It’s believed that significant reforms to NSW strata laws will create a wave of new interest in the Sydney strata market after years of flat growth.

A recent client event co-hosted by CBRE and Brown Wright Stein Lawyers highlighted that investor interest in strata investment had surged in the past 12 months in anticipation of the upcoming changes.

Due to be implemented on November 30, 2016, the reforms will create an alternative process for owners to jointly end a strata scheme so that a site can be sold or developed.

CBRE residential development manager Rich Gell says this is expected to hold particular appeal to owners of both residential and commercial strata property in instances where maintenance and repair costs can’t be justified and where the necessary special levies are beyond the means of many owners, especially retirees on fixed incomes.

“The changes will promote the urban renewal of dated and near obsolete strata complexes throughout metropolitan Sydney, which are approaching the end of their physical life,” Gell says.

“As Sydney entrenches itself as one of the world’s most green, global and connected cities, there is a greater requirement to create sustainable communities for people to reside, particularly in light of forecasts that the city’s population will be circa 6 million by 2031.”

Ahead of the changes, a number of owners have already voluntarily banded together to sell whole strata residential blocks – capitalising on the ongoing developer interest in this style of investment opportunity.

Deborah Kent of Brown Wright Stein Lawyers says the November 30 commencement of the Strata Schemes Development Act 2015 will enable a 75 per cent majority of lot owners to secure a collective sale or redevelopment of an entire strata scheme.

Anyone will be able to submit a written proposal to the owners’ corporation for a collective sale or redevelopment. If the owners’ corporation “opt in” to participate in the sale or redevelopment, a strata renewal committee will proceed to prepare a strata renewal plan for consideration by the lot owners.

“If 75 per cent of the lot owners support the plan, it will become binding and any dissenting owners will be forced to sell,” Kent says.

“However, the Land and Environment Court will oversee the sale or redevelopment to ensure that the lot owners receive no less than the compensation value of the lot that they would have been entitled to under section 55 of the Land Acquisition (Just Terms Compensation) Act 1991.”

While much of the interest in the strata reforms has focused on the residential market, significant potential is also presented for the CBD commercial market.

Daniel Courtnall of CBRE’s Sydney strata office team says the new laws will provide much-needed processes to deal with common scenarios around collective sale and renewal.

“The Sydney CBD is a very tightly-held precinct and opportunities to secure freehold buildings or development sites are rare.

“The implementation of these laws will create new offerings for developers or purchasers to approach strata owners with proposals that would have been considered too hard or a waste of time and money previously due to the need for a unanimous decision.”

CBRE’s Julian Choo says the reforms will complement the City of Sydney’s plan to send the CBD skyward through the lifting of height restrictions to 310 metres from the current 235 metres and by unlocking an additional 30 per cent of floor area in the CBD.

“Importantly, the new strata laws include strict rules to ensure owners are appropriately compensated for a sale,” Choo says.

“These reforms will create a new wave of interest in the Sydney strata market that has become very buoyant in the past 12 months after years of flat growth.

“We have received interest from domestic groups identifying certain assets, but we believe this may increase to foreign buyers – in particular Chinese groups – looking at alternative investment opportunities in light of the increased stamp duty on residential property.”

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/rQkdtjXMrqU/

In news that should shock no one, new data shows that almost 70 per cent of all property investors are forced to make sacrifices to their lifestyle in order to buy their investment property.

Perhaps more surprising is the fact that Australians are increasingly taking property debt into their retirement years, which has been revealed by another set of data.

According to Mortgage Choice’s annual Investor Survey, 69.4 per cent of investors admitted to making sacrifices in order to buy property, up from 68 per cent in 2015.

Mortgage Choice chief executive officer John Flavell says with property prices rising across most markets, he isn’t surprised to hear a greater percentage of investors are forced to make lifestyle sacrifices in order to buy property.

“Data from CoreLogic found property values climbed 8.3 per cent across the combined capital cities over the last 12 months,” he says.

“While some capital cities performed better than others in terms of property price growth, it’s fair to say that most markets have enjoyed an upswing in values over the last few years.

“With that in mind, I’m hardly surprised to hear investors are having to make sacrifices in order to achieve their property investment goals.”

Asked what sacrifices they had made to afford their property purchase, 57.9 per cent of respondents said they’d cut back on their day-to-day spending.

“There are a few ways most people can easily reduce their spending and increase their level of savings,” Flavell says, adding the following tips:

Tip 1: Pack a lunch

Take leftovers or a homemade lunch to work every day. A bought lunch can cost as much as $15 a day – that’s $75 a week or $3900 a year. If that money was invested into a high interest savings account, for example, a person could be more than $4000 wealthier each year.

Tip 2: Live off cash

Set yourself a cash budget. Plan exactly how much you need to spend each week to cover all expenses and then withdraw that amount in cash at the beginning of each week. According to data from RateCity, 40 per cent of all ATM transactions are being done at “foreign” ATMs, costing Australians approximately $548 million in avoidable fees a year.

Tip 3: Ask for discounts

Been with the same gym for some time? It may be worth calling head office and asking if they can reduce the regular payments. This could end up saving you $5 a week, or $260 a year.

Tip 4: Shop around

Many people will choose a health insurance or car insurance provider and then stick with them year after year. Get online and see what companies are on the market that can offer better priced and better suited solutions.

Tip 5: Pay all bills on time

If you struggle to remember when bills are due, put a reminder in your calendar.

Meanwhile, data from ING DIRECT reveals more and more Aussies are taking property debt into their retirement years, with the number of over-65-year-olds still holding a mortgage rising by 28 per cent in the past three years.

Of those in their retirement years that still have a mortgage, 26 per cent hold an investor loan while 74 per cent are owner-occupiers.

The average debt they’re holding is $158,000.

Mark Woolnough, head of third party distribution at ING DIRECT, says: “As property prices climb and people wait longer to get onto the property ladder, it’s not a surprise that people are holding their home loan debt later in life.

“However, proper planning is critical to make sure that this debt doesn’t cause stress in later years and people can enjoy the retirement they have worked hard for.”

According to ING DIRECT’s Autumn Buyers Guide, since June 2012 the average capital city residential property has increased in value by 32 per cent, with growth of 7.6 per cent in the past 12 months alone.

The average age of a homebuyer has also risen in recent years to 38.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/drw2Cn_8toI/

Housing approvals up in the top end

Australian Bureau of Statistics (ABS) figures for June 2016 reveal a 4.2 per cent increase in new dwelling approvals in the Northern Territory.

The same set of figures indicate that new home building approvals fell in most other Australian states, with a 2.9 per cent decline occurring nationally.

While this slight increase in approvals in the territory is promising, Neilia Ginnane, executive director of the Housing Industry Association (HIA) says forecasts continue to indicate a downward cycle for at least the next six months.

“The first half of the year has been challenging for the territory’s residential building industry and the residential property market in general, a result of many factors including reduced consumer confidence, minimal population growth and uncertainty around taxation for investors and new home buyers in the lead up to the Federal Election.

“We expect that after the Northern Territory Government election in August, activity in new home building will continue at reduced activity levels before improving toward mid-2017.

“Homebuyers and investors need greater assurances around the direction of long-term policy to determine how best to spend their investment dollars,” she adds.

“This is greatly affected by the stamp duty burden, with homebuyers in the NT suffering some of the highest rates in the country.”

With the Reserve Bank announcing further cuts to the Official Cash Rate (OCR) – reducing it to the new low of 1.50 per cent – Ginnane says this will provide further incentives for new homebuyers to enter the market.

Nationally

During June 2016, total seasonally-adjusted new home building approvals rose most strongly in South Australia (+12.4 per cent), with increases also occurring in Victoria (+4.1 per cent) and Western Australia (+2.5 per cent).

Reductions

Tasmania experienced the largest fall in approvals (-23.9 per cent), with reductions also affecting New South Wales (-4.0 per cent) and Queensland (-2.1 per cent).

The Australian Capital Territory fell by 2.7 per cent.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/npgRbsoz8mg/

Better signs for home building

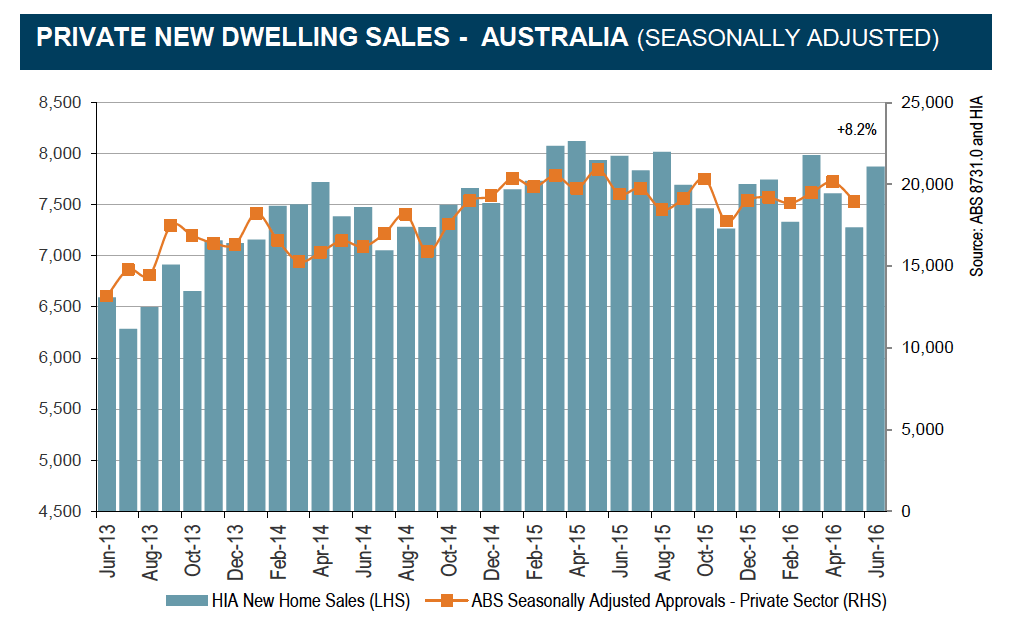

According to The Housing Industry Association’s (HIA) New Home Sales Report, a survey of Australia’s largest volume builders, total new home sales ended 2015/16 on a higher note.

“The overall trend is still one of modest decline for new home sales, but a bounce of 8.2 per cent in June 2016 highlights the resilience of the national new home building sector,” HIA chief economist Harley Dale says.

“The overall profile of HIA New Home Sales is signalling an orderly correction to national new home construction in the short term, as are other leading housing indicators.

“Below the national surface, the large geographical divergences between state housing markets have been a prominent feature of the current cycle – that will continue. The New Home Sales series highlights this fact.

“Comparing the June quarter this year to the same period last year, detached house sales are down very sharply in South Australia (-21.4 per cent) and in Western Australia (-27.5 per cent), yet sales are up by 17.0 per cent in Victoria and by 7.1 per cent in Queensland.”

New South Wales rounds off the detached house coverage and sales are down by 7.3 per cent on an annual basis there.

The sale of detached houses bounced back by 7.2 per cent in the month of June 2016.

Multi-unit sales continued their recent recovery, growing by 11.5 per cent after a lift of 4.9 per cent in May.

In the month of June, detached house sales increased in all five mainland states, with the largest increases occurring in Queensland (+14.9 per cent) and WA (+9.1 per cent).

Detached house sales increased by 7.5 per cent in NSW, 3.7 per cent in South Australia, and 2.2 per cent in Victoria.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/0324YvoULq4/

Property agency hopes to boost philanthropy

Radley Property, an innovative real estate agency combining property services with philanthropy (launched this week) pledges 20 per cent of its commission to Australian registered charities.

For each transaction, landowners individually donate half of Radley Property’s 20 per cent pledge to their chosen charity. This donation is made in the vendor’s name, does not affect their profit and is tax deductible.

Radley Property invests the other half to its non-profit education partners, Room to Read and the Australian Indigenous Education Foundation.

“We want to give landowners and developers the opportunity to engage in philanthropy by simply selling their property with us,” Radley Property’s founder and director Belinda Bentley says.

“While the business model reflects our values; we’re also mindful that our commission needs to be relevant and competitive to the market.”

Bentley and fellow director Michael Radovnikovic have been members of Philanthropy Australia’s New Generation of Giving program for the past two years.

Both directors have had extensive careers in the property industry and also regularly contribute to various property and arts not-for-profit organisations.

“We were inspired by the social change that was disrupting other sectors through the growing number of social enterprises and ‘profit with purpose’ businesses,” Bentley says.

“When we looked at our own industry, we were disappointed that not much has changed.

“We’ve experienced first hand what it’s like to give back and we want landowners to have a similar opportunity to consider the causes they care about.

“By promoting philanthropy through property, we’re able to reach a greater population without affecting their bottom line.”

Radley Property services inner Sydney (inner west, eastern suburbs and North Shore), focusing on residential and commercial sales as well as project marketing for development sites.

“Impact drives us as a company – we’re a property group with a social conscience,” Bentley adds.

“With technology, there’s no need for a shopfront so we’re able to keep our overheads low and create the highest value for our clients and non-profit partners.”

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/X8TLsqX5VJM/

ASIC bans SMSF spruiker

The Australian Securities and Investments Commission (ASIC) has banned Ronald Cross, of Figtree, New South Wales, from providing financial services for a period of four years.

Cross is the CEO and a director of Park Trent Properties Group Pty Ltd (Park Trent).

On November 27, 2015, further to proceedings issued by ASIC, the Supreme Court of NSW found that Park Trent had unlawfully carried on an unlicensed financial services business for more than five years by advising clients to purchase investment properties through a self-managed super fund (SMSF).

The court also permanently restrained Park Trent from providing unlicensed financial product advice to clients regarding SMSFs.

ASIC found that, as the key decision maker of Park Trent, Cross:

- was knowingly involved in Park Trent’s contraventions, making all of its major strategic and business decisions and intended to influence clients to purchase properties through SMSFs;

- was willing to ignore legal advice and warnings about Park Trent’s practices, demonstrating that he is likely to contravene financial services laws.

ASIC deputy chairman Peter Kell says: “ASIC’s action against Mr Cross shows that we will not hesitate to exclude property spruikers who provide unlicensed financial services from the industry.”

Cross has the right to appeal to the Administrative Appeals Tribunal for a review of ASIC’s decision.

ASIC launched legal proceedings in November 2014 against Park Trent who, by the time of the trial in June 2015, had advised more than 860 members of the public to establish and switch funds into an SMSF.

On October 15, 2015, the Supreme Court of NSW found Park Trent had been unlawfully carrying on a financial services business for more than five years by providing advice to clients to purchase investment properties through an SMSF.

Park Trent has appealed the decision to the NSW Court of Appeal and the appeal is set down for a final hearing on August 31.

Catch the September issue of API for the first part of our two-part exposé on property advisors and avoiding spruikers

![]()

View all articles by Angela Young »

<!–

–>

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/UZRd8FSmCxw/

A solid Melbourne market

There’s been solid price growth for the June quarter in Melbourne according to just-released data.

During this time Melbourne’s median house price increased 3.6 per cent to a record high $725,000 – the largest price growth since September 2015.

Real Estate Institute of Victoria (REIV) chief executive officer Geoff White says the latest quarterly figures indicate real strength in the Victorian market.

“Recent national data from the Real Estate Institute of Australia (REIA) shows that most states, apart from Melbourne and Adelaide, have experienced moderating home prices in the opening months of 2016.”

Growth was widespread across Melbourne and at both ends of the market, from Toorak to Wyndham Vale and Roxburgh Park.

Double-digit growth was experienced in Camberwell, Prahran and Richmond, while significant growth was also recorded in affordable suburbs such as Hillside in the city’s outer north west, St Albans, Sunshine West and Sunbury.

While this is good news for the Melbourne market, price growth is slower than at the market peak in late 2014 and early 2015, according to White.

“Just over a year ago we were seeing quarterly price growth just above five per cent,” he says.

“While growth is now below four per cent, it’s still solid, given market conditions.

“While fewer sellers are putting their homes on the market, prices are still extremely solid.

“The message to vendors is that the market is still bubbling along nicely – and that, given the sales results and prices, those looking to list their homes should do so prior to spring.

“Now is a great time to sell.”

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/Hl2Vx30gXz0/

More optimism on house-buying than last year

The latest quarterly housing market sentiment survey by CoreLogic and TEG Rewards reveals that almost two thirds of Australians think now is a good time to be buying residential property, while roughly the same proportion believe the housing market is vulnerable to a significant correction.

According to CoreLogic research head Tim Lawless, the latest CoreLogic and TEG Rewards Housing Market Sentiment Survey highlights the paradox in housing market attitudes, with the large majority of survey respondents indicating that it’s a good time to buy a home at a time when the market may be vulnerable to a significant downturn.

Of the 2432 Australian residents who participated in the June quarter survey, 64 per cent thought it was a good time to buy a dwelling, up from 60 per cent a year ago.

In Sydney, where affordability constraints are the most pressing of any capital city, respondents were the most pessimistic about whether now is a good time to buy, though slightly more than half still felt it was.

The regions, on the other hand, where dwelling values have peaked and shown a downturn, are where respondents are most confident about buying conditions. Eighty per cent or more of respondents in the Northern Territory, regional Western Australia and Perth indicated they thought it was a good time to buy.

“With such as a large proportion of respondents thinking that now’s a good time to buy a dwelling, it was surprising to see almost two thirds (65 per cent) also indicated they thought dwelling values could suffer a significant correction,” Lawless says.

“While the results suggest that survey respondents are concerned there could be a substantial fall in Australian home values, the proportion is lower from a year ago, when 75 per cent of respondents thought the market was vulnerable to a significant correction.”

On the subject of whether dwelling values would rise, fall or remain steady over the next 12 months, the majority of those asked expected values to remain steady, with Tasmanians the most optimistic about the direction of value growth.

Nationally, 38 per cent are expecting dwelling values to rise over the next year. In contrast, a year ago 45 per cent of respondents thought values would rise, indicating that people have become less optimistic with regards to capital gains.

Interestingly, just 11 per cent of respondents are expecting weekly rents to fall over the next 12 months, despite the CoreLogic rental series showing the weakest rental conditions in at least two decades.

Nationally, almost equal numbers of survey respondents indicated that weekly rents would either rise or remain stable over the coming year, though there were considerable variations across the regions.

Less than one fifth of respondents in Perth and regional WA think weekly rents will rise.

This low expectation is in line with current rental statistics showing ongoing falls in weekly rents across most parts of WA, according to Lawless.

Another thing the survey explores is attitudes toward foreign investment.

Ninety-four per cent of survey respondents believe that foreign buying activity is placing some degree of upwards pressure on Australian home values, while 17 per cent believe foreign buying is placing “extreme” upwards pressure on home values.

When it comes to negative gearing, almost one third of respondents indicated that they weren’t sure if the federal government should make any changes, 40 per cent indicated that they didn’t think the Labor policy of removing negative gearing benefits for established properties should be implemented, and a much lower 28 per cent thought the policy should be changed.

The survey also indicated that most respondents are expecting a steady mortgage rate environment over the next six and 12 months, with 29 per cent indicating they think rates could rise over the next year.

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/TLABKesG9VU/

Eight Perth suburbs bucking the market downturn

Lathlain, Swanbourne and South Fremantle are among Perth’s top eight suburbs recording the highest annual house price growth in the year to May 2016.

While the Perth property market has experienced a knock-on effect from the mining downturn in recent years, Real Estate Institute of Western Australia (REIWA) president Hayden Groves says there are still suburbs across the metropolitan area that experienced annual median house price growth during this time.

“The bulk of Perth’s house price growth was experienced in the central sub-region, and there were some good performers in the northwest sub-region as well,” he says.

“Pleasingly, these high growth suburbs are all within the trade-up sector, rather than first homebuyer territory. This shows that more home owners are recognising there is plenty of opportunity in the current real estate market to take their next step.

“Reiwa.com data shows Lathlain was the standout performer, with its median house price lifting 11 per cent in the year to May 2016 compared to the year to May 2015, followed by Swanbourne, which had 9.3 per cent growth to its annual median house price and South Fremantle with 7.2 per cent growth.

“Although Perth’s property market has moderated over the last year or two, it’s encouraging for home owners that there are pockets throughout the metro area that have performed well and enjoyed positive price growth in more complex market conditions.”

Perth’s 8 highest growth suburbs

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/IzuuIclVfPs/

Three capitals offering greater home affordability

Affordability for homebuyers eased back in the June 2016 quarter according to the latest affordability report from the Housing Industry Association (HIA).

The HIA Affordability Index shows affordability fell by 3.7 per cent during the June 2016 quarter and was 2.1 per cent less favourable than the same period a year earlier.

The capital city housing affordability index fell by 4.3 per cent during the quarter, while regional market index experienced a 1.9 per cent improvement.

HIA economist Geordan Murray says home price growth moderated in the early part of the year and the index shows an improvement in affordability during the March 2016 quarter.

“However, in the June quarter dwelling price growth returned and the index reverted to the level we saw at the end of 2015.

“While there was a decline in the headline index tracking the national picture, there was substantial variation around the country – with substantial differences between states, and also differences between capital city markets and regional markets.”

During the June 2016 quarter, improvements in affordability were observed in three capital cities with the largest improvement in:

- Perth (+3.2 per cent),

- Darwin (+2.9 per cent)

- Hobart (+2.2 per cent).

Affordability worsened in the remaining five capital cities, with Melbourne showing the largest decline;

- Melbourne (-7.4 per cent)

- Canberra (-5.7 per cent)

- Sydney (-1.6 per cent)

- Adelaide (-1.3 per cent)

- Brisbane (-1 per cent).

The geographic variation in affordability is most evident in the comparison between Melbourne and Perth.

“Over the last year, the median dwelling price in Perth has fallen by 4.7 per cent while Melbourne’s has grown by 11.5 per cent. This has seen the affordability index for Perth increase by 6.2 per cent over the last year, while the index for Melbourne has fallen by 6.2 per cent,” Murray says.

“These differences in affordability align with the relative economic performance of these two states. The Western Australian economy is navigating the tail end of the mining boom, which has seen conditions in the local labour market deteriorate and consequently the rate of population growth has fallen quite sharply.

“In contrast, Victoria has experienced a healthy level of growth in the labour force and continues to record the strongest rate of population growth in the country.”

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/05pMlw52TuQ/