Home values rebound

Home values rebound

Posted on Monday, July 02 2012 at 4:29 PM

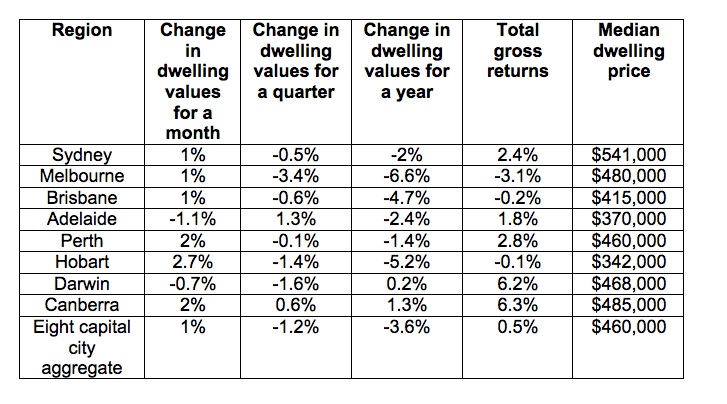

Property prices in most capital cities are on the up, after increasing by one per cent or more in the traditionally slow month of June

RP Data reports home

values rose in Sydney (one per cent), Melbourne (one per cent), Brisbane (one per

cent), Perth (two per cent), Canberra (two per cent) and Hobart (2.7 per cent).

Research director

Tim Lawless says the increases have been helped along by interest rate cuts

over May and June.

“The RP

Data-Rismark daily index across the eight major capitals has been consistently

rising over the month, foreshadowing this positive month-on-month result. The

increase in capital city dwelling values is an encouraging sign that the market

appears to be responding to improved housing affordability and lower interest

rates,” he says.

While there were

signs of weakness in Darwin (-0.7 per cent) and Adelaide (-1.1 per cent),

dwelling values in both these cities started flat lining or rising again over

the second half of June.

Rismark chief

executive officer Ben Skilbeck says the most significant insight is the rebound

in the Melbourne housing market, which has recovered by 1.7 per cent since June

11.

“The rebound in

capital city home values during June indicates that the Reserve Bank of

Australia’s (RBA) relaxed monetary policy stance may have reached the point of

inflating asset prices despite households remaining cautious about the

economy,” Skilbeck says.

“The housing

market’s fundamentals are increasingly solid; Rismark’s dwelling

price-to-income ratio is at its lowest level since March 2003, while the RBA’s

Guy Debelle has said the default rates are low and there’s no evidence of

overbuilding. If interest rates continue to be pushed lower, as they have been

since November, with total cash rate cuts of 1.25 percentage points, then asset

prices will inevitably respond to the stimulus. The fact is that mortgage rates

are well below their long-term averages, with three year fixed rates as low as

5.75 per cent.”

Article source: http://feedproxy.google.com/~r/API_Property_News/~3/ergWN4YOQ1w/home-values-rebound