted for the sale is between $300 and $400 million it appears to be a short-term gain for the government, with long-term, and yet unknown, ramifications for the South Australian public.

“Our land titles system protects consumers, maintains a high level of expertise, is efficient and is a system that has supported South Australians well for 150 years.”

In the last year, property transfers lodged at the Lands Titles Office exceeded $20 billion and 63,300 mortgages provided a slightly lesser amount of capital to people for purchases and development.

Hayes says commercialisation should be considered carefully and with caution, as personal data of South Australians will be exposed to unnecessary risk if placed in the hands of the private sector.

The government’s claim that the business case for commercialisation is “undeniably strong” is questionable according to the president of AICSA Tim O’Halloran.

“We have significant concerns around the loss of efficiency and expertise, increased costs for consumers, the access and privacy of data, governance and the continued implementation of best practise anti-fraud procedures,” he says.

“We will continue to work with the South Australian Government to ensure our concerns under a privatised model are addressed, including legal protections around the titles register, capping LTO fee increases to CPI, ensuring the efficiency of the LTO is maintained and data privacy is preserved.

“Given the government has now committed to commercialise the LTO, the AICSA will work hard to ensure the best result for the SA public,” Hayes says.

In South Australia, registered conveyancers perform or supervise more than 90 per cent of all transactions lodged with the Lands Titles Office.

AICSA advises consumers, conveyancers, real estate agents and other parties involved in property transactions and can be contacted on (08) 8359 2090 or through the website at www.aicsa.com.au if assistance is needed.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/dFGQY77OVdk/

Figures show approvals fell after last rate cut

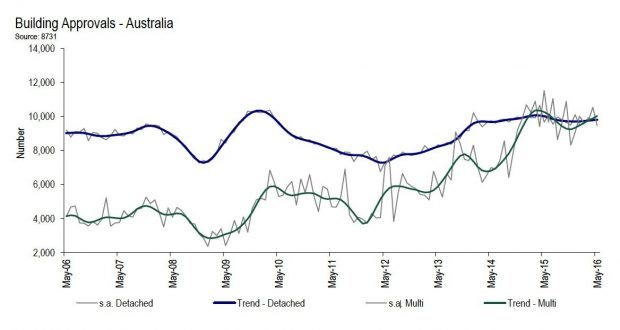

After two consecutive months of increase, total new dwelling approvals declined during May as a result of weakness on the multi-unit dwelling side of the market, according to the Housing Industry Australia (HIA).

Compared with April, total new dwelling approvals fell by 5.2 per cent in seasonally-adjusted terms. This involved a decline of 10.3 per cent in multi-unit approvals, with detached house approvals inching up by 0.2 per cent over the same period.

“Multi-unit approvals tend to bounce around a lot from one month to the next, but it’s been clear for some time that activity on this side of the market has peaked,” HIA senior economist Shane Garrett says.

“Interestingly, the RBA cut interest rates during May and today’s result indicate that this move may have helped contribute to steadier conditions for detached house approvals.”

In geographic terms, the decline in approvals during May was quite widespread, with Victoria being the only major state to experience an increase during the month.

“Today’s figures fit closely with our view that new home building activity is in the process of declining from last year’s record peak to more modest levels as the end of the decade approaches,” Garrett continues.

“The contraction in activity is predicted to be concentrated on the multi-unit side, with a more measured reduction in detached house building.”

During May 2016, total seasonally adjusted new home building approvals rose in Victoria (+3.1 per cent) with a slight increase also occurring in Tasmania (+0.1 per cent).

New dwelling approvals saw the largest reductions in Western Australia (-20.0 per cent), Queensland (-17.6 per cent) and South Australia (-13.0 per cent), with a fall also occurring in New South Wales (-6.9 per cent).

In trend terms, approvals rose by 18.7 per cent in the Northern Territory and by 8.2 per cent in the Australian Capital Territory.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/-LnbiSI6jOk/

With the final stages in the election fight heating up over the negative gearing pro and contra dance between the party policies, many property market voters are baffled and in uncertainty of what may lie ahead.

While for plenty of people that are already invested in the property market the possible changes may drive them to offload their negatively geared properties, many others are still confused as to how their voting decision would affect their retirement planning and, specifically, their property investing strategy.

Sam Comer, senior manager of tax advisory for Crowe Horwath (part of Findex), says: “Abolishing the current negative gearing and capital gains rules could have a drastic impact on the property market, possibly flooding the market with property as investors transition to different financing models.

“For property investors, their election decision could largely be steered by the impact any new policy will have on their investments and retirement planning,” she says, explaining that with property usually being purchased with much higher leverage than shares, a change in the ruling would have the most drastic impact on the property market, which has always been a strong backbone of the Australian economy and investment main stake for mum-and-dad investors.

“If we’re seeing the negative gearing ruling changed, I anticipate a strong shift toward SMSF [self managed super fund] investing, taking the already strong trend to a massive migration.

“I don’t think the full flow-on effect a new ruling would have has even been contemplated.”

For those voters unsure of the potential impact their vote would have on their investment strategy, RateCity.com.au has released an Election Calculator.

The quick, 10-question survey-based app (which you can find at www.ratecity.com.au/election-2016) enables voters to see the effect for them financially based on their situation and vote, giving them an added insight for when they have to make their choice come election day this weekend.

With 46 per cent of all property loans going to investors, other issues of the election battle are somewhat overshadowed by this heated property topic.

We could expect to see many Australians literally resorting to voting with their wallets and from a place of wanting to protect and safeguard their investments, rather than a more holistic assessment of each party’s policy.

According to statistics from the Election Calculator, in New South Wales:

- 55 per cent of people under 80k, (12.3 per cent of total) plan to negatively gear

- 34.6 per cent between 80-180k (20.4 per cent) plan to negatively gear

- 10.3 per cent over 180k (6.6 per cent) plan to negatively gear.

In Victoria, the numbers are:

- 62.2 per cent under 80k (11.2 per cent)

- 35.2 per cent between 80 and 180 (18.8 per cent)

- 7.6 per cent over 180k (5.1 per cent).

In Queensland:

- 56.1 per cent under 80k (7.2 per cent)

- 35.3 per cent between 80-180 (16.7 per cent)

- 8.6 per cent over 180k (5 per cent).Based on the data received, RateCity claims that in terms of election polls, Labor should be further ahead than is currently depicted in news polls.

There’s no doubt it’s going to be be an interesting election, with voters being urged to look at their choices objectively and consider the full impact their vote could have on their property/retirement investment planning, along with other important issues.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/ydkZkMM9b_M/

Will interest rates hit 10%?

Let me start by saying I’m sure that at some point in my lifetime interest rates will return to the dizzy heights of 2007/08 and hit about 10 per cent per annum. But rest assured it won’t be happening any time soon. The indicator that I look at to determine where interest rates are heading, and in what timeframe, is typically a three-year fixed rate offered by the banks.

A quick snapshot of most fixed rates on the market today will have a three-year fixed rate at approximately 4.7 per cent per annum. Make no mistake, while this sounds cheap and banks like to promote fixed interest rates because it gives them certainty, and brokers like to promote them as they’re guaranteed their trail commission for that period of time, they’re not providing these rates by way of charity.

Banks are billion-dollar corporations, making billion-dollar profits for millions of their shareholders and they’re making substantial profits on these products. So, while it’s really easy to get caught up in the “will interest rates rise in 2016?” debate, it’s important to realise that while interest rates might go up, they won’t be going up rapidly and they won’t be going up by a lot at least in the near term.

While the purpose of this column isn’t to predict interest rate movements, it is designed to inform all of you out there whose heart skipped a beat when you read the headline. It’s designed to help you understand what drives interest rate movements, what that means for investors and how you can protect yourself.

In my 13 years involved in the property industry, without doubt the number one concern I’ve seen investors have relates to dramatic increases to the interest rate. This fear typically comes from owner-occupiers who had mortgages in the late 1980s when interest rates were around 18 per cent per annum.

For those younger investors out there, just ask your parents what it was like!

While that had a massive cash flow impact on any owner occupier with a mortgage, it was a very different scenario for investors. To overcome the fear, it’s even more useful to understand the cause and effect relationship of why interest rates rise, because that’ll give you some perspective to allow you to continually invest with confidence.

CASH FLOW CONSIDERATIONS

Let’s start with cash flow. There are three sources of income that contribute towards holding costs for most investment properties. The majority of the holding costs are covered by the rental income. Tax benefits also provide some cash flow and in some cases there will be a small out-of-pocket holding cost. When interest rates rise, landlords pass on some of those costs to the tenants by increasing the rent.

When rates increase, you obviously pay more loan interest, which gives you greater deductions and therefore greater tax benefits. So, while there’s no doubt that you’ll see a small increase in the holding costs with an investment property if interest rates rise, it’s not nearly as dramatic as you might think, given that rents increase and tax benefits increase as well to lessen that burden on your cash flow. The smarter you can be with what you buy to maximise the rent and tax, the more you’ll reduce your out of pocket exposure.

But personally I love it when interest rates are rising.

Something else that’s important to remember is that interest rates don’t go from five per cent to seven per cent and beyond overnight. There are small incremental increases that happen over an extended period, which allows you to build in these cash flow buffers and increase rent systematically, to continue to minimise the out-of-pocket impact on you, the investor.

So, while this gives you some peace of mind that there isn’t going to be a major cash flow impact should interest rates rise, fear simply comes from a lack of knowledge.

More relevant is an understanding of the direct cause and effect relationship behind why interest rates rise. This is fundamental knowledge for any property investor.

WHY DO RATES RISE?

When the economy is in a growth phase interest rates increase and when the economy is in a tightening phase interest rates will fall. Therefore, low interest rate environments are fantastic for maximising your borrowing capacity and being able to hold property with a minimal holding cost, at worst.

But personally I love it when interest rates are rising. The reason for that is rates rise due to the economy moving in a positive fashion, which is the result of several factors. To name a few, spending and consumer confidence is up, so is job security, with unemployment down, wage growth is up and all of these factors lend themselves to an environment where owner-occupiers buy houses because they feel stable in their jobs.

It’s fundamental to understand that interest rates rises are the effect, caused by these positive behaviours occurring.

Interest rate moves aren’t predictive of what’s going to happen in the economy at any time. We can anticipate with some confidence when interest rates are going to rise, based on the available data and be able to protect ourselves against that.

If owner-occupiers are buying more houses and spending more on them, and fewer investors are buying property because they’re worried about the same things you were worried about when you saw this headline, that has numerous positive effects on those that are already in the market with an investment property, namely prices being pushed up, so we’re creating

equity for the small amount of money that we have spent out of pocket.

I’m more than happy to have a $50 increase in my holding cost per property if it means that I’ve created tens or hundreds of thousands dollars of equity in a reasonably short timeframe.

Take Sydney, for example. In 2011, if I’d said to you for $100 a week, you could hold a property that could grow by $300,000 or $400,000 in value in the next four years, that would seem like a good investment. What that does is create equity, whereby if the cash flow increase that we’re hypothetically experiencing due to interest rate rises is prohibitive, we have equity there that we can borrow against to increase our buffer.

In low interest rate environments, while properties pay for themselves, there’s more competition among buyers and there are fewer renters as those with marginal borrowing capacities can actually achieve finance approval based on more favourable servicing calculators and, as a result, greater vacancy risk.

So, like most things in life, don’t judge a book by its cover.

Understand what drives interest rate increases and embrace it knowing your investment is growing in value, but as always protect your cash flow in the process.

![]()

View all articles by Michael Beresford »

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/mKVi87xEkQU/

It costs to live in top school zones

It’s no secret it costs a premium to live within a specific school zone. But how much?

New Real Estate Institute of Victoria (REIV) data shows that homes located within the catchment area for some of Melbourne’s best public secondary schools are attracting close to a $600,000 premium compared to those outside the zone.

In 2016, the median house price of properties with more than two bedrooms in desirable public school zones is significantly higher than the median price of nearby similar homes bordering the zone.

Top of the class?

The analysis, undertaken in the 12 months to March, shows the largest price difference was recorded for homes zoned for University High in inner northern Parkville.

Homes within the school zone had a median house price of $1,395,000 while homes within a one-kilometre radius of the school zone had a median of $799,000 – a difference of $596,000.

Homes zoned for McKinnon Secondary College also achieved sale prices significantly higher than those located outside the catchment area. The median house price for homes within the zone was $1,500,000 compared to a median of $1,195,000 for homes in the same suburb but outside the school zone.

Vendors of homes within the school zone for Cheltenham Secondary College could also expect higher sale prices than those located outside the zone. A difference of $150,000 was recorded for homes that sold within the school zone.

REIV CEO Geoff White says access to high-quality amenities and services – particularly schooling and education – is a key driver of price growth across Melbourne.

“Rather than paying private school fees, parents of school-aged children are increasingly investing that money in the family home and buying into areas zoned for top performing public schools,” he says.

“These areas also experience a high number of sales indicating the level of buyer demand within these zones.”

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/VbmROcyekOY/

Population growth strongest in Victoria

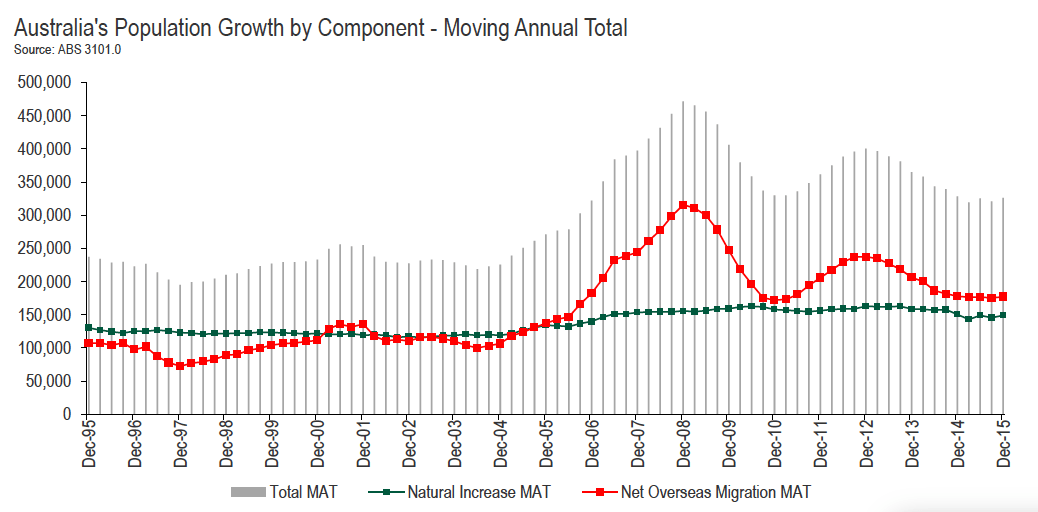

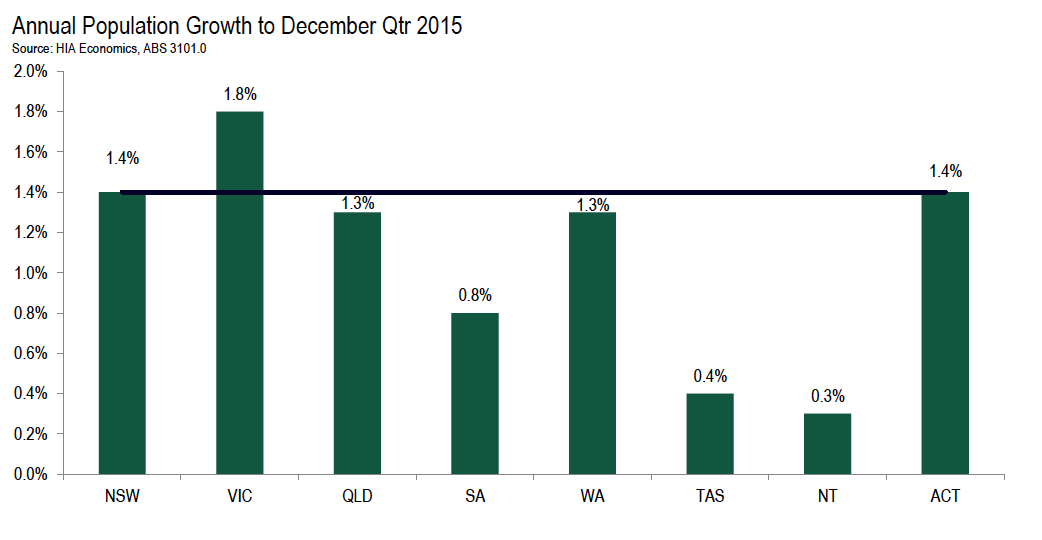

The latest demographic statistics released by the Australian Bureau of Statistics (ABS) show the pace of population growth steadied in the latter half of 2015, though there are quite wide divergences between the states and territories, according to the Housing Industry Association (HIA).

The ABS figures show Australia’s population reached 23.94 million at the end of December 2015, an increase of around 326,000 people over the full calendar year amounting to 1.4 per cent annual growth.

Net overseas migration (incoming minus outgoing migrants) resulted in an additional 177,138 people during 2015, but the net inflow was 0.5 per cent smaller compared with a year earlier.

Natural population growth (births minus deaths) added 148,935 people to the population in 2015, which is almost exactly the same as the previous year.

“Variation in economic performance across geographic areas has a significant impact on the flow of migration, and vice versa,” HIA economist Geordan Murray says.

“The states posting better economic performance have people flocking to them, while the underperforming states and the mining states face challenges.

“The states along the eastern seaboard were the star economic performers in 2015, and the demographic statistics reaffirms this.

“Victoria posted the strongest population growth of 1.9 per cent over the year, while New South Wales was second fastest with growth of 1.4 per cent.

“Queensland posted the third strongest rate of population growth of 1.3 per cent.”

Murray explains that while this is relatively slow for the sunshine state (in a historic context), when you consider the state is also feeling the effects of the downturn in investment from the resource sector it’s still a positive result.

“The strength of Queensland’s performance is particularly evident if you draw comparisons with the other mining states,” he adds.

“The rate of population growth in Western Australia has dropped to 1.2 per cent, with fewer overseas migrants arriving and a larger net outflow due to interstate migration.

“The Northern Territory fared even worse – the NT’s population actually shrank in the final quarter of 2015 and the annual rate of population growth fell to 0.3 per cent, which is the slowest in the country.

“Housing markets around the country are responding to these demographic dynamics,” Murray explains.

“Victoria and NSW have seen the strongest rates of population growth and the population influx increased demand for housing.

“The residential building sector in these two states is responding accordingly – Victoria and NSW are currently the two strongest markets for residential building.

“There’s no coincidence that NSW and Victoria are also the strongest two state economies.”

The flow of inward migration to Australia has slowed markedly over the last few years and given the impending problems that are expected to arise in Australia as baby boomers exit the workforce, workforce numbers will need to be replenished, according to Murray.

“A strong migration flow is the key to this. Policy makers must ensure that Australia remains an attractive place for skilled migrants to settle,” he concludes.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/N5kkd-_b-x4/

Labor has no plan for Australia except to increase taxes by $100 billion over ten years. – Prime Minister Malcolm Turnbull, Liberal Party of Australia email to subscribers, May 8, 2016.

Tax is shaping up to be a hot button issue in this election, with both major parties aiming to paint their opponents as high taxers. So is Prime Minister Malcolm Turnbull right to say that Labor plans to increase taxes by A$100 billion over ten years?

It all depends on the question: what exactly is that “increase” based on?

Where does the figure of $100 billion come from?

In his budget reply speech, Opposition Leader Bill Shorten promised to deliver savings of A$71 billion over ten years, chiefly by rejecting almost all the budget’s company tax cut.

But in an interview with the ABC in April, Shadow Treasurer Chris Bowen said

Our fiscal rule is very clear and we’ve led the way with $100 billion – more than $100 billion worth of improvements to the budget bottom line.

The Conversation understands that prime minister’s statement about the $100 billion was based on Labor’s own numbers relative to the Coalition’s position. The policies that would add up to a A$100 billion increase include:

- Labor’s policy to limit negative gearing to new residential housing

- Labor’s policy to increase Australia’s capital gains tax rate by 50%

- Labor’s policy to leave Australia’s top marginal income tax rate at 47% (49% including the Medicare Levy)

- Labor’s policy to reject the reduction in company taxes laid out under the Coalition’s Enterprise Tax Plan

- Labor’s superannuation policies.

So the PM is arguing that Labor’s plan is a $100 billion increase on what the Coalition has promised; it’s not $100 billion more than what the federal government currently collects in taxes.

Note that the only appearance of the word “increase” in this list is in item two, on the capital gains tax rate. I think it’s also fair enough to think of a proposed limit on negative gearing in item one as a “tax increase”, although it would really be a removal of a tax subsidy, not an increase in a tax rate. (You can read more here on what meets the official definition of a tax.)

But to suggest Labor’s rejection of the Coalition’s plan to reduce company taxes in item four is a “tax increase” is a bit rich (pardon the pun).

In the typical use of the English language, an “increase” refers to a positive change in something relative to a well-established reality, not relative to a hypothetical scenario.

If my boss doesn’t give me a pay raise when I ask for one, I might be disappointed. But I can’t really call it a “pay cut” just because I asked for a raise. My current pay is the baseline reality. My requested raise is a pure hypothetical.

In terms of an “increase in taxes”, a reasonable baseline reality would be projected tax receipts under existing tax rates prior to the recent budget.

But the Coalition’s position that includes cuts to company taxes is really a hypothetical scenario until passed by parliament.

Labor’s plan is not to “increase taxes by $100 billion” from current levels, but rather it is to limit negative gearing; raise capital gains taxes; maintain the current top marginal income tax rate; not cut company taxes in the way proposed by the Coalition; and apply different policies to superannuation than the Coalition.

This is clearly a more complex set of policies than just a simple tax increase.

A more accurate statement

It would be fair to say that Labor’s plan could lead to $100 billion more (or thereabouts) in taxes than the Coalition’s plan over the next ten years. But, once again, the difference is not all due to an actual increase in taxes. Some of it is due to not decreasing taxes.

Perhaps I am asking for too much precision of language from our politicians who have been trained to produce highly simplified sound bites. But “increase” is a widely used and well understood word. So its misuse here is problematic.

Finally, it’s worth noting that an average of $10 billion more a year in taxes equals only about 0.6% of current total income in the Australian economy. It is a near certainty than any projection will be off by far more than this at some point in the next decade, regardless of who wins the election.

Verdict

The PM’s statement is misleading. As I interpret it, his quote makes it sound as though Labor plans to increases taxes from the current levels by $100 billion over ten years.

It would be fairer to say that Labor’s plan could lead to $100 billion more in taxes than the Coalition’s plan over the next ten years. But the difference is not all due to an actual increase in taxes. Some of it is due to not decreasing taxes. – James Morley.

Review

I like this article and its attempt to diagnose a difficult issue. I am not sure that arguing over long projections such as ten year horizons is all that useful. No one knows what the future holds so far out, and future governments can chop and change these measures in subsequent budgets or economic statements.

This FactCheck also makes the valid point that “saving measures” are not inherently “tax increases”. Not providing or matching a promised tax cut is not necessarily a “tax increase”.

Take, for example, business company tax: Labor’s plan would keep the tax take at about the same level as now, so that’s not a tax increase in any normal sense. However, it would imply that Labor would have business paying more tax than the Coalition under the current proposals.

I am not sure that the verdict is accurate that Turnbull is being “misleading”. If you add up the impact over four years Labor’s proposed negative gearing changes, superannuation changes, capital gains tax increase, plus the higher income supercharge on high income earners, and the hike in the tobacco tax, then Labor may be raising $100 billion more in revenue in the medium to longer term.

However, while Labor has announced it is increasing these taxes, the Coalition is also increasing superannuation taxation (with three coordinated changes to current arrangements) and increasing the tobacco tax. That said, the Coalition has also announced tax reductions to business, those earning above A$80,000, and the very high income earners who currently pay the extra levy. So the comparable “net effect” of the tax proposals from both sides is likely to be far less than the $100 billion Turnbull claims.

The last statement in this FactCheck article is a fair representation of the facts. – John Wanna

![]()

James Morley, Professor of Economics and Associate Dean (Research), UNSW Australia

This article was originally published on The Conversation. Read the original article.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/So9MYsi7Pfs/