It’s spring and the property market’s blooming

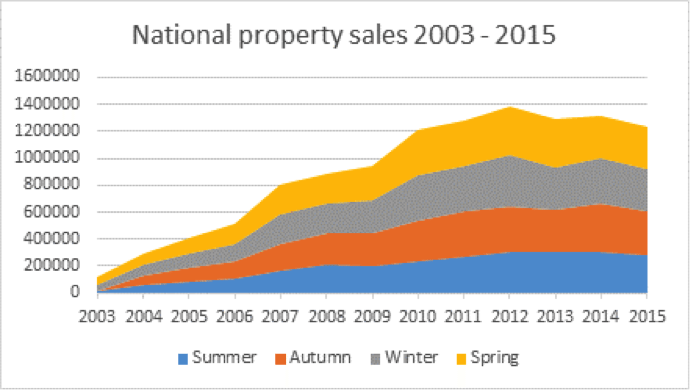

Spring season sees more property settlements and transactions across Australia than any other season, according to conveyancing technology experts GlobalX.

GlobalX CEO Peter Maloney says that from September to November the grass is greener, gardens are in full bloom and the weather is comfortably warm, making for optimal house selling conditions.

Source: GlobalX

Maloney says spring sales are often driven by the desire for a new beginning, with individuals, couples and families preferring to move before the end of the year.

“Buyers who have children prefer to get settled ahead of the new school year, and a spring sale means relocation can take place near or over the holiday period, allowing ample time for unpacking,” he explains.

“Similarly, investment properties can be renovated in time for the January-February period, which sees many people searching for rental properties before universities and training institutions begin the academic year.”

This year’s spring sales are off to a strong start, with auction clearance rates over the past nine weeks above 75 per cent, according to CoreLogic’s November market report.

“That puts them at their strongest level in more than a year and only marginally under a five-year high,” Maloney says.

Over the past 12 months, combined capital city home values have increased by 7.5 per cent, which is trending up from a recent low of 6.1 per cent at the end of July.

Nationally, capital city home values rose by 9.1 per cent over the first 10 months of 2016, with only two cities – Perth and Darwin – recording falling values over the past quarter.

Annually, home value increases have been strongest in Sydney (10.6 per cent), Melbourne (9.1 per cent) and Canberra (7.9 per cent), Hobart (5 per cent), Adelaide (2.5 per cent) and Brisbane (4.1 per cent), while falls were recorded in Perth (down 3.7 per cent) and Darwin (down 3.8 per cent).

“It’s also worth noting that the average level of discount (to a property’s listed or reserve price) on homes has eased from 6.1 per cent a year ago to 5.8 per cent, so home sellers are coming away with more cash from their sales,” Maloney says.

“It’s the same for unit owners, with the average discount reducing slightly from 6.1 per cent a year ago to now 5.5 per cent.”

In a market where Australian residential real estate is worth around $6.7 trillion, six out of every 10 new home listings are currently located in capital cities.

However, while the nation’s total mortgage debt of $1.59 trillion represents around 23 per cent of the value of residential real estate, just more than half the average Australian’s household’s wealth is invested in housing (51.5 per cent).

“To put the nation’s accumulated mortgage debt into context, the total value of Australia’s residential real estate market is more than three times the funds held in the nation’s superannuation accounts, and just under four times the amount held in Australian listed stocks,” Maloney says.

In the past year, more than 451,000 properties changed hands, with the average house price sitting at $600,000 nationally and the average unit price at $510,000.

“With the Reserve Bank of Australia holding the official cash rate at a historically low 1.5 per cent, and lending institutions vying fiercely for every mortgage dollar, now is a good time to consider purchasing property,” Maloney says.

“It’s spring and the market is showing signs of blooming once more.”

![]()

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/T289lgDoo0I/